-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Eurozone PMIs Below 50 After ECB Hikes 50

EXECUTIVE SUMMARY:

- EUROZONE PRELIMINARY JULY PMIS FALL BELOW 50

- UK PMIS COME IN ABOVE EXPECTATIONS

- ECB'S KAZIMIR SAYS SEPTEMBER RATE HIKE MAY BE 25 BPS OR 50 BPS

- ITALY CRISIS WASN'T BEHIND CREATION OF ECB'S NEW TOOL: DE COS

- ECB WOULD BE DETERMINED IN USING TPI IF NEEDED: VILLEROY

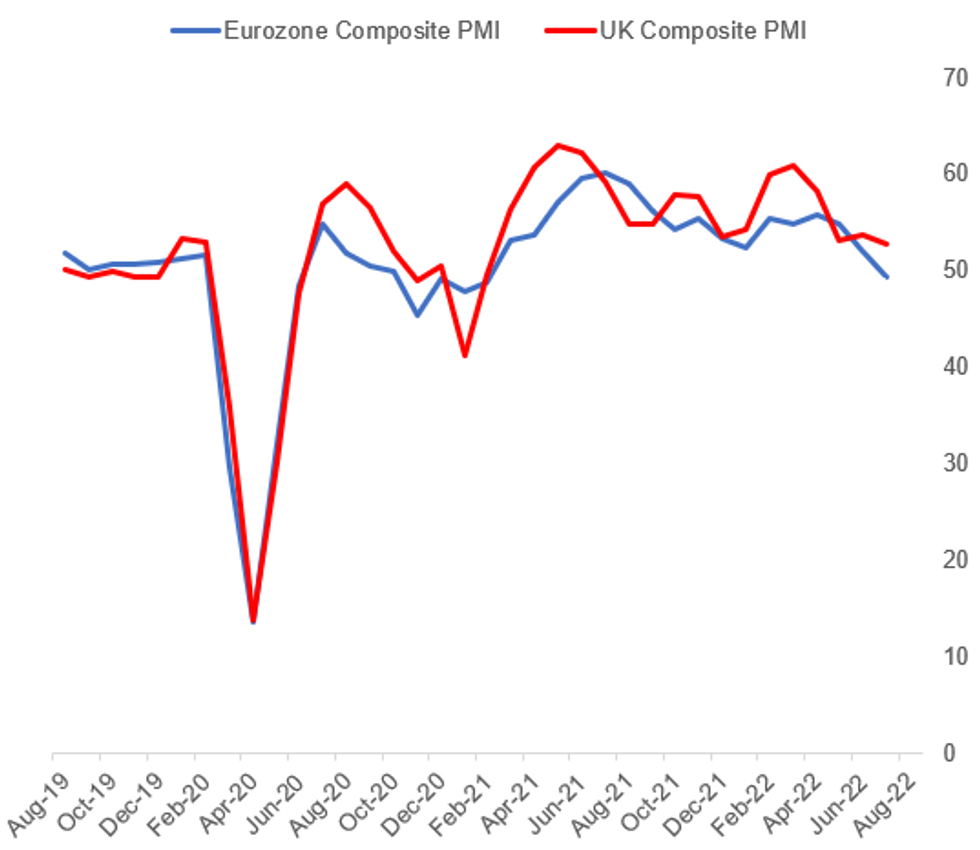

Fig. 1: UK PMIs Outperform Eurozone In July

Source: S&P Global, BBG, MNI

Source: S&P Global, BBG, MNI

NEWS:

ECB (BBG): European Central Bank Governing Council Peter Kazimir said that the next interest-rate hike by policy makers might be a quarter point or a half point, depending on their judgment. “How much we raise rates in September and at our next meetings will be determined by economic developments in the euro zone and beyond,” the Slovak central bank governor said in a statement on his institution’s website on Friday. “It is therefore possible to expect an increase of 25 or 50 basis points.”

ECB (RTRS): The political crisis in Italy earlier this week was not behind the creation of an anti-fragmentation tool by the European Central Bank, policymaker Pablo Hernandez de Cos said on Friday. The ECB announced on Thursday its new Transmission Protection Instrument (TPI), which will let it buy bonds from indebted countries such as Italy to cap any excessive rise in their borrowing costs, helping limit financial fragmentation within the euro zone.

ECB (BBG): The European Central Bank’s new bond-buying tool marks decisive progress and policy makers would be determined to use it if required, according to Governing Council member Francois Villeroy de Galhau.As the ECB rushed to raise rates on Thursday, it unveiled the Transmission Protection Instrument to intervene on government-debt markets if there’s any unwarranted volatility as borrowing costs increase.“Few people would have bet five weeks ago after our exceptional meeting that we would succeed in fine-tuning it as quickly and effectively,” Villeroy told a news conference Friday in Paris. “If needed, we’d be as determined in activating it.”

ECB / EUROZONE: Inflation across the euro area is currently forecast to be just above the European Central Bank's medium-term inflation target, the bank's latest survey of professional forecasters shows. The outlook for 2024 from the Q3 SPF is currently in line with those of the ECB's own staff forecasts. Inflation is seen at 7.3% for 2022, 3.6% in 2023, 2.1% in 2024 and 2.2% over the longer term. That compares to 6.0%, 2.4%, 1.9% and 2.1%, respectively, in the Q2 survey. The forecast of inflation at 2.1% in 2024, the ECB's medium-term horizon, is the same as that in the last-round projections from the central bank's staff economists.

GERMANY / EUROPE ENERGY (BBG): The German government is in the final stage of a deal to bail out Uniper SE to prevent the collapse of a linchpin in the country’s energy network in the wake of Russia’s moves to slash gas supplies.Chancellor Olaf Scholz’s administration will get a stake of between 25% and 30% in a capital increase, with a nominal price of 1.70 euros a share, according to people familiar with the situation. Senior officials in the German government will discuss the package on Friday and an agreement could be announced later in the day, they said. Scholz will address the press at around noon in Berlin.

FRANCE / ECB (BBG): French Finance Minister Bruno Le Maire welcomed the European Central Bank’s decision to raise borrowing costs to combat inflation and introduce an anti-fragmentation tool, adding that he didn’t believe the euro area would see another sovereign debt crisis.“Structurally, we have to get this inflation down, we can’t live with inflation at 5% or 6% for years,” Le Maire said in an interview with BFM TV on Friday. “That’s why Christine Lagarde and the European Central Bank took this decision, and from this point of view, these are wise decisions.”

DATA:

MNI BRIEF: UK Retail Sales Fall, But Helped By Jubilee Weekend

UK retail sales were mixed in June, as a modest improvement in food sales over the Jubilee weekend ran into weaker petrol sales, the Office for National Statistics said Friday. Overall sales by volume fell 0.1% m/m, down 5.8% on the year, while ex-fuel, sales rose 1.4% y/y.

“After taking account of rising prices, retail sales fell slightly in June and although they remain above their pre-pandemic level, the broader trend is one of decline," Heather Bovill, ONS Deputy Director for Surveys and Economic Indicators said.

Food store sales were the only sector to see an increase in the month, the data highlight, linked largely to an upswing early in the month for the 4-day holiday weekend. Bovill noted that retailers said consumers were cutting back on spending due to higher prices and concerns around affordability. Overall, sales fell 1.2% on the three months to June and the ONS said it would have a -0.06 percentage point impact on Q2 GDP.

MNI: UK JUL FLASH MANUF PMI 52.2 (FCST 52.0); JUN 52.8

UK FLASH JUL SERVICES PMI 53.3 (FCST 53.0); JUN 54.3

UK FLASH JUL COMPOSITE PMI 52.8 (FCST 52.4); JUN 53.7

UK: PMIs surprise to the upside but price pressures begin to ease

- UK PMI data has surprised to the upside (bucking the trend seen in French, German and Eurozone data earlier this morning). The details appear relatively strong - particularly with new orders growing. Price pressures appear to be easing somewhat, however, which partly explains why SONIA futures have only pulled back 2-3 ticks of the rally they have seen this morning. Highlights from the press release:

- "New order volumes across the UK private sector as a whole increased moderately in July, driven by a sustained rise in new work across the service economy. A number of firms attributed higher workloads to resilient consumer spending on travel and leisure services. In contrast, manufacturing companies signalled a further reduction in sales volumes and the rate of decline was the fastest for just over two years. Weaker demand led to the steepest drop in backlogs of work at manufacturing firms since June 2020."

- "Solid rise in private sector employment, despite the pace of job creation easing to a 16-month low... some firms reported that shortages of candidates and concerns about the demand outlook had led to the non-replacement of leavers."

- "Input cost inflation moderated for the second month running... This signalled the slowest rate of inflation since September 2021."

- "Further slowdown in prices charged inflation at private sector companies. The latest rise in output charges was the least marked since January, reflecting some efforts to moderate price increases in the wake of softer customer demand."

- "Private sector firms remain relatively cautious about the business outlook, despite a slight improvement from June’s 25-month low amid stronger optimism in the service economy"

GERMANY FLASH JUL MANUF PMI 49.2 (FCST 50.7); JUN 52.0

GERMANY FLASH JUL SERVICES PMI 49.2 (FCST 51.4); JUN 52.4

GERMANY FLASH JUL COMPOSITE PMI 48.0 (FCST 50.2); JUN 51.3

GERMANY: Disappointing data as services, manuf and composite all below 50

- Outside of employment, the underlying details of the disappointing German PMI prints were also weak (manufacturing, services and composite prints all falling below 50). Price pressures are easing a bit, but expectations for the future are being hit too

- "Declines in both domestic and export demand was indicated by the latest data as a combination of an uncertain business environment, supply shortages and stretched client budgets weighed on the sector. Expectations about the future sank into negative territory for the first time since May 2020, the height of the first wave of the COVID pandemic."

- "Sales in the service sector declined for a second successive month and to the sharpest degree since February 2021. With manufacturers registering an even sharper fall in new orders – the biggest since May 2020 – the decline at the composite level was a 26-month record."

- "Cost pressures remain elevated. Prices paid for energy and commodities, a weaker euro as well as rising interest rates and higher wages reported in services, meant that overall input costs rose substantially. That said, inflation did maintain its recent downward trend, dropping to a sixmonth low. Costs in manufacturing continued to rise at a quicker rate than in services, despite inflation here dropping to its lowest in nearly a year-and-a-half."

- "average prices charged for goods and services also rose at a slower rate (weakest in five months),"

- "Employment growth held broadly steady at a solid rate as firms sought to keep on top of workloads. Overall, backlogs of work were subsequently little changed compared to June"

MNI: FRANCE JUL FLASH MANUF PMI 49.6 (FCST 51.0); JUN 51.4

FRANCE FLASH JUL SERVICES PMI 52.1 (FCST 52.8); JUN 53.9

*FRANCE FLASH JUL COMPOSITE PMI 50.6 (FCST 51.1); JUN 52.5

FRANCE: French PMI misses expectations with manufacturing below 50

Bund futures jump from 152.77 to a high of 153.15 on the back of the weaker-than-expected French flash PMI print. The details look soft and price pressures are showing some more signs of being close to a peak. Most of the details are downbeat but expectations and employment remained positive. Highlights form the press release:

- "The first decline in private sector new business since February 2021. This enabled companies to channel extra resources to tackling their backlogs, which fell in July for the first time in almost a year-and-a-half."

- "There was a fractional uptick in the rate of output price inflation during July, though it remained softer than May’s record. On the other hand, input prices rose to the slowest extent in five months, albeit still sharply overall."

- "Demand for French goods falling for a second month in a row and at the quickest pace since November 2020... services firms also recorded a drop in the level of incoming new business for the first time in 16 months."

- "Output expectations remained positive in July and strengthened slightly from May’s 19-month low."

- "Data pointed to sustained growth in employment across the French private sector at the start of the third quarter."

MNI: EUROZONE FLASH JUL MANUF PMI 49.6 (FCST 51.0); JUN 52.1

*EUROZONE FLASH JUL SERVICES PMI 50.6 (FCST 52.0); JUN 53.0

EUROZONE FLASH JUL COMPOSITE PMI 49.4 (FCST 51.0); JUN 52.0

EUROZONE: Rest of the Europe below 50, but not as weak as Germany

- Rest of Europe output it below 50 in the PMI survey - although not as weak as the German data.

- "The rest of the region as a whole meanwhile recorded a marginal contraction of output, the composite PMI dropping to 49.9 to represent the first deterioration since February 2021."

FIXED INCOME: PMIs drive core FI higher - with Bunds leading the way

Flash PMI data has been the driver of markets this morning.

- Bunds have seen the biggest moves in core fixed income with disappointing PMI prints across France, Germany and the Eurozone, with several of the prints coming in below 50 - with Germany in particular looking very weak. Schatz yields have fallen 21bp on the day with the Germany curve bull steepening.

- Gilts have been dragged around by Bunds but are underperforming - with the underperformance helped further by a slightly higher than expected PMI print - in contrast to the European misses.

- Treasuries have seen the smallest moves on the day, but have still moved higher, although the curve has flattened.

- Looking ahead, the only notable scheduled event is the US PMI print. Markets are likely to continue to digest this morning's PMIs, yesterday's larger-than-expected ECB 50bp hike and begin to look towards next week's FOMC meeting.

- TY1 futures are up 0-22 today at 119-19 with 10y UST yields down -6.6bp at 2.811% and 2y yields down -3.2bp at 3.055%.

- Bund futures are up 1.99 today at 154.17 with 10y Bund yields down -16.8bp at 1.050% and Schatz yields down -21.0bp at 0.436%.

- Gilt futures are up 1.02 today at 117.26 with 10y yields down -10.6bp at 1.938% and 2y yields down -12.1bp at 1.865%.

FOREX: EUR/USD Through Post-ECB Lows as PMIs Flash Recession Warning

- After EUR/USD's flat finish on Thursday, the pair has slipped through the overnight lows to touch 1.0130 on the back of a series of particularly poor PMI numbers from across Germany and France. This tipped the Eurozone-wide flash composite PMI below 50 for the first time since the lockdown-induced slowdown in early 2021.

- Despite this, ECB speakers continue to talk up the prospect of rate hikes across H2, with Kazimir this morning going through the likelihood of a further 25 or 50bps rate rise in September - the first in a series of "similar steps".

- With the EUR weaker across the board, the greenback is the main beneficiary, putting the USD Index back above the 107 level but still comfortably off the Monday highs of 108.036.

- Having sold off alongside the EUR this morning, GBP saw some reprieve on a better set of manufacturing, services PMIs, which seemed to counter the mixed messages in the morning's retail sales report. EUR/GBP is through the Thursday low and narrowing the gap with Monday's 0.8458.

- Focus going forward turns to the prelim US PMI data that's still expected to slow a modest rise is activity, as well as Canadian retail sales for May.

EQUITIES: Europe Stocks Embrace More Dovish ECB Hike Outlook

- Asian markets closed mostly stronger: Japan's NIKKEI closed up 111.66 pts or +0.4% at 27914.66 and the TOPIX ended 5.38 pts higher or +0.28% at 1955.97. China's SHANGHAI closed down 2.027 pts or -0.06% at 3269.974 and the HANG SENG ended 34.51 pts higher or +0.17% at 20609.14.

- European equities are largely shrugging off recessionary PMI data (and perhaps embracing it with less ECB hiking now priced), with the German Dax up 20.51 pts or +0.15% at 13317.24, FTSE 100 up 16.64 pts or +0.23% at 7320.4, CAC 40 up 6.94 pts or +0.11% at 6216.02 and Euro Stoxx 50 up 4.51 pts or +0.13% at 3584.12.

- U.S. futures are a little weaker, with the Dow Jones mini down 10 pts or -0.03% at 31997, S&P 500 mini down 11 pts or -0.27% at 3990.25, NASDAQ mini down 70 pts or -0.55% at 12570.

COMMODITIES: Crude Slips Amid Recessionary Eurozone PMI Data

- WTI Crude up $0.29 or +0.3% at $96.65

- Natural Gas down $0.08 or -0.97% at $7.855

- Gold spot down $0.12 or -0.01% at $1707.94

- Copper up $1.75 or +0.53% at $331.65

- Silver down $0.11 or -0.61% at $18.7441

- Platinum up $5.9 or +0.67% at $882.97

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.