-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Rising Bond Yields Weigh On Equities

EXECUTIVE SUMMARY:

- UK WAGE GROWTH COOLS BUT JOBS MARKET REMAINS HOT

- BRENT CRUDE OIL HITS 7-YEAR HIGH

- GERMAN ZEW MUCH STRONGER THAN EXPECTED

- BOJ KURODA RULES OUT EARLY TIGHTENING (MNI STATE OF PLAY)

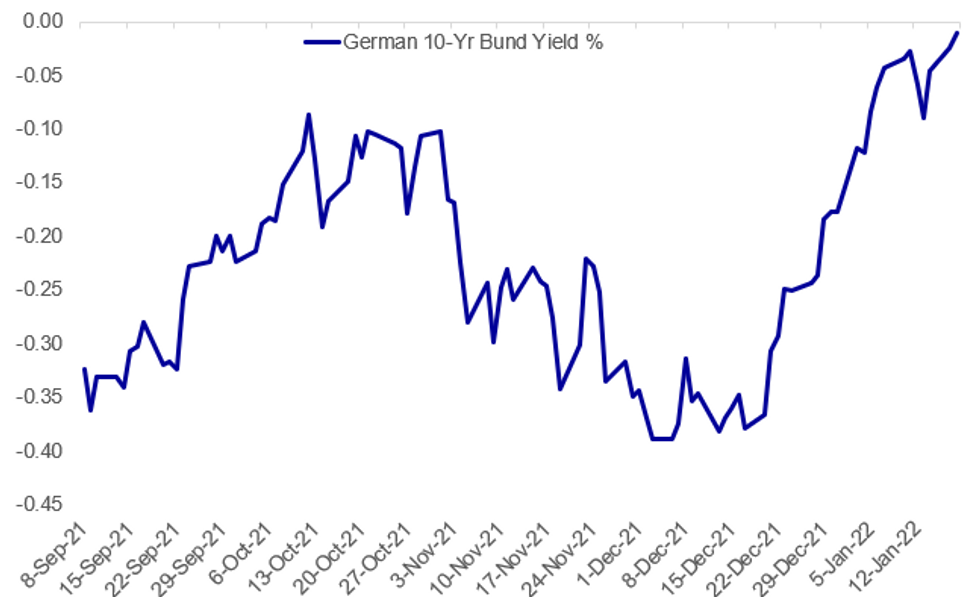

Fig.1: Bund Yields Nearing Zero

Source: BBG, MNI

Source: BBG, MNI

NEWS:

OIL / MIDDLE EAST (BBG): Iran-backed Yemeni fighters launched drone strikes on the United Arab Emirates that caused explosions and a deadly fire outside the capital, Abu Dhabi, ratcheting up security risks in the oil-exporting region at a critical time.One of the biggest attacks to date on UAE soil ignited a fire at Abu Dhabi’s main airport on Monday and set fuel trucks ablaze in a nearby industrial area, killing three people. It took place days after Yemen’s Houthi fighters warned Abu Dhabi against intensifying its air campaign against them.

OIL (BBG): Brent oil surged to the highest level in seven years as physical markets run hot in the world’s largest consuming region and Goldman Sachs Group Inc. said prices are headed for $100 a barrel. Futures in London surged as high as $88.13 a barrel, a level last seen in October 2014. With fears fading over the demand impact from omicron, traders are paying higher and higher premiums to get hold of cargoes in Asia. That’s a sign that they view the market as tight, and is underpinning this year’s 13% rally in headline prices.

GERMAN ZEW (BBG): Investor confidence in Germany’s economy hit its highest level since July 2021 on hopes for a strong recovery once the current wave of Covid-19 infections passes. The ZEW institute’s gauge of expectations jumped to 51.7 in January from 29.9 the previous month. An index of current conditions, however, dropped to a eight-month low of -10.2, reflecting tighter virus restrictions and curbs on activity. “The economic outlook has improved considerably with the start of the new year,” ZEW President Achim Wambach said Tuesday in a statement. “The main reason for this is the assumption that the incidence of Covid-19 cases will fall significantly by early summer. The more positive economic expectations include the consumer-related and export-oriented sectors and thus a large part of the German economy.”

BOJ (MNI STATE OF PLAY): Bank of Japan Governor Haruhiko Kuroda on Tuesday completely ruled out the possibility of unwinding easy policy or changes in policy rates before the 2% price target is achieved in a stable manner. Kuroda told reporters that the BOJ board did not discuss a rate hike or a change of easy policy. "I don't think about a rate hike or a change of easy policy absolutely, and we didn't discuss them," Kuroda said.

PBOC: The People's Bank of China will not allow one-way bet on the yuan to form a trend and will work to correct distortions when market force fails, officials of the central bank told reporters on Tuesday. Liu Guoqiang, vice governor of the PBOC, said the yuan exchange rate may overshoot sometimes, but a long-run one-way volatility means forex market is failing and policy will correct it timely. Also, the PBOC will cut the reserve requirement ratio when necessary and the benchmark loan prime rate will reflect market rate changes at a timely and sufficient pace, officials of the central bank said.

RUSSIA (BBG): Russia said it will move forces to Belarus for military drills next month, amid deepening confrontation with the U.S. and Europe over Ukraine. The joint exercises, called “Allied Determination-2022,” will take place Feb. 10-20, with Russian troops in place in Belarus by Feb. 9, Deputy Defense Minister Alexander Fomin said at a briefing Tuesday for military attaches in Moscow. They’ll practice search-and-destroy measures against “illegal formations” and defense of the state border against “armed groups of militants,” he said.

BofA GLOBAL FUND MANAGER SURVEY (BBG): Global fund managers expect inflation -- not economic growth -- to decline this year, and are placing record bets on a boom in both commodities and stocks, a Bank of America Corp. survey showed.Net overweight positions in commodities rose to a historical high in January, according to the monthly poll, which surveyed 329 panelists with $1.1 trillion in assets under management. Meanwhile, the spread between overweight positions on stocks and bonds increased to peaks last seen in January 2011, as underweight positions on equities fell to an all-time-low.

EU: EU inflation rates will start to fall back, but not before the second half of this year, EU Economic Affairs Commissioner Paolo Gentiloni said Tuesday. "It's clear that factors driving inflation will fade but probably not as soon as expected. Probably in the second half of the year, but not before," he told reporters. OECD Chief Economist Laurence Boone had told euro zone finance ministers Monday evening that factors driving US and EU inflation were not the same, Gentiloni added.

EUROPE AUTOS (BBG): Europe’s car sales slid during December for a sixth month of declines in a row, showing the extent of the uphill battle automakers are facing in the chip supply crisis.Passenger car registrations dropped 22% last month to 950,218 vehicles, the European Automobile Manufacturers’ Association said Tuesday. New-car sales fell 1.5% last year, when automakers had their worst-ever showing since the association started tracking the market in the early 1990s.

JAPAN AUTOS (BBG): Toyota Motor says its full-year global output forecast for the year ending March “is expected to be lower than the previous forecast of 9m units.”Feb. production plan is expected to be about 700,000 units as semiconductor demand continues to impact output.

DATA:

MNI: UK NOV UNEMPLOYMENT RATE 4.1%

MNI BRIEF: UK Wage Growth Cools But Labour Market Remains Hot

The unemployment rate unexpectedly in the three months to November, slipping to 4.1% from the forecast 4.2%, the Office for National Statistics said Tuesday. That comes as employment rose by 60,000 according to the LFS series. Salaried employment rose by a record-high 184,000 according to RTI data, following a downwardly-revised rise of 162,000 in November (originally reported as +257,000).

However, wage growth continued to slow in line with expectations. Average hourly earnings rose by an annual rate of 4.2% in the three months to November, down from 4.9% in the three months to October, while regular earnings growth slowed to an annual rate of 3.8%, below the 4.3% recording in the previous period.

Adjusted for inflation, real earnings slowed dramatically. Excluding bonuses, real regular earnings were unchanged in the three months to November, the slowest growth since July 2020 and last lower in Feb 2017.

MNI: GERMANY JAN ECONOMIC SENTIMENT INDEX 51.7

GERMANY JAN ZEW CURRENT CONDITIONS -10.2

FIXED INCOME: Waiting to see what happens when the US get back to their desks

Core fixed income has drifted further today, moving below yesterday's levels to challenge more key supports. Today's slow slide has come amid a sell-off in global equities (particularly in Europe and the US) as expectations of easy monetary policy withdrawal continue to drive the market.

- There is not a great deal on the calendar today (although this morning's UK labour market report was notable but largely in line).

- The key to today's session is whether we see more downside as the US return to their desks after yesterday's MLK Day holiday or whether that acts as some support to the market here.

- TY1 futures are down -0-15+ since Friday at 127-22+ with 10y UST yields up 2.7bp at 1.814% and 2y yields up 6.3bp at 1.032%.

- Bund futures are down -0.04 today at 169.61 with 10y Bund yields up 0.6bp at -0.21% and Schatz yields up 0.2bp at -0.569%.

- Gilt futures are down -0.09 today at 122.94 with 10y yields up 0.7bp at 1.192% and 2y yields up 0.7bp at 0.835%.

FOREX: Greenback Extending Recovery, But Faces Stiff Resistance

- The dollar is among the strongest currencies in G10 early Tuesday, with the USD Index extending the recent recovery off last week's lows and rising for a third consecutive session. USD gains come alongside similar strength in the JPY, as haven FX follows the US yield curve higher.

- Equities trade lower across the board, with a negative close across Hong Kong and Japan feeding directly into weakness across Europe. Stocks traded lower on the resumption of trade for US assets following Monday's MLK public holiday, which saw the US 10y yield gap higher to touch 1.85% - the highest rate since early 2020 and therefore the highest rate since the COVID pandemic.

- Elsewhere, USD/CNH rallied sharply just ahead of the European open as the PBoC warned that while currencies may deviate from their equilibrium level in the short-term, the PBoC will not allow for a one-way move in the Yuan. As a result USD/CNH rallied to show above the 6.36 level before moderating slightly.

- Looking ahead, US housing starts and the NAHB housing market index take focus, with ECB's Villeroy due to speak in the afternoon.

EQUITIES: Tech Stocks Hit Hard As US Yields Gain

- Asian markets closed mixed: Japan's NIKKEI closed down 76.27 pts or -0.27% at 28257.25 and the TOPIX ended 8.33 pts lower or -0.42% at 1978.38. China's SHANGHAI closed up 28.248 pts or +0.8% at 3569.914 and the HANG SENG ended 105.25 pts lower or -0.43% at 24112.78.

- European equities are lower, with the German Dax down 207.94 pts or -1.31% at 15693.02, FTSE 100 down 74.8 pts or -0.98% at 7541.52, CAC 40 down 97.93 pts or -1.36% at 7106.93 and Euro Stoxx 50 down 54.93 pts or -1.28% at 4239.58.

- U.S. futures are likewise lower, led by tech stocks, with the Dow Jones mini down 266 pts or -0.74% at 35530, S&P 500 mini down 53.25 pts or -1.14% at 4601.5, NASDAQ mini down 279 pts or -1.79% at 15316.75.

COMMODITIES: Energy Easily Outperforming

- WTI Crude up $1.29 or +1.54% at $85.14

- Natural Gas up $0.04 or +0.89% at $4.292

- Gold spot down $9.19 or -0.51% at $1811.96

- Copper down $3.2 or -0.72% at $438.95

- Silver down $0.18 or -0.79% at $22.8783

- Platinum down $8.73 or -0.89% at $969.17

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/01/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 18/01/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 18/01/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 18/01/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 18/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/01/2022 | 2100/1600 | ** |  | US | TICS |

| 19/01/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 19/01/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 19/01/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 19/01/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 19/01/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 19/01/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 19/01/2022 | 1000/1100 | ** |  | EU | construction production |

| 19/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 19/01/2022 | 1330/0830 | *** |  | CA | CPI |

| 19/01/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 19/01/2022 | 1330/0830 | *** |  | US | housing starts |

| 19/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.