-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRiEF: Riksbank Puts Neutral Rate In 1.5 To 3.0% Range

MNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI US OPEN: High Euro Inflation Print Ahead Of US Jobs Report

EXECUTIVE SUMMARY:

- MNI DEALER MEDIAN FOR DECEMBER U.S. PAYROLLS: +450K

- ST LOUIS FED MODEL SEES 1M+ JOBS ADDED IN DEC (MNI)

- EUROZONE INFLATION AT RECORD HIGH AND ABOVE EXPECTATIONS

- BOJ UNRUFFLED ON YEN, EYES GOV'T REAX IF 120 HIT (MNI INSIGHT)

- KAZAKHSTAN'S TOKAYEV VOWS TO CRUSH RESISTANCE IN CRACKDOWN

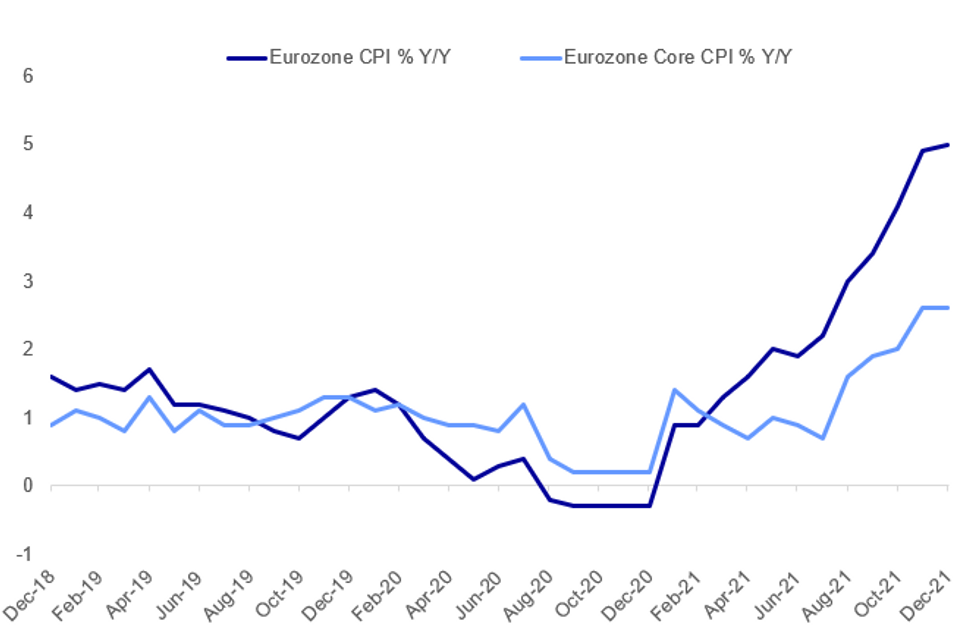

Fig. 1: Eurozone Inflation Hits Fresh Highs In Dec

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

U.S. PAYROLLS (MNI): U.S. hiring in December likely picked up strongly from a month earlier, according to the St. Louis Fed's analysis of real-time employment data from scheduling software company Homebase, showing a seasonally-adjusted rise of over 1 million jobs, economist Max Dvorkin told MNI on Thursday. For full article contact sales@marketnews.com

BOJ (MNI INSIGHT): Bank of Japan officials remain unruffled about the yen's recent fall as the depreciation is moderate and the background is clear, but the central bank has broader concerns about government reaction, MNI understands. For full article contact sales@marketnews.com

KAZAKHSTAN (BBG): President Kassym-Jomart Tokayev declared that order had largely been restored in Kazakhstan but vowed to push ahead with a deadly crackdown after Russian troops helped suppress mass protests that had swept the country.Russia and its allies dispatched more troops to help quell the demonstrations and retake the airport in Almaty, with 75 planes used by the government in Moscow to deploy units, according to the Defense Ministry.The intervention marks the second major move by the Kremlin in as many years to shore up an ally facing upheaval. In 2020, President Vladimir Putinstepped in to back Belarusian leader Alexander Lukashenko’s crackdown on popular protests, which drew sanctions from the U.S. and its allies.

FRANCE / EUROPE ENERGY (BBG): French Finance Minister Bruno Le Maire said the government is worried about the economic and social fallout from the surge in energy prices and is trying to find ways to keep protecting consumers and businesses.The government has pledged to contain the annual increase in electricity prices at 4% primarily using tax cuts. But the surge in wholesale costs has taken policy makers by surprise and the finance ministry is negotiating with state-controlled EDF for other fixes. “If we don’t find a solution in the coming days, French people will see an increase between 35% and 40% in electricity bills,” Le Maire said at a press conference in Paris. “It is an absolute emergency because the explosion in electricity prices is neither sustainable for households nor for businesses.”

EU / FRANCE: French President Emmaneul Macron and European Commission President Ursula von der Leyen will hold a press conference at 1115CET (0515ET, 1015GMT) following talks between the two earlier this morning. VdL and the College of Commissioners have been in Paris most of the week inan effort to show the Commission's committment to working with the Frenchgov't following is assumption of the rotating presidency of the Council ofthe European Union on 1 Jan.

U.K. DATA (BBG): U.K. house prices rose at the fastest pace since before the financial crisis in December after a sixth consecutive month of growth. The average price of a home rose 1.1% last month to a record 276,091 pounds ($374,000), mortgage lender Halifax said in a report published Friday. The gain from a year earlier was 9.8%, the most since July 2007.It means a typical property has increased in value by more than 24,500 pounds over the past 12 months. That’s the biggest gain in cash terms since 2003.

SNB: The Swiss National Bank expects annual profits for 2021 of CHF 26 billion, it was announced Friday, with the profit of just under CHF 26 billion on foreign currency positions.

DATA:

PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Deutsche Bank | 600K | Scotiabank | 600K |

| Amherst Pierpont | 540K | Jefferies | 530K |

| BNP Paribas | 500K | Bank of America | 500K |

| Goldman Sachs | 500K | NatWest | 500K |

| Nomura | 500K | TD Securities | 500K |

| Citi | 450K | Credit Suisse | 450K |

| HSBC | 450K | J.P.Morgan | 450K |

| Barclays | 400K | Societe Generale | 400K |

| Wells Fargo | 400K | RBC | 385K |

| UBS | 375K | Mizuho | 350K |

| BMO | 300K | Morgan Stanley | 260K |

| Dealer Median | 450K | BBG Whisper | 486K |

EZ DEC FLASH HICP +0.4% M/M; +5.0% Y/Y; NOV +4.9% Y/Y

Eurozone Inflation Climbs To Fresh Euro-Era High

EZ DEC FLASH HICP +0.4% M/M; +5.0% Y/Y; NOV +4.9% Y/Y

EZ DEC FLASH CORE HICP +0.4% M/M; +2.6% Y/Y; NOV +2.6% Y/Y

- Flash data for Eurozone harmonised inflation remained above market forecasts, once again breaking euro-era records.

- Headline inflation increased marginally to +5.0% y/y in the flash reading for December, above the forecast of +4.8% y/y which had expected a dampening from +4.9% y/y in November. On the month, flash HICP was at +0.4%, once again marginally above expectations.

- The core flash estimate also outpaced the forecast of +2.5% y/y, coming in at +2.6% y/y and remaining unchanged from the November reading.

- In the December estimate, energy prices remained the key driver, hitting +26.0% y/y, albeit weakening slightly from +27.5% y/y in November.

- Food, alcohol and tobacco rose 3.2% in December (2.2% November), industrial goods by +2.9% (2.4% in November) and services by 2.4% (lessening from 2.7% in November).

MNI: FRANCE NOV IP -0.4% M/M, -0.5% Y/Y; OCT 0.9% M/M

French IP dips below expectations

FRANCE NOV IP -0.4% M/M, -0.5% Y/Y; OCT 0.9% M/M

- French industrial production came in almost one point below market expectations, dipping to -0.4% m/m (+0.5% m/m expected) in November from October's reading of +0.9% m/m.

- On the year, French IP failed to extend the recovery, remaining at the October level of -0.5% y/y in November (+0.6% y/y expected).

- Since the onset of the pandemic in February 2020, French manufacturing and IP has seen substantial declines of -5.8% and -5.0% respectively.

- Transport production (except automobiles) fell sharply (-4.6% in November, compared to +0.8% in October) as well as other transport equipment (-13.1% in November, +12.9% in October).

FIXED INCOME: Gilts and GGBs the movers ahead of payrolls

Core fixed income is fairly subdued ahead of the US employment report due later today. Treasuries and Bunds trade within yesterday's ranges.

- Gilts are underperforming on the day, with 10-year yields hitting their highest levels since October 2021, albeit on little new news.

- Peripheral spreads across the Eurozone are all wider this morning, led by Greek spreads which are 13.2bp wider on the day relative to 10-year Bunds. There doesn't seem to be an obvious driver, with market contacts pointing to potential Greek issuance over the next couple of weeks. This seems like a bit of an outsized move to us, as Greece nearly always issues a new benchmark in January but with low liquidity this seems to be the only obvious driver.

- Payrolls are, of course, the main event of the day. See our preview here.

- TY1 futures are up 0-2+ today at 128-19+ with 10y UST yields up 0.3bp at 1.726% and 2y yields up 0.4bp at 0.872%.

- Bund futures are down -0.03 today at 170.31 with 10y Bund yields up 0.1bp at -0.104% and Schatz yields up 0.4bp at -0.604%.

- Gilt futures are down -0.03 today at 123.24 with 10y yields down -0.4bp at 1.151% and 2y yields down -1.1bp at 0.794%.

FOREX: Greenback Sits Flat-to-Lower Ahead of NFP

- The greenback sits flat-to-lower ahead of the NY crossover, with most major pairs trading inside their recent ranges. This has favoured EUR/USD, which has climbed back above the 1.13 handle, while GBP/USD is north of 1.3550.

- The EUR/CHF chart stands out slightly, with the cross extending the rally off the week's low to narrow the gap with the 50-dma of 1.0452. This level was last crossed at the end of August last year, and a rise through here could signal a reversal from the solid downtrend posted across Q4 2021.

- AUD/USD has shown below yesterday's lows, but losses are more muted as markets watch sizeable option expiries rolling off today at $0.7160 (A$2.4bln).

- The strongest currency so far Friday is NOK, which is benefiting from the steepening of the crude futures curve, which has put the active Brent crude price at the highest levels since October.

- The December jobs data takes focus going forward, with markets expecting 447k jobs to have been added over the month. This is seen pressing the unemployment rate 0.1ppts lower to 4.1%. MNI preview here: https://roar-assets-auto.rbl.ms/documents/13381/US...

EQUITIES: Mixed Ahead Of Payrolls, With Energy And Tech Leading

- Asian stocks closed weaker (with the exception of Hong Kong): Japan's NIKKEI closed down 9.31 pts or -0.03% at 28478.56 and the TOPIX ended 1.33 pts lower or -0.07% at 1995.68. China's SHANGHAI closed down 6.536 pts or -0.18% at 3579.543 and the HANG SENG ended 420.52 pts higher or +1.82% at 23493.38

- European equities are a little weaker, with energy and tech stocks outperforming: the German Dax down 44.09 pts or -0.27% at 16012.04, FTSE 100 up 4.86 pts or +0.07% at 7457.81, CAC 40 down 9.53 pts or -0.13% at 7238.81 and Euro Stoxx 50 down 2.4 pts or -0.06% at 4322.77.

- U.S. futures are edging higher ahead of the December payrolls report, with the Dow Jones mini up 58 pts or +0.16% at 36181, S&P 500 mini up 8.25 pts or +0.18% at 4695.75, NASDAQ mini up 17 pts or +0.11% at 15776.

COMMODITIES: Oil Higher With Kazakh Output Disruption Eyed

- WTI Crude up $0.8 or +1.01% at $80.16

- Natural Gas up $0.06 or +1.52% at $3.87

- Gold spot up $0.94 or +0.05% at $1792.21

- Copper up $3 or +0.69% at $438.45

- Silver up $0.01 or +0.02% at $22.2138

- Platinum up $5.06 or +0.52% at $975.1

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/01/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 07/01/2022 | 1330/0830 | *** |  | US | Employment Report |

| 07/01/2022 | 1500/1000 | * |  | CA | Ivey PMI |

| 07/01/2022 | 1500/1000 |  | US | San Francisco Fed's Mary Daly | |

| 07/01/2022 | 1600/1600 |  | UK | BOE Mann at CFR meeting | |

| 07/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 07/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/01/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/01/2022 | 1400/1500 |  | EU | ECB Schnabel at AEA meeting | |

| 08/01/2022 | 1500/1500 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.