-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

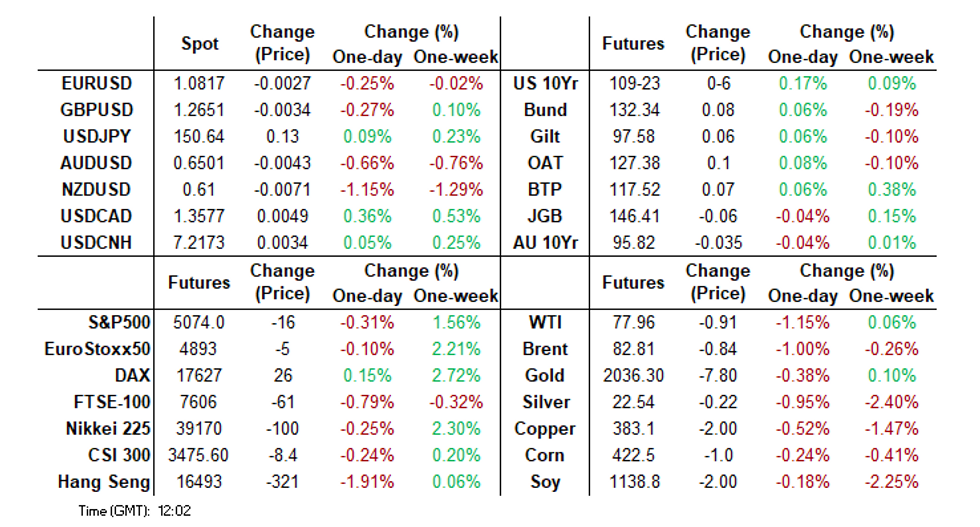

Free AccessMNI US MARKETS ANALYSIS: USD On Front Foot

- USD firmer on RBNZ, weaker e-minis and yield spreads.

- Bonds hold narrow ranges, European supply dominates.

- Fedspeak provides the highlights in NY hours.

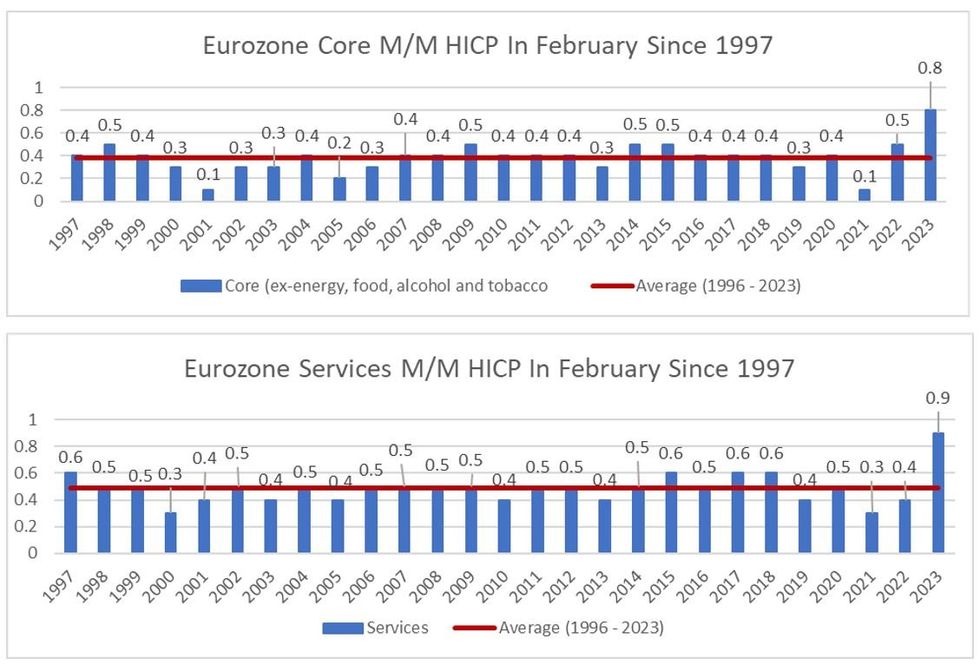

MNI Eurozone Inflation Preview – February 2024

Services Under Scrutiny Ahead Of March ECB Meeting

Eurozone core and headline inflation are expected to resume their downtrends in February on an annual basis, with headline printing a 3-month low 2.5% Y/Y (vs 2.8% prior) and core returning to below 3% for the first time since February 2022 at 2.9% (3.3% prior).

- February marks the first of a two-month sequence that typically sees reaccelerations in non-seasonally adjusted HICP (both core and headline), with March being typically pronounced, though the base effects from an especially strong Feb 2023 (especially in categories such as food) will help keep a lid on the overall print.

- The main area of scrutiny will again be services, which having printed 4.0% Y/Y for 3 consecutive months is overwhelmingly expected to pull back. A figure in the 3.6-3.7% Y/Y area is the base case.

- February’s inflation data will be the last before the ECB’s March meeting and projections. It would take an extraordinary downside surprise in the data to spur even a discussion on a March cut – but the report could play a crucial role in the meeting communications and potential for an April cut.

- Click for full preview: Feb2024EZCPIPreview.pdf

US TSYS: Modestly Richer Following RBNZ But Rangebound

Cash Tsys trade 1-2.5bp richer across the curve, aided by a dovish RBNZ and more recently some softer Eurozone confidence readings.

- With the roll nearly complete, TYM4 holds to narrow ranges, trading at the day's high of 110-08 but firmly within yesterday’s range. Trend conditions are seen bearish with support at 109-25+ (Feb 23 low).

- Data focus is firmly on the second Q4 release for GDP and PCE inflation, with potentially larger revisions for PCE inflation after annual CPI revisions earlier this month. Attention then shifts to Fedspeak early in the afternoon, although corporate earnings either side of the cash session will provide additional interest.

- Data: Weekly MBA mortgage data (0700ET), GDP/PCE 2nd Q4 release (0830ET), Goods trade balance Jan adv (0830ET), Retail/wholesale inventories Jan/Jan P (0830ET)

- Fedspeak: Bostic (1200ET), Collins (1215ET, incl text) and NY Fed’s Williams (1245ET, incl text) – see STIR bullet for details.

- No coupon Tsy issuance after a front-loaded start to the week with 2s (0.4bp tail), 5s (0.8bp tail) and 7s (0.3bp stop).

- Bill issuance: US Tsy $60B 17W Bill auction (1130ET)

STIR: Fed Rate Path Dipped Post-RBNZ + Context For Upcoming Fedspeak

Fed Funds implied rates have overnight reversed yesterday’s modest gain, primarily in spillover from a dovish RBNZ.

- Cumulative cuts from 5.33% effective: 1bp Mar, 5bp May, 19bp Jun and 79bp Dec. The latter saw 76bp of cuts yesterday, with Fed swaps fleetingly nudging the 75bps from the median Dec dot.

- Ahead, Bostic (’24 voter) and Collins (’25 voter) both appear in separate fireside chats at 1200ET and 1215ET, Collins with prepared remarks. Bostic said Feb 16 that he still expects two rate cuts this year; he could support three cuts with positive data but if the economy performs well he’s ok waiting longer to cut. Collins on Feb 7 stuck to central FOMC lines that there needs to be more evidence to consider rate cuts, with it likely being appropriate to ease "later" this year.

- NY Fed’s Williams (voter) follows shortly after with keynote remarks including text at 1245ET. He recently said on Thu (published Fri) that he also sees rate cuts “likely later this year”, with consumer spending growth to slow this year partly on the recent spike in auto and credit card delinquencies.

STIR: OI Points to Mix Of SOFR Futures Positioning Swings On Tuesday

The combination of yesterday’s mixed movement in SOFR futures and preliminary OI data points to the following net positioning swings:

- Whites: Net long setting (SFRH4) and net short setting (SFRU4). It is hard to give any inference re: SFRZ3 & SFRM4 as prices were unchanged,

- Reds: A mix of net long cover and net short setting, which generally offset in net pack terms.

- Greens: Hard to be sure outside of what seemed to be net short setting in SFRU6.

- Blues: Hard to be sure outside of some net short setting in SFRM7 & U7.

| 27-Feb-24 | 26-Feb-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,122,182 | 1,123,045 | -863 | Whites | -9,825 |

| SFRH4 | 1,115,914 | 1,114,843 | +1,071 | Reds | +1,327 |

| SFRM4 | 1,098,325 | 1,118,923 | -20,598 | Greens | +25,706 |

| SFRU4 | 867,179 | 856,614 | +10,565 | Blues | +3,300 |

| SFRZ4 | 1,134,790 | 1,135,977 | -1,187 | ||

| SFRH5 | 672,780 | 676,949 | -4,169 | ||

| SFRM5 | 720,574 | 721,153 | -579 | ||

| SFRU5 | 650,935 | 643,673 | +7,262 | ||

| SFRZ5 | 739,678 | 722,886 | +16,792 | ||

| SFRH6 | 502,660 | 487,549 | +15,111 | ||

| SFRM6 | 487,830 | 508,305 | -20,475 | ||

| SFRU6 | 337,147 | 322,869 | +14,278 | ||

| SFRZ6 | 304,408 | 303,514 | +894 | ||

| SFRH7 | 186,721 | 186,905 | -184 | ||

| SFRM7 | 177,812 | 176,855 | +957 | ||

| SFRU7 | 152,463 | 150,830 | +1,633 |

RBNZ: Inflation Risks “More Balanced”, Forecast Changes Reflect History

The RBNZ left rates at 5.5% and apart from updates to history and their impact on the forecasts, there was little change in its outlook. The main change seems to be a more neutral tone to the meeting assessment with November’s more hawkish elements removed. The tone suggests that the RBNZ is happy with where rates are for now and is not looking to change them in either direction but policy will need to stay restrictive to return inflation to target.

- Inflation risks are now seen as “more balanced” whereas in November the MPC was concerned and “wary of ongoing inflationary pressures”, so there was no longer mention of rates having to “increase further”. But the RBNZ won’t “tolerate upside surprises” and is ready to act to higher inflation driven by geopolitical and climate developments, including higher shipping costs.

- The Q4 2023 OCR was 0.1pp lower than the November projection. Now that 5.5% for Q4 has been put into the forecast the subsequent quarters are 0.1pp lower too. So the peak rate at 5.6% instead of November’s 5.7% is technical. The RBNZ still expects rates to be on hold until Q2 2025 and 200bp of easing over 2025-2026.

- CPI inflation is still forecast to return to target in Q3 2024 with the midpoint in H2 2025. H1 2024 is now projected to be 0.5pp lower helped by Q4 2023 0.3pp lower than the RBNZ forecast in November. But end-2024 is unrevised at 2.5% and end-2025 at 2.0%.

- There were few changes to growth expectations and the unemployment rate was revised down through to Q3 2025 as employment growth is expected to be stronger. Q1 2024 labour costs were revised up 0.2pp to 3.8%.

FOREX: USD Holding Onto gains going into the US session

The Dollar has held onto gains going into the European early session and heading into the US session.

- Risk has been tilted to the downside, but moves have been fairly limited, this combined with overall higher Yields have been supporting factors, despites US treasuries futures showing in green territory.

- The Greenback saw some early extensions vs PLN, CAD, MXN, SGD, CZK, NOK, SEK, GBP and JPY.

- But, despites some of the moves most G10 pair/crosses still trade within past ranges, USDJPY is still in a 150/151 range, with the immediate resistance unchanged at 150.89 High Feb 13 intact, failed at 150.80 for now. Cable has mostly traded in a 1.2600/1.2700 range for the past 6 sessions, and is now sitting at the middle of that range at 1.2644.

- NZDUSD was the biggest mover overnight following a dovish rate hold from the RNBZ.

- NZDUSD is now down 1.17%, with the initial support seen at 0.6090 holding in early trade, printed a 0.6493 low.

- Looking ahead, out of the US, will see 2nd readings for GDP/Core PCE, and wholesales inventories.

- Speakers include, BoE Mann, Fed Bostic Collins, Williams.

FX OPTIONS: Expiries for Feb28 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0825 (810mln), 1.0850 (2.17bn), 1.0855 (616mln), 1.0865 (3.32bn), 1.0900 (666mln)

- USDJPY: 150.00 (803mln), 150.50 (354mln), 150.70 (550mln), 151.00 (1.95bn). 151.25 (547mln)

- USDCAD: 1.3550 (343mln), 1.3570 (600mln)

- NZDUSD: 0.6125 (425mln)

- AUDNZD: 1.0650 (317mln), 1.0665 (640mln)

EUROPEAN & UK ISSUANCE UPDATE

Bund auction results

- E1bln (E813mln allotted) of the 1.00% May-38 Bund. Avg yield 2.6% (bid-to-offer 2.33x; bid-to-cover 2.87x).

- E500mln (E407mln allotted) of the 3.25% Jul-42 Bund. Avg yield 2.65% (bid-to-offer 2.48x; bid-to-cover 3.05x).

BTP/CCTeu auction results

- E3.75bln (E3.75bln allotted) of the 3.35% Jul-29 BTP. Avg yield 3.41% (bid-to-cover 1.40x).

- E4.5bln (E4.5bln allotted) of the 3.85% Jul-34 BTP. Avg yield 3.91% (bid-to-cover 1.36x).

- E1.5bln (E1.5bln allotted) of the 1.15% Oct-31 CCTeu. Avg yield 5.2% (bid-to-cover 1.74x).

6-year BTP Valore day 3 books at E2.00bln

- Day 3 books for the MEF's 6-year Mar-30 BTP Valore (ISIN: IT0005583478) are currently E2.00bln.

- Books opened on Monday and already stand at E13.05bln sold across the first 3 days (E6.44bln sold on day 1 and E4.61bln sold on day 2).

- The previous 5-year BTP Valore in October saw a total of E17.19bln sold across the week with E4.77bln of take-up on day 1, day 2 saw a further E4.54bln and day 3 saw E3.58bln.

- The inaugural 4-year BTP Valore in June saw a total of E18.19bln sold across the week with E5.43bln of take-up on day 1, day 2 saw a further E5.20bln, day 3 saw E4.22bln.

- There will be a step-up coupon with a 3.25% rate for years 1-3 and 4.00% for years 4-6 with a bonus of 0.7% for those who hold from the initial issue through to maturity.

- Unless there is an early close, books are due to close at 13:00CET on Friday 1 March.

Gilt auction results

- There was strong demand for the new 7-year 4.00% Oct-31 gilt - demonstrated by the 3.00x bid-to-cover.

- However, as we noted was likely in our preview, the tail was relatively wide at 2.2bp. We aren't too concerned about this as a 7-year gilt hasn't been launched in some time so pricing was a bit more uncertain that usual. Also the closest comparable gilt more recently issued would be the 4.50% Jun-28 gilt which was some variable tails through H2-23 auctions.

- Overall, it's a mixed auction. Gilt futures moved lower on the publication of the results - probably in reaction to the wide tail - but have already started to recover some of this move.

- GBP4bln of the 4.00% Oct-31 Gilt. Avg yield 4.085% (bid-to-cover 3x, tail 2.2bp).

EQUITIES: EUROSTOXX 50 Bulls Remain In The Driver’s Seat

The trend condition in S&P E-Minis remains bullish following last week’s gains and pullbacks are considered corrective. The move higher continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 5009.39, the 20-day EMA. A resumption of gains would open vol-band based resistance at 5142.10.

- The bull cycle in EUROSTOXX 50 futures remains firmly intact and the contract traded higher yesterday. Moving average studies remain in a bull-mode position too, highlighting positive market sentiment. Sights are on 4904.40 next, the 2.236 projection of the Nov 8 - 24 - 28 price swing. Further out, scope is seen for a climb towards a bull channel top at 4975.20. The channel is drawn from the Oct 27 low. Initial firm support lies at 4762.00, the 20-day EMA.

COMMODITIES: WTI Resistance Remains Intact

Gold is in consolidation mode. Recent activity has defined a key resistance at $2065.5, the Feb 1 high, and a key support at $1984.3, the Feb 14 low. Both levels represent important short-term directional triggers. A clear break of the Feb 1 high would highlight a short-term reversal and open $2088.5, the Dec 28 high. For bears, clearance of $1984.3 would expose an important support and bear trigger at $1973.2, the Dec 13 low.

- In the oil space, WTI futures traded higher Tuesday. The latest bull cycle still appears corrective and key short-term resistance at $79.09, Jan 29 high, remains intact. Clearance of this level would alter the picture and highlight a bullish development, opening $81.70, 76.4% of the Sep 19 - Dec 13 bear cycle. Initial support is at $75.69, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2024 | 1330/0830 | * |  | CA | Current account |

| 28/02/2024 | 1330/0830 | * |  | CA | Payroll employment |

| 28/02/2024 | 1330/0830 | *** |  | US | GDP |

| 28/02/2024 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/02/2024 | 1530/1530 |  | UK | BOE's Mann at FT future forum event 'The economic outlook..' | |

| 28/02/2024 | 1700/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2024 | 1715/1215 |  | US | Boston Fed's Susan Collins | |

| 28/02/2024 | 1745/1245 |  | US | New York Fed's John Williams | |

| 29/02/2024 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/02/2024 | 2350/0850 | ** |  | JP | Industrial production |

| 29/02/2024 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 29/02/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 29/02/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/02/2024 | 0700/0800 | *** |  | SE | GDP |

| 29/02/2024 | 0745/0845 | *** |  | FR | GDP (f) |

| 29/02/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 29/02/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 29/02/2024 | 0745/0845 | ** |  | FR | PPI |

| 29/02/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/02/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 29/02/2024 | 0800/0900 | *** |  | CH | GDP |

| 29/02/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 29/02/2024 | 0900/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 29/02/2024 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/02/2024 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/02/2024 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/02/2024 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 29/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/02/2024 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 29/02/2024 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/02/2024 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 29/02/2024 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 29/02/2024 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 29/02/2024 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 29/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 29/02/2024 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 29/02/2024 | 1600/1100 |  | US | Chicago Fed's Austan Goolsbee | |

| 29/02/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 29/02/2024 | 1815/1315 |  | US | Cleveland Fed's Loretta Mester | |

| 01/03/2024 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 2330/0830 | * |  | JP | labor force survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.