-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Still Eye March Fed Hike

Highlights:

- RUB folds under sanctions pressure, bleeds into European markets

- Treasuries gap higher on renewed risk-off, but STIRs still point to March Fed rate hike

- Equities off, but E-mini S&P still clear of Friday low

US TSYS SUMMARY: Bull Steepening On Safe Haven Flows

- Despite modestly softening through the European session, cash Tsys remain significantly firmer on the day in a bull steepening on safe haven flows. The front-end sits 13.5bps off post-US CPI highs although whilst it’s steepened, the curve remains relatively flat with 2s10s at just 41bp.

- 2YY -7.4bp at 1.496%, 5YY -6.7bp at 1.798%, 10YY -5.2bp at 1.910% and 30YY -3.5bp at 2.238%.

- TYM2 sits 22 ticks higher at 126-27+ but within the session range, on strong volumes.

- Data: International trade, wholesale & retail inventories, the MNI Chicago PMI and Dallas Fed manufacturing activity survey.

- Fedspeak: Bostic (non-voter) speaks in a moderate virtual discussion with Q&A (1030ET). Powell ahead on Wed.

- Bill issuance: US Tsy $60B 13W, $51B 26W bill auctions (1130ET).

STIR FUTURES: Fed Funds Keep To March Liftoff, 3 Consecutive Hikes

- Fed Funds implied hikes opened softer and whilst they’ve firmed since London came in, remain close to lows on the first day of the Russian invasion.

- Whilst softer, market pricing nevertheless still has March liftoff (29bp) with three consecutive hikes up to and including June (79bp) although it now falls just shy of 6 hikes for the year (145bps), seemingly putting relatively little impact on more medium-term growth fears.

- FOMC members last week implied little imminent disruption to hiking plans from the invasion. Only Bostic (2024) scheduled for today but more scheduled this week including Powell's semi-annual testimony before the House on Wed (1000ET). Potential for unscheduled interjections in the meantime to see if this is still the case after the escalation in sanctions over the weekend.

Fed Funds Futures Cumulative Hikes For Specific MeetingsSource: Bloomberg

Fed Funds Futures Cumulative Hikes For Specific MeetingsSource: Bloomberg

EGB/GILT SUMMARY: Markets Braced For Further Russia-Ukraine Fallout

Markets have again shifted to a risk-off posture after a further escalation in the Russia-Ukraine crisis.

- President Vladimir Putin announced at the weekend that Russia's nuclear deterrent is on high alert, while the central bank was forced to hike policy rates to 20.0% from 9.50% amid a collapse of the ruble which saw USDRUB at one point trade down 30%.

- Elsewhere, the movement towards further economic sanctions against Russia continued to gain momentum with the US, EU and UK forcing several Russian banks and the central bank out of SWIFT.

- Gilts have traded firmer with the short-end rallying sharply and the curve bull steepening. Cash yields are now 1-8bp lower on the day.

- Bunds opened lower and have retained most of the early gains. Yields are 3-6bp lower across much of the curve, although the very long end has traded below the Friday close. The 2s30s spread has widened 7bp.

- It is a similar story for OATs where the 2s30s spread has traded up 6bp.

- BTPs gave up most of the early gains while continuing to trade marginally above the Friday close.

- Supply this morning came from Germany (Bubills, EUR5.363bn allotted) and the EU (NGEU, EUR2.5bn). Later today France will offer EUR4.6-5.8bn of BTFs.

EUROPE ISSUANCE UPDATE:

European Union sells E2.5bln 0% Jul-26 EU NGEU, Avg yield 0.161% (Prev. -0.487%), Price 99.30 (Prev. 102.35)

EUROPE OPTION FLOW SUMMARY:

Eurozone:

RXM2 160/158ps 1x1.5 bought for 12.5 in 3k

OEJ2 131.00p, bought for 38 in 2.5k

OEJ2 131/130ps 1x1.5,sold at 16 in 3k

OEJ2 130.50/129.50ps 1x1.5, sold at 12 in 6k

OEK2 127.75p, bought for 6.5 in 2k

SX7E 16th December 110/120cs, bought for 1.45 in 6k

SX7E 18/03 85/80ps, bought for 0.95 in 10k

SX5E 18/03 3575p, bought for 54.30 in 12k

FOREX: Risk-Off as Sanctions Sweep Roils Russian Assets

- The impacts of Western sanctions targeting Russia's economy are clear to see early Monday, with Russian assets sliding aggressively, putting the RUB and Russia-related stocks considerably lower. London listings for the likes of Sberbank and Gazprom are down as much as 60%, while the USD/RUB rate sits higher by as much as 35%. The CBR's snap decision to more than double domestic interest rates has done little to help, with the 1050bps rate rise to 20% failing to stall the downtick in RUB rates.

- Acute volatility has bled into CEE and G10 FX, with regional currencies including SEK, NOK, HUF and PLN all lower so far. The primary beneficiaries have been haven currencies, putting USD, CHF and JPY at the top of the board, with markets now pondering any Fed response to renewed economic uncertainty - raising the focus on Powell's testimony to Congress this week.

- Focus turns to any further Russian efforts to stabilise the domestic economy as well as any potential counter-sanctions that Russia could send westwards.

- MNI Chicago PMI is the data highlight Monday, with CB speakers including ECB's Lagarde and Panetta as well as Fed's Bostic.

FX OPTIONS: Expiries for Feb28 NY cut 1000ET (Source DTCC)

- EURUSD: 1.1135 (452mln), 1.1160 (553mln), 1.1190 (260mln), 1.1200 (402mln), 1.1250 (1.48bn)

- USDJPY: 115.10 (462mln), 115.40 (1.01bn)

- USDCAD: 1.2800 (624mln)

Price Signal Summary - S&P E-Minis Technical Signals Point To A S/T Base

- In the equity space, the S&P E-minis trend condition remains bearish. However, short-term technical signals highlight potential for a correction near-term. Bullish divergence between price and momentum signals scope for some unwinding of recent weakness or at the very least, a period of consolidation. Note that last Thursday’s candle pattern is a hammer - a short-term reversal signal. The next resistance is at 4412.50, the 20-day EMA. 4101.75, the Feb 24 low, is the bear trigger. EUROSTOXX 50 futures traded down sharply last Thursday. Price however remains above recent lows. The break lower confirms a resumption of the bear cycle and futures have recently cleared a number of key support levels. This suggests scope for a deeper sell-off and has opened 3727.00, the Mar 25 2021 low on the continuation chart. The bear trigger is 3749.50, Feb 24 low. Resistance to watch is at 4049.50, the Feb 23 high.

- In FX, EURUSD remains vulnerable following last week’s move lower. The trigger for a resumption of weakness is 1.1106, Feb 24 low. A break would open 1.1040, 76.4% retracement of the Jan ‘21 - Mar ‘21 bull phase. Resistance is seen at 1.1280, Feb 14 low. The GBPUSD outlook remains bearish. A sharp sell-off last week resulted in the break of a number of support levels. An extension lower would expose 1.3163, Dec 8 low. USDJPY key short-term support at 114.16, the Feb 2 low, remains intact. While it holds, trend conditions are bullish. A move higher would refocus attention on the bull trigger at 116.35, this year’s high on Jan 4.

- On the commodity front, volatile price action in Gold last week saw the yellow metal reverse sharply from the session high of $1974.3 on Feb 24 . Conditions remain bullish however gold is back inside its bull channel, drawn from the Aug 9 2021 low. The channel top intersects at $1940.1 today and represents a key short-term resistance. Watch support at $1878.4, the Feb 24 low low. WTI futures remain in an uptrend despite the pullback from last Thursday’s high. The $100.00 level has been probed and a clear breach of this psychological barrier would strengthen current trend conditions and open 102.01 next, 3.382 projection of the Dec 2 - 9 - 20 price swing.

- In the FI space, Bund futures remain in a short-term bullish corrective cycle. A resumption of gains would signal potential for a climb towards the 50-day EMA at 168.50. Support to watch is at 165.16, the Feb 22 low. The trend condition in Gilts remains bearish. Resistance to watch is at 123.53, the Feb 18 high. A break would signal potential for a stronger short-term climb. Key near-term support is at 121.10, the Feb 16 low.

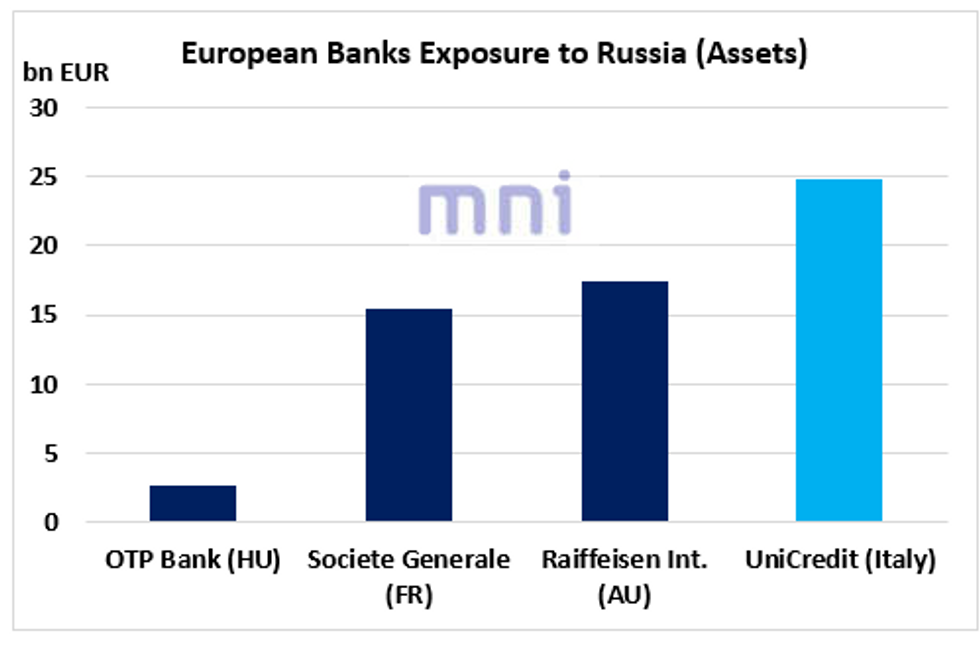

EQUITIES: Escalation in Russia/Ukraine Conflict Weighs on European Banks (Especially UniCredit)

- European banks have been dramatically impacted by the escalation of the Russia/Ukraine conflict this month, with the SX7E index (Euro banks) down over 20% from peak to trough.

- This is a second ‘shock’ for European banks following recent Lira depreciation in Q4 2021, which significantly impacted Spanish banks due to their ‘large’ exposure to Turkey (particularly BBVA).

- This time, it seems that UniCredit is the most exposed to the current conflicts, with the bank totaling nearly 25bn EUR in exposure to Russia (assets) according to the EBA.

- UniCredit stock price is down nearly 30% this month, breaking below its 200DMA this morning.

- Next support to watch on the downside stands at 10.39, which is the low reached on Nov 30 2021.

- Next key level to watch on the downside stands at 9.8180, which corresponds to the 61.8% Fibo retracement of the 6.09 – 15.85 range.

- UniCredit lost 10bn EUR in market cap this month, currently standing at 25bn EUR, bringing the price-to-book ratio down to 0.40.

- Despite their attractive valuations based on a range of 'value metrics', the prolonged deterioration in the Russia/Ukraine conflict could weigh on European financials as the ECB may delay its tightening cycle to limit the economic downturn.

Source: EBA/Benjamin Braun

COMMODITIES: European natgas leading energy prices higher

- WTI Crude up $4.9 or +5.35% at $96.49

- Natural Gas (NYM) up $0.16 or +3.49% at $4.624

- Natural Gas (ICE Dutch TTF) up $15.08 or +16.19% at $108.25

- Gold spot up $11.44 or +0.61% at $1899.88

- Copper up $3.4 or +0.76% at $451.95

- Silver up $0.07 or +0.27% at $24.3339

- Platinum up $3.67 or +0.35% at $1062.47

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2022 | 1130/1230 |  | EU | ECB Panetta speech at EUI monetary policy debate | |

| 28/02/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 28/02/2022 | 1330/0830 | * |  | CA | Current account |

| 28/02/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 28/02/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/02/2022 | 1530/1030 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2022 | 1550/1650 |  | EU | ECB Lagarde speech on Women in Econ & Finance | |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/03/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0030/1130 |  | AU | Balance of Payments: Current Account | |

| 01/03/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 01/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/03/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/03/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 01/03/2022 | 0730/0730 |  | UK | DMO Gilt Operations Announcement W/C 4/11 April | |

| 01/03/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/03/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 01/03/2022 | - |  | EU | ECB Panetta at G7 Finance Ministers/CB Governors Meeting | |

| 01/03/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/03/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 01/03/2022 | 1300/1400 |  | EU | ECB Lagarde visits Chancellor Scholz | |

| 01/03/2022 | 1330/0830 | * |  | US | construction spending |

| 01/03/2022 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 01/03/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/03/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2022 | 1830/1830 |  | UK | BOE Saunders speech at East Anglia University | |

| 01/03/2022 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2022 | 1900/1900 |  | UK | BOE Mann panels Cleveland Fed discussion | |

| 01/03/2022 | 1900/1400 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.