-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: The Euro Runs Out Of Energy

Highlights:

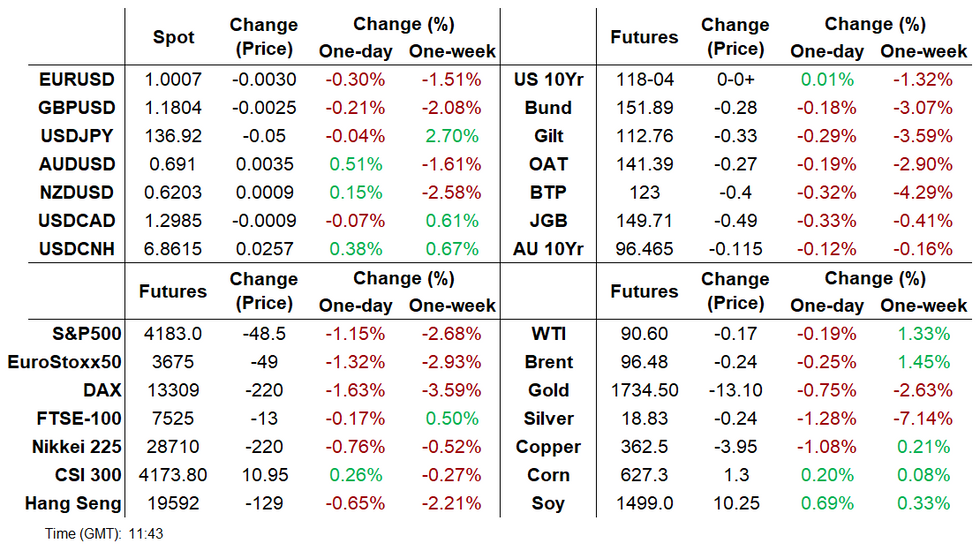

- Most notable activity early Monday has been in FX, with the dollar gaining amid broader risk-off moves

- EURUSD falls below parity again as European energy woes mount; CNYUSD at 2-year high

- Limited event schedule Monday, with attention already on Jackson Hole and Tuesday's PMIs

US TSYS: Treasuries Bear Flatten Into Light Docket

- Cash Treasuries have bear flattened with stagflationary pressures emanating from Europe on inflationary impacts from year-ahead power prices setting new record highs and the long-end cheapening somewhat on improved growth prospects from China planning $29B in special loans to shore up troubled property developers.

- The net result is 2s10s falling 5.5bps to -31bps, unwinding more than half of Friday’s steepening but still off pre-CPI lows almost -50bps.

- 2YY +6.1bps at 3.295%, 5YY +2.3bps at 3.116%, 10YY +0.6bps at 2.978% and 30YY +0.4bps at 3.216%.

- TYU2 trades just 1+ tick higher at 118-05 and just off overnight month lows of 117-31+, on average volumes. Key near-term support is seen at 117-14+ (Jul 21 low).

- Data: Chicago Fed national activity index (0830ET)

- Bill issuance: US Tsy $54B 13W, $42B 26W bill auctions (1130ET)

STIR FUTURES: Fed Sept Pricing Back At Pre-FOMC Minutes Levels

- Fed Funds implied hikes have churned higher overnight, possibly a spillover from continued European energy woes. The 66bps (+3bps) for the Sep FOMC is back to levels just prior to last week’s FOMC minutes taking the edge off 75bp expectations, although remains below the ~70bps priced prior to the CPI miss.

- Further out, the 140bp (+7bps) to a peak 3.73% in Mar’23 is below pre-FOMC minutes levels but above pre-CPI. Fed talk of higher for longer has helped this increase although whilst trimmed, there is still almost 40bps of cuts priced to end’23.

- No Fedspeak today with attention firmly on Powell at Jackson Hole on Friday.

Source: Bloomberg

Source: Bloomberg

EGB/GILT: Off To A Weak Start

European government bonds have got off to a weak start, with equities also trading lower at the beginning of the week.

- Gilts initially opened higher but have progressively sold off through the morning with the curve bear steepening. Cash yields are up 3-8bp.

- According to a report in the FT, chief UK economist at Citi indicated “We now expect CPI inflation to peak at over 18 per cent in January” as a result of successive increases in the household energy price cap. Elsewhere, the Bloomberg average inflation forecast for Q123 has been steadily grinding higher through the year and now stands at 11.0%.

- Bunds opened higher but subsequently sold off towards the Friday close with yields now up 1bp across much of the curve.

- The OAT curve has steepened with the 2s30s spread widening 6bp.

- BTPs have weakened across most of the curve with yields broadly up 2-4bp.

- Supply this morning came from Germany (Bubills, EUR1.98575bn allotted) and Belgium (OLOs, EUR2.001bn). The EFSF is selling a new Dec-25 bond for EUR4bn and tapping the 2.375% Jun-32 bond for EUR1.5bn via syndication.

EUROPE ISSUANCE UPDATE

Belgian auction results

- E780mln of the 0% Oct-27 OLO. Avg yield 1.258% (bid-to-cover 2.36x).

- E1.221bln of the 0.35% Jun-32 OLO. Avg yield 1.809% (bid-to-cover 1.77x).

- E4bln of the new Dec-25 EFSF. Books in excess of E19.1bln (inc JLM interest).E1.5bln tap of the 2.375% Jun-32 EFSF.

- Books in excess of E4.5bln (inc JLM interest).

EUROPE RATE / BOND OPTIONS

- OEV2 123/122ps sold at 16.5 in 5k

- OEV2 124.50/123.00ps vs 127c, bought the ps for flat in 4k

- DUU2 109.80/109.60ps sold at 16 in 28k

- ERU2 99.125/98.875ps, sold at 2.5 in 5k

EUROPE: Energy Pincer Movement Continues To Apply Economic (And FX) Pressure

Euro and Sterling remain under pressure this morning amid continued macroeconomic headwinds, many of which stem from soaring energy prices. German baseload electricity 1-year forward prices (EUR/Mwh) (chart below) provide one of the more frightening charts out there right now, up 10+% today and 650% Y/Y.

- A few other selected headlines from this morning:

- EUROPEAN GAS PRICES SURGE AS MUCH AS 10% TO EU269.50/MWH -bbg

- EUROPEAN COAL FOR NEXT YEAR RISES 5.1% TO RECORD $335/TON -bbg

- NORDIC NEXT-YEAR POWER JUMPS 7.3% TO RECORD EU195/MWH -bbg

- Some of these headlines represent near-term/idiosyncratic factors - our Commodities team points out that Nord Stream maintenance is expected for 3 days on Aug 31, and there is currently an unplanned gas outage in Norway.

- But the broader picture is that there is an economic pincer movement underway between higher Russia-Ukraine war-related energy prices squeezing the European private sector as a whole, and China growth weakness adding to pressure on eurozone exporters.

- While it could be argued that this dynamic has been substantially priced in already, upside in energy/power prices and China economic weakness look like they have been underestimated. That suggests potential for continued stagflationary pressures on European assets, with FX seeming to bear the burden.

Source: BBG, MNI

Source: BBG, MNI

FOREX: Early action is in FX

- Most of the early action has been in FX, in early trade.

- The Dollar remains king, helped by the early Risk Off tone.

- The move in Equity, saw some safe haven bid into the Yen and the CHF.

- EURCHF was the early focus, as it tested the 0.9600 figure, printed 0.95833 low, and another lowest print since January 2015.

- Further out, would see support at 0.9500, and 0.93404 for the EURCHF.

- The Pound was also under pressure with the EUR in early trade.

- Cable broke below Friday's low, but failed to test the next key support at 1.1760, printed 1.1782 low.

- EURUSD tested parity, with a 0.9990 low printed so far today.

- The pair printed a 0.9952 low in July, also the lowest print since December 2002.

- For the Scandies, despite the move lower in Oil, NOK extended gains, and leads versus the SEK, up 0.64% in early trade.

- NOKSEK sees next upside resistance at 1.0897, 76.4% retrace of the March May fall.

- NOKSEK is at session high, at 1.0868.

- Looking ahead, there's nothing of real interest to start the week, but there's plenty of focus looking forward.

- NOTABLE DATA: Japan services PMI, Singapore CPI, FR/GE/EU/UK/US prelim services PMIs (tue), SA CPI, US Durable goods (wed), German final GDP, US (2nd) GDP, Core PCE (thu), FR/IT cons conf, US Wholesale Inventories, PCE core deflator, final Michigan

- MAIN EVENTS: ECB minutes and Jackson Hole.

FX OPTION EXPIRY

FX OPTION EXPIRY (closest ones)

Of note:

EURUSD 1.88bn at 1.0000 (thur)- EURUSD: 0.9950 (201mln), 0.9961 (317mln), 1.0000 (257mln).

- USDJPY: 137 (367mln), 137.20 (300mln), 137.50 (230mln).

- USDCAD: 1.2950 (231mln).

- NZDUSD: 0.6150 (403mln).

- USDCNY: 6.82 (415mln).

Price Signal Summary - S&P E-Minis Correction Extends

- In the equity space, the trend condition in S&P E-Minis remains bullish, however, a corrective cycle suggests scope for a pullback near-term. This will allow an overbought reading in momentum studies to unwind - attention is on the 20-day EMA at 4164.93. A breach of this EMA would signal scope for a deeper pullback, potentially exposing the 50-day EMA, at 4078.40. EUROSTOXX 50 futures remain in an uptrend, however, the contract has entered a corrective phase. The 20-day EMA, at 3709.50, has been cleared and sights are on the 50-day EMA at 3650.80 - a key area of support.

- In FX, EURUSD outlook remains bearish. The recent move down has confirmed a short-term reversal and means the pair has failed to clear channel resistance. The bear channel is drawn from the Feb 10 high and intersects at 1.0282. Sights are on 0.9952 next, the Jul 14 low. GBPUSD is weaker, having breached support at 1.2004, the Aug 5 low. The break lower signals scope for an extension and has opened 1.1760, the Jul 14 low and bear trigger. USDJPY continues to appreciate and last week traded above resistance at 135.58 last week, the Aug 8 high. The pair has today pierced 137.27, 76.4% of the Jul 14 - Aug 2 downleg. A clear break of this level would open 137.96, the Jul 22 high.

- On the commodity front, Gold is trading lower, extending the pullback from $1807.9, the Aug 10 high. The yellow metal has failed to confirm a clear break of the 5-month downtrend and the break of support at $1754.4 Aug 3 low, signals scope for a deeper pullback towards $1711.7 next. In the Oil space, WTI futures remain vulnerable. Last week’s move down has resulted in a print below support at $87.01, the Aug 5 low. This reinforces bearish conditions and a clear break of $87.01 would confirm a resumption of the downtrend. Attention is on $85.37, the Mar 15 low. Key short-term resistance has been defined at $95.05, the Aug 11 high.

- In the FI space, Bund futures remain in a bear cycle and the contract is trading at its recent lows. The focus is on the 150.00 handle next. Gilts remain vulnerable. The next objective is 112.24, 76.4% retracement of the Jun 16 - Aug 2 upleg.

MARKET SNAPSHOT: Cyclical Equities And Commodities Head Lower

Equities:

- Asia Market Closes: Japan's NIKKEI closed down 135.83 pts or -0.47% at 28794.5 and the TOPIX ended 1.93 pts lower or -0.1% at 1992.59. China's SHANGHAI closed up 19.716 pts or +0.61% at 3277.794 and the HANG SENG ended 116.05 pts lower or -0.59% at 19656.98.

- Europe: German Dax down 217.42 pts or -1.61% at 13847.56, FTSE 100 down 19.29 pts or -0.26% at 7521.73, CAC 40 down 74.62 pts or -1.15% at 6573.53 and Euro Stoxx 50 down 49.34 pts or -1.32% at 3795.33.

- U.S. Futures: Dow Jones mini down 295 pts or -0.88% at 33411, S&P 500 mini down 46.5 pts or -1.1% at 4185, NASDAQ mini down 187.75 pts or -1.42% at 13080.5.

Commodities:

- WTI Crude down $0.12 or -0.13% at $91.95

- Natural Gas up $0.26 or +2.81% at $9.312

- Gold spot down $11.74 or -0.67% at $1774.56

- Copper down $3.45 or -0.94% at $366.1

- Silver down $0.11 or -0.59% at $19.1478

- Platinum down $13.74 or -1.53% at $895.55

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/08/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.