-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Russia-Ukraine Fears Weigh Heavily On Stocks

EXECUTIVE SUMMARY:

- G7 FINANCE MINISTERS THREATEN MAJOR SANCTIONS AGAINST RUSSIA

- KREMLIN SAYS DOESN'T SEE UKRANIAN ENVOY'S COMMENTS RE NATO AS OFFICIAL CHANGE IN POSITION

- EUROPEAN ENERGY PRICES JUMP ON MOUNTING TENSION OVER UKRAINE

- KC FED PRES GEORGE: 50BP POSSIBLE BUT NO INTER-MEETING HIKE (WSJ)

- STAIKOURAS SAYS GREECE WILL REPAY FINAL IMF LOANS BY END-MARCH (RTRS)

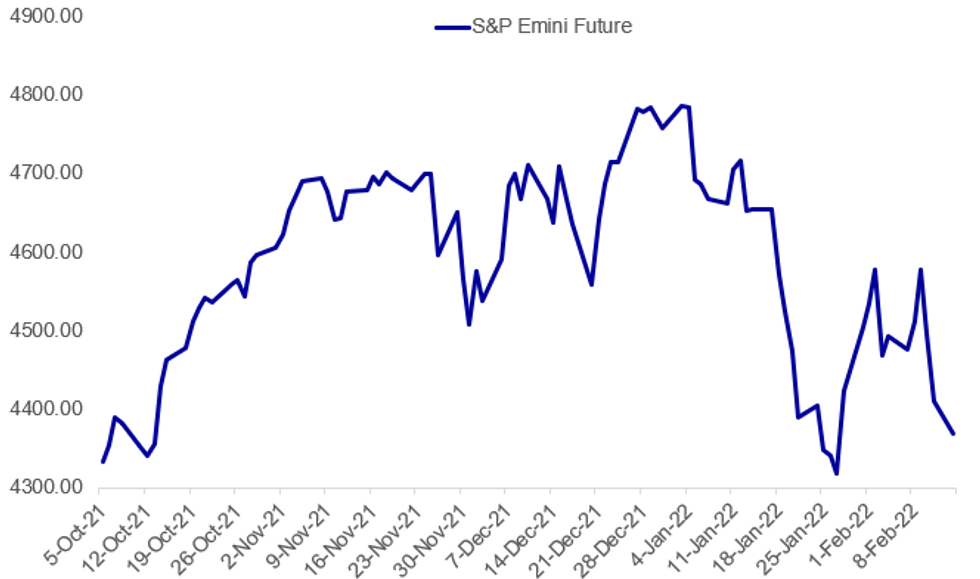

Fig. 1: Stocks Tumble On Geopolitical Concerns

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UKRAINE-RUSSIA-G7: G7 finance ministers have releaseda joint statement, declaring that, "The ongoing Russian military build-up at Ukraine’s borders is a cause for grave concern. We, the G7 Finance Ministers, underline our readiness to act swiftly and decisively to support the Ukrainian economy, while also supporting the ongoing efforts to urgently identify a diplomatic path towards de-escalation."

- "Our immediate priority is to support efforts to de-escalate the situation. However, we reiterate that in particular any further military aggression by Russia against Ukraine will be met with a swift, coordinated and forceful response. We are prepared to collectively impose economic and financial sanctions which will have massive and immediate consequences on the Russian economy."

- Statement comes as concerns over a Russian invasion of Ukraine reach fever-pitch. Massed Russian forces on Ukraine's borders viewed as being able to launch an incursion at any point given supply lines and stocks of fuel, medical equipment etc. established among deployed troops.

BANK INDONESIA (MNI INSIGHT): Indonesia’s central bank is forecasting higher growth and inflation as conditions combine with the likely impact of tightening policies from developed world central banks to drive a likely rate rise later this year, MNI understands. For full article contact sales@marketnews.com

HONG KONG / COVID (BBG) :Hong Kong’s daily virus cases topped 2,000 for the first time, with the worsening outbreak throwing the city’s Covid Zero push into disarray. Health authorities announced 2,071 cases on Monday, as well as 4,500 preliminary infections. Cases have exceeded capacity at Hong Kong’s public hospitals, health officials have said, adding they will now shift to prioritizing care for the elderly and children who get Covid. Authorities said thousands of people are waiting to be hospitalized and a backlog at its testing facilities means there is a delay in confirming positive cases.

DATA:

No key data releases in the European morning.

FIXED INCOME: Core bond futures higher across the board

Core bond futures are higher across the board this morning as markets react to continue political uncertainty in Ukraine.

- Bunds are outperforming, as there have also been some comments from ECB policymakers over the weekend leaning against rate hikes.

- Fed's George seems opposed to an inter-meeting hike and despite saying a 50bp hike is possible in March, that she's uncertain about the path ahead for rates - comments that are relatively dovish for one of the FOMC members who is considered to be on the hawkish end of the spectrum.

- ECB's Lagarde is due to address the European Parliament later this afternoon in comments that will be closely watched.

- TY1 futures are up 0-7+ today at 126-20 with 10y UST yields down -2.0bp at 1.921% and 2y yields up 2.2bp at 1.527%.

- Bund futures are up 0.91 today at 165.86 with 10y Bund yields down -7.4bp at 0.220% and Schatz yields down -5.7bp at -0.391%.

- Gilt futures are up 0.36 today at 120.31 with 10y yields down -4.5bp at 1.498% and 2y yields up 1.4bp at 1.421%.

FOREX: Havens Favoured as Markets Watch Russia/Ukraine Clock Ticking

- Haven currencies are outperforming early Monday, with markets starting the week on an acutely risk-off footing. The blunt and direct warnings from US leaders late last week that we're approaching a crunchpoint in Russia/Ukraine talks (US intelligence suggested a full invasion could occur as soon as Wednesday) continues to roil markets, putting JPY and CHF at the top of the G10 pile.

- Resultingly, growth proxies are on the backfoot, with AUD, NZD, SEK and NOK slipping lower and reversing recent recoveries. German Chancellor Scholz is the next world leader headed to meet Putin, in the latest part of the Western attempt to de-escalate tensions - despite insistence among both Kiev and Moscow representatives that the situation on the ground is somewhat more placid.

- The data docket is typically quiet for a Monday, with no major releases due. This should keep focus on the speaker slate, with Fed's Bullard appearing on CNBC at 1330GMT/0830ET. His comments will be watched particularly closely given his outright hawkishness last week, in which he brought up the prospect of both a 50bps rate hike, as well as the possibility of an inter-meeting hike. ECB's Lagarde follows later in the day, speaking at 1615GMT/1115ET.

EQUITIES: Russia-Ukraine Fears Fuel Equity Drop

- Asian equities closed lower: Japan's NIKKEI closed down 616.49 pts or -2.23% at 27079.59 and the TOPIX ended 31.96 pts lower or -1.63% at 1930.65. China's SHANGHAI closed down 34.066 pts or -0.98% at 3428.882 and the HANG SENG ended 350.09 pts lower or -1.41% at 24556.57

- European equities are falling sharply, with the German Dax down 551.92 pts or -3.58% at 14885.38, FTSE 100 down 159.85 pts or -2.09% at 7525.46, CAC 40 down 231.71 pts or -3.3% at 6818.03 and Euro Stoxx 50 down 150.5 pts or -3.62% at 4011.94.

- U.S. futures are weaker as well, with the Dow Jones mini down 359 pts or -1.04% at 34268, S&P 500 mini down 52.5 pts or -1.19% at 4357.25, NASDAQ mini down 197.75 pts or -1.39% at 14043.75.

COMMODITIES: Gas Prices Defy Broader Risk-Off Move

- WTI Crude down $0.27 or -0.29% at $93.3

- Natural Gas up $0.22 or +5.51% at $4.157

- Gold spot down $1.1 or -0.06% at $1856.31

- Copper down $4 or -0.89% at $447.25

- Silver up $0.16 or +0.7% at $23.7501

- Platinum down $6.46 or -0.63% at $1029.2

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 14/02/2022 | 1615/1715 |  | EU | ECB Lagarde Speech on anniversary of Euro at EU Parliament | |

| 14/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/02/2022 | 1630/1730 |  | EU | ECB Lagarde Intro at ECB Annual Report 2020 Plenum | |

| 15/02/2022 | 2350/0850 | *** |  | JP | GDP (p) |

| 15/02/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 15/02/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/02/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/02/2022 | 1000/1100 | * |  | EU | employment |

| 15/02/2022 | 1000/1100 | *** |  | EU | GDP (p) |

| 15/02/2022 | 1000/1100 | * |  | EU | trade balance |

| 15/02/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/02/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2022 | 1330/0830 | *** |  | US | PPI |

| 15/02/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/02/2022 | 1400/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 15/02/2022 | 1915/1415 |  | US | Senate Banking Committee votes on Federal Reserve nominees | |

| 15/02/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.