-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI US MARKETS ANALYSIS - Markets Steadier, With Equities Near Week's Best

Highlights:

- Equities off lows, E-mini S&P eyes Monday high for direction

- Evans eyes peak Fed rate around March next year

- Markets steadier Tuesday, durables and consumer confidence up next

Key Links: BOE Review / NBH Preview / BoT Preview

US TSYS: Large Belly-Led Retracement Ahead Of Loaded Docket

- Cash Tsys see a sizeable belly-led rally that has picked up pace through the European session and continued with the US coming in, following yesterday’s heavy selling pressure drove fresh cycle highs across the curve. Yields remain within yesterday’s wide ranges whilst 2s10s of -42bps broadly consolidates yesterday’s bear steepening at the higher end of the past couple weeks and off last week’s lows of -57bps.

- 2YY -9.1bps at 4.244%, 5YY -12.3bps at 3.068%, 10YY -10.7bps at 3.817%, 30YY -6.2bps at 3.678%.

- TYZ2 trades 15+ ticks higher at 111-27, just off session highs on average volumes, but the trend signals point south with support seen at 111-00+ (Sep 26 low), after which lies 110-13+ (3.0% 10-dma envelope).

- Fedspeak: Chair Powell on digital currency panel (0730ET), Bullard (1000ET), Kashkari (1300ET) and Daly (2035ET).

- Data: Durable goods orders, Conf. Board consumer confidence, Richmond Fed, new home sales and FHFA house prices.

- Bond issuance: US Tsy $44B 5Y Note auction ((91282CFM8) – 1300ET – after yesterday’s 2Y tailed.

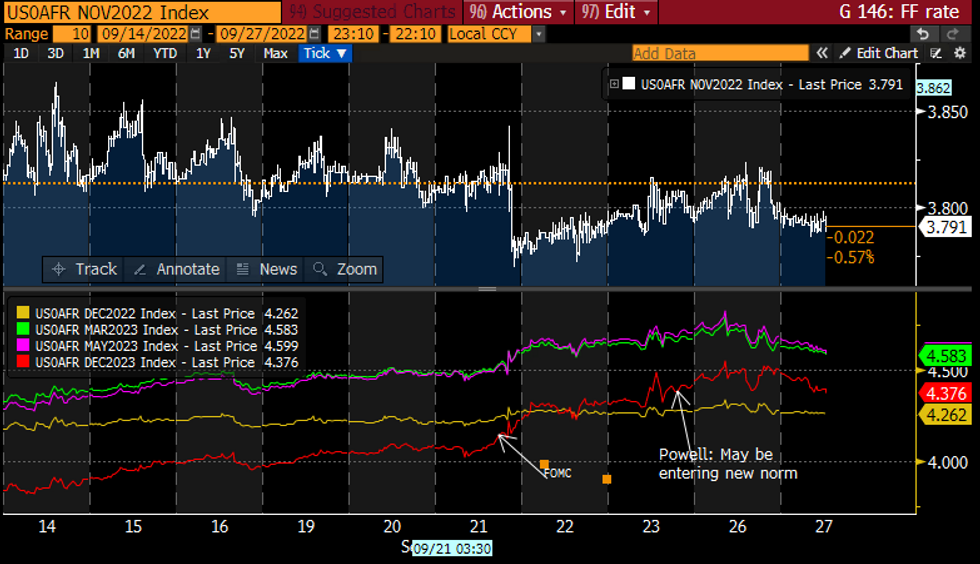

STIR FUTURES: Fed Terminal Moves Towards Post-FOMC Lows

- Fed Funds implied hikes drift lower over 2022 with 69.5bp for Nov (-0.5bp) and 4.26% for Dec (-2bp) but see a larger slide for 2023 with a terminal 4.60% May’23 (-8.5bp) and 4.38% Dec’23 (-12bp) further off yesterday’s cycle highs.

- Continued real rates talk from Mester (’22) yesterday and Evans (’23) today – comments below – after Powell explicitly mentioned the 1% real rate expected once hitting the terminal 4.6% next year in the FOMC Q&A.

- Ahead: Evans is currently appearing again before Powell (digital currency panel), Bullard (’22), Kashkari ('23) and Daly ('24) late on.

Source: Bloomberg

Source: Bloomberg

- Mester: Mon pol will need to be in restrictive stance with real rates moving into positive territory and remaining there for some time, Fed rates are not coming down next year. Dollar value set in markets but we study implications. ·

- Evans: Real rate may be 1.5% next spring, by spring 2023 we can sit and wait on rates although exact timing of rate path less important than goal. If things get better perhaps we could do less.

GILTS: Curves continue to steepen

- Gilt futures have settled in a 96.42-96.95 range over the past hour or so.

- The 2s5s curve remains relatively stable today but there is continued steepening of the 5s10s and 10s30s curves.

- The 10s30s curve is 14.6bp steeper on the day at 42.8bp and is approaching the 43.4bp intraday high from 30 August - which was the steepest since the August MPC meeting when the original active gilt sales plans were announced. The cycle high is still some way away at 59.6bp.

FOREX: GBP Steadies as USD Index Sees Rare Relief

- Following the market tumult across the UK Friday/Monday, GBP is trading higher as the dust settles, putting the currency above all others in G10 ahead of the NY crossover. Gains remain marginal at this stage, however, with GBP/USD yet to top the late Monday high of 1.0931, which remains the key upside level to prompt any further recovery.

- The USD Index is also working in favour of GBP/USD, sitting lower in what would mark only the second lower close in seven sessions if current price action is sustained into the close. Equity markets are seen firmer, with futures indicating a positive open on Wall Street later today.

- Progress for the single currency is slower, however, with a statement issued by Nord Stream hampering any EUR upside. The pipeline operator has claimed that damage to the pipeline is "unprecedented" and they are unable to give an estimate as to when flows will be resumed. EUR/USD dipped on the headline to put the pair within range of overnight lows at 0.9584.

- Focus turns to the prelim durable goods orders release for August as well as September consumer confidence. The speakers slate is busy: ECB's Centeno, Villeroy, Panetta, de Guindos are scheduled as well as BoE's Pill, Fed's Bullard, Kashkari, and Powell - although the Fed Chair is speaking on digital currencies today.

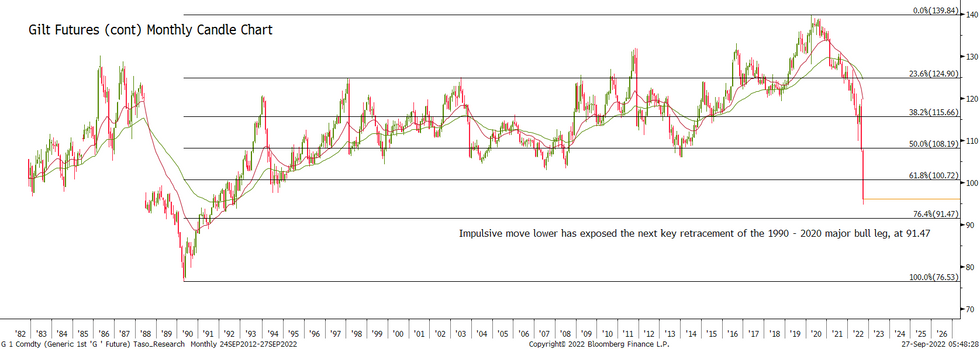

Price Signal Summary - Gilt Futures Trend Needle Still Points South

- In the equity space, S&P E-Minis trend conditions remain bearish following last week’s extension lower - the trend has accelerated following the break of the July support. This strengthens bearish conditions and attention is on key support at 3657.00, Jun 17 low and an important medium-term bear trigger. A break would confirm a resumption of the broader downtrend. EUROSTOXX 50 futures remain soft following the reversal on Sep 13, from 3678.00, the Jun 13 high and last week’s follow through. Key short-term support at 3423.00, the Sep 5 low has been cleared, the break strengthens bearish conditions and has led to a breach of 3341.00, the Jul 5 low. The focus is on 3300.00.

- In FX, the EURUSD is vulnerable. The break lower last week and Monday, confirms a resumption of the primary downtrend - reinforced too by last week’s breach of 0.9864, the Sep 6 low. The move lower maintains the bearish price sequence of lower lows and lower highs. Price is also trending down inside a bear channel drawn from the Feb 10 high. The channel base intersects at 0.9513. Bearish trend conditions in GBPUSD remain intact. An important short-term support has been defined at 1.0350, Monday’s low. The trend is down and a break of this support would confirm a resumption of bearish activity. Yesterday’s close also highlights an important candle pattern - a hammer and potential reversal signal. A break above Monday’s high is required to strengthen this signal and highlight a potential short-term base. The pullback on Sep 22 in USDJPY resulted in a print below the 20-day EMA, currently at 142.17. The trend structure remains bullish and recent weakness is considered corrective. A continuation higher would expose 145.90, the Sep 22 high and the next bull trigger. Key short-term support has been defined at 140.36, Sep 22 low. A break would highlight a short-term top in the trend.

- On the commodity front, Gold traded lower Friday, breaking out of its recent range and in the process confirmed the bear flag formation evident on the daily chart. The break confirms a resumption of the downtrend and opens $1610.5, the 1.00 projection of the Jun 13 - Jul 21 - Aug 10 swing. In the Oil space, a bearish threat in WTI futures remains present. The recent break of support at $84.25, the Jul 14 low, confirmed a resumption of the downtrend that started Jun 8 and marks the end of a broad sideways move that has been in place since mid-July. Yesterday’s move lower reinforces current conditions. Attention is on $76.11, 1.618 projection of the Jul 29 - Aug 16 - 30 price swing.

- In the FI space, Bund futures remain in a clear downtrend and the extension lower last week and yesterday, confirmed a resumption of the bear leg that started early August. The major support at 140.67, the Jun 16 low (cont), has been cleared. The focus is on 137.00. Gilts resumed bearish activity Monday and gapped lower. The extension maintains the bearish price sequence of lower lows and lower highs. The psychological 100.00 handle has been cleared, attention is on 94.72, the Sep 1992 low (cont). Further out, the focus is on the next key retracement of the 1990 - 2020 major bull leg, at 91.47.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/09/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/09/2022 | 0035/2035 |  | US | San Francisco Fed's Mary Daly | |

| 28/09/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/09/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/09/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/09/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/09/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/09/2022 | 0715/0915 |  | EU | ECB Lagarde at Frankfurt Forum Discussion | |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/09/2022 | 0815/0915 |  | UK | BOE Cunliffe Keynote at AFME Conference | |

| 28/09/2022 | 0900/1100 | * |  | IT | Industrial Orders |

| 28/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/09/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/09/2022 | 1235/0835 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/09/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/09/2022 | 1410/1010 |  | US | St. Louis Fed's James Bullard | |

| 28/09/2022 | 1415/1015 |  | US | Fed Chair Jerome Powell | |

| 28/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 28/09/2022 | 1500/1700 |  | EU | ECB Elderson Intro at Greens/EFA Event | |

| 28/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 28/09/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/09/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 28/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 28/09/2022 | 1800/1900 |  | UK | BOE Dhingra Chairs Panel at LSE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.