-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI US MARKETS ANALYSIS - 50bps Up For Debate at ECB

Highlights:

- Various reports cite likelihood of ECB discussing 50bps hike this week

- Lagarde reportedly pushing for TPM announcement on Thursday

- German curve bear flattens in response

US TSYS SUMMARY: Treasuries Lag Europe With Light Docket

- Cash Tsys trade little changed on the day having firmed through Asia hours before cheapening as they lagged larger moves in European sovereigns on headlines that the ECB will discuss the possibility of a 50bp hike in Thursday’s meeting plus confirmation of strong CPI inflation in June.

- The minimal twist steepening on the day doesn’t really change the overall picture, with 2s10s holding at -18bps for levels last seen in 2000, whilst the shorter-term 3M to 10Y spread at +50bps holds at a relatively more elevated level but is still back at Mar’20 levels.

- 2YY -0.4bps at 3.170%, 5YY -0.3bps at 3.100%, 10YY +0.4bps at 2.989%, 30YY +0.8bps at 3.164%.

- TYU2 sits 7+ ticks higher at 118-07+ on slightly below average volumes. The recent pullback is still considered corrective with the short-term trend viewed as bullish, with initial resistance eyed at 119-06 (Jul 13 high) and support at 117-18 (Jul 8 low).

- Data: Housing starts/building permits for June (0830ET)

- Fedspeak: Still in blackout but VC Brainard speaks on the community reinvestment act (1430ET)

- No issuance today

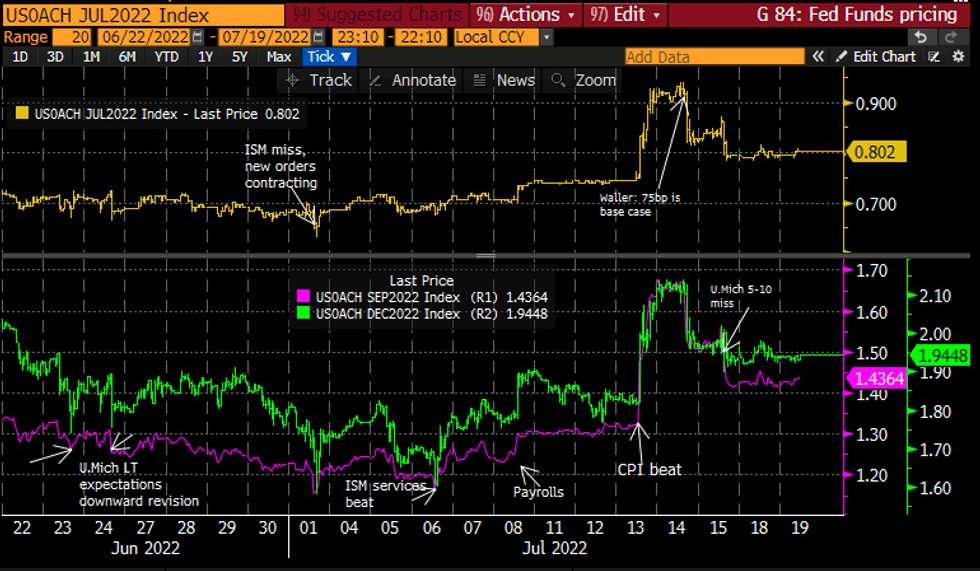

STIR FUTURES: Fed Hike Pricing Ignores Latest ECB Sources

- Implied Fed hikes sit little changed, indifferent to a spike higher in ECB pricing on latest Reuters/BBG sources that it will be discussing the possibility of a 50bp hike on Thu (+6bp to 35bp priced).

- As it is, FOMC-dated Fed Funds imply hikes of 80bps for Jul 27 (+1bp), 144bps for Sep (+2bp) and 194.5bps for Dec (+1bp).

- A peak in Fed Funds is seen broadly in Dec/Feb meetings at circa 3.54% with just over 50bps of cuts through 2023.

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

EGB/GILT SUMMARY: Pressure Mounting On The ECB

EGBs have traded lower this morning while gilts have rallied. Equities trade mixed and the dollar remains on the backfoot.

- Euro area inflation accelerated to 8.6% Y/Y in June, in line with the flash estimate and accelerating from 8.1% the previous month.

- Bunds have sold off with the curve bear flattening. Cash yields are up 3-10bp while the 2s30s spread has narrowed 8bp.

- OATs have similarly weakened but have trailed bunds with yields 1-7bp higher on the day.

- The BTP curve has twist flattened with the 2s30s spread narrowing 9bp.

- We have published our ECB Preview for July, which is available online and by email.

- UK labour market data was mixed. The 3m/3m employment came far higher than expected for May (296k vs 170k expected), although the change in payrolled employees for June was weaker than expected (31k vs 68k), as was headline wage growth for May (6.2% Y/Y vs 6.7%).

- Following the latest voting round to find PM Boris Johnson's successor, Tom Tugendhat was eliminated leaving four candidates and with former Chancellor of the Exchequer Rishi Sunak in pole position. While many expected the final list to be whittled down to Sunak and Penny Mordaunt, Foreign Secretary Liz Truss has gained ground. A further two votes are expected to take place on Tuesday and Wednesday.

- Gilts have firmed with yields down 2-4bp.

- Supply this morning came from the UK (Gilt, GBP2.0bn), Germany (Bobl, EUR2.684bn) and the ESM (Bills, EUR1.1bn).

EUROPE ISSUANCE UPDATE

Gilt auction results

GBP2bln of the 1.125% Jan-39 Gilt. Avg yield 2.641% (bid-to-cover 2.56x, tail 0.2bp)

German auction results

E4bln of the 1.30% Oct-27 Bobl. E2.684bln allotted. Avg yield 0.96%.

A 50bps Rate Hike Discussion Wouldn't Be a Surprise

A few thoughts on those BBG/Reuters ECB exclusives this morning - firstly on headline rates - both pieces mentioned the ECB will be discussing the possibility of a 50bps hike this week. Not too surprising given some member's preference for more sizeable policy move:

- Kazaks: ECB should consider an initial increase in rates above the planned quarter-point hike if there are signs that high inflation readings are feeding expectations.

- Knot: refused to rule out a 50 basis point hike at its upcoming July meeting.

- Holzmann: ECB should raise rates by 50bps in July

- Simkus: ECB should consider raising interest rates by twice the planned amount next month if the inflation outlook deteriorates.

- And the June meeting accounts: A number of members expressed an initial preference for keeping the door open for a larger hike at the July meeting.

Nonetheless, worth noting from our policy exclusive on Friday - a July 25bps move looks set in stone, with September more primed for larger rate moves: "Anything from 25- to 75-basis-point hikes could be on the table when the European Central Bank in September, though next week’s widely-expected 25-basis-point increase is now looking almost set in stone, Eurosystem sources told MNI."

FOREX: EUR Makes Light Work of Monday High

- The EUR sits close to the top of the G10 pile Tuesday, with the release of several sources reports to Bloomberg and Reuters making a 50bps rate hike at this Thursday's ECB a certain topic for discussion - although the median consensus still looks for a smaller 25bps rise this week.

- EUR/USD made light work of the Monday highs upon release, turning attention to resistance at 1.0258, the 20-day EMA. A breach of the average would strengthen bullish conditions and signal scope for an extension within the bear channel.

- The greenback is among the poorest performers early Tuesday, extending the weakness noted on Monday as the USD Index extends the pullback off last week's cycle high. The USD Index is now near 2.5% off the best levels of last week.

- As was the case pre-market yesterday, US equity futures are firmer, indicating a positive open on Wall Street later today after the late downdrift in markets into the close. The firmer risk backdrop is helping AUD and NZD shore up recent strength, while WTI back above $102/bbl helps oil-tied FX outperform.

- US housing data takes focus going forward, with housing starts and building permits data on the docket. ECB's Makhlouf is due to speak, although policy comments are likely few and far between given the proximity to Thursday's rate decision. BoE's Bailey is also scheduled to speak, delivering the Mansion House speech alongside Chancellor Zahawi.

FX OPTIONS: Expiries for Jul19 NY cut 1000ET (Source DTCC)

- EUR/USD: Jul20 $1.0100(E1.0bln); Jul21 $1.0000(E1.2bln), $1.0200(E1.4bln)

- AUD/USD: Jul22 $0.6800(A$1.1bln)

- USD/CAD: Jul20 C$1.3285-00($1.0bln)

- USD/CNY: Jul20 Cny6.6000($3.7bln), Cny6.7000($3.7bln), Cny6.8000(1.1bln)

Price Signal Summary - EURUSD Recovery Extends Inside The Bear Channel

- In the equity space, S&P E-Minis traded higher Monday before finding resistance at the session high. Short-term gains are considered corrective - for now. Resistance to watch is unchanged at 3950.00, the Jun 27 high, and the 50-day EMA at 3952.01. A clear breach of this zone would strengthen a bullish case. Support to watch lies at 3923.75, the Jul 14 low. Short-term gains in EUROSTOXX 50 futures are still considered corrective. Yesterday’s climb however resulted in a break of resistance at 3504.00, Jul 8 high. The breach exposes the 50-day EMA at 3553.60 and 3584.00, the Jun 27 high. A break of this zone would suggest scope for a stronger short-term recovery. On the downside, the key support and bear trigger is unchanged at 3343.00, Jul 5 low.

- In FX, EURUSD has resumed its short-term recovery and has cleared Monday’s high. Attention is on resistance at 1.0258, the 20-day EMA. A breach of the average would strengthen bullish conditions and signal scope for an extension within the bear channel, drawn from the Feb 10 high. This would open 1.0359, the Jun 15 low. GBPUSD is holding onto its most recent gains. The latest recovery is considered corrective and firm resistance is seen at 1.2049, the 20-day EMA. A break of this average would signal scope for a stronger short-term climb and open 1.2125 the Jul 5 high. Key support has been defined at 1.1760, the Jul 14 low. USDJPY remains in an uptrend and the latest pullback is likely a correction. A resumption of gains would open 139.48, 1.00 projection of the Jun 16 - 22 - 23 price swing and the 140.00 psychological handle.

- On the commodity front, Gold is consolidating. The yellow metal remains in a downtrend and last week’s trend lows reinforce bearish conditions. This has opened $1690.6 next, the Aug 9 2021 low. Firm resistance is seen at $1764.0, the 20-day EMA. In the Oil space, WTI futures traded higher Monday. A recent reversal signal was confirmed on Jul 14 - a hammer candle formation. Attention is on the next firm resistance at $104.94, the 50-day EMA. A clear break of this average is required to suggest scope for a stronger recovery. On the downside, a reversal lower would refocus attention on $90.56, the Jul 14 low and bear trigger.

- In the FI space, a short-term bull cycle in Bund futures is still in play and the current retracement is considered corrective. Scope is seen for a climb towards 154.00 next. The trend condition in Gilts remains bullish. Scope is seen for a climb to 117.48, 1.236 projection of the Jun 16 - 24 - 29 price swing. Initial firm support to watch lies at 114.08, the Jul 8 low.

EQUITIES: Europe Stocks Pare Gains On ECB 50bp Hike Speculation

- Asian stocks closed mixed (Japan returned from a Monday holiday): Japan's NIKKEI closed up 173.21 pts or +0.65% at 26961.68 and the TOPIX ended 10.29 pts higher or +0.54% at 1902.79. China's SHANGHAI closed up 1.328 pts or +0.04% at 3279.431 and the HANG SENG ended 185.12 pts lower or -0.89% at 20661.06.

- European stocks pared earlier modest gains after multiple media reports that the ECB was considering hiking by 50bp in July; tech stocks are lagging, with defensives (utilities) leading: the German Dax down 62.77 pts or -0.48% at 12959.81, FTSE 100 down 11.14 pts or -0.15% at 7218.69, CAC 40 down 39.08 pts or -0.64% at 6091.91 and Euro Stoxx 50 down 21.72 pts or -0.62% at 3511.86.

- U.S. futures are a little stronger, with the Dow Jones mini up 90 pts or +0.29% at 31135, S&P 500 mini up 16.25 pts or +0.42% at 3850, NASDAQ mini up 51 pts or +0.43% at 11958.

COMMODITIES: Precious Metals Benefit From Weaker USD But Copper Retreats

- WTI Crude down $0.4 or -0.39% at $101.77

- Natural Gas down $0.01 or -0.11% at $7.519

- Gold spot up $3.78 or +0.22% at $1710.43

- Copper down $5 or -1.49% at $334.7

- Silver up $0.15 or +0.79% at $18.8595

- Platinum up $7.45 or +0.86% at $873.39

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/07/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/07/2022 | 1700/1800 |  | UK | BOE Bailey at Mansion House Dinner | |

| 19/07/2022 | 1835/1435 |  | US | Fed Vice Chair Lael Brainard | |

| 20/07/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 20/07/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 20/07/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 20/07/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/07/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/07/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 20/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/07/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/07/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.