-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI US OPEN - US Retail Sales In Focus

MNI US OPEN - US Retail Sales In Focus

EXECUTIVE SUMMARY

- Biden & Xie tentatively agree to prevent further escalation in bilateral tensions

- European FI trades firmer on the day, while equities and FX have been mixed

- US retail sales and industrial production data for October come into focus today.

NEWS

US-CHINA (FT): Joe Biden and Xi Jinping held extensive talks about Taiwan in a virtual meeting on Monday but failed to establish any "guardrails" to ensure that tensions over the island do not escalate into a dangerous conflict. The US president opened the three-hour meeting by telling his Chinese counterpart that they had to ensure competition between the powers did "not veer into conflict". But they did not reach agreement or find any way to ease tensions over Taiwan, which China claims as part of its territory. "On Taiwan, there was sort of nothing new established in the form of guardrails or any other understandings," a senior US official said. "The president was very clear in reaffirming very longstanding US policy and raising very clear concerns, but the idea of establishing specific guardrails with respect to Taiwan was not part of the conversation." Taiwan has evolved into a flashpoint as China increasingly flies fighter jets and bombers into its air defence identification zone.

UK (INDEPENDENT.IE): Boris Johnson has insisted he wants to negotiate a solution to the post-Brexit issues affecting Northern Ireland, but said overriding parts of his deal with the EU would be "perfectly legitimate". Mr Johnson insisted solving the problems with Brussels "still seems possible", but said the UK could trigger Article 16 of the Northern Ireland Protocol "reasonably and appropriately". European Commission vice-president Maros Sefcovic said on Monday that if the British Government suspended the protocol, it would have "serious consequences" for the region and Brussels' relationship with the UK. During a speech to business leaders and diplomats at the Lord Mayor's Banquet in London, Mr Johnson said: "Let me say - given all the speculation - that we would rather find a negotiated solution to the problems created by the Northern Ireland Protocol - and that still seems possible.

EUROZONE (BLOOMBERG): The euro area's accelerating economic recovery is encouraging businesses to hire workers, offering a potential boost to consumption in the months ahead. Employment rose 0.9% in the third quarter, the second straight increase since the 19-nation currency bloc emerged from a double-dip recession, data released Tuesday showed. Even so, about half a million jobs are still missing compared to the pre-pandemic period, and surging Covid-19 infections are raising the risk that wide-ranging new restrictions will be imposed. Economic growth is already under pressure from a global supply squeeze that's affecting manufacturing in particular. For now, the bottlenecks are merely set to delay the recovery, and carmakers including Daimler AG have expressed confidence that the worst might already be over.

DATA

EUROPEAN ISSUANCE UPDATE

GILT AUCTION RESULTS: 0.875% Jan-46 Gilt

Tail wider than previously but broadly in line with recent gilt auction results.

| 0.875% Jan-46 Gilt | Previous | |

| Amount | GBP1.75bln | GBP2.00bln |

| Avg yield | 1.178% | 0.940% |

| Bid-to-cover | 2.03x | 2.38x |

| Tail | 1.0bp | 0.2bp |

| Avg price | 93.636 | 98.583 |

| Pre-auction mid | 93.553 | 98.471 |

| Previous date | 17-Aug-21 |

SPAIN AUCTION RESULTS: 3/9-month letras

| Type | 3-month letras | 9-month letras |

| Maturity | Feb 11, 2022 | Aug 12, 2022 |

| Amount | E505mln | E1.393bln |

| Target | E1.5-2.5bln | Shared |

| Previous | E446mln | E1.48bln |

| Avg yield | -0.769% | -0.641% |

| Previous | -0.667% | -0.599% |

| Bid-to-cover | 3.25x | 2.04x |

| Previous | 6.46x | 2.78x |

| Previous date | Oct 19, 2021 | Oct 19, 2021 |

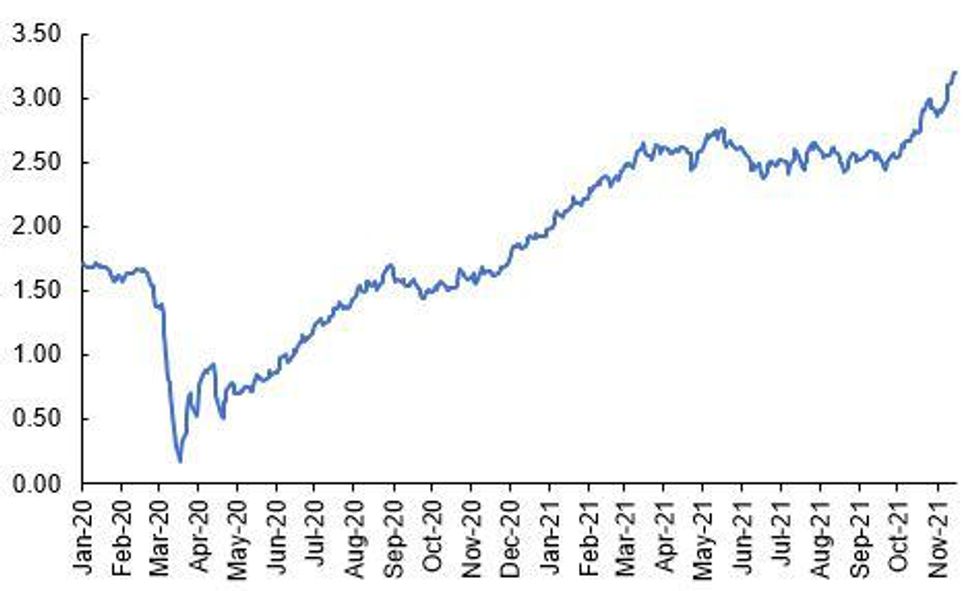

FIXED INCOME: Consolidatory tone

After coming off their highs yesterday, core fixed income has had more of a consolidatory tone today. Perhaps the most notable moves have been for US 10-year UST yields which are down 1.7bp on the day, reversing some of the big gains seen yesterday.

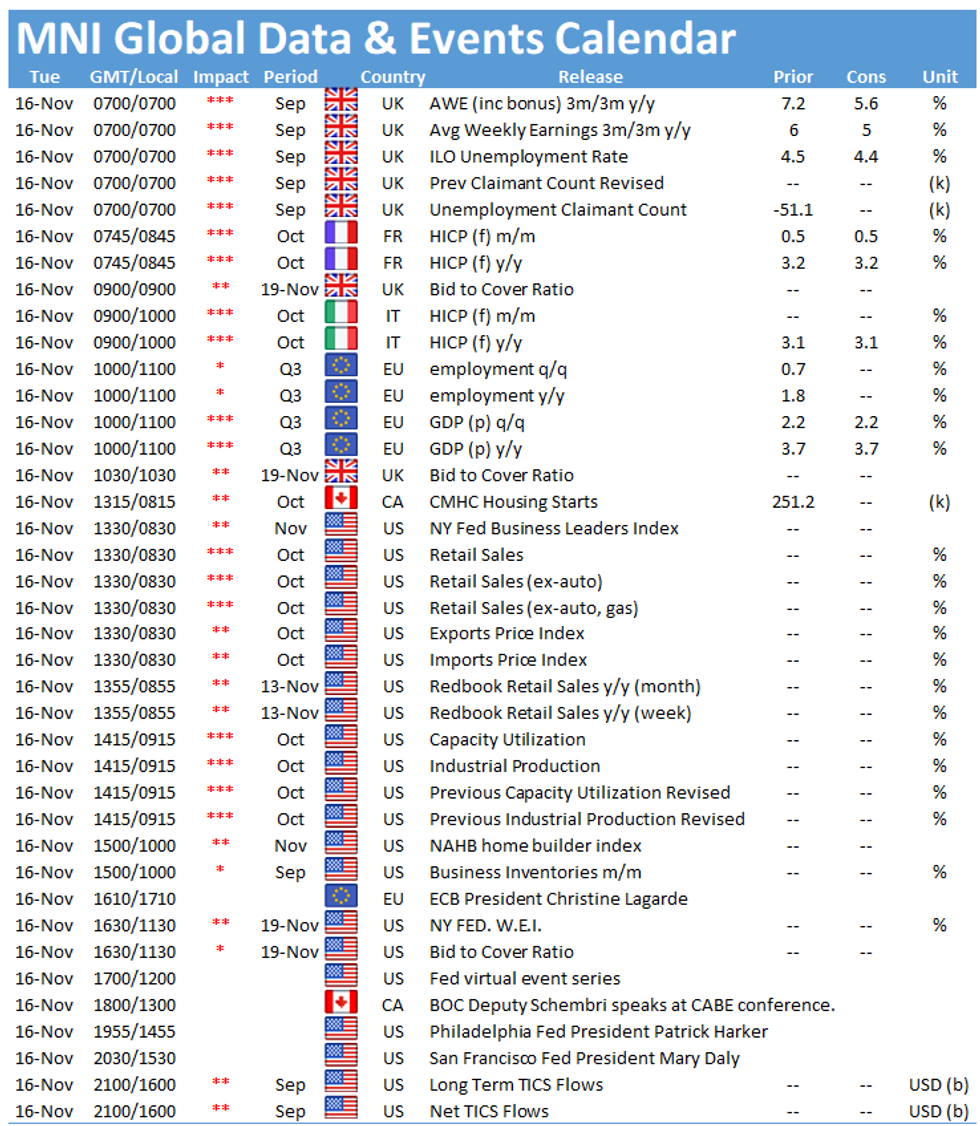

- Looking ahead, focus will be on US retail sales with US industrial production, import/export price indices, business inventories all due today too as well as TIC data.

- On top of the heavy US data docket, we are due speeches from Bullard, Barkin, Bostic, George and Daly as well as ECB's Lagarde.

- TY1 futures are up 0-3 today at 130-12+ with 10y UST yields down -1.6bp at 1.600% and 2y yields unch at 0.519%.

- Bund futures are down -0.13 today at 170.62 with 10y Bund yields down -0.8bp at -0.238% and Schatz yields down -2.2bp at -0.799%.

- Gilt futures are down -0.09 today at 125.94 with 10y yields down -0.7bp at 0.955% and 2y yields down -0.5bp at 0.553%.

FOREX: GBP Extends Recovery on Favourable Jobs Data

- GBP trades stronger for a second session, extending the move seen off the back of the somewhat hawkish comments from BoE members including the governor Bailey in front of lawmakers yesterday. UK jobs data this morning showed that payrolled employment actually increased by around 160,000 across October, indicating that employment rose despite the conclusion of the UK government's COVID-era furlough scheme.

- GBP/USD has traded back above the 1.3450 mark, although gains have faded somewhat ahead of the NY crossover. The USD Index has firmed, but trades just shy of the year-to-date highs printed Monday. The weakest currencies across G10 include NZD, SEK and CHF.

- US retail sales and import/export price indices data crosses later today, with industrial production numbers following shortly afterwards.

- Central bank speakers today include Fed's Bullard, Barkin, Bostic, George as well as Daly, while ECB's Lagarde and BoC's Schembri are also on the docket.

EQUITIES: Mixed markets this morning

- Japan's NIKKEI up 31.32 pts or +0.11% at 29808.12 and the TOPIX up 2.31 pts or +0.11% at 2050.83

- China's SHANGHAI closed down 11.515 pts or -0.33% at 3521.787 and the HANG SENG ended 322.87 pts higher or +1.27% at 25713.78

- German Dax up 40.75 pts or +0.25% at 16189.68, FTSE 100 down 2.9 pts or -0.04% at 7348.38, CAC 40 up 19.69 pts or +0.28% at 7148.06 and Euro Stoxx 50 up 10.38 pts or +0.24% at 4396.53.

- Dow Jones mini down 4 pts or -0.01% at 36007, S&P 500 mini down 5.5 pts or -0.12% at 4674, NASDAQ mini down 25.75 pts or -0.16% at 16164.5.

COMMODITIES: Natgas leading the way higher

- WTI Crude up $0.59 or +0.73% at $81.36

- Natural Gas up $0.09 or +1.81% at $5.106

- Gold spot up $9.55 or +0.51% at $1872.39

- Copper up $0.15 or +0.03% at $440.65

- Silver up $0.11 or +0.44% at $25.1734

- Platinum up $10.84 or +0.99% at $1101.47

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.