-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Treasury Rally Stalls Ahead of UMich

Highlights:

- SEK spirals after CPI falls below forecast

- GBP softens as GDP report points to weakness ahead

- Treasury rally stalls as focus turns to prelim UMich data

US TSYS SUMMARY: Limited Treasury Rally Supported By China TSF Disappointment

- After a quiet session through European hours, cash Tsys see a rally broadly across the key benchmarks on the significantly smaller than expected increase in China aggregate funding led by new yuan loans, impacting risk sentiment more broadly, although the move has partly retraced.

- 2YY -2bps at 3.199%, 5YY -1.7bps at 2.970%, 10YY -2.2bps at 2.866% and 30YY -2.1bps at 3.133% but 20Y bucks the trend with -3.7bps.

- TYU2 trades 5 ticks higher at 119-08, towards the low end of yesterday’s range on above average but still low summer volumes. The recent break of trendline resistance at 119-16 suggests a deeper retracement is likely near-term , opening 118-05 a Fibo retracement of the Jun 14 – Aug 2 bull cycle.

- Fedspeak: Barkin (’24 voter) speaks on CNBC interview at 1000ET

- Data: U.Mich consumer sentiment/inflation expectations in focus at 1000ET, with monthly international trade prices beforehand at 0830ET.

- No issuance

STIR FUTURES: Fed Terminal Rate Not Far Off Pre-CPI Peaks

- Fed Funds implied hikes show 62bps for Sept, the middle of the narrow post-CPI range.

- There’s been a stronger relative rise further out though, with the 117bps to 3.50% in Dec and especially the 128bps to a peak of 3.61% in Mar’23 taking it back towards post-payrolls levels at a sustained peak of circa 3.65% in the run up to CPI.

- In an interview late yesterday, Daly (’24 voter) expanded on guidance of a 50bp hike for Sept and a 3.4% by year-end, where she’s been since the last meeting. She doesn’t want to tip labor market over so 50bps makes sense, but open to 75bp should data evolve differently. Fed is data not data point dependent - CPI shows enough uncertainty, looks a little bit of improvement but we don’t want to be head faked.

- Barkin (’23) speaks on CNBC at 1000ET.

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

EGB/GILT SUMMARY: UK Slides Into Negative Growth

European government bonds have traded lower this morning alongside gains for equities and the dollar vs G10 FX.

- Data published this morning confirmed that the UK economy slipped into recession during the second quarter with GDP contracting 0.1% Q/Q (a touch better than expected)) with monthly data showing a 0.6% M/M drop in June.

- Gilts sold off earlier in to the session and despite reclaiming some ground, continue to trade below yesterday's close. Yields are up 2-4bp with the longer end of the curve underperforming.

- Supply this morning came from the UK (UKTBs, GBP3.5bn).

- The bund curve has marginally bear steepened with the 2s30s spread widening 2bp.

- The OAT curve has similarly slightly steepened.

- BTP yields are up 1-4bp.

- US import/export prices for July and the preliminary University of Michigan consumer confidence update for August will be published later today.

EUROPE OPTION FLOW SUMMARY

Eurozone:

ERU2 99.37/99.25/99.00 broken p fly, bought for 1.5 in 2k

ERU2 99.50/99.62cs, bought for 1.5 in 2.5k

0RU2 98.62/98.87/99.12c ladder, sold at 5.25 and 5 in 5k

SX5E (16th Sep) 4000 call, bought for 9.50 in 20k

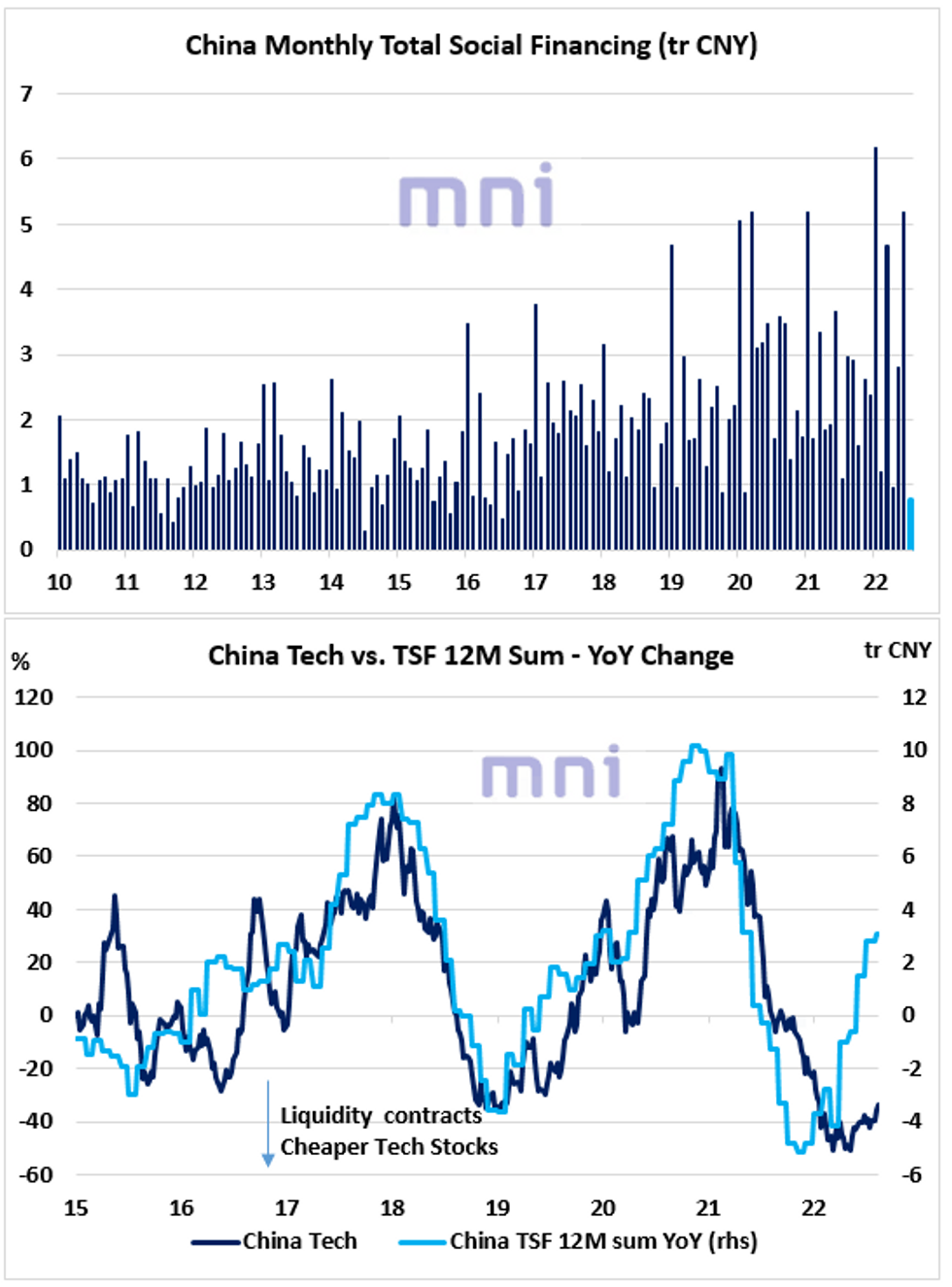

CHINA: Aggregate Financing Comes in Below Expectations But Annual 'Liquidity' Continues To Rebound

- The PBoC reported this morning that aggregate financing rose by 756bn CNY in June, significantly below expectations of 1.35tr CNY with new yuan loans rising by 679bn CNY (1.125tr CNY exp.).

- However, China ‘liquidity’ metric, computed as the annual change in China Total Social Financing (TSF), continues to rise, now up 3tr USD in the past year.

- Even though a recovery in liquidity has historically had a positive impact on domestic risky assets and some China-sensitive commodities (i.e. copper) or currencies (i.e. AUD), the easing conditions (policy and liquidity) have been barely enough to limit the downside risk on the real economy.

- The bottom chart shows that liquidity-sensitive sectors such as tech equities have remained 'depressed' despite the sharp rebound in liquidity since the start of the year.

- We also saw in recent weeks that ST rates have been constantly falling in the past two months, currently pricing more cuts from PBoC as the economic outlook has weakened significantly due to the zero-Covid policy.

- 7D IB repo rate dropped by 1.1% this week and is currently trading over 80bps below China ‘benchmark’ policy rate at 2.1% (7D reverse repo).

- However, China officials have been reluctant to cut rates as they have been inferring that the policy rate is currently standing at its ‘fair’ value

Source: Bloomberg/MNI

FOREX: SEK Spirals as Markets Price Out Odds of Imminent Riksbank Action

- The greenback is directionless early Friday, contrasting with the general theme of the week where the dollar has drifted lower across early European hours. The notable volatility following Wednesday's CPI may have flushed positioning somewhat, with markets now looking ahead to the UMich release as well as Fedspeak, with Barkin appearing on CNBC following the Wall Street opening bell.

- GBP is another source of weakness, with EUR/GBP inching to a new August high this morning following signs of a further deterioration for the economy in this morning's GDP report. Both private consumption and government spending came in below forecast, putting EUR/GBP above the 100-dma at 0.8472.

- SEK is underperforming, slipping against all others in G10 after the softer-than-expected inflation release this morning. CPI slowed to 0.1% on the month (vs. Exp. 0.3%) and 8.5% on the year (vs. Exp. 8.7%). The softer report has prompted markets to price out the outside chance of an inter-meeting rate hike from the Riksbank (something that many on the sell-side had seen a material risk of).

- NOK/SEK has rallied to the best levels since late April in response, topping 1.06 as well as the 50% retracement of the Mar - May downleg at 1.0621.

- US import and export price index data crosses later today, with the prelim University of Michigan survey for August also on the docket. Focus will turn to the inflation expectations answers, which are expecting to slow to 5.1% and 2.8% for the 1-yr and 5-10yr forecast horizons respectively.

RIKSBANK VIEW CHANGE: Danske looks for two 75bp hikes

- "The CPIF Ex Energy print was 0.8p.p. above the Riksbank’s forecast from June. Hence, we update our call and now expect Riksbank to hike with 75bp at the ordinary meeting in September and also in November. We also remove our previous expected hike of 25bp in February 2023, resulting in our new end point being raised somewhat from 2.00% to 2.25%."

- "The case for an emergency inter-meeting hike has diminished on the back of today's figures (and yesterday's Prospera), which should be seen as SEK negative. Strategically, we see EUR/SEK as a buy on dips since we still think total pricing is a tad aggressive and furthermore since the SEK is not helped by a pending global recession."

FX OPTIONS: Expiries for Aug12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0185-00(E812mln), $1.0225-30(E639mln), $1.0300(E1.8bln), $1.0325(E800mln), $1.0350(E766mln), $1.0435-40(E521mln)

- USD/JPY: Y132.00($810mln), Y132.45-50($575mln), Y133.98-00($1.7bln)

- GBP/USD: $1.2300(Gbp576mln)

- AUD/USD: $0.7100(A$593mln)

- USD/CAD: C$1.2700($1.3bln), C$1.2800($880mln), C$1.3135-55($1.5bln), C$1.3200($1.1bln)

- USD/CNY: Cny6.80($899mln), Cny6.85($500mln)

Price Signal Summary - S&P E-Minis Trend Needle Still Points North

- In the equity space, S&P E-Minis traded higher again Thursday. This reinforces bullish conditions and attention is on 4272.35, the 1.764 projection of the Jun 17 - 28 - Jul 14 price swing. On the downside, initial trend support is at 4080.50, the Aug 2 low. The short-term uptrend in EUROSTOXX 50 futures remains intact and the contract is trading closer at its recent highs. The focus is on 3840.00, the Jun 6 high. Initial firm support to watch is 3618.80, the 50-day EMA.

- In FX, EURUSD traded higher Wednesday and briefly traded above the bear channel top, currently at 1.0335. The channel is drawn from the Feb 10 high. 1.0335 and Wednesday’s high of 1.0368 marks a key resistance zone and a clear break would strengthen bullish conditions and confirm a clear channel breakout. Note that a deeper pullback and a breach of 1.0123, the Aug 3 low, would instead signal a reversal inside the channel. A bullish short-term theme in GBPUSD remains intact and Wednesday’s gains reinforce this theme. The focus is on 1.2293, the Aug 1 high. Watch support at 1.2004, the Aug 5 low, a break would be bearish. USDJPY traded sharply lower Wednesday. This signals a reversal of the recent correction between Aug 2 - 8. A continuation lower would expose 130.41, the Aug 2 low and the bear trigger. Firm resistance has been defined at 135.58, the Aug 8 high.

- On the commodity front, Gold traded higher Wednesday and did breach trendline resistance at $1794.6. The trendline is drawn from the Mar 8 high and the break represents an important technical breach plus highlights a stronger bullish reversal. Clearance of Wednesday’s $1807.9 high would reinforce bullish conditions and confirm a break of the trendline. Key support to watch is at $1754.4 the Aug 3 low. In the Oil space, WTI futures traded higher yesterday and the contract cleared $92.65, the Aug 9 high. This signals scope for a bullish extension towards $97.97, the 50-day EMA.

- In the FI space, Bund futures traded lower Thursday. The latest retracement is still considered corrective and the short-term trend direction is up. A resumption of gains would open 159.79, Apr 4 high (cont). Initial support is 154.75, Jul 28 low. First resistance is at 157.74, Aug 10 high. The trend direction in Gilts remains up and the recent pullback is considered corrective. However, futures have managed to break support at 116.79, a trendline drawn from the Jun 16 low. This has exposed 114.86, 50.0% retracement of the Jun 16 - Aug 2 upleg. Resistance to watch is at 118.10, Aug 10 high.

EQUITIES: Eurostoxx Retesting August's Highs

- Asian stocks closed higher: Japan's NIKKEI closed up 727.65 pts or +2.62% at 28546.98 and the TOPIX ended 39.53 pts higher or +2.04% at 1973.18. China's SHANGHAI closed down 4.777 pts or -0.15% at 3276.888 and the HANG SENG ended 93.19 pts higher or +0.46% at 20175.62.

- European futures are stronger, with energy stocks continuing to lead gains: German Dax up 55.23 pts or +0.4% at 13694.51, FTSE 100 up 45.24 pts or +0.61% at 7465.91, CAC 40 up 31.12 pts or +0.48% at 6544.67 and Euro Stoxx 50 up 11.74 pts or +0.31% at 3757.05.

- U.S. futures are higher as well, with the Dow Jones mini up 148 pts or +0.44% at 33452, S&P 500 mini up 20.75 pts or +0.49% at 4230.5, NASDAQ mini up 71.25 pts or +0.54% at 13382.5.

COMMODITIES: Holding Ground

- WTI Crude down $0.2 or -0.21% at $94.09

- Natural Gas down $0.17 or -1.94% at $8.494

- Gold spot down $2.49 or -0.14% at $1790.94

- Copper down $0.5 or -0.13% at $369.85

- Silver up $0.02 or +0.09% at $20.3762

- Platinum down $2.02 or -0.21% at $969.29

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/08/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/08/2022 | 1400/1000 |  | US | Richmond Fed Pres Barkin on CNBC | |

| 12/08/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/08/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.