-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Another Day, Another High For 10Y Yields

EXECUTIVE SUMMARY:

- BANK OF RUSSIA CUTS KEY RATE BY 300BPS TO 17%

- UKRAINE SAYS DOZENS KILLED IN RUSSIAN ATTACK ON RAILWAY STATION

- BOJ MULLS NEW EASY POLICY LANGUAGE BEFORE HOLIDAY (MNI INSIGHT)

- LATEST POLLS SHOW FRANCE'S MACRON RETAINING SHRINKING LEAD OVER LE PEN

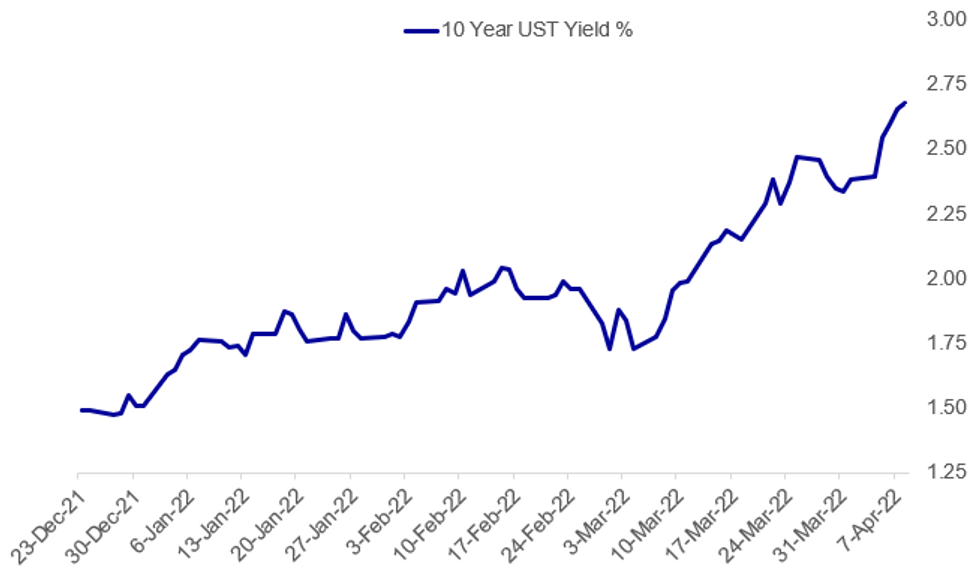

Fig. 1: Another Day, Another Cycle High For 10Y Tsy Yields

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BANK OF RUSSIA (DJ): Russia's central bank cut its key interest rate following an unscheduled meeting of policy makers Friday, but borrowing costs remained well above their level before President Vladimir Putin ordered the invasion of Ukraine. In a statement announcing the reduction in the key rate to 17% from 20%, the Bank of Russia said the ruble's rebound from sharp losses in the days immediately following the Feb. 24 invasion had reduced the risk that inflation would move sharply higher. "The latest weekly data point to a noticeable slowdown in the current price growth rates, including owing to the ruble's exchange rate dynamics," the central bank said.

UKRAINE-RUSSIA (BBG): Dozens were killed Friday morning as Russian troops allegedly shelled people waiting at a train station to be evacuated from the Donetsk region. Russian forces have at this point fully withdrawn from northern Ukraine ahead of what’s expected to be a major offensive in the east. U.S. officials warned that the war may last for weeks, months or even years, as Kyiv’s foreign minister pleaded for urgent military assistance while it can still make a difference.

BOJ (MNI INSIGHT): The Bank of Japan may consider adding a fresh reference to easy policy in the statement following its April 27-28 meeting in response to prolonged pandemic curbs, but will leave yield-control targets untouched despite fears that higher U.S. rates will continue to weaken the yen, MNI understands. For full article contact sales@marketnews.com

FRANCE ELECTION: Latest polling from outlet BVA has incumbent President Emmanuel Macron retaining a shrinking lead over right-wing Rassemblement National leader Marine Le Pen, with both candidates likely to make the second round following Sunday's first round vote.

- BVA first round poll: Macron (EC-RE): 26% (-1), Le Pen (RN-ID): 23% (+2), Mélenchon (LFI-LEFT): 17.5% (+2), Zemmour (REC-NI): 9.5%, Pécresse (LR-EPP): 8.5% (-1). +/- vs. 30 - 31 March. Fieldwork: 6 - 7 April 2022. Sample size: 1,010

- BVA second round poll: Macron: 53% (-1.5), Le Pen: 47% (+1.5). +/- vs. 30 - 31 March. Fieldwork: 6 - 7 April 2022. Sample size: 1,010

DATA:

FIXED INCOME: UST 10y yield another new cycle high

- USTs have continue their drift lower this morning with 10-year yields surpassing yesterday's cycle highs to hit a high of 2.6905% at writing, another new high since March 2019. We are now within 12bp of the 2019 highs which are just shy of 2.80%.

- The German and gilt curves remain within yesterday's ranges with peripheral spreads a bit wider on the day.

- Looking ahead there is little on the calendar today other than Canadian employment.

- Instead the focus will be on the release of any French opinion polls ahead of Sunday's first round Presidential election. Given Le Pen's movement up the polls in the past couple of weeks, these have the potential to move both peripheral spreads and the euro in particular.

- TY1 futures are down -0-10 today at 120-07+ with 10y UST yields up 1.9bp at 2.679% and 2y yields up 5.3bp at 2.516%.

- Bund futures are up 0.11 today at 156.94 with 10y Bund yields down -0.2bp at 0.677% and Schatz yields up 1.5bp at -0.4%.

- Gilt futures are up 0.04 today at 120.21 with 10y yields unch at 1.728% and 2y yields up 0.1bp at 1.455%.

FOREX: US markets lead the way

- US markets have led the way in early European trade, with Yield higher, and in turn a supported USD, as market participants and Investors price risk of more aggressive rate hike path from the Fed.

- The Dollar saw some broader base upside continuation, but has faded somewhat off its best level, as Europe awaits for the US to join the session.

- Worst performer in G10 is the Kiwi versus the Greenback, and the NZDUSD cross has now lost just over 2.5% in the past three sessions.

- Pound and the EUR were under pressure against the Dollar, but are off their worst levels at the time of typing.

- Looking ahead, there are no tier 1 of market moving data, attention is already turning to the US CPI and the ECB next week.

- Remaining speakers are ECB Panetta, Stournaras, Maklouf and Herodotou

- Most of the focus today, will be on French Election polls, with many expected to hit throughout the day, no set times, but it's the last day polls can be published

EQUITIES: Energy Names Lead European Equity Gains

- Japan's NIKKEI closed up 97.23 pts or +0.36% at 26985.8 and the TOPIX ended 3.89 pts higher or +0.21% at 1896.79. China's SHANGHAI closed up 15.155 pts or +0.47% at 3251.85 and the HANG SENG ended 63.03 pts higher or +0.29% at 21872.01.

- European equities are higher, with the German Dax up 190.27 pts or +1.35% at 14282.16, FTSE 100 up 87.84 pts or +1.16% at 7640.14, CAC 40 up 107.57 pts or +1.66% at 6574.78 and Euro Stoxx 50 up 53.54 pts or +1.41% at 3859.66.

- U.S. futures are gaining, with the Dow Jones mini up 118 pts or +0.34% at 34608, S&P 500 mini up 15 pts or +0.33% at 4511.25, NASDAQ mini up 62.5 pts or +0.43% at 14598.

COMMODITIES: Copper Pushes Higher

- WTI Crude up $0.65 or +0.68% at $97.06

- Natural Gas up $0.02 or +0.28% at $6.381

- Gold spot down $0.38 or -0.02% at $1930.85

- Copper up $5.7 or +1.21% at $475.8

- Silver up $0.09 or +0.38% at $24.6865

- Platinum down $0.85 or -0.09% at $964.82

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/04/2022 | 1115/1315 |  | EU | ECB Panetta at IESE Business School Conference | |

| 08/04/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/04/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/04/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.