-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US MARKETS ANALYSIS - US CPI Takes Top Billing

Highlights:

- US CPI in focus, with markets still split on whether Fed go 50 or 75bps in Sept

- NOK on top as CPI surges ahead of forecast

- Treasury curve sits steeper, with 10y auction to digest on top of data

US TSYS SUMMARY: Twist Steepening With US CPI, Fedspeak & 10Y Auction Ahead

- Cash Tsys currently see a twist steepening after a mixed overnight that saw only limited support from a Chinese white paper reiterating the country’s stance on Taiwan whilst failing to take the prospect of military action off the table, final German CPI inflation for July coming inline and Transneft getting ready to resume flow via the Druzhba southern leg.

- Moves are limited ahead of US CPI, with MNI’s full preview here, but also with interest in the 10Y auction later.

- 2YY -0.6bps at 3.264%, 5YY +1.2bps at 2.973%, 10YY +1.5bps at 2.792% and 30YY +1.4bps at 3.003%. The combination sees 2s10s pull back modestly from fresh post-2000 lows of almost -50bps yesterday to -46.5bps. BofA wouldn’t rule out the curve flattening another 10-25bps to inversion between 60-85bps “if inflation remains elevated and terminal is priced to 4% or higher (about a 50bps shock)”.

- TYU2 trades unchanged at 119-15+ after a mixed session on modestly below low seasonal volumes. It continues to trade near recent lows, eyeing trendline support at 119-11+ drawn from the Jun 16 low, with the 50-day EMA at 119-07+.

- Data: US CPI and Real Av Earnings (0830ET), Wholesale Inventories/Trade Sales (1000ET), Mthly Budget Statement (1400ET).

- Fedspeak: Chicago Fed Evans, mon-poli/eco-outlook, Drake Univ event (1100ET), MN Fed Kashkari on inflation, Aspen Eco Strategy Grp (1400ET).

- Bond issuance: US Tsy $35B 10Y note auction (91282CFF3) – 1300ET

- Bill issuance: US Tsy $30B 119-day bill CMB auction – 1130ET

Source: Bloomberg

Source: Bloomberg

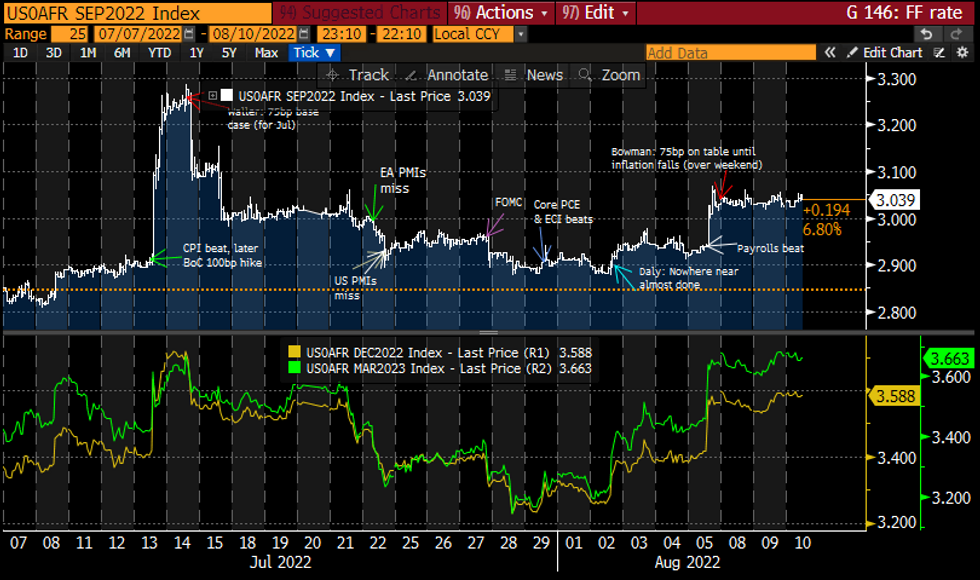

STIR FUTURES: Bullard Helps Fuel Potential Hawkish Reaction In Event Of Another CPI Beat

- Fed Funds implied hikes keep 69-70bps for the Sept FOMC and hold onto yesterday’s steady gains with a cumulative 124bp to year-end and 131bp to an implied peak of 3.65% in Mar’23 before 54bps of cuts to Dec’23.

- MNI’s Exclusive Interview with Bullard (’22 voter) yesterday could add further fuel to a hawkish reaction in the event of another beat in today’s CPI – full preview here: https://marketnews.com/mni-us-cpi-preview-buckle-up

- The Fed will be prepared to hold interest rates "higher for longer" should inflation continue to surprise to the upside, and market pricing will need to adjust accordingly, with the destination a little bit higher than what he thought even a couple months ago. A podcast of the interview is available here https://marketnews.com/podcasts/ with the text highlights here: https://marketnews.com/mni-interview-bullard

- Further Fedspeak post US CPI with ’23 voters in Evans (1100ET) and Kashkari (1400ET).

FOMC-dated Fed Funds futures implied rate at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rate at specific meetingsSource: Bloomberg

EGB/GILT SUMMARY: Trading Mixed Ahead of US CPI Report

European government bonds initially rallied through the morning following a weak start, but eventually started to give back some of the gains. Equities have inched higher while the dollar is again on the backfoot against G10 FX.

- The gilt curve has sharply twist flattened, largely on the back of the short-end selling off. The 2s30s spread has narrowed 11bp.

- The bund curve has similarly twist flattened with the 2s30s trading down 6bp.

- Having rallied earlier in the morning, OATs subsequently sold off and now trade mixed on the day, albeit with the short end trading marginally below yesterday's close.

- BTPs have traded lower with yields up to 4bp higher at the short end.

- The final estimate of German CPI for July matched the initial reading (8.5% Y/Y)

- Supply this morning came from Germany (Bund, EUR1.165bn allotted), Italy (BOTs, EUR7bn).

- Focus today shifts to the US CPI data for July, with the Bloomberg consensus expecting a slight deceleration to 8.7% Y/Y from 9.1% in June.

EUROPE OPTION FLOW SUMMARY

Eurozone:- ERZ2 99.37/99.12/99.00 broken p fly, 1x3x2, sold at 2.75 in 5k

EUROPE ISSUANCE UPDATE

Germany sells:

- E1.5bln (E1.165bln allotted) of the 1.25% Aug-48 Bund. Avg yield 1.1% (bid-to-cover 1.25x)

FOREX: NOK Surges as Norges Bank Pricing Bumped Higher on CPI

- The greenback again trades softer ahead of NY hours Wednesday, mimicking the price action seen on Tuesday, albeit within a more muted range. EUR/USD continues to hold just above the 1.02 handle, but is yet to make any meaningful test on the Tuesday European high of 1.0247. Among the crosses however, EUR is faring less well, with headlines this morning concerning the impassability of the Rhine river hampering supply chains further on the continent. EUR/NZD is testing the 1.62 handle in response.

- Risk sentiment is generally improving, with both equities and high beta currencies on the front foot. The e-mini S&P has improved over the past hour so, erasing a modest Asia-Pac session drift to narrow in on 4155.00, the overnight Tuesday high. As a result, the likes of NZD and CAD are edging higher - although volumes and activity remain light at this stage.

- NOK's strength so far Wednesday follows a bumper inflation print for July, coming in at 1.3% on the month vs. Exp. 0.9%. This has prompted a wide range of analysts to bring forward expectations for tightening from the Norges Bank, with consensus shifting to a 50bps rise next week, from a 25bps rise previously.

- Chinese inflation data overnight could fuel further calls for PBOC easing across the second half of this year as both CPI and PPI data came in below expectations. While CPI rose to 2.7% Y/Y, the pace of increase slowed and fell short of forecast. Similarly, PPI fell well below expectations, and dropped to the lowest level since early 2021 - leaving CNH as one of the worst performers so far Wednesday.

- US CPI takes focus going forward, with markets expecting headline and core CPI M/M to slow to 0.2% and 0.5% respectively. The speakers slate could be similarly interesting, with Fed's Evans & Kashkari and BoE's Pill on the docket.

FX OPTIONS: Expiries for Aug10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E874mln), $1.0168-75(E1.7bln), $1.0210(E1.2bln), $1.0215-20(E752mln), $1.0400(E1.4bln)

- USD/JPY: Y133.90-05($1.4bln)

- GBP/USD: $1.2040-50(Gbp528mln), $1.2400(Gbp690mln)

- AUD/USD: $0.6985-00(A$794mln)

- USD/CAD: C$1.2900($1.1bln)

- USD/CNY: Cny6.7500($732mln)

Price Signal Summary - Gold Pierces Trendline Resistance

- In the equity space, S&P E-Minis remain in consolidation mode. The short-term trend outlook is unchanged and bullish. A fresh high print Monday reinforces the current condition and this signals scope for a climb towards 4204.75, May 31 high and the next key resistance. Initial key support is 4008.43, the 50-day EMA. The first support to watch is 4080.50, Aug 2 low. The short-term uptrend in EUROSTOXX 50 futures is intact. The contract has recently cleared the 76.4% retracement of the Jun 6 - Jul 5 downleg, at 3722.40. The focus is on 3840.00, the Jun 6 high. Initial firm support to watch is 3607.80, the 50-day EMA.

- In FX, EURUSD short-term conditions are bullish as long as support at 1.0097, the Jul 27 low, remains intact. Potential is seen for an extension higher inside the bull channel drawn from the Feb 10 high - the top intersects at 1.0352 and this is a key short-term resistance. A breach of 1.0097 would highlight a bearish development. A bullish short-term theme in GBPUSD remains intact despite the recent pullback. A resumption of gains would open 1.2332, the Jun 27 high. Potential is also seen for a climb towards 1.2406, the Jun 16 high and a key resistance. Initial support to watch lies at 1.2004, the Aug 5 low. No change in USDJPY and the pair is holding on to its recent gains. It is still possible that the latest bounce is a correction. Resistance to watch is 135.96, 61.8% retracement of the Jul 14 - Aug 2 downleg. 130.41, Aug 2 low, is the bear trigger.

- On the commodity front, Gold maintains a firmer tone. Attention is on trendline resistance, drawn from the Mar 8 high. The line was pierced yesterday, a clear break would represent an important technical breach and highlight a stronger reversal of the 5-month downtrend. The trendline intersects at $1794.6 and yesterday’s high was $1800.4. A clear break of the $1800.0 handle would confirm a trendline break. Initial firm support lies at $1754.4 the Aug 3 low. In the Oil space, WTI futures remain vulnerable following last week’s move lower. Price has breached support at $88.23, Jul 14 low and a key support. This has exposed $85.37, the Mar 15 low. Yesterday’s candle pattern is a doji and this signals the end of the 3-day corrective bounce.

- In the FI space, a short-term bull cycle in Bund futures remains intact and the recent pullback is likely a correction. Scope is seen for a climb to 159.79 next, the Apr 4 high (cont). Initial firm support is 155.16, the 20-day EMA. The trend direction in Gilts remains up and the recent pullback is considered corrective. Two support levels to watch are:

- 116.41, 50-day EMA.

- 116.61, trendline support drawn from the Jun 16 low.

EQUITIES: Financials Lead Early European Gains

- Asian markets closed weaker: Japan's NIKKEI closed down 180.63 pts or -0.65% at 27819.33 and the TOPIX ended 3.37 pts lower or -0.17% at 1933.65. China's SHANGHAI closed down 17.412 pts or -0.54% at 3230.02 and the HANG SENG ended 392.6 pts lower or -1.96% at 19610.84.

- European stocks are mostly higher, with financials leading gains and consumer staples/health care lagging: the German Dax up 43.19 pts or +0.32% at 13578.28, FTSE 100 down 1.51 pts or -0.02% at 7486.54, CAC 40 up 3.62 pts or +0.06% at 6492.84 and Euro Stoxx 50 up 6.78 pts or +0.18% at 3722.22.

- U.S. futures are pointing higher, with the Dow Jones mini up 85 pts or +0.26% at 32822, S&P 500 mini up 14 pts or +0.34% at 4138.5, NASDAQ mini up 59.25 pts or +0.45% at 13090.75.

COMMODITIES: Copper Edges Higher, Precious Lower

- WTI Crude down $0.19 or -0.21% at $90.3

- Natural Gas up $0.01 or +0.13% at $7.843

- Gold spot down $1.66 or -0.09% at $1792.6

- Copper up $1.35 or +0.38% at $359.85

- Silver down $0.09 or -0.42% at $20.4348

- Platinum down $2.46 or -0.26% at $934.28

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/08/2022 | 1230/0830 | *** |  | US | CPI |

| 10/08/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 10/08/2022 | 1500/1100 |  | US | Chicago Fed's Charles Evans | |

| 10/08/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/08/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/08/2022 | 1800/1400 |  | US | Minneapolis Fed's Neel Kashkari | |

| 11/08/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 11/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/08/2022 | 1230/0830 | *** |  | US | PPI |

| 11/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/08/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/08/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.