-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI US MARKETS ANALYSIS - Watch for Pause Clues in May CPI

Highlights:

- Markets look for Fed pause clues in Tuesday CPI

- Headline CPI expected to backtrack further, but core seen sticky

- China's unexpected rate cut presages weak financing data

US TSYS: Pulled Two Ways By External Factors For Little Change Ahead Of CPI

- Cash Tsys have seen a decent run of cheapening pressure following stronger than expected UK labour market data early in European hours.

- It only takes them back to levels near unchanged on the day though after being helped richer by the PBoC following its well-documented PBoC cut to the 7-day reverse repo rate which was followed by heightened speculation surrounding the potential for wider policy easing (via BBG sources). That was in addition to cementing expectations for cuts to benchmark interest rates in the coming day along with a shallower than expected bounce in credit data through May.

- 2YY +0.0bp at 4.577%, 5YY -0.5bp at 3.888%, 10YY -0.2bp at 3.734%, 30YY -0.5bps 3.876%.

- TYU3 trades 5+ ticks higher at 113-17 in reasonably tight ranges with an earlier high of 113-22 only just poking above yesterday’s brief push higher. Volumes are close to recent averages but still subdued at 230k ahead of CPI. It maintains a bearish outlook with the key support level still close by at 112-29+ (May 26/30 lows), whilst resistance is seen at 114-06+ (Jun 6 high).

- Data: CPI clearly headlines at 0830ET, with real earnings hitting at the same time.

- Note/bond issuance: US Tsy $18B 30Y bond re-open (1300ET)

- Bill issuance: US Tsy $38B 52W bill, $45B 42D CMB (1130ET)

Still +6.5bps Priced For Tomorrow’s FOMC Pre-CPI

- FOMC-dated OIS implied rates are relatively little changed from yesterday’s close, with a reasonable push higher from strong UK labour data only unwinding weakness through Asia hours.

- With CPI in the crosshairs, there is still +6.5bps priced for tomorrow’s FOMC decision and a cumulative +22bps to a terminal 5.30% effective in July before 24bp of cuts to year-end.

- Cumulative changes: +6.5bp Jun (+0.5bp on the day), +22bp Jul (unch), +20.5bp Sep (+0.5bp), +11.5bp Nov (unch), -2bp Dec (-1bp) and -18bp Jun (+2.5bp).

Strong Core CPI + Worrying Details Required To Sway Fed Decision

Today's US inflation report for May presents a clear risk to Wednesday's FOMC decision and communications - and mostly in a hawkish direction if (as expected) the Fed came into today planning on delivering a hold.

- Our view is that the bar to a hike has been set very high and it would require a significant beat on CPI to seriously put a raise on the table. (Our CPI preview is here.)

- With consensus on core at 0.4% M/M (with a downside skew in the survey w average at 0.36%), the figure would either have to be 0.5% M/M to begin having that conversation, or in the case of an in-line reading, for the details themselves to be relatively worrisome.

- Note that the last two monthly core readings were in line and saw yields drop sharply.

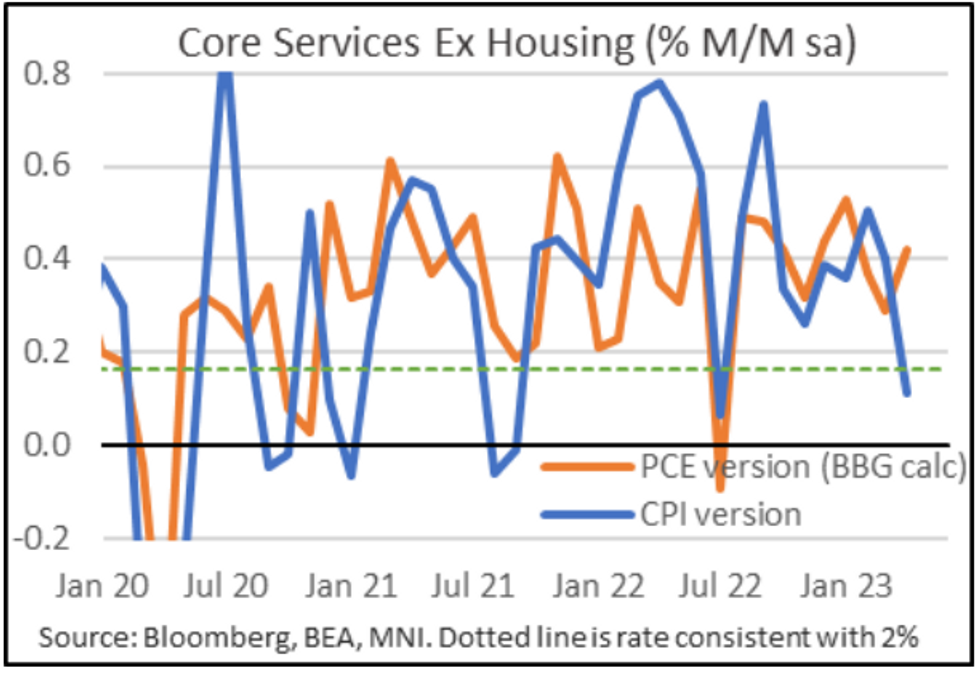

- It would probably require both a beat and worrying details for serious consideration of a surprise hike Wednesday. Particular attention will be paid to the role paid by rents: if we get a strong core figure, and it's driven mostly by shelter, the FOMC will largely look through it as it is more focused on services ex-housing. In terms of expectations: OER seen at an average 0.50% (range 0.46-0.54%) and primary rents an average 0.53% (range 0.48-0.60%). We'd also put used cars in this category, as they are are seen pulling back in May. If it's ex-cars, ex-shelter driving the beat, that will be considered relatively worrisome for the FOMC.

- Ex-Fed Vice Chair Alan Blinder (who argues for no further Fed hikes) told MNI last week that a "really bad looking" CPI report could still prompt a surprise 25bp hike, with Chair Powell "right in the middle" of the increasingly divisive hawkish and dovish factions.

- Though with the bar to a hike set so high by pre-blackout communications, an unexpectedly hawkish CPI report today could instead translate into a more aggressive dot plot (more members seeing potential for 2+ further hikes this year to above the 5.4% median that is consensus for the June dot plot) in conjunction with an increased core PCE forecast for 2023 (already seen rising from 3.6% in March to 3.7-3.9%). It would probably tilt Powell's press conference more hawkish too.

- It could also cement some hawkish dissents. The prime candidates among voting participants are Kashkari and Logan; Bowman and Waller might object but there hasn't been a Governor dissent in nearly 20 years.

Assessing Probability Of CPI Tipping The Fed Toward A Hike

In our reading of 31 sell-side analysts' previews (summarized in MNI's Fed meeting preview which is here), though several noted potential for Tuesday’s CPI data in particular to tilt the balance toward a hike, Citi and TD are alone in having a core view of a 25bp raise. Below are some sell-side opinions on the impact CPI could have on the Fed decision/communications Wednesday:

- Barclays: Barclays is penciling in a skip by the FOMC in June, but “our conviction is limited”. The outcome “could easily hinge on Tuesday’s outcome for May core CPI inflation”, with a number above 0.4% M/M likely sufficient to tip the balance to a hike depending on the composition, with 0.4% itself potentially tipping the balance to a hike.

- ING: ING expects some dissent and a potentially “very close decision” with the FOMC’s June pause. A shock 0.5% M/M core CPI reading on Tuesday could be sufficient to convince enough FOMC members to vote for a hike. “That’s not our base case and we believe there will be a majority on the committee who think they have tightened policy a lot and it makes sense to wait.”

- NatWest: “A strong May CPI report … would be enough to potentially argue for one more, and perhaps the last, hike from the Fed (an argument a few current non-voting FOMC members could likely make).” NWM forecasts 0.5% M/M core.

- RBC: RBC sees a FOMC hold in June (20% subjective prob of a 25bp hike) - the bar is set high for a beat/miss in Tuesday’s CPI to alter the rate outcome. "The impact (if any) will most likely be felt in Powell’s tone at the press conference, but a beat/miss could prompt a repricing into the decision and certainly move the market’s hawkish/dovish goalposts...beat. if core CPI comes in at 0.5% m/m, our hike probability goes to 60%. If it comes in at 0.3% m/m, we go to 0%."

- Scotia: "hike or hold is probably close to a coin toss…if core CPI is hot again then it may tip the balance toward a hike...[the FOMC may] want to see CPI and will then ring up the WSJ and others in clandestine fashion like they did pretty much one year ago to the day in order to affect market pricing and mitigate the game day surprise to whatever action they choose to embrace."

- Standard Chartered: If core CPI on Tuesday comes in at 0.4-0.5% M/M driven by rents and used cars, FOMC likely OK with a hold, but if ex-autos/shelter shocks to the upside, the hawkishness of communications could increase.

GILTS: Cheapening Further, 2-/10-Year Spread Moves to Deepest Level Of Inversion Since Mini-Budget

Further headwinds for Gilts as 2s extend the move beyond their mini-Budget yield highs, while 5s move through their YtD yield peak but haven’t challenged their own mini-Budget extremes. The remainder of the major UK benchmark yields haven’t challenged YtD highs, which lie below mini-Budget extremes, with 10-Year yields showing just above 4.40% at typing. The major benchmarks run 2-19bp cheaper on the day, with the bear flattening impulse extending as the 2-/10-Year yield spread moves to the deepest level of inversion witnessed since the time of the mini-Budget.

- Gilt futures recently hit fresh session lows to print -85 or so at typing. Bears look to the May 26 low and bear trigger (94.21) as the next meaningful level of technical support.

- SONIA futures sit as much as 27.5bp cheaper through the reds, while the BoE-dated OIS strip points to terminal rate pricing of just below 5.80%.

- Rhetoric from incoming MPC member Greene has been crossing as she appears at her TSC confirmation hearing. Greene’s initial comments seemingly place her in the centre-slightly hawkish zone of the BoE spectrum, which is distinctly at odds with her dovish predecessor, Tenreyro.

EUROPE ISSUANCE UPDATE:

Gilt auction results:- A relatively wide tail of 1.0bp for the 10-year gilt auction (3.25% Jan-33 gilt), which also saw the LAP below the pre-auction mid-price (91.334 vs 91.339). The last two 10-year gilt auctions have seen tight tails of 0.2bp and stronger bid-to-covers of 2.81/3.04x (versus 2.33x today). We did see a 1.1bp tail a the February auction, however, which is more comparable to today's 1.0bp tail.

- The last couple of 10-year auctions were strong, this is a below average result and saw the price fall on the release of the result, but we are still off the lows of the day.

- GBP3.5bln of the 3.25% Jan-33 Gilt. Avg yield 4.351% (bid-to-cover 2.33x, tail 1bp).

- E2.025bln of the 2.50% Jul-33 DSL. Avg yield 2.71%.

- Average auction with bid-to-covers generally in line with the previous results (despite the smaller size for the 3/7-year BTPs). The price dipped shortly after the auction closed and we continue to trade below both the pre-auction mid-price and the average auction price (other than the 30-year BTP which has moved to its highest level for around 2 hours).

- E2.75bln of the 3.80% Apr-26 BTP. Avg yield 3.46% (bid-to-cover 1.55x)

- E3.25bln of the 3.7% Jun-30 BTP. Avg yield 3.75% (bid-to-cover 1.36x)

- E1.5bln of the 4.50% Oct-53 BTP. Avg yield 4.54% (bid-to-cover 1.53x)

- E5bln (E3.993bln allotted) of the 2.40% Oct-28 Bobl. Avg yield 2.41% (bid-to-cover 1.33x).

- E921mln of the 3.00% Sep-33 RFGB. Avg yield 2.98% (bid-to-cover 1.31x)

- E498mln of the 0.125% Apr-36 RFGB. Avg yield 3.133% (bid-to-cover 2.26x).

MNI ECB Preview - June 2023: Tightening Towards The Stop

MNI ECB Preview - June 2023: Tightening Towards The Stop

- The ECB will hike rates by 25bp and confirm the previous decision to end APP reinvestments in July.

- Absent a sharp drop in core inflation, we would expect the ECB to hike again in July.

- Even if the ECB were to raise rates further in September, this would likely be the last turn of the screw.

As other ECB watchers have commented, the June policy decision has been well-telegraphed: the deposit rate will almost certainly increase by 25bp and the previous decision to end APP reinvestments in July will be confirmed. The communication since the May meeting indicate that the dovish members concede that there is still some room to raise rates, while the more hawkish members are no longer calling for larger hikes (50bp+). Continuing to hike by a more modest 25bp is the compromise position that the GC seem to be aligning around.

For the full publication, please see:

FOREX: GBP Posts Shallow Rally on Solid Wages Data

- US CPI takes focus going forward, with the greenback modestly softer headed into the figure. Markets expect inflation to have faded further in May - helping justify a possible pause in rate hike increases this Wednesday - putting M/M CPI at 0.1% and Y/Y at 4.1%, although core metrics are expected to stay sticky.

- UK wage data out at the open provided the latest catalyst for another move higher in UK rates. The front-end of the UK yield curve surged to the highest level since 2008 as weekly earnings came in ahead of expectations (6.5% vs. Exp. 6.1%).

- This further complicates the BoE's inflation outlook and has prompted a small number of sell-side analysts to add to expectations of renewed tightening beyond Summer. A number of MPC members are set to speak Tuesday, with Governor Bailey and MPC's Dhingra set to follow incoming policy maker Megan Greene, who testifies in front of the Treasury Select Committee.

- GBP gained on the back of the jobs release, putting GBP/USD back toward the Monday high. 1.2599 marks the next upside level, and a break above puts the pair back toward mid-May highs. Nonetheless, a broader rally for the currency is lacking, as GBP/USD failed to stage any material test on Monday's 1.2599.

- EUR sits slightly firmer, helping keep EUR/GBP within range of yesterday's best levels and holding the bulk of the cross rally. 0.8636 is the key test for any further upside.

FX OPTIONS: Expiries for Jun13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-02(E638mln), $1.0750-60(E966mln), $1.0775-90(E1.4bln)

- USD/JPY: Y139.50-60($627mln)

- EUR/GBP: Gbp0.8605(E519mln)

- AUD/USD: $0.6870(A$655mln)

- USD/CAD: C$1.3255($508mln), C$1.3330($630mln)

EQUITIES: E-Mini S&Ps Trade to Fresh YtD High

- Eurostoxx 50 futures are trading higher today. Attention turns to resistance at 4362.00, the May 29 high. Clearance of this level would be a bullish development and signal scope for an extension higher towards key resistance at 4409.50, the Nov 18 2021 high on the continuation chart. The recent break of a number of support levels still highlights a potential bearish threat. A reversal lower would expose 4216.00, May 31 low and bear trigger.

- S&P E-minis traded higher Monday, starting the week on a bullish note. This confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on the 4400.00 handle next. The 50-day EMA, at 4217.21 marks a key support. A break would signal a reversal. Initial firm support is at 4279.15, the 20-day EMA.

COMMODITIES: WTI Futures Pierce Support at $67.03 May 31 Low

- WTI futures continue to trade below resistance at $75.06, the Jun 5 high. The pullback from this level reinforces a bearish theme and yesterday’s sell-off marked an extension of the latest move lower. Support at $67.03, May 31 low, has been pierced, a clear break would open $63.90, the May 4 low. Moving average studies are in a bear mode position highlighting a downtrend. A break of resistance at $75.06 is required to signal a reversal.

- The bear cycle in Gold remains intact. The yellow metal continues to challenge trendline support drawn from the Nov 3 2022 low. The trendline intersects at $1960.2. A clear breach of this line would reinforce bearish conditions and open $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/06/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/06/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/06/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 13/06/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/06/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/06/2023 | 1230/0830 | *** |  | US | CPI |

| 13/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/06/2023 | 1400/1500 |  | UK | BOE Bailey Lords Economic Affairs Committee Hearing | |

| 13/06/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 13/06/2023 | 1500/1600 |  | UK | BOE Dhingra Speech at Manchester Metropolitan University | |

| 13/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 13/06/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 14/06/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 14/06/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 14/06/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 14/06/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 14/06/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 14/06/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/06/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 14/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/06/2023 | 1230/0830 | * |  | CA | Household debt-to-income |

| 14/06/2023 | 1230/0830 | *** |  | US | PPI |

| 14/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 14/06/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 15/06/2023 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.