-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Inflation Stands Out In European PMIs

EXECUTIVE SUMMARY:

- HIGH INFLATION STANDS OUT IN EUROPEAN PMI READINGS

- G-7 TO WARN PUTIN AGAINST USING CHEMICAL OR NUCLEAR WEAPONS

- NORGES BANK RAISES POLICY RATE TO 0.75%

- SNB LEAVES KEY POLICY RATE UNCHANGED AT -0.75%

- EUROZONE INFLATION TO REMAIN HIGH EVEN IF OIL PRICES STOP RISING: ECB'S ELDERSON

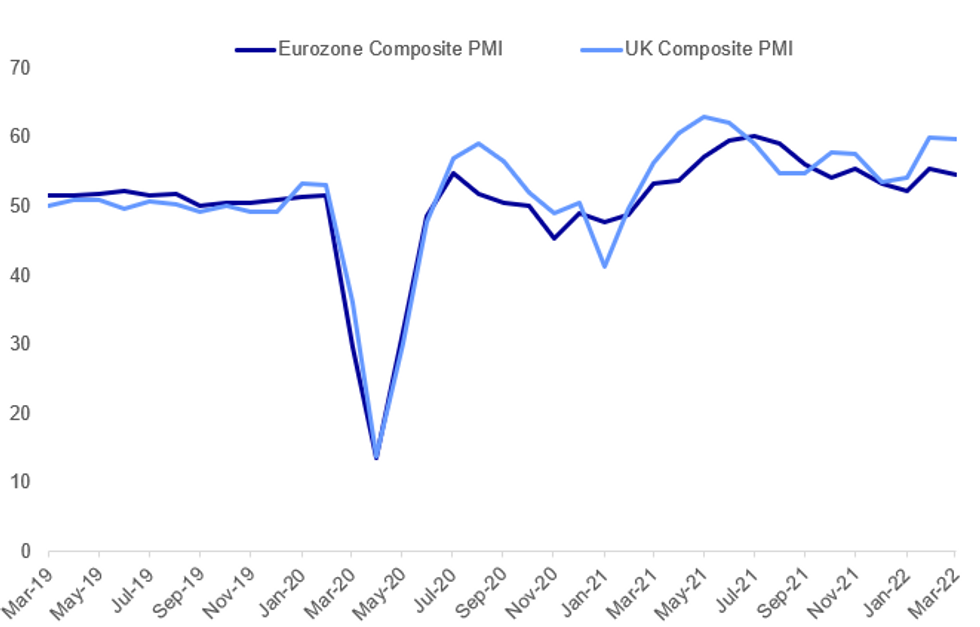

Fig. 1:

Source: S&P Global, MNI

Source: S&P Global, MNI

NEWS:

G7 / RUSSIA (BBG): The world’s leading economic powers plan to warn Russian President Vladimir Putin against using chemical or nuclear weapons in Ukraine in a draft statement the Group of 7 plans to issue on Thursday. The G-7 leaders also plan to say that they will continue to impose “severe consequences” on Russia by fully implementing the sanctions that countries have already imposed and stand ready to apply additional measures.“ We task the relevant ministers in a focused initiative to monitor the full implementation of sanctions and to coordinate responses related to evasive measures, including regarding gold transactions by the Central Bank of Russia,” according to the draft statement obtained by Bloomberg.

NORGES BANK: Rate decision and policy statement broadly in line with expectations.

- Policy rate will most likely be raised further in June

- Rate path gets the expected boost, with year-end average depo rate raised to 1.32% from 1.11% in Dec. This prices year-end rates at 1.50%- Terminal rate (now end-2025) up to 2.31%, and path projects 4 rates hikes this year (inline with exp) and a further 4 hikes in 2023 (Q4 2023 path projection upped to 2.35% from 1.62% prior.

- Broadly inline with expectations for the rate path, and leaves Norges Bank set to raise rates at each quarterly monpol report meeting. Leaves very little suggestion of either back-to-back rate rises or a 50bps moves.

- No distinct reaction in NOK prices, with EUR/NOK just off the lows of the day and either side of the 9.50 level.

NORGES BANK / NATO (BBG): Leaders of NATO countries are set to agree at a summit Thursday on Jens Stoltenberg, the military alliance’s secretary general, staying on in his post possibly for another year despite his being picked as Norway’s next central bank chief. Senior officials from several members of the North Atlantic Treaty Organization have held talks about Stoltenberg prolonging his mandate, as he leads the alliance’s response to Russia’s invasion of Ukraine, according to a western diplomat who asked not to be named discussing a confidential issue.

ECB (RTRS): Euro zone inflation could remain above the European Central Bank's 2% target "well into" 2023, even if oil prices do not rise any further, ECB board member Frank Elderson said on Thursday. "Even if global oil prices do not increase any further and stabilise at high levels, we currently expect inflation to be above our 2% target well into 2023, before settling around target in 2024," Elderson said in a speech. But the ECB is committed to bringing price growth down as its commitment price stability is "unwavering", Elderson added.

SNB (RTRS): The Swiss National Bank kept its ultra-expansive monetary policy on hold on Thursday, bucking the trend of other central banks which have started hiking interest rates to tackle rising inflation. MThe SNB kept its policy rate locked at -0.75%, as unanimously forecast by economists in a Reuters poll, as well as its commitment to conduct currency interventions to stem the rise of the safe-haven Swiss franc. The central bank also kept its description of the franc as "highly valued", the same wording it has deployed since September 2017, despite the currency recently hitting its highest level against the euro in seven years.

SNB (RTRS): The Swiss National Bank is not powerless to battle rising inflation in Switzerland, Chairman Thomas Jordan said on Thursday, as the central bank doubled its forecast for price rises this year. "We will take all measures to maintain price stability over the medium term," Jordan told reporters after the SNB gave its latest monetary policy update.

UK-RUSSIA (RTRS): Britain froze the assets of Russia's Gazprombank and Alfa Bank, and the state-run shipping firm Sovcomflot, in its latest round of sanctions announced on Thursday. They were among 59 individuals and entities added to the sanctions list which has been used to target Moscow since Russia invaded Ukraine. Gazprombank is one of main channels for payments for Russian oil and gas. Alfa-Bank is one of Russia's top private lenders, controlled by Mikhail Fridman, who was sanctioned by Britain earlier this month, and his partners.

CHINA/US: China hopes the U.S. can remove all additional tariffs imposed on Chinese goods as soon as possible and push bilateral economic and trade relations back to a normal track, said Shu Jueting, spokeswoman of the Ministry of Commerce at a briefing on Thursday. China has noticed the U.S. has restored tariff exemptions for 352 imported goods from China on Wednesday, which will help normal trade of related products, said Shu. She urged the U.S. to look at the interests of consumers and producers facing high inflation and economic recovery challenges.

DATA:

MNI: FRANCE FLASH MAR SERVICES PMI 57.4 (FOREC 55.0); FEB 55.5

MNI: GERMANY FLASH MAR SERVICES PMI 55.0 (FOREC 53.7); FEB 55.8

GERMAN DATA: Inflation a concern, but confidence falling (unlike in France)

Highlights from the German PMI release:

- Record input and output prices (like France)

- Manufacturing demand fell due to both supply problems and weaker demand.

- However, unlike in France, business confidence fell and this led to a reluctance for manufacturers to take on new staff.

MNI: EUROZONE FLASH MAR SERVICES PMI 54.8 (FOREC 54.3); FEB 55.5

Eurozone PMI sees weak confidence and rising prices

Highlights from PMI press release:

- Prices increased at unprecedented levels

- But exports fell and business confidence was weakest for nearly 18 months (France had seen confidence hold up).

- However, unlike in Germany, employment increased.

- Output growth outside of Germany and France was the weakest for a year (excluding the Omicron hit in Jan)

- Bund futures continue to move lower.

MNI: UK FLASH MAR SERVICES PMI 61.0 (FOREC 58.0); FEB 60.5

- UK FLASH MAR MANUF PMI 55.5 (FORECAST 57.0); FEB 58.0

- UK FLASH MAR COMPOSITE PMI 59.7 (FORECAST 57.5); FEB 59.9

UK DATA: High inflation, strong growth, but weakening confidence

Highlights from the PMI:

- Inflation second fastest "for more than 2 decades" (only faster in Nov 2021)

- "New business received by UK private sector firms increased sharply in March, although the rate of growth eased from February's eight-month peak." Manufacturing saw weakest new orders expansion since Feb 2021, however.

- Employment strong

- Supply chains: "Supplier delays the least widespread since October 2020. However, survey respondents continued to note that shortages of raw materials, staff absences and shipping delays had held back production growth."

- Weak confidence however: "Sharp drop in business optimism. The index dropped from 76.1 in February to 71.4 in March, to signal the lowest level of confidence since October 2020. Moreover, the monthly fall in business expectations (down 4.7 index points) signalled by far the greatest setback since the start of the pandemic and reflected much weaker year ahead growth projections in both the manufacturing and services sectors. "

FIXED INCOME: Bear steepening, but within yesterday's ranges

Bond markets continue to see relatively low liquidity with markets seemingly in cycles of up day followed by down day followed by up day... This morning is no exception. We have seen core fixed income generally move lower, but remaining within yesterday's ranges (and yields still a little away from the cycle highs seen). Curve are bear steepening on the day.

- The morning session has seen the release of PMIs across Europe and the UK. Record (or close-to-record) high inflation has been the dominant theme with output expectations showing some variation across countries. With the exception of France, however, confidence is seeping away, leading to concerned fears of stagflation. Markets seem more focused on the inflation than the growth side again, however.

- The busy data day continues later with US durable goods the headline (released alongside weekly claims data) while the US Markit PMI will also be released.

- The NATO summit could provide further headlines today (but is unlikely to change the narrative too much) while Fed's Evans is the highlight of cen-bank speak today.

- TY1 futures are down -0-10+ today at 122-26 with 10y UST yields up 6.5bp at 2.359% and 2y yields up 4.4bp at 2.143%.

- Bund futures are down -0.50 today at 159.30 with 10y Bund yields up 5.1bp at 0.515% and Schatz yields up 4.4bp at -0.215%.

- Gilt futures are down -0.05 today at 120.93 with 10y yields up 2.3bp at 1.648% and 2y yields up 1.4bp at 1.352%.

FOREX: Wall Street Pullback Does Little to Deter New USD/JPY Highs

- The greenback is mixed-to-higher in early Thursday trade, reflecting the more modest performance for European equities after the pullback on Wall Street into yesterday's close. The price action has done little to deter USD/JPY bulls, however, which continue to press the rate to new cycle highs, with 121.75 printed at the European open.

- European PMI data came in generally better-than-forecast, with the details of most releases continuing to outline price and cost pressures for purchasing managers. The EUR saw some support on stronger German release, but the impact faded through the morning.

- Both the Norwegian and Swiss central banks held relatively uneventful rate decisions, with the Norges Bank raising rates by 25bps and the SNB keeping rates unchanged - both alongside expectations. Nonetheless, both banks acknowledged the risks surrounding higher inflation in the near-term.

- NOK markets watched the release of the new rate path projections from the Bank, with the terminal rate (now end-2025) at 2.31%, the path projects 4 rates hikes this year (inline with exp) and a further 4 hikes in 2023 (Q4 2023 path projection upped to 2.35% from 1.62% prior. This was broadly inline with expectations, and leaves Norges Bank set to raise rates at each quarterly monpol report meeting.

- Focus turns to today's NATO summit, with a press conference due just ahead of the US cash equity open. Participants are set to discuss the Ukraine conflict, further sanctions pressure on Russia, and what possible red lines could be drawn against Russian activity in the country. Data highlights include weekly jobless claims and preliminary February durable goods. Fedspeak includes Kashkari, Waller, Bostic and Evans, but Evans should take the broader focus - he's the only FOMC member speaking today that hasn't already commented on policy.

EQUITIES: Energy Stocks Lead Early European Gains

- Asian markets closed mixed: Japan's NIKKEI closed up 70.23 pts or +0.25% at 28110.39 and the TOPIX ended 2.86 pts higher or +0.14% at 1981.56. China's SHANGHAI closed down 20.768 pts or -0.63% at 3250.264 and the HANG SENG ended 208.13 pts lower or -0.94% at 21945.95

- European equities are a little higher, with the German Dax up 44.58 pts or +0.31% at 14336.4, FTSE 100 up 21.61 pts or +0.29% at 7479.46, CAC 40 up 36.12 pts or +0.55% at 6610.45 and Euro Stoxx 50 up 11.59 pts or +0.3% at 3882.21.

- U.S. futures are gaining, with the Dow Jones mini up 160 pts or +0.47% at 34410, S&P 500 mini up 28.25 pts or +0.64% at 4475.75, NASDAQ mini up 113.5 pts or +0.79% at 14560.5.

COMMODITIES: Oil Edges Higher, Metals Mixed

- WTI Crude up $0.65 or +0.57% at $115.61

- Natural Gas down $0.02 or -0.32% at $5.213

- Gold spot down $4.99 or -0.26% at $1939.78

- Copper up $1.8 or +0.38% at $479.3

- Silver down $0.08 or -0.34% at $25.029

- Platinum down $8.22 or -0.8% at $1016.32

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/03/2022 | 1030/1030 |  | UK | Bank of England Financial Policy Report | |

| 24/03/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/03/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 24/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/03/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/03/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 24/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/03/2022 | 1230/0830 |  | US | Minneapolis Fed's Neel Kashkari | |

| 24/03/2022 | 1300/1300 |  | UK | BOE Mann Panels Institute of International Finance event | |

| 24/03/2022 | 1300/1400 |  | EU | ECB Elderson in Panel at LSE | |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/03/2022 | 1350/0950 |  | US | Chicago Fed's Charles Evans | |

| 24/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/03/2022 | 1500/1100 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2022 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 25/03/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 25/03/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 25/03/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 25/03/2022 | 0800/0900 | *** |  | ES | GDP (f) |

| 25/03/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 25/03/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/03/2022 | 0900/1000 | ** |  | EU | M3 |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 25/03/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 25/03/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/03/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/03/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 25/03/2022 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 25/03/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/03/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 25/03/2022 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 25/03/2022 | 1645/1245 |  | CA | BOC Deputy Kozicki speaks at SF Fed conference on "A world of difference: households, the pandemic and monetary policy" |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.