-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US MARKETS ANALYSIS - Rates Repricing Continues

Highlights:

- Rates repricing continues, with STIR futures extending bounce

- Greenback falters as yields still trade heavy

- Markets watch final UMich inflation expectations

US TSYS SUMMARY: Early Risk-On To Finish Week

Markets trade with a modest risk-on tone ahead the weekend. Off early London highs, Tsys now mildly weaker (30YY 3.2124% +.0128) on moderate volumes (TYU2 <325k) as stocks inch higher (ESU2 +30.75 at 3830.50). Crude firmer (WTI +1.85 at 106.12), as is Gold (+4.83 at 1827.60) after Thu's rout.- Tsy 30Y bond futures USU2 near recent lows, taking cues from lower EGBs and China rates (10YY slightly over 200DMA, 2.8360%).

- Tsy yield curves narrowly mixed (2s10s +.637 at 7.037) as short end continues to adjust to Thu's rate hike re-pricing post weak PMI: Fed baseline still 75bp in near term amid ongoing recession concerns, but mkt pricing of hikes stalls out in early 2023.

- Limited data today w/ U. of Mich. Sentiment (50.2 est) and New Home Sales (590 est)/MoM (-0.2%) at 1000ET.

- Fed speak kicks off w/ StL Fed Bullard on inflation, UBS event, Zurich, no text, Q&A at 0730ET. SF Fed Daly Fox Business interview at 1315ET.

- US Banks passed 2022 Fed Stress Tests -- under a stress scenario tougher than that of last year's, the 34 banks would collectively lose USD612 billion, the Fed said in late Thu release.

EGB/GILT SUMMARY: Modest Retracement Following Strong Gains

European government bonds have traded weaker this morning, but the correction has been modest compared to the sizeable gains made in recent days. European equities are higher and DM currencies are gaining ground against the USD.

- Gilts have traded lower with the curve bear flattening. Cash yields are up 1-4bp.

- While headline May retail sales data for the UK was a touch worse than expected in annualized terms, the ex auto fuel series reported a significant miss versus consensus (-5.7% Y/Y vs -5.0%).

- Pressure on UK Prime Minister Boris Johnson continues to mount after the ruling Conservative party lost two by-elections to Labor and the Liberal Democrats.

- The bund curve has shifted higher with yields up 4-5bp.

- OATs are underperforming bunds at the longer end. Yields are up 2-8bp on the day with the 2s30s spread widening 3bp.

- BTP yields have pushed up 2-7bp with the belly of the curve underperforming.

EUROPE ISSUANCE UPDATE:

Italy auction result:

- E4bln of the 1.75% May-24 BTP Short Term. Avg yield 1.63% (bid-to-cover 1.58x).

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ2 152/154cs, sold at 24 in 2.5k

RXQ2 146/144.5/143.5p fly, bought for 20.5 in 2k

ERU2 99.625/99.375 ps, bought for 13 in 6.3k

0RU2 98.00/97.75/97.25p ladder, bought for flat in 4k

0RU2 98.00/97.50ps 1x2, bought the 1 for 2 in 5k

EU H2-22 funding plan

- E50bln of funding in NGEU bonds including green in H2-22 (same as in H1)

- Up to E9bln more in MFA loans for Ukraine and up to E6.6bln for SURE.

- 5 syndication dates:

- W/C 11 July

- W/C 12 September

- W/C 10 October

- W/C 14 November

- W/C 5 December

- Bond auction dates:

- 29 August

- 26 September

- 24 October

- 28 November

- Bill auctions will continue with two dates per month with 3/6-month bills sold in each operation.

- The 21 December bill auction date is optional.

Another Blow To PM Johnson's Position Following Poor By-Election Results

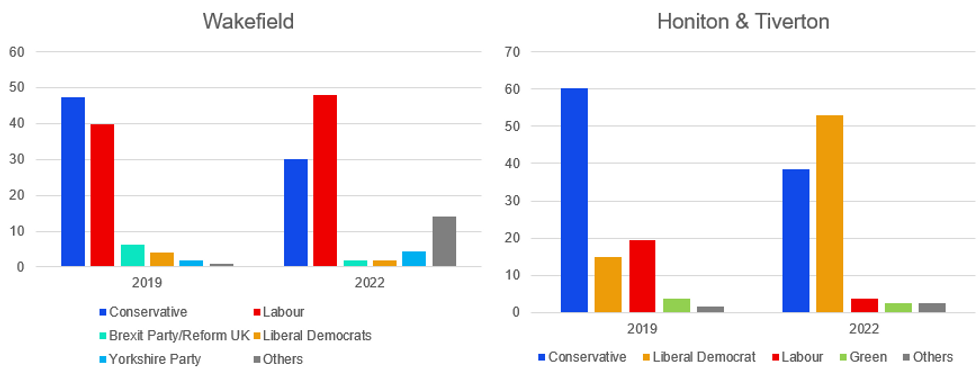

Prime Minister Boris Johnson's position is set to come under increasing pressure in the days and weeks ahead as he deals with the fallout of two parliamentary by-election losses on the same day. Following the loss of Wakefield in northern England to the centre-left Labour Party, and Honiton & Tiverton in southwest England to the centrist Liberal Democrats, Conservative Party chairman Oliver Dowden unexpectedly resigned.

- In his resignation letter Dowden, who backed Johnson for the Conservative leadership in 2019, stated that grassroots party members were "distressed and disappointed" by a slew of by-election losses. Adding that “We cannot carry on with business as usual. Somebody must take responsibility”. Observers have seen the last comment as a potential attack on Johnson over the 'partygate' scandal that has damaged the Conservatives' standing.

- The by-election losses were significant. Wakefield formed part of the 'red wall' of seats won from Labour for the first time in generations in 2019, and Labour's easy winning back of the seat will concern freshman MPs in northern English seats that Johnson is not the electoral draw he once was. In Tiverton and Honiton, the Liberal Democrats scored a major win, overturning a 24k+ vote majority in a result that will concern heartland southern England Conservative MPs

Source: Returning officers, MNI

Source: Returning officers, MNI

- Betting markets show little clarity in when they believe Johnson will leave office. Data from Smarkets shows an implied probability of 37.6% that Johnson leaves office in 2024 or later, 35.7% that he leaves in 2022, and 31.3% that he leaves in 2023 (sums to more than 100% due to bookie's over round).

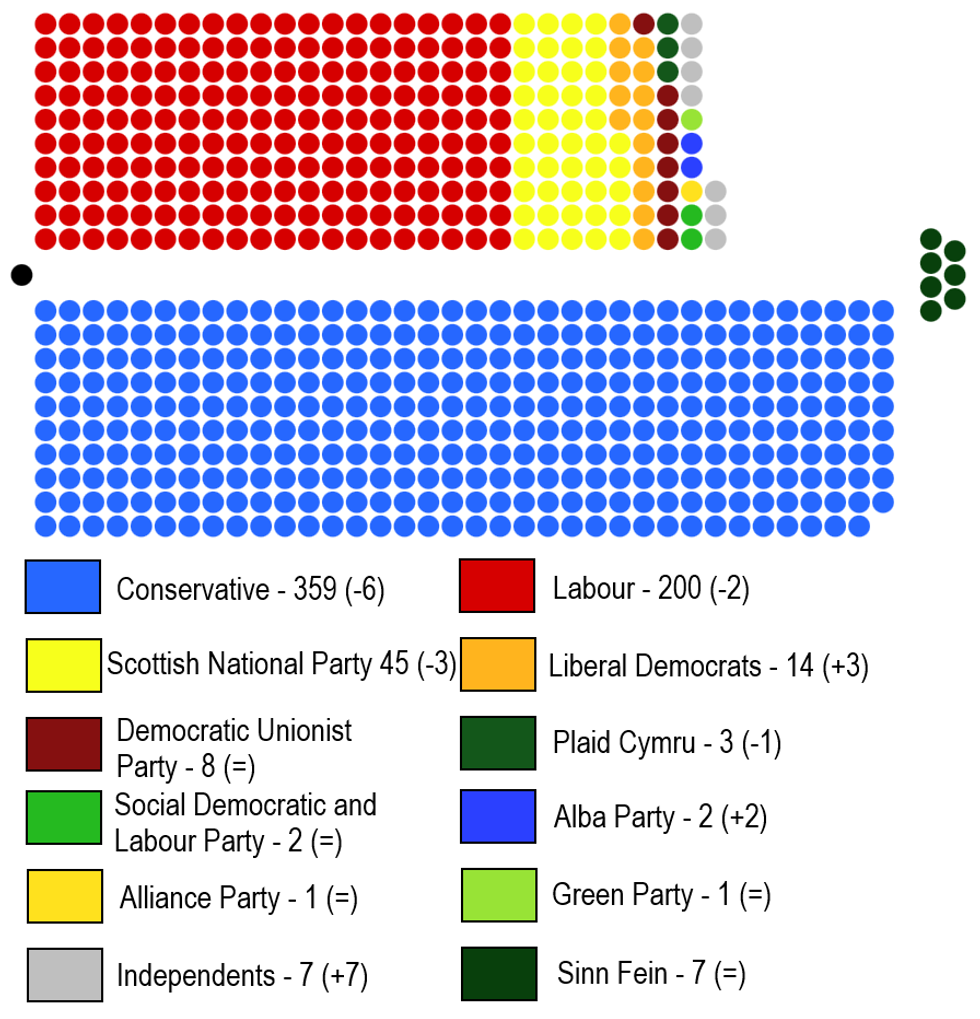

Chart 2. House of Commons, Seats, Chg from 2019 GE in brackets

Source: House of Commons, MNI. Sinn Fein do not sit in parliament and as such are placed as crossbenchers.

Source: House of Commons, MNI. Sinn Fein do not sit in parliament and as such are placed as crossbenchers.

CHINA: 10Y Yield Breaking Above 200DMA?

- We previously saw that China 10Y yield has not followed the global retracement in LT bond yields in recent months despite inflationary pressures remaining elevated globally.

- Hence, the surge in US LT bond yields since the start of the year has led to a sharp fall in the China 10Y bond yield premium, which plummeted from 1.25% in the beginning of January to -0.25% today (reaching a low of nearly -70bps in mid June).

- The disappearance of Chinese ‘carry’ could have been one of the drivers of CNY weakness in Q2 2022, and the negative bond yield premium could continue to weigh on the yuan in the medium term.

- Interestingly, China 10Y yield has been slowly rising in the past two weeks, currently trading slightly above the 200DMA (2.8360%).

- The 200DMA has acted as a strong resistance in the past year; China 10Y yield rejected it in the end of April.

- Therefore, could a breakout of the 200DMA increase the selling pressure on Chinese bonds in the near term?

- Flows data have been indicating that foreigners have become net sellers of CNY bonds in recent months.

Source: Bloomberg/MNI

FOREX: Greenback Holds Losses as Yields Remain Under Pressure

- The greenback trades softer early Friday, with the USD Index remaining under pressure as US yields backtrack. The US 10y yield holds below the 3.10% level, with the moderation in rate expectations this week helped equities off recent lows.

- Meanwhile, Scandi currencies are inching higher, with the NOK among the best performers following yesterday's sizeable Norges Bank rate hike. Despite the NOK strength, EUR/NOK remains in a decent uptrend, with recent highs at 10.54 still well within range. Trend signals also hold bullish, with the 50-dma forming a golden cross formation at the beginning of last week.

- JPY trades moderately lower, with USD/JPY circling just below the Y135.00 level following the CPI release overnight. Japanese CPI held at 2.5% on Y/Y basis.

- The final reading of University of Michigan survey is due Friday, with markets looking to confirm the lofty inflation expectations reading that has become a key factor in Fed policymaking. Any upside or downside surprise here, while unlikely, would be carefully watched by traders. New home sales data also crosses as well as speeches from Fed's Bullard & Daly, ECB's de Cos, de Guindos and Centeno as well as BoE's Pill & Haskel.

FX OPTIONS: Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0390-00(E970mln), $1.0450(E664mln), $1.0495-00(E1.3bln), $1.0600(E761mln)

- GBP/USD: $1.2280-00(Gbp560mln)

- AUD/USD: $0.6895-00(A$1.1bln), $0.7100-20(A$989mln)

- USD/CAD: C$1.2950($675mln)

- USD/CNY: Cny6.8250($550mln), Cny6.8300($800mln)

Price Signal Summary - Evening Star Candlestick Reversal In EURJPY?

- In the equity space, S&P E-Minis maintain this week’s bull cycle and the contract has traded higher again today. Short-term gains are still considered corrective. The primary trend direction is down and the focus is on 3600.00 next. Initial resistance to watch is at 3843.00, Jun 15 high. EUROSTOXX 50 futures are consolidating and continue to trade closer to recent lows. The trend outlook is bearish and attention is on the 3300.00 handle next. 3567.00 is first resistance, Jun 16 high.

- In FX, EURUSD is unchanged. Short-term gains are still considered corrective and the primary trend direction is down. The focus is on weakness towards 1.0350, May 13 low and the bear trigger. Key channel resistance intersects at 1.0645 today - the channel is drawn from the Mar 10 high and a break is required to reverse the short-term direction. GBPUSD is in consolidation mode. The short-term outlook is bearish and the focus is on 1.1934, Jun 14 low and bear trigger. Resistance to watch is 1.2406, the Jun 16 high. USDJPY remains bullish and this week’s gains confirmed a resumption of the uptrend and opens 136.88 next, the Oct 30 1998 high. Short-term pullbacks are considered corrective, support to watch is at 133.22, the 20-day EMA. Keep an eye on EURJPY, price action over the past 3-sessions is a concern for bulls. A 3-day candle pattern - evening star reversal - was confirmed at yesterday’s close. This is a strong reversal and warns of a deeper pullback near-term. The next support to watch is 140.75, the 20-day EMA. A break would signal scope for a deeper pullback and also suggest scope for Yen strength that may result in a deeper USDJPY correction. Key resistance is at 144.25, the Jun 8 high and yesterday’s peak.

- On the commodity front, Gold maintains a bearish tone. The focus is on $1787.0, May 16 low where a break would resume the downtrend. Key trendline resistance is at $1876.6. The trendline is drawn from the Mar 8 high and a break would signal a short-term reversal. In the Oil space, WTI futures remain vulnerable following this week’s move lower and break of the 50-day EMA. This has opened $100.66, the May 19 low. A breach of this level would pave the way for a move towards $95.47, the May 11 low.

- In the FI space, Bund futures traded higher yesterday and cleared the 20-day EMA. The break strengthens short-term bullish conditions and signals scope for a stronger corrective recovery towards 150.06, 61.8% retracement of the May 12 - Jun 16 bear leg. Gains are still considered corrective. Gilts rallied yesterday and also cleared the 20-day EMA. This signal scope for a stronger short-term recovery and has opened 155.55, the Jun 6 high.

EQUITIES: Stocks moving higher this morning

- Japan's NIKKEI up 320.72 pts or +1.23% at 26491.97 and the TOPIX up 14.98 pts or +0.81% at 1866.72.

- China's SHANGHAI closed up 29.598 pts or +0.89% at 3349.747 and the HANG SENG ended 445.19 pts higher or +2.09% at 21719.06.

- German Dax up 86.72 pts or +0.67% at 12999.94, FTSE 100 up 75.82 pts or +1.08% at 7096.5, CAC 40 up 78.3 pts or +1.33% at 5961.63 and Euro Stoxx 50 up 39.24 pts or +1.14% at 3475.53.

- Dow Jones mini up 179 pts or +0.58% at 30851, S&P 500 mini up 25.75 pts or +0.68% at 3825.25, NASDAQ mini up 102.75 pts or +0.88% at 11838.5.

COMMODITIES: Natgas and copper move lower, oil higher

- WTI Crude up $0.87 or +0.83% at $105.15

- Natural Gas (NYM) down $0.08 or -1.22% at $6.162

- Natural Gas (ICE Dutch TTF) down $2.34 or -1.76% at $131.295

- Gold spot up $3.4 or +0.19% at $1826.61

- Copper down $4.45 or -1.19% at $370.1

- Silver up $0.02 or +0.08% at $20.9724

- Platinum up $7.42 or +0.82% at $917.82

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/06/2022 | 1130/0730 |  | US | St. Louis Fed's James Bullard | |

| 24/06/2022 | 1130/1330 |  | EU | ECB de Guindos Panels UBS Discussion | |

| 24/06/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 24/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/06/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/06/2022 | 1330/1430 |  | UK | BOE Pill Speaks at Walter Eucken Institute Conference | |

| 24/06/2022 | 1345/1445 |  | UK | BOE Haskel Panels Chatham House London Conference | |

| 24/06/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/06/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/06/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/06/2022 | 2000/1600 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.