-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Euro Rises Ahead Of ECB

EXECUTIVE SUMMARY:

- E.C.B. DECISION COMING UP; LAGARDE PRESS CONFERENCE EYED

- NORGES BANK HOLDS RATES, LEAVES STATEMENT LANGUAGE UNCHANGED

- BIDEN TO ORDER MASKS, QUARANTINE FOR TRAVELERS IN COVID FIGHT

- MUTATION IS A THREAT TO COVID-19 CONTAINMENT EFFORTS: GERMANY'S MERKEL

- B.O.J. HAS NO SET IDEAS ON POLICY REVIEW: KURODA

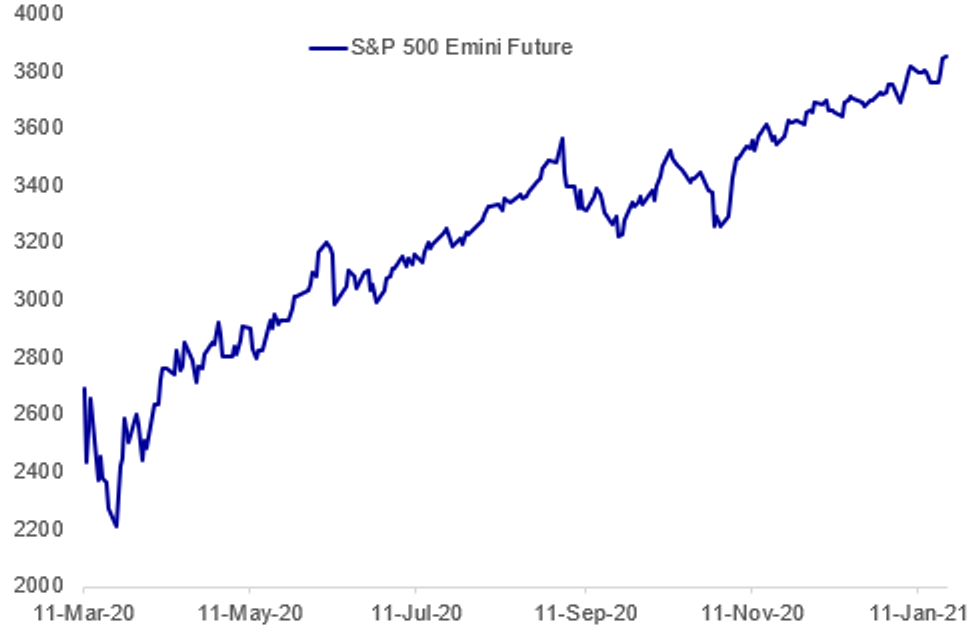

Fig. 1: Fresh Highs Overnight

BBG, MNI

BBG, MNI

NEWS:

E.C.B. (MNI MARKETS PREVIEW):The January ECB meeting will likely be a non-event given that the GC delivered a significant easing package in December. With no material policy developments expected, the focus will instead be on the press conference. Front and centre will be questions about the impact of the latest Covid social restrictions on economic activity. It will be difficult to fully assess the damage at this stage, with President Lagarde instead likely to assert that risks are tilted to the downside and that the ECB stands ready to adjust all of its policy instruments if necessary. There are likely to be questions on recent political developments in Italy and the Netherlands, but as is customary the ECB will not be drawn into any specific discussion on these.

NORGES BANK: Norges Bank leaves rates unchanged at 0.0%, as expected. The Bank also retain their language in the accompanying statement: Policy rate will most likely remain at today's level for some time ahead; Economic developments have so far been broadly in line with the projections in the December Report. NOK largely unchanged.

BOJ: The Bank of Japan board decided to leave monetary policy settings unchanged at its meeting on Thursday as the economy continues to improve despite the spread of the coronavirus. The BOJ also left the forward guidance for the policy rates unchanged, indicating that the policymakers are vigilant against the impact of any prolonged pandemic impact on the economy and financial markets.

BOJ: The Bank of Japan is open to all ideas coming out of the ongoing policy reviews, Governor Haruhiko Kuroda said Thursday, refusing to discuss any thinking ahead of the March release, although he did say the bank continued to monitor the cumulative effects of the current easy policy ahead of any decisions on the need for further sustainable easing. Kuroda told reporters following the BOJ's latest policy decision that there were currently no firm proposals for possible policy moves, such as widening the range of 10-year policy interest rate, although he acknowledged the issue could be discussed in March.

U.S. (BBG): President Joe Biden will push for additional travel safety during the coronavirus pandemic by requiring people to wear masks in airports and on planes while enforcing quarantines for people who arrive in the U.S. from other countries. In an executive order he will issue Thursday, his second day in office, Biden will codify an action by former President Donald Trump on Jan. 12 to require a negative Covid-19 test before flying to the U.S. from other nations, according to a Biden administration fact sheet. The order will be coupled with one requiring masks on federal properties that was signed by Biden on Wednesday. The language of the orders hadn't been released so it's difficult to assess how the various provisions will be enforced.

U.S. (BBG): U.S. infectious-disease chief Anthony Fauci pledged his country's commitment to the World Health Organization, including membership in a global effort to deploy Covid-19 vaccines.Fauci addressed the Geneva-based group a day after Joe Biden's inauguration, underlining the new U.S. president's effort to mend ties with an agency crucial to fighting the pandemic. He confirmed that the U.S. will join Covax, a 92-nation vaccine collaboration that the Trump administration declined to participate in.

GERMANY/COVID (RTRS): Germans should take a new variant of the coronavirus believed to spread much faster very seriously or else risk a third wave of infections, Chancellor Angela Merkel said during a news conference on Thursday. "The mutation of the virus is a threat," said Merkel. "The mutation is much more infectious than we knew last year and this makes it more difficult to control the pandemic. I urge people to take this seriously. Otherwise it is difficult to prevent a third wave."

TURKEY (BBG): Turkish authorities are considering the removal of a year-old ban on banks' dividend payments, counting on an expected recovery in the $750 billion economy following the coronavirus pandemic, according to people with direct knowledge of the matter. The banking regulator known as BDDK and the Ministry of Treasury and Finance are discussing a possible easing with commercial lenders, which are pushing for an official decision on dividend distribution before next month's annual general meetings, the people said, asking not to be identified as talks are confidential.

DUBAI (BBG): Dubai ordered hotels and restaurants to put entertainment activities on hold and asked hospitals to cancel elective surgeries amid a record daily surge in coronavirus cases in the United Arab Emirates. Dubai's Department of Tourism and Commerce Marketing called for a temporary hold to all entertainment activities from Jan. 21 until further notice after inspections showed "an increase in number of violations," it said in a circular.

CHINA: China will look expand the scope of its free trade network, hopefully bringing in Japan and South Korea, as Beijing pursues an increased opening up, said Gao Feng, spokesman of the Ministry of Commerce at a regular briefing on Thursday.

GERMANY: A recent survey of the Ifo institute reveals the negative effect of the Russia sanctions on the German industrial sector, with companies in eastern Germany more affected than companies in the western half. Sanctions lead to increased bureaucracy which weighs on business activity with Russia, survey respondents noted. "Machinery and car manufacturers, the chemical and electrical sectors, and logistics are the most frequently affected," says Jasmin Grschl, Deputy Director of the ifo Center for International Economics. The survey saw around 50% of respondents seeing a benefit from lifting current EU sanctions, while a subgroup of respondents divided opinion over the Nordstream 2 pipeline with a small majority being against a halt in construction.

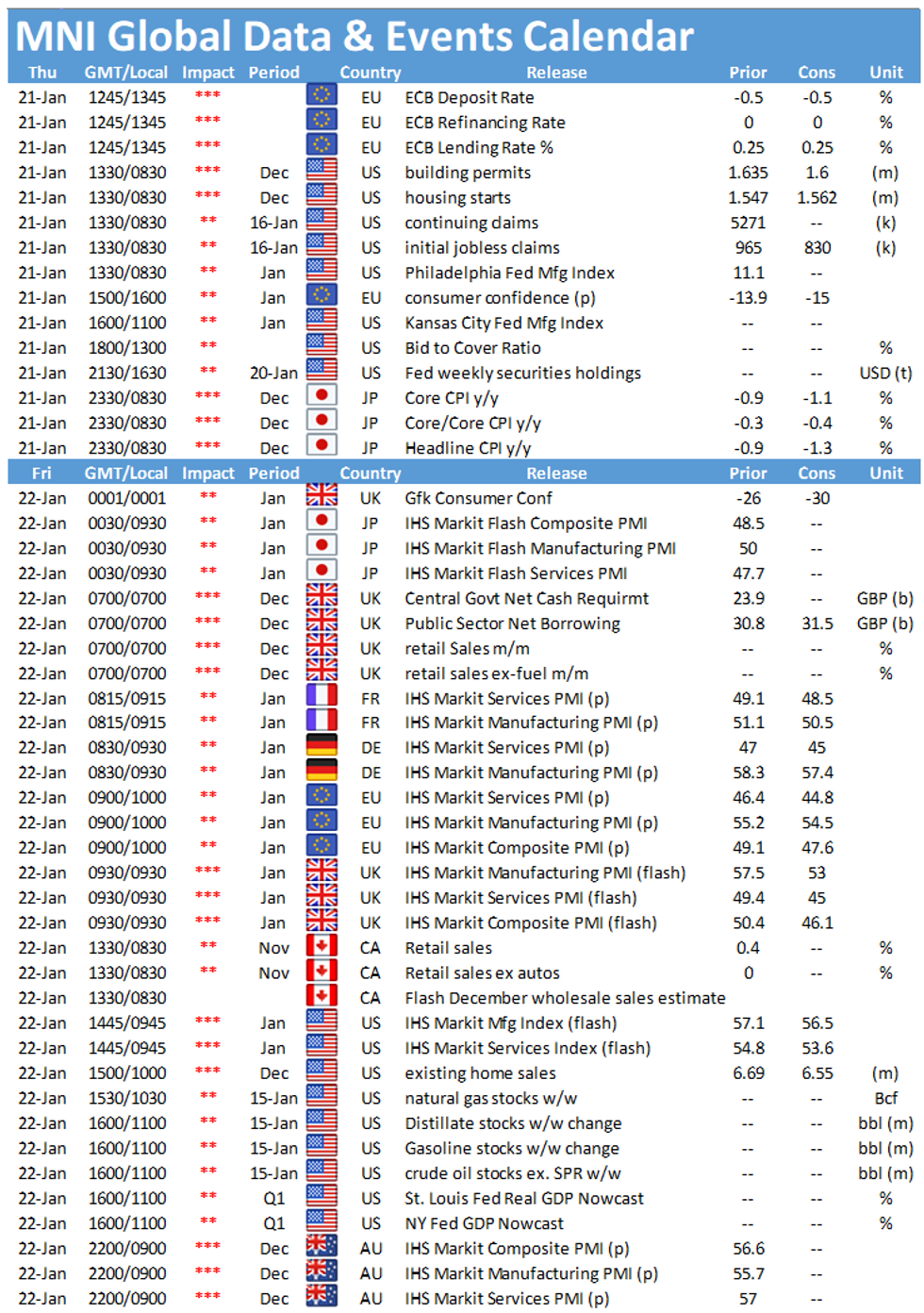

DATA:

FIXED INCOME: Steady ahead of ECB

A tight range session for EGBs, with supplies from Spain and France in focus this morning.

- Bund trades a touch in the red, weighted by delta hedging.

- German curve trades flat, albeit leaning bear steeper, while peripherals are faring better, and trading tighter against the German 10yr.

- Greece leads and trades 4.9bps tighter.

- Gilts are better offered today, with the main early story for the UK, the strength of the British Pound, extending to highest levels since May 2018 versus the USD.

- This is weighing on the contract as well as the GBP3.25bln of the 0.125% Jan-24 gilt .

- US Treasuries have stayed within the overnight tight ranges, albeit just a touch in the Green, after some small unwind from the highs in Equities, with risk sentiment buoyed by US stimulus hopes.

- Looking ahead, ECB rate decision and presser, although likely to be a non event.

- On the data front, US IJC will be the highlight.

- Bund futures are down -0.10 today at 177.35 with 10y Bund yields up 0.6bp at -0.524% and Schatz yields up 0.3bp at -0.710%.

- BTP futures are up 0.05 today at 151.40 with 10y yields down -0.8bp at 0.610% and 2y yields down -1.1bp at -0.336%.

- OAT futures are down -0.09 today at 167.33 with 10y yields up 0.4bp at -0.300% and 2y yields down -0.3bp at -0.627%.

- Gilt futures are down -0.09 today at 134.23 with 10y yields up 0.4bp at 0.304% and 2y yields up 0.6bp at -0.117%.

- TY1 futures are unch today at 136-31 with 10y UST yields up 0.5bp at 1.086% and 2y yields up 0.2bp at 0.130%.

FOREX: Greenback At New Weekly Low as Biden White House Takes Shape

The USD's softer early Thursday, prompting the USD index to edge below the Monday low ahead of the NY crossover, as markets confirm a retreat from the 50-dma resistance earlier in the week at 90.887. Biden's White House is continuing to take shape, with a few more announcements this morning giving markets a further glimpse of the new administration.

Reports this morning show Biden is to use the production act to boost the supply of vaccines, PPE and COVID-19 tests, and is to clamp down on airport mask-wearing and air travel tests - signalling the new admin's commitment to arresting the spread of the virus.

Equities are higher in Europe, translating to modest risk-on in currency markets. Alongside the weaker greenback, JPY is also soft, with CHF also on the backfoot.

Best performers so far Thursday are GBP, NOK and NZD, with GBP/USD seeing another notable rise to multi-year highs of 1.3746.

Focus turns to the ECB rate decision and press conference, as well as policy statements from the South African, Turkish central banks.

EQUITIES: US Futures Easing Off Overnight All-Time Highs

- Asian stocks closed mixed, with Japan's NIKKEI up 233.6 pts or +0.82% at 28756.86 and the TOPIX up 11.06 pts or +0.6% at 1860.64. China's SHANGHAI closed up 38.172 pts or +1.07% at 3621.264 and the HANG SENG ended 34.71 pts lower or -0.12% at 29927.76.

- European equities are mixed, with the German Dax up 53.07 pts or +0.38% at 14005.6, FTSE 100 up 4.85 pts or +0.07% at 6763.94, CAC 40 down 5.34 pts or -0.09% at 5646.86 and Euro Stoxx 50 up 13.79 pts or +0.38% at 3644.42.

- U.S. futures are up slightly (led by tech once again), Dow Jones mini up 20 pts or +0.06% at 31116, S&P 500 mini up 6.5 pts or +0.17% at 3851.5, NASDAQ mini up 54.75 pts or +0.41% at 13349.

COMMODITIES: Crude Lagging

A mixed performance by commodities so far, with oil notably underperforming on COVID lockdown/demand concerns.

- WTI Crude down $0.45 or -0.84% at $52.96

- Natural Gas down $0.06 or -2.44% at $2.491

- Gold spot up $0.13 or +0.01% at $1869.79

- Copper up $1.65 or +0.45% at $365.45

- Silver up $0.05 or +0.21% at $25.821

- Platinum up $12.26 or +1.1% at $1116.55

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.