-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: ECB Warily Eyeing Euro Weakness

EXECUTIVE SUMMARY:

- VILLEROY WARNS ECB WILL WATCH EURO FOR IMPORTED INFLATION DANGER

- MCCONNELL AIMS TO APPROVE FINLAND IN NATO BEFORE AUG RECESS

- BOJ'S KURODA REPEATS EASY POLICY, YEN STANCES

- EU INFLATION SEEN HIGHER, GROWTH TO SLOW: BRUSSELS

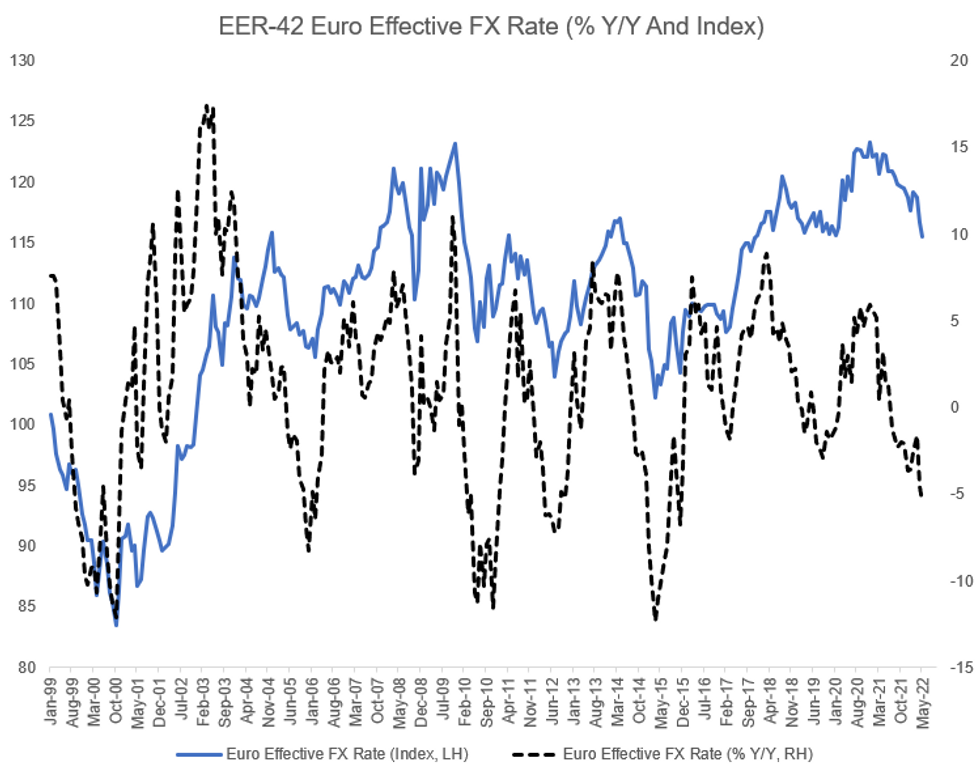

Fig. 1: ECB Warily Eyeing Exchange Rate Weakness

Source: ECB, MNI

Source: ECB, MNI

NEWS:

ECB (BBG): Bank of France Governor Francois Villeroy de Galhau signaled that the weakness of the euro is focusing the minds of European Central Bank policy makers at a time the currency is heading toward parity with the dollar. The Governing Council member, speaking in Paris, renewed his warning first voiced on May 6 that officials need to keep an eye on the foreign-exchange market, cognizant of the impact that it might have on consumer prices. “Let me stress this: we will carefully monitor developments in the effective exchange rate, as a significant driver of imported inflation,” Villeroy said. “A euro that is too weak would go against our price stability objective.”

ECB (BBG): A consensus is “clearly emerging” at the European Central Bank on normalizing monetary policy and June’s meeting will be “decisive,” Villeroy says. “In this uncertain situation, our first duty as a central bank is to provide appropriate monetary policy. The consensus in our Governing Council is now clearly emerging, as summed up by Christine Lagarde in her speech last Wednesday: to fight an inflation which is not only higher but broader, we now have to normalize our monetary policy”. Villeroy declines to give exact timeline for ECB decisions, but says to expect “a decisive June meeting, and an active summer”.

NATO / US (BBG): Governments in Helsinki and Stockholm are set to deliver their formal applications at NATO’s headquarters in Brussels later in the week once their respective parliaments have signed off. Speaking to reporters in the Finnish capital on Monday, Senate Minority Leader Mitch McConnell said Congress aims to ratify Finland’s accession into NATO before the August recess. There’s “strong” bipartisan support for its entry and a vote “won’t be close,” he said, after meeting with President Sauli Niinisto, adding “Finland punches above the weight of many existing NATO members.”

BOJ: Bank of Japan Governor Haruhiko Kuroda told lawmakers on Monday that easy policy needs to be maintained to boost the medium- to long-term inflation expectations and support economic activity, and tighten the labor market to cause wage hikes that would boost tolerance of higher prices. Kuroda added that the BOJ is not targeting foreign exchange rates but continues to monitor the impact on economy and prices, repeating that rapid forex moves are undesirable. The yen traded at a high of 129.64 against the dollar on Monday, down from a level just over JPY131 this month.

EU: Inflation is expected to remain well above the European Central Bank's 2% target in 2022 and 2023 according the European Commission's latest round of forecasts, with overall growth also set to slow markedly on the levels forecast as recently as February, the Spring Economic forecasts published Monday show. Impacted by higher energy prices as the war in Ukraine rumbles on, inflation in the eurozone is now seen at 6.1% in 2022 and 2.7% in 2023, revised higher from 3.5% and 1.7% laid out in the Winter Forecast three months ago.

ECB / DIGITAL EURO: The European Central Bank could start the three-year process of developing the technical solutions needed to provide a digital euro at the end of 2023, Executive Board member Fabio Panetta said in a speech Monday, as he highlighted the intiative's role in backstopping both public confidence and the EU's strategic interests. "As we face the most serious geopolitical crisis since the Cold War, old certainties are increasingly being challenged. The invasion of Ukraine has cast further doubt on the reliability of a global order that enabled unprecedented economic interdependence," he said.

DATA:

- MNI: BRUSSELS EZ INFLATION AT 6.1% (3.5%) '22, 2.7% (1.9%) '23

- EZ GDP SEEN AT 2.7% 2022 AND 2.3% 2023 (VS 4.0% AND 2.7% RESP)

FIXED INCOME: ECB repricing pushing yields higher

- Core fixed income has moved lower this morning, led by EGBs and gilts. There have been no headline triggers for the move but there has also been an increase in market expectations of ECB hikes this year driving the moves.

- With little in the way of data on the calendar, the focus today will be on politics and central bank speakers. We have already heard from a number of ECB speakers (nothing really new). Still due are the Fed's Williams and the Riksbank's Ingves (the latter in his role as ESRB VP so unlikely to focus on monpol).

- We also have Governor Bailey, Ramsden, Haskel and Saunders all testifying before the Treasury Select Committee at 15:15BST / 10:15ET today with regards to the MPR. Note that Haskel is the only one of these MPC members who we have not heard from since the May MPC meeting.

- TY1 futures are up 0-2+ today at 119-08 with 10y UST yields up 0.5bp at 2.926% and 2y yields up 1.8bp at 2.600%.

- Bund futures are down -0.54 today at 153.22 with 10y Bund yields up 5.2bp at 0.996% and Schatz yields up 4.8bp at 0.146%.

- Gilt futures are down -0.36 today at 119.88 with 10y yields up 3.6bp at 1.778% and 2y yields up 3.2bp at 1.264%.

FOREX: EUR is underpinned by ECB comments

- EUR trades in the green against all the majors, keeping the lid on Govies.

- Earlier comment from ECB Villeroy: "Sees consensus on normalizing Policy, sees a decisive June meeting, too weak EUR goes against the ECB price stability goals."

- EU have also upped their inflation forecast, from 2.7% in 2023, up From 1.7% previously, and Inflation at 6.1% in 2022, up From 3.5% Previously.

- The Dollar still holds onto gains, a continuation from the overnight session, as Risk was tilted to the downside, but Equities have recovered from their lows.

- EUR and the CAD are the only Currencies in the green in G10 versus the Greenback.

- CNH has extended losses against the USD and the EUR, following the Chinese retail sales and Industrial output miss overnight.

- Friday's high and the highest print since Sep 2020 comes at 6.8380 for USDCNH, and will be seen as the initial resistance, printed a 6.8205 high at the time of typing.

- AUD remains the worst performer in G10 against the USD, but the AUDUSD pair is fading from the session low.

- Looking ahead, there's very little in terms of market moving data to start the week.

- Speakers still scheduled, Fed Williams, BoE Bailey, Ramsden, Haskel, Saunders answer questions from the Treasury Committee.

EQUITIES: Tech/Cyclicals Lagging In Early Mixed Trade

- Asian markets closed mixed: Japan's NIKKEI closed up 119.4 pts or +0.45% at 26547.05 and the TOPIX ended 0.94 pts lower or -0.05% at 1863.26. China's SHANGHAI closed down 10.535 pts or -0.34% at 3073.749 and the HANG SENG ended 51.44 pts higher or +0.26% at 19950.21.

- European stocks are likewise mixed, with utilities and energy leading (and tech and consumer discretionary lagging): the German Dax down 31.68 pts or -0.23% at 13942.26, FTSE 100 up 16.55 pts or +0.22% at 7370.23, CAC 40 up 0.91 pts or +0.01% at 6305.69 and Euro Stoxx 50 down 9.55 pts or -0.26% at 3676.88.

- U.S. futures are a little weaker, with the Dow Jones mini down 7 pts or -0.02% at 32113, S&P 500 mini down 9 pts or -0.22% at 4010.75, NASDAQ mini down 53.25 pts or -0.43% at 12329.5.

COMMODITIES: Gold Brief Break < $1800

- WTI Crude down $0.57 or -0.52% at $110.12

- Natural Gas up $0.15 or +1.92% at $7.809

- Gold spot down $11.27 or -0.62% at $1807.63

- Copper down $0.25 or -0.06% at $417.45

- Silver up $0.02 or +0.11% at $21.1041

- Platinum down $6.21 or -0.66% at $940.37

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/05/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 16/05/2022 | 1255/0855 |  | US | New York Fed's John Williams | |

| 16/05/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 16/05/2022 | 1400/1500 |  | UK | BOE TSC to discuss May MPR | |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 16/05/2022 | 2000/1600 | ** |  | US | TICS |

| 17/05/2022 | 0130/1130 |  | AU | RBA May Meeting Minutes | |

| 17/05/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 17/05/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2022 | 0900/1100 | * |  | EU | Employment |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 17/05/2022 | 1005/1105 |  | UK | BOE Dep Gov Jon Cunliffe comments | |

| 17/05/2022 | 1200/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/05/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/05/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/05/2022 | 1315/0915 |  | US | Philadelphia Fed's Patrick Harker | |

| 17/05/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/05/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/05/2022 | 1505/1605 |  | UK | BOE Cunliffe Fireside Chat | |

| 17/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 17/05/2022 | 1700/1900 |  | EU | ECB Lagarde Speech at Soroptimist International Club | |

| 17/05/2022 | 1800/1400 |  | US | Fed Chair Jerome Powell | |

| 17/05/2022 | 1830/1430 |  | US | Cleveland Fed's Loretta Mester | |

| 17/05/2022 | 2245/1845 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.