-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

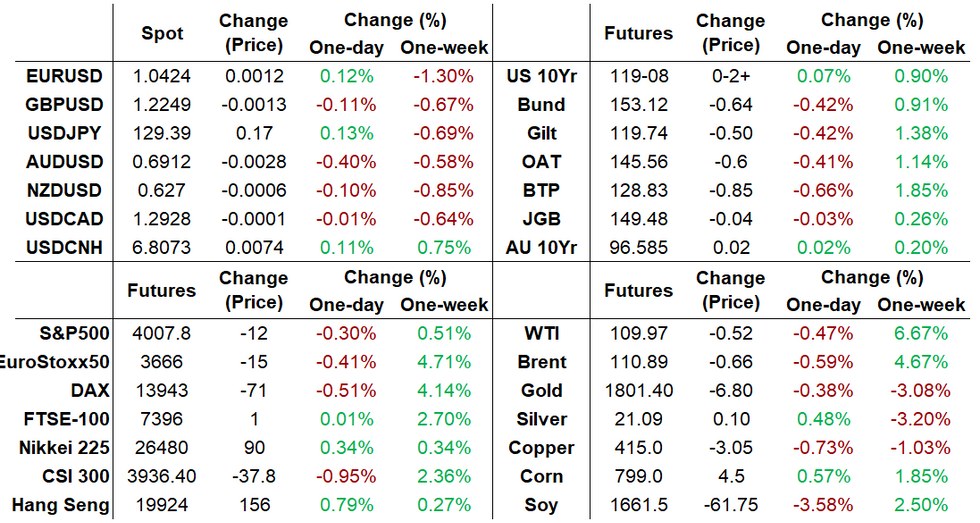

Free AccessMNI US MARKETS ANALYSIS: EUR Weakness/USD Strength In Focus

Highlights:

- ECB rate hike expectations firmed on hawkish comments by Villeroy

- But Fed hike pricing has also risen, muting the upside impact on EURUSD

- Attention turns to today's central bank speakers (Fed's Williams, BoE's Bailey, Ramsden, Haskel, Saunders)

US TSYS: Mild Bear Flattening Amidst Low Volumes

- Cash Treasuries see a mild sell-off after mixed signals from China overnight with Shanghai restarting its re-opening process and PBOC support for the property sector but also softer than expected data.

- The broadly parallel moves in the curve compared to recent shifts leave 2s10s towards the lower end of last week’s wide range at 33bps.

- 2YY +1.7bps at 2.595%, 5YY +1.4bps at 2.879%, 10YY +0.7bps at 2.926% and 30YY +1.2bps at 3.091%.

- TYM2 sits 2+ ticks higher at 119-08 on low volumes. The primary downtrend in Treasuries remains intact, however, a corrective (bullish) cycle established last week remains in play, suggesting potential for short-term gains. Support is eyed at 118-03+ (May 11 low post-CPI) whilst resistance is seen at 120-01 (Apr 28 high).

- Light docket (Empire Mfg and TIC Flows) puts additional focus on NY Fed Williams's discussion with the MBA at 0855ET (no text)

- Bill issuance: US Tsy $45B 13W, $42B 26W bill auctions (1130ET)

STIR FUTURES: Fed Hikes Firm Back To Friday Highs

- Fed Funds implied hikes have continued to firm through European hours, helped earlier by ECB’s Villeroy pushing back against EUR weakness, back to Friday’s highs: 54bps for Jun, 103bps for July and 191bp to year-end over five meetings.

- Only NY Fed’s Williams (voter) scheduled today at 0855ET with likely housing-focused remarks at a MBA discussion. Focus likely ahead on six different speakers tomorrow, including Powell’s WSJ interview at 1400ET.

- Whilst 2x50bp is seen as appropriate (fully reflected in pricing), both Powell and Mester last week noted an openness to larger hikes if necessary but with Mester specifically noting it as a Sep FOMC decision.

Source: Bloomberg

Source: Bloomberg

EGB/GILT: Trading Gets Off To A Weak Start

European government bonds have traded weaker this morning while performance in equities and FX has been mixed.

- Gilts initially opened stronger before selling off through the morning with yields now up 4-5bp.

- Bunds have similarly traded weaker with yields up 5-6bp on the day.

- The belly of the OAT curve has marginally underperformed. Cash yields across the curve have pushed up 4-6np.

- BTPs have underperformed core EGBs with yields up 7-9bp.

- The proposed EU import ban will be in focus this week, with markets weighing the potential impact on growth and inflation if Member States show further signs of aligning behind the proposal.

- Chinese economic data missed by a wide margin in April: Industrial production (-2.9% Y/Y vs 0.5% expected), retail sales (-11.1% Y/Y vs -6.6%). The sharp deterioration in economic activity comes amid growing concerns over the global economic outlook, fueled in part by Covid restrictions in China.

- Supply this morning came from Germany (Bubills, EUR1.914bn allotted), the Netherlands (DTCs, EUR2.44bn) and Slovakia (SlovGBs, EUR480mn).

EUROPE OPTION FLOW SUMMARY

Rates/Bonds:

- RXM2 158.00c, bought for 3 in 2k

- RXM2 154.5/156.00cs 1x1.5, bought for 11 in 1k

- RXM2 153.5/154.00cs, bought for 22 in 1.9k

- ERU2 99.75^, trades 22 in 2k

- ERZ2 99.37p vs 2RZ2 98.00p, bought the front for flat in 5k

- SX7E (16th Dec) 85/100cs 1x2 trades 2.70 and 2.75 in 24k total (24kx48k)

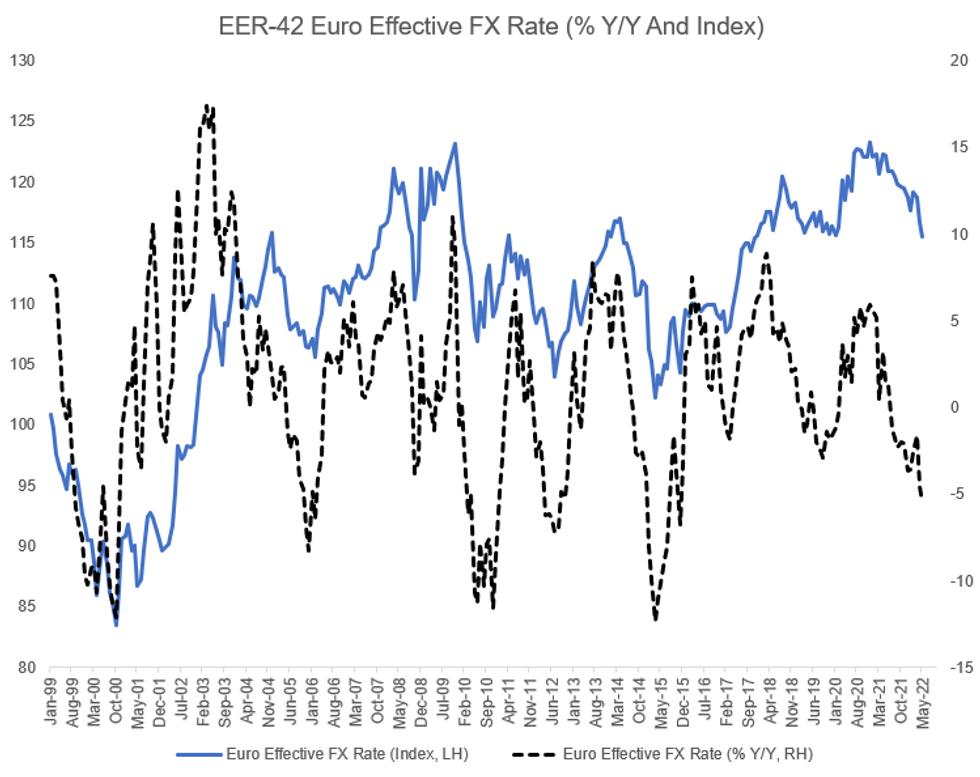

EUR: Putting "Weak" Broad FX Rate In Context

ECB's Villeroy this morning: "Let me stress this: we will carefully monitor developments in the effective exchange rate, as a significant driver of imported inflation." And "a euro that is too weak would go against our price stability objective.” To put the exchange rate move in context, when considering what "too weak" might mean:

- The daily nominal EER-42 euro effective exchange rate, the rate eyed by the ECB in its macroeconomic projections, was 115.52 on Friday. A monthly close at this level would be the weakest since late 2017. (It traded to a daily low just below 114 in Feb 2020 but rebounded by end-month.)

- On a year-on-year monthly close basis, a close here would mean the Euro index is falling at its fastest rate (-5.5%) since late 2015.

- The index would have to fall about 12% further to reach its low of the last decade (in 2016), or around 28% further to reach its all-time low in 2000.

- The ECB's March 2022 projections' technical assumptions included 118.7 average this year (and 2023-24), and 1.12 USD/EUR, based on spot value at the time. It's averaging 118.1 in 2022 so far. If it stays level at 115.52 for the rest of the year, it will average around 116 for the year as a whole.

Source: ECB, BBG

Source: ECB, BBG

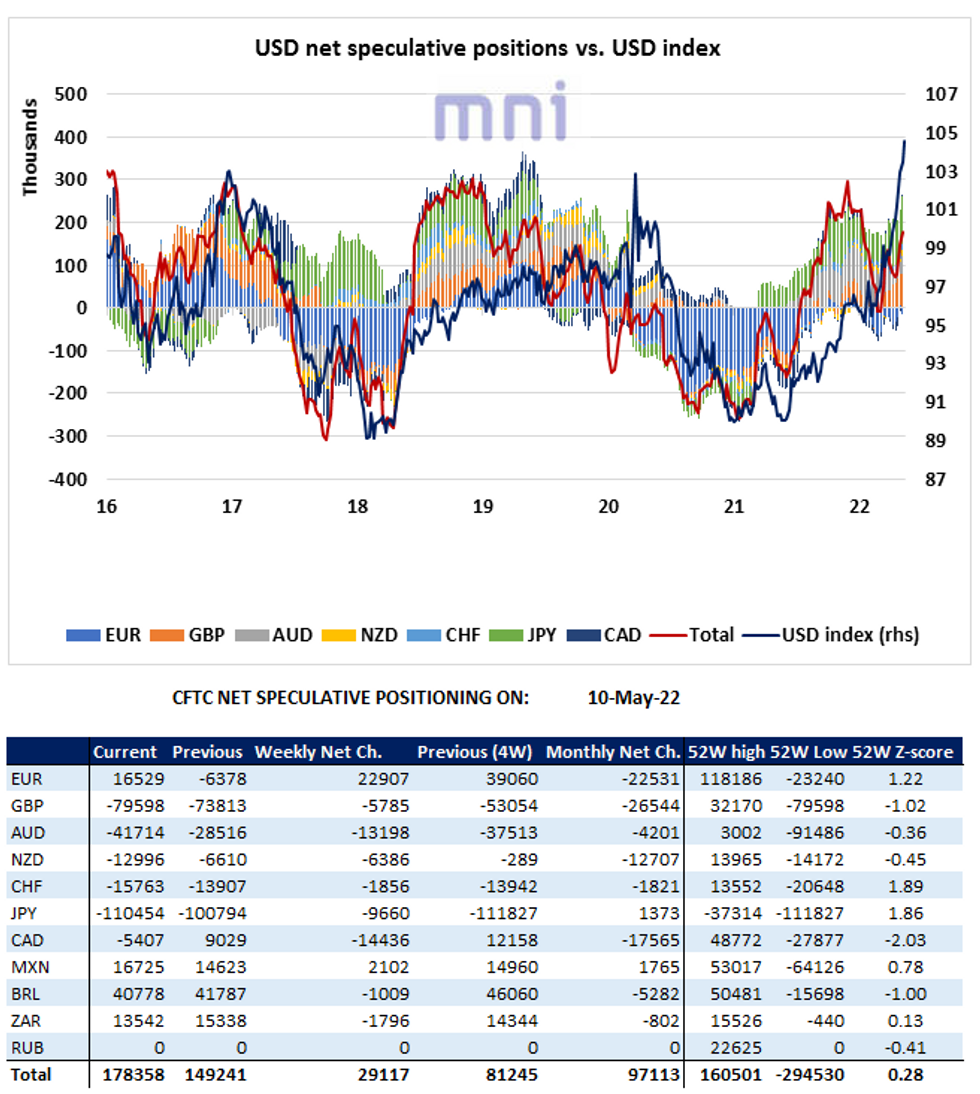

USD: Net USD Specs Continue To Rise As USD Remains Strong

- Net long specs on the US Dollar continued to rise in the week ended May 10, increasing by 299.1K to a total of 178.4K contracts.

- Momentum on the dollar has been mainly driven by the renewed geopolitical tensions, the ‘hawkish’ Fed tone and surging stagflation risks.

- Even though odds of a 75bps hike in June have fallen considerably following the Fed May 4 meeting, a 'large 75bps' over the summer cannot be ruled out if inflation continues to come in higher than expected.

- As a reminder, CPI inflation came in at 8.3% YoY in April, slightly more than expected (8.1%) but down from 8.5% the previous month.

- However, 50bps hikes combined with the elevated market uncertainty should be enough to support the USD in the near to medium term.

- DXY index broke above its 104 resistance last week and is currently trading at its highest level since December 2002.

- Next level to watch on the topside stands at 107.31.

- On the downside, support to watch below the 104 level stands at 103.37.

Source: Bloomberg/MNI

FOREX: EUR is underpinned by ECB comments

- EUR trades in the green against all the majors, keeping the lid on Govies.

- Earlier comment from ECB Villeroy: "Sees consensus on normalizing Policy, sees a decisive June meeting, too weak EUR goes against the ECB price stability goals."

- EU have also upped their inflation forecast, from 2.7% in 2023, up From 1.7% previously, and Inflation at 6.1% in 2022, up From 3.5% Previously.

- The Dollar still holds onto gains, a continuation from the overnight session, as Risk was tilted to the downside, but Equities have recovered from their lows.

- EUR and the CAD are the only Currencies in the green in G10 versus the Greenback.

- CNH has extended losses against the USD and the EUR, following the Chinese retail sales and Industrial output miss overnight.

- Friday's high and the highest print since Sep 2020 comes at 6.8380 for USDCNH, and will be seen as the initial resistance, printed a 6.8205 high at the time of typing.

- AUD remains the worst performer in G10 against the USD, but the AUDUSD pair is fading from the session low.

- Looking ahead, there's very little in terms of market moving data to start the week.

- Speakers still scheduled, Fed Williams, BoE Bailey, Ramsden, Haskel, Saunders answer questions from the Treasury Committee.

FX OPTION EXPIRY

Very little for today:

- USDCAD: 1.3000 (400mln), 1.3025 (237mln).

- AUDUSD: 06880 (731mln).

Price Signal Summary - USD Index Remains Above 104.00

- In the equity space, S&P E-Minis remain vulnerable and short-term gains are considered corrective. Last week’s continuation lower and fresh cycle lows, reinforces the primary bearish trend condition and signals scope for an extension lower. The next objective is 3843.25, the Mar 25 2021 low (cont). Initial firm resistance is at 4099.00, the May 9 high. EUROSTOXX 50 futures outlook remains bearish and short-term gains are also considered corrective. Recent weakness has resulted in a breach of support at 3608.00, Apr 27 low and of 3551.60, 61.8% retracement of the Mar 7 - 29 rally. This has exposed 3458.90 next, the 76.4% retracement. Initial resistance is at 3743.6, the 50-day EMA.

- In FX, EURUSD traded lower last Thursday and cleared support at 1.0472, Apr 28 low. The breach confirms a bear flag breakout and a resumption of the primary downtrend. The focus is on 1.0341, the Jan 3 2017 low and a key support. GBPUSD remains weak following last week’s extension of the downtrend. The focus is on 1.2162 next, the May 22 2020 low. The USDJPY primary uptrend remains intact and last week’s move lower is likely a correction. Initial support has been defined at 127.52, Thursday’s low. A resumption of gains would refocus attention on the bull trigger at 131.35, May 9 high. A break would open 131.96, the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing. The USD Index (DXY) is trading above 104.00. This signals a potential break of the multi year range resistance and reinforces the current bullish USD theme

- On the commodity front, Gold remains vulnerable following last week’s resumption of the downtrend. The yellow metal has started the week on a softer note, trading through the $1800.0 handle. The focus is on $1780.4, the Jan 28 low. In the Oil space, a bearish threat in WTI futures remains present, despite the recovery from last Wednesday’s low of $98.20 low. Key short-term resistance is at $111.37, the May 5 high. This level has been probed but a clear break is required to suggest scope for a stronger bounce. Today’s high so far is $111.71. $98.20, May 11 low, is a key support.

- In the FI, Bund futures remain in a downtrend and last week’s gains are considered corrective. A fresh cycle low on May 9 reinforced the bearish condition. A resumption of weakness would refocus attention on 150.49, the bear trigger. Firm trend resistance is 156.00, the Apr 28 high. The broader trend condition in Gilts remains down. However, Thursday’s move higher resulted in a break of resistance at 119.79, the Apr 25 high. This signals potential for a stronger short-term corrective phase and opens 121.84 next, 50.0% of the Mar 1 - May 9 bear leg. On the downside, key support has been defined at 116.87, the May 9 low. This is also the bear trigger.

EQUITIES: Tech/Cyclicals Lagging In Early Mixed Trade

- Asian markets closed mixed: Japan's NIKKEI closed up 119.4 pts or +0.45% at 26547.05 and the TOPIX ended 0.94 pts lower or -0.05% at 1863.26. China's SHANGHAI closed down 10.535 pts or -0.34% at 3073.749 and the HANG SENG ended 51.44 pts higher or +0.26% at 19950.21.

- European stocks are likewise mixed, with utilities and energy leading (and tech and consumer discretionary lagging): the German Dax down 31.68 pts or -0.23% at 13942.26, FTSE 100 up 16.55 pts or +0.22% at 7370.23, CAC 40 up 0.91 pts or +0.01% at 6305.69 and Euro Stoxx 50 down 9.55 pts or -0.26% at 3676.88.

- U.S. futures are a little weaker, with the Dow Jones mini down 7 pts or -0.02% at 32113, S&P 500 mini down 9 pts or -0.22% at 4010.75, NASDAQ mini down 53.25 pts or -0.43% at 12329.5.

COMMODITIES: Gold Brief Break < $1800

- WTI Crude down $0.57 or -0.52% at $110.12

- Natural Gas up $0.15 or +1.92% at $7.809

- Gold spot down $11.27 or -0.62% at $1807.63

- Copper down $0.25 or -0.06% at $417.45

- Silver up $0.02 or +0.11% at $21.1041

- Platinum down $6.21 or -0.66% at $940.37

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/05/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 16/05/2022 | 1255/0855 |  | US | New York Fed's John Williams | |

| 16/05/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 16/05/2022 | 1400/1500 |  | UK | BOE TSC to discuss May MPR | |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 16/05/2022 | 2000/1600 | ** |  | US | TICS |

| 17/05/2022 | 0130/1130 |  | AU | RBA May Meeting Minutes | |

| 17/05/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 17/05/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2022 | 0900/1100 | * |  | EU | Employment |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 17/05/2022 | 1005/1105 |  | UK | BOE Dep Gov Jon Cunliffe comments | |

| 17/05/2022 | 1200/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/05/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/05/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/05/2022 | 1315/0915 |  | US | Philadelphia Fed's Patrick Harker | |

| 17/05/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/05/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/05/2022 | 1505/1605 |  | UK | BOE Cunliffe Fireside Chat | |

| 17/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 17/05/2022 | 1700/1900 |  | EU | ECB Lagarde Speech at Soroptimist International Club | |

| 17/05/2022 | 1800/1400 |  | US | Fed Chair Jerome Powell | |

| 17/05/2022 | 1830/1430 |  | US | Cleveland Fed's Loretta Mester | |

| 17/05/2022 | 2245/1845 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.