-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI US OPEN: Stocks And Yields Up On Cease-Fire Prospects

EXECUTIVE SUMMARY:

- UKRAINE'S PODOLYAK SAYS DISCUSSING CEASE-FIRE IN RUSSIA TALKS

- FRENCH AND GERMAN CONSUMER CONFIDENCE DOWN SHARPLY

- INFLATION TO FADE, RECENT PRICE RISES TO STAY: ECB'S LANE

- ECB'S DE COS: WAR SHOCK INCREASES RISK OF SECOND-ROUND EFFECTS

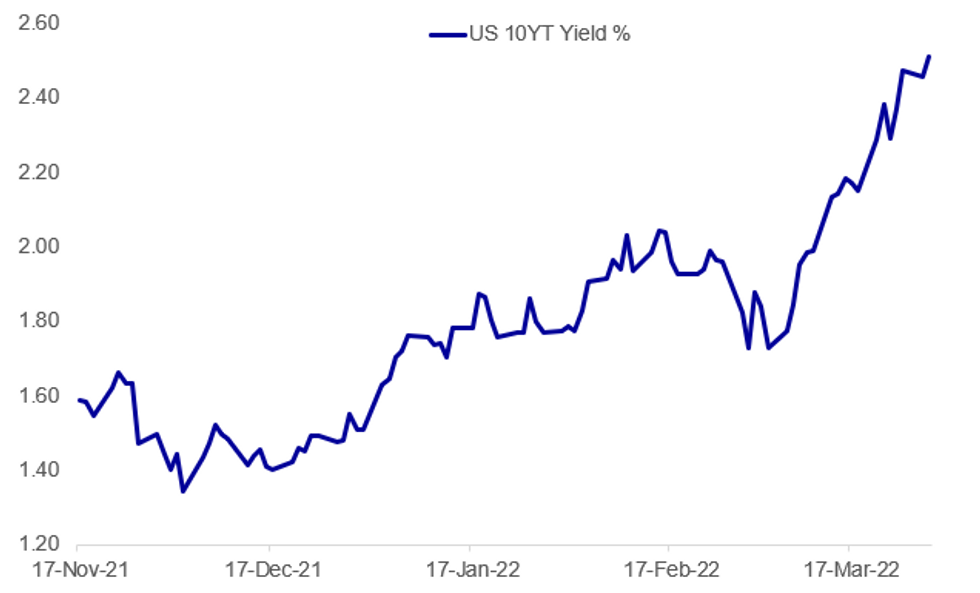

Fig. 1: 10Y Tsy Yield Pushing Through 2.50% Again

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA/UKRAINE (BBG): Ukrainian negotiator Mykhailo Podolyak says a cease-fire to resolve humanitarian problems and security guarantees are topics under discussion in talks with Russia. Podolyak speaks in Istanbul where negotiators from both countries are meeting.

RUSSIA/UKRAINE (BBG): Russia will likely publish a statement on talks with Ukraine in a few hours, chief negotiator Vladimir Medinsky says Tuesday, according to Tass. Talks in Istanbul are still ongoing.

ECB: Much of the current inflation will 'fade away' later this year and next, but consumers across the eurozone may need to get used to current higher prices, European Central Bank Chief Economist Philip Lane said in an interview with Politico published Tuesday. "Europe may have to get used to higher prices," Lane said but added that "most of this inflation will fade away the momentum where every month you wake up and you read that inflation is higher than the previous month - that element, the momentum element - we do think will decline. We do think that inflation will decline later this year and will be a lot lower next year and the year after compared to this year."

ECB (BBG): The additional increase in energy prices resulting from the war in Ukraine pushed inflation significantly higher in March, European Central Bank Governing Council member Pablo Hernandez De Cos says. Energy spike “is going to cause an additional increase in inflationary tensions that we’re already seeing -- for example, the data for March are going to be particularly negative, with a very significant rise in inflation,” de Cos tells event in northern Spain. The energy-price increase could be persistent.

EU: Funding increased defence spending may require new joint EU funding, Economy Commissioner Paolo Gentiloni said Tuesday. "Financing them (higher defence expenditures) will require a supportive framework of fiscal rules and potentially new joint funding mechanisms at European level," Gentiloni said in a speech in Romania today.

AUSTRALIA FISCAL (BBG): Australia announced a series of spending measures -- from fuel-tax cuts to cash handouts -- designed to cushion the impact of rising living costs and catapult Prime Minister Scott Morrison back into contention for a May election.At the same time, Tuesday’s budget showed the deficit narrowing to A$78 billion in fiscal 2023, or 3.4% of GDP, and A$43.1 billion, or 1.6% of GDP, by 2026. That’s better than the Group of 20 nations average, as Australia’s soaring commodity prices and strengthening labor market deliver windfall tax revenue.

FRANCE POLITICS: In rolling Ifop-Fiducial presidential polling, right-wing nationalist Rassemblement National (RN) leader Marine Le Pen continues to narrow the gap between her and incumbent President Emmanuel Macron in a hypothetical second round run-off between the two. The 53%-47% gap between the two is the narrowest recorded by the Ifop-Fiducial rolling tracker since it began collecting data in January.

UK CONSUMER DATA (BBG): U.K. consumers took on unsecured debt at the strongest pace in almost five years, adding to evidence that a surge in the cost of living is straining household finances. Borrowing on credit cards and personal loans jumped 1.9 billion pounds ($2.5 billion) in February, the Bank of England said Tuesday. That’s 1 billion pounds more than economists had expected and up from 600 million pounds in January.

UK (BBG): U.K. police said they will recommend 20 fines for staff and officials close to Boris Johnson over parties during the pandemic, which broke rules imposed by the government to contain the spread of coronavirus.The individuals -- who London’s Metropolitan Police did not name -- will be the first to be handed so-called fixed penalty notices over the events, which took place in the heart of the British government while the rest of England was restricted from socializing in groups due to Covid-19.

DATA:

MNI: GERMANY GFK CONSUMER CONFIDENCE APR -15.5; MAR -8.5r

GfK Consumer Confidence Drops

GERMANY GFK CONSUMER CONFIDENCE APR -15.5 (FORECAST: -14.5); MAR -8.5r

- German consumer confidence came in one point weaker than the consensus forecast, with a seven-point fall to -15.5 seen for April.

- Pre-pandemic this indicator tended to hover around the 10-point mark.

- Downside surprises were largely to be expected, as seen in a range of Friday forecasts pencilling -15 in. This all but cancels out the positive effects seen with pandemic restrictions easing in the previous print.

- March saw a downwards revision of 0.4pp to -8.5.

- The two key driving forces dampening consumer confidence are inflation and the war in Ukraine, the latter causing a notable downturn translating into a substantial decline in economic and income expectations. The fall in the propensity to buy was more moderate.

- With energy prices climbing further due to Russian sanctions and considerable food inflation, the direct reduction in disposable income is being felt by households. Income expectations declined to the lowest value since January 2009.

- Friday's data painted a similar picture, with German IFO current and future expectations slumping more than anticipated and expectations seeing a series-record fall. The UK followed suit at an October 2020 low, with UK consumer confidence highlighting cost-of-living concerns against a backdrop of wage-growth stagnation.

MNI: FRANCE MAR CONSUMER SENTIMENT 91 (FORECAST: 94); FEB 97r

March Consumer Confidence Slumps

FRANCE MAR CONSUMER SENTIMENT 91 (FORECAST: 94); FEB 97r

- French consumer sentiment fell by six points to 91 in March, the lowest since February 2021.

- This is the largest point drop since March to April 2020 (the onset of the pandemic).

- A sharp decline in expectations of future financial situations fell to a close to an eight-year low.

- Across the Eurozone, consumer confidence has seen steep declines. The German GfK index also fell more than expectations, to the February 2021 low and the Eurozone aggregate consumer confidence slid almost 6 points more than expected, to the lowest level since May 2020.

- Consumer confidence has seen substantial slumps due to the combined effects of soaring inflation and the Ukraine war, which is seen as accelerating energy-price growth. These factors are having a direct impact on consumers' real disposable income.

- Growth outlooks for the region remain subdued for the foreseeable future, as the ECB weighs up two-sided risks of inflation and dampened growth.

Source: Insee

MNI: UK BOE FEB MORTGAGE APPROVALS 70,993

MNI: UK FEB M4 MONEY SUPPLY +1% M/M, +6% Y/Y

FIXED INCOME: Bunds breach 0.65%

Core fixed income is moving lower on headlines that Russia and Ukraine ceasefire talks are ongoing with Russia's main objective now seen as Donbass rather than the rest of Ukraine. There doesn't appear to be a whole lot new in these headlines but markets are paying attention to the positives nonetheless.

- Treasuries and gilts remain some way above yesterday's lows but Bund futures have broken to new lows with 10year Bund yields up around 7bps on the day to 0.65%, the highest level since March 2018.

- It's another relatively light calendar for today with the Fed's Williams and Harker the headline speakers and US Conference Board consumer confidence and JOLTS the highlights on the data calendar.

- Markets will instead continue to focus on Russia-Ukraine and be driven by technical developments and momentum.

- TY1 futures are down -0-11 today at 121-11+ with 10y UST yields up 4.8bp at 2.509% and 2y yields up 5.9bp at 2.429%.

- Bund futures are down -1.04 today at 157.28 with 10y Bund yields up 7.3bp at 0.649% and Schatz yields up 7.1bp at -0.54%.

- Gilt futures are down -0.74 today at 120.54 with 10y yields up 7.0bp at 1.686% and 2y yields up 4.1bp at 1.393%.

FOREX: Ceasefire Discussions Boost Risk Proxies, CHF Slips

- After a more placid Asia-Pac session, price action is picking up headed through the NY crossover as markets read positively into headlines concerning Russia and Ukraine. TASS newswire cites a Russian representative as saying that a statement on Ukraine talks is coming "in a few hours", adding that the main tasks of the first phase of the military operation have now been completed. Meanwhile, Ukraine's Podolyak stated that the two sides are discussing a ceasefire - headlines that have boosted risk sentiment and put equity futures at their best levels since late January.

- In currencies, this has translated into EUR strength and weakness among haven currencies - CHF is the poorest performer so far, boosting EUR/CHF back toward the 50-dma at 1.0353.

- Scandi currencies are outperforming into the NY crossover, with regional FX benefiting from the more positive tones emanating from Russia and Ukraine. As a result, NOK and SEK are the top performers so far today.

- Data highlights Tuesday include the March US consumer confidence release as well as JOLTS job openings. The speaker slate includes ECB's Vasle and Fed's Williams and Harker.

EQUITIES: Cyclical Stocks Lead Europe Gains

- Asian markets closed higher: Japan's NIKKEI closed up 308.53 pts or +1.1% at 28252.42 and the TOPIX ended 18.29 pts higher or +0.93% at 1991.66. China's SHANGHAI closed down 10.564 pts or -0.33% at 3203.939 and the HANG SENG ended 242.66 pts higher or +1.12% at 21927.63

- European stocks are gaining, with the German Dax up 177.58 pts or +1.23% at 14594.5, FTSE 100 up 62.75 pts or +0.84% at 7535.02, CAC 40 up 102.33 pts or +1.55% at 6692.43 and Euro Stoxx 50 up 59.77 pts or +1.54% at 3947.17.

- U.S. futures are a little stronger, with the Dow Jones mini up 101 pts or +0.29% at 34954, S&P 500 mini up 14.5 pts or +0.32% at 4582.5, NASDAQ mini up 41.75 pts or +0.28% at 15027.

COMMODITIES: Oil Steadies After Sharp Losses

- WTI Crude up $0.92 or +0.87% at $106.93

- Natural Gas down $0.11 or -2.02% at $5.397

- Gold spot down $8.72 or -0.45% at $1913.99

- Copper down $1.3 or -0.28% at $471.25

- Silver down $0.13 or -0.51% at $24.7469

- Platinum down $5.33 or -0.54% at $982.18

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/03/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/03/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 29/03/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/03/2022 | 1445/1045 |  | US | Philadelphia Fed's Patrick Harker | |

| 29/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 30/03/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/03/2022 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/03/2022 | 0130/2130 |  | US | Atlanta Fed's Raphael Bostic | |

| 30/03/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 30/03/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/03/2022 | 0800/1000 | * |  | IT | Industrial Orders |

| 30/03/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2022 | 0800/1000 |  | EU | ECB Lagarde Speech at Central Bank of Cyprus | |

| 30/03/2022 | 0810/0910 |  | UK | BOE Broadbent Speaks at NIESR | |

| 30/03/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/03/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/03/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/03/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/03/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 30/03/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 30/03/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2022 | 1415/1615 |  | EU | ECB Panetta Hearing on Digital Euro at ECON | |

| 30/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/03/2022 | 1700/1300 |  | US | Kansas City Fed's Esther George |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.