-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis:

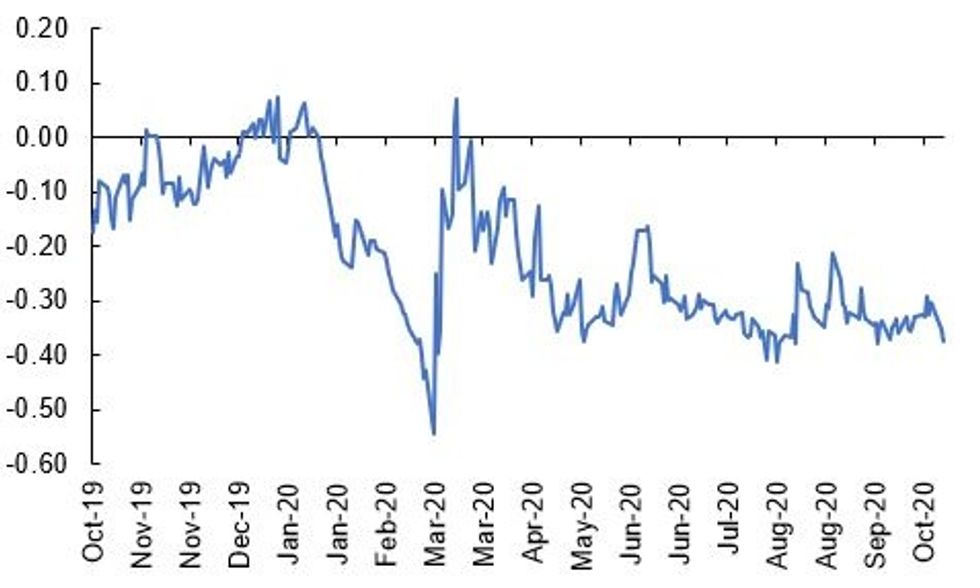

Fig 1: Eonia 5y1y

Source: MNI, Bloomberg

US TSYS SUMMARY: Curve Flattens As Equities Dip

Treasuries have strengthened in European trading - curve flattening has accelerated in the past hour as equities have weakened (no real driver seen for stock drop), 5s30s nearly 2bps lower.

- The 2-Yr yield is down 0.2bps at 0.137%, 5-Yr is down 0.6bps at 0.2976%, 10-Yr is down 1.5bps at 0.7123%, and 30-Yr is down 2.5bps at 1.4862%.

- Dec 10-Yr futures (TY) up 2/32 at 139-8.5 (L: 139-04.5 / H: 139-09.5)

- Comes against the backdrop of negative tone on well-known themes: US fiscal impasse, vaccine COVID vaccine setbacks.

- Among earnings reports today, UnitedHealth beat expectations; BofA, United Airlines and Goldman Sachs up later.

- Very busy slate of Fed speakers. Richmond's Barkin at 0835ET, VC Clarida at 0900ET, VC Quarles at 1030ET, Barkin again at 1400ET, NYFed's Logan at 1420ET, Quarles/Dallas' Kaplan at 1500ET, and Kaplan again at 1800ET.

- Today's data is Sep PPI, at 0830ET. In supply, $55B in 105-/154-day bills. NY Fed buys ~$1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY: Bull Flattening

European govies have rallied this morning with core curves bull flattening.

- Gilts yields are 2-4bp lower on the day, while the 2s30s spread is 2bp narrower. The Dec-20 gilt future has traded up toward the top of the day's range (L:136.00 / H: 136.26) and last printed 136.23.

- Bunds are trading broadly in line with gilts. The curve is similarly 2bp flatter.

- OAT yields have traded down 1-3bp. Last yields: 2-year -0.7039%, 5-year -0.6674%, 10-year -0.3168%, 30-year 0.3599%

- BTPs have firmed, but have slightly underperformed core EGBs.

- EGB Supply this morning came from Germany (Bunds, EUR0.8974bn) and Portugal (OTs, EUR1.00bn). The UK's DMO sold GBP2.50bn of the 0.875% Oct-29 Gilt.

- Today's data slate has been relatively uneventful. The final Spanish CPI print for September was unchanged, while Eurozone industrial production for August was marginally below expectations (0.7% M/M vs 0.8% survey).

DEBT SUPPLY

GILT AUCTION RESULTS: DMO sells GBP2.50bln nominal of 0.875% Oct-29 gilt

- Avg yld 0.166% (0.153%), bid-to-cover 3.29x (2.38x), tail 0.2bps (0.3bps), price 106.346 (106.576).

- Pre-auction mid-price 106.314

- An additional GBP625mln will be available through the PAOF to successful bidders until 13:00BST.

GERMAN AUCTION RESULTS: Germany Allots E0.8974bn of the 0% Aug-50 Bund

- Average yield -0.16% (-0.05%), Buba cover 2.4x (2.91x), bid-to-cover 2.1x (2.42x), price 104.95

PORTUGAL AUCTION RESULTS: Portugal Sells E1.0bn of OTs Vs E0.75-1.00bn Target

- E0.654bn of the 2.125% Oct-28 OT : Average yield -0.085%, bid-to-cover 2.36x

- E0.346bn of the 4.10% Apr-37 OT: Average yield % (1.90%), bid-to-cover 2.29x (1.83x)

OPTIONS

EGB OPTIONS: Schatz CS vs PS

DUZ0 112.02/00ps vs 112.40/60cs, sold the cs at -2 in 5k.

- Was also sold in 13k last week

EGB OPTIONS: Bund Dec CS

RXZ0 177/177.5cs, bought for 7.5 in 3k

EGB OPTIONS: Upside structure

RXX0 176/177cs, bought for 6.5 in 2.5k

SHORT STERLING OPTIONS: More mid buyer

0LZ0 100.00/100.12cs, bought for 5 in another 7,151 (ref 100.04, 36 del). They bought 6k earlier

SHORT STERLING OPTIONS: Longer dated 1x2 CS

LU1 100.25/100.50cs 1x2, bought for 1.75 in 3k

TECHS

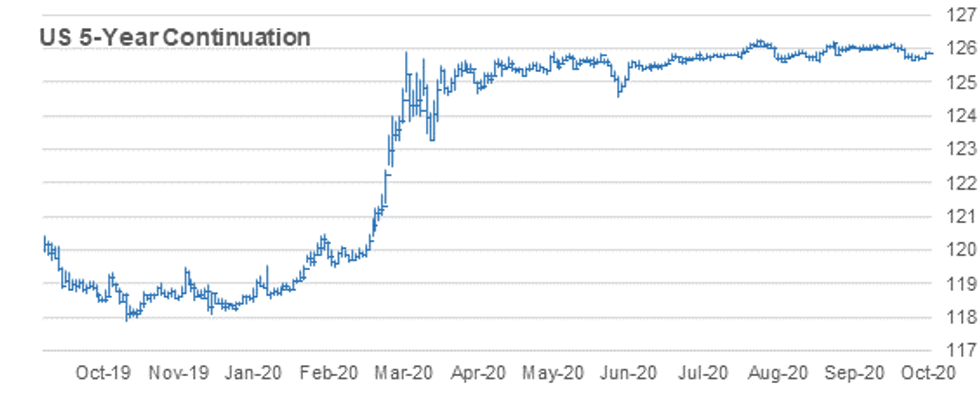

(Z0) Finds Support

- RES 4: 126-006 76.4% retracement of the Sep 30 - Oct 7 sell-off

- RES 3: 125-316 High Oct 5

- RES 2: 125-30+ 61.8% retracement of the Sep 30 - Oct 7 sell-off

- RES 1: 125-29 50-day EMA

- PRICE: 125-28+ @ 11:21 BST Oct 14

- SUP 1: 125-23+ Low Oct 13

- SUP 2: 125-202 Low Oct 7 and the bear trigger

- SUP 3: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 4: 125-112 1.236 proj of Aug 4 - 13 sell-off from Sep 3 high

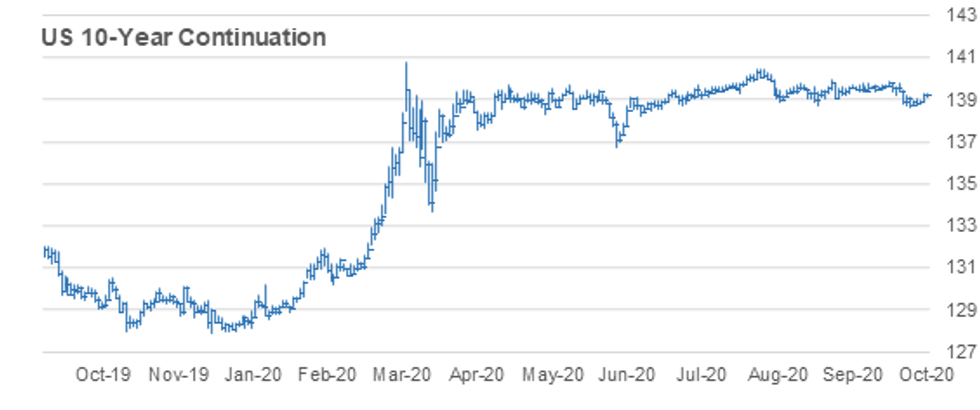

(Z0) Bounce Likely To Extend

- RES 4: 139-25 High Oct 2

- RES 3: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 2: 139-11+ 61.8% retracement of the Sep 29 - Oct 7 sell-off

- RES 1: 139-09+ Intraday high

- PRICE: 139-09 @ 11:28 BST Oct 14

- SUP 1: 138-28+ Low Oct 13

- SUP 2: 138-20+ Low Oct 7 and the bull trigger

- SUP 3: 138-18+ Low Aug 28 and the bear trigger

- SUP 4: 138-04+ 1.000 proj of Aug 4 - 28 sell-off from Sep 3 high

Treasuries rallied Tuesday signalling a possible reversal of the recent bearish theme. The strong daily close yesterday reinforces this possibility and signals scope for stronger S/T gains. Futures are testing a band of resistance highlighted by the 20- and 50-day EMAs. Clearance of these averages would strengthen a S/T bullish argument and together with this week's gains, open 139-11+, a retracement level. Initial support is at 138-28+, yesterday's low.

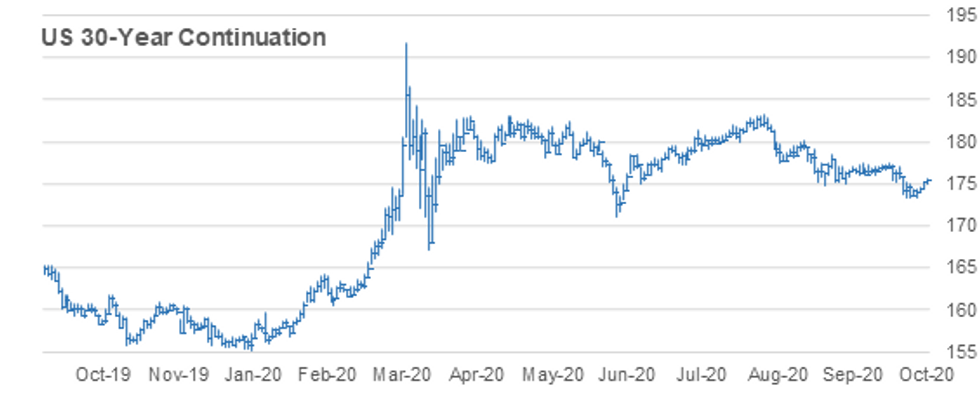

(Z0) Enters An EMA Resistance Zone

- RES 4: 177-14 High Sep 17

- RES 3: 177-00 High Oct 2

- RES 2: 176-10 50-day EMA

- RES 1: 175-25 High Oct 5

- PRICE: 175-18 @ 11:41 BST Oct 14

- SUP 1: 174.08 Low Oct 13

- SUP 2: 173-10 Low Oct 7 and the bear trigger

- SUP 3: 172-13 0.764 projection of Aug 6 - 28 decline from Sep 3 high

- SUP 4: 170-16 1.00 projection of Aug 6 - 28 decline from Sep 3 high

30yr futures rallied yesterday signalling a potential reversal of the recent decline between Sep 29 and Oct 7. Futures are holding onto gains and have pushed higher today. Futures have entered a band of resistance between 175-15 and 176-10, the 20- and 50-day EMAs. Clearance of this zone would strengthen the short-term bullish picture and open 177-00, Oct 2 high. Initial support is at 175-08, yesterday's low. The reversal trigger is at 173-10.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.