-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: China Moves Calm Equity Markets

EXECUTIVE SUMMARY:

- CHINA TAKES ACTIONS TO SOOTHE MARKET NERVES

- ECB WILL RUN ECONOMY HOT TO HIT 2% TARGET: PANETTA

- EUROZONE ECONOMIC SENTIMENT HITS RECORD HIGH IN JULY

- CHINA RAISES EXPORT TARIFFS FOR SOME STEEL PRODUCTS FROM AUG.

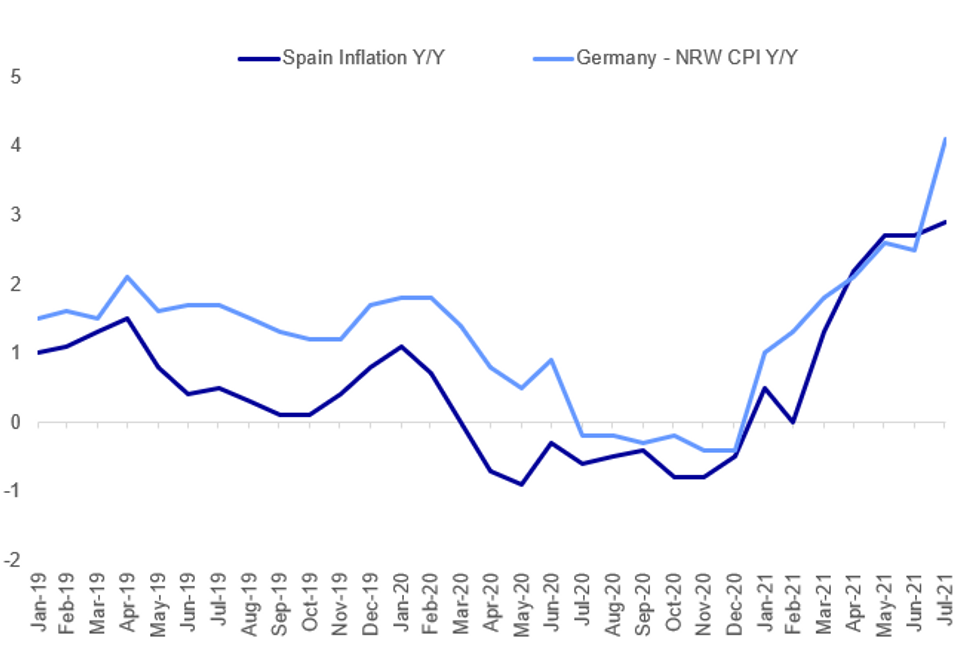

Fig. 1: Spanish And German State-Level Inflation Rises Further In July

Source: Statistics Agencies, BBG, MNI

Source: Statistics Agencies, BBG, MNI

NEWS:

CHINA (BBG): China's central bank broke out of its usual pattern of daily liquidity operations, as it boosted a cash injection into the financial system, soothing market nerves frayed by regulatory crackdowns.The People's Bank of China added 30 billion yuan ($4.6 billion) of liquidity into the financial system with seven-day reverse repurchase agreements, raising it from 10 billion yuan of injections for the first time since June 30. The move also came amid seasonal tightness in liquidity ahead of the month-end.The cash injection is seen as a signal that regulators are seeking to restore calm in financial markets after reforms in China's after-school eduction sector and unverified rumors that U.S. funds are offloading China and Hong Kong assets induced a sharp selloff. Interbank borrowing costs dropped Thursday, with the overnight repurchase rate falling the most in nearly a month.

ECB: The ECB should be prepared to "run the economy hot," Fabio Panetta said in an interview Thursday, as he called for asset purchases post-PEPP to be conducted at a level consistent with reaching the new price stability target of 2% over the medium term and ensure even transmission of monetary policy across the euro area. Inflation will fall back as the impact of transitory factors fades out, and rejected suggestions the central bank is falling into the trap of fiscal dominance, he said. The reintroduction in some countries of social distancing measures could "stymie," rather than derail the recovery, the ECB Executive Board member said, while the epidemiological situation in emerging economies poses an additional challenge. However, the overall impact is likely to be weaker than with previous waves, thanks to changes in behaviour and vaccination campaigns.

CHINA /EQUITIES (BBG): China's securities regulator convened executives of major investment banks on Wednesday night, attempting to ease market fears about Beijing's crackdown on the private education industry. The hastily arranged call, which included attendees from several major international banks including Goldman Sachs Group Inc and UBS Group AG, was led by China Securities Regulatory Commission Vice Chairman Fang Xinghai, people familiar with the matter said, asking not to be named discussing private information. Some bankers left with the message that the education policies were targeted and not intended to hurt companies in other industries, the people said.It's the latest sign that Chinese authorities have become uncomfortable with a selloff that sent the nation's key stock indexes to the brink of a bear market on Wednesday morning.

CHINA / COMMODITIES (BBG): China will raise exports tariffs for some steel products after earlier having lowered them temporarily, Ministry of Finance says in statement. China removed imports tariffs for some steel products and raise export tariffs for the metal from May 1

MNI: HESSE JUL CPI +0.8% M/M, +3.4% Y/Y; JUN +2.2% Y/Y

MNI: BADEN-W JUN CPI +0.8% M/M, +3.4% Y/Y; JUN +2.4% Y/Y

MNI: BRANDENBURG JUL CPI +1.0% M/M, +4.3% Y/Y

MNI: SPAIN JUL FLASH HICP -1.2% M/M, +2.9% Y/Y; JUN +2.5% Y/Y

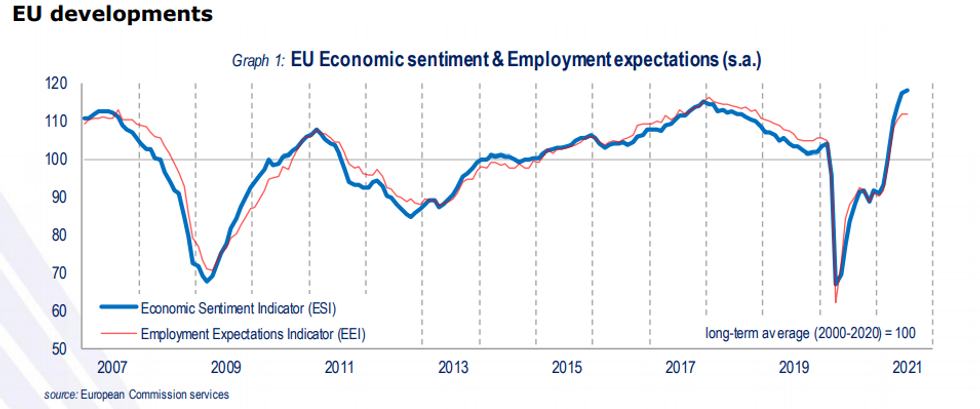

EZ Economic Sentiment At Record High in July

Economic Sentiment Indicator (ESI): 119.0; Prev (Jun): 117.9

Consumer: -4.4(Jun: -3.3); Industry: +14.6 (Jun: +12.8); Services: +19.3 (Jun: +17.9); Retail: +4.6 (Jun: +4.7); Construction: +4.0 (Jun: +5.2)

- The EZ ESI rose 1.1pt to 119.0 in July, coming in stronger than markets expected (BBG: 118.5).

- The index rose to the highest level since records began in 1985 and recorded the sixth consecutive gain.

- Jul's increase was led by the industrial and service sector, which rose by 1.8pt and 1.4pt, respectively.

- Industrial sentiment recorded a new all-time high, while the service sector posted the highest level since 2007.

- The other three sub-indicators saw a monthly decline in Jul, with consumer sentiment dropping 1.1pt, while retail trade confidence was down 0.1pt.

- Confidence in the construction sector eased by 1.2pt in July, marking a three-month low.

- The report noted that Jul's improvement was weaker than in previous months, suggesting that the index is approaching its peak.

- The ESI rose markedly in France (+4.0pt) and Italy and Spain (both up +1.7pt) and ticked up as well slightly in Germany (+0.3pt), while the headline index fell in the Netherlands (-0.3pt) and Poland (-0.7pt).

- The employment expectations index remained at Jun's level of 111.7 in Jul, which is the highest level since Nov 2018.

Source: European Commission

UK Mortgage Borrowing At Record High

JUN MORTGAGE APPROVALS 81,338 VS MAY 86,949

JUN NET CONSUMER CREDIT GBP0.308BN VS MAY GBP0.430BN

JUN NET CHANGE SECURED LENDING GBP17.868BN VS MAY GBP6.785BN

- The UK mortgage market remained strong in Jun with mortgage borrowing surging to a record high of GBP 17.9bn ahead of the end of the stamp duty holiday. The BOE noted that there has been a shortening of time between mortgage being approved and the lending itself. Mortgage approvals eased slightly in Jun to 81,338, down from 86,949 seen in May and showing the lowest reading since Jul 2020. The effective rate on new mortgages rose by 5bp to 1.95%.

- Households borrowed GBP0.3bn as consumer credit, slightly less than in the previous month. The annual growth rate remained weak in Jun, although it ticked up slightly to -2.2%. The effective interest rate on new consumer credit edged marginally higher to 5.67% in Jun.

FIXED INCOME: Paring early gains

EGBs have faded from their best levels this morning, helped by decent beats across Regional German CPIs versus last and Unemployment data.

- The Bund resistance at 176.62/176.67, has so far held.

- Peripheral spread sees Italy, Portugal and Spain wider, while Greece trade 1.3bp tighter against the German 10yr.

- Gilts are underperforming Bund this morning, translating to a 0.5bp wider spread, which is not that impressive.

- Although it is still worth noting that the UK/Bund spread is now at widest levels since the beginning of May.

- US Treasuries saw some downside continuation from the Asian session spilling over into the European session

- Tnotes are now trading back into the Fed meeting ranges, with the contract flat on the day.

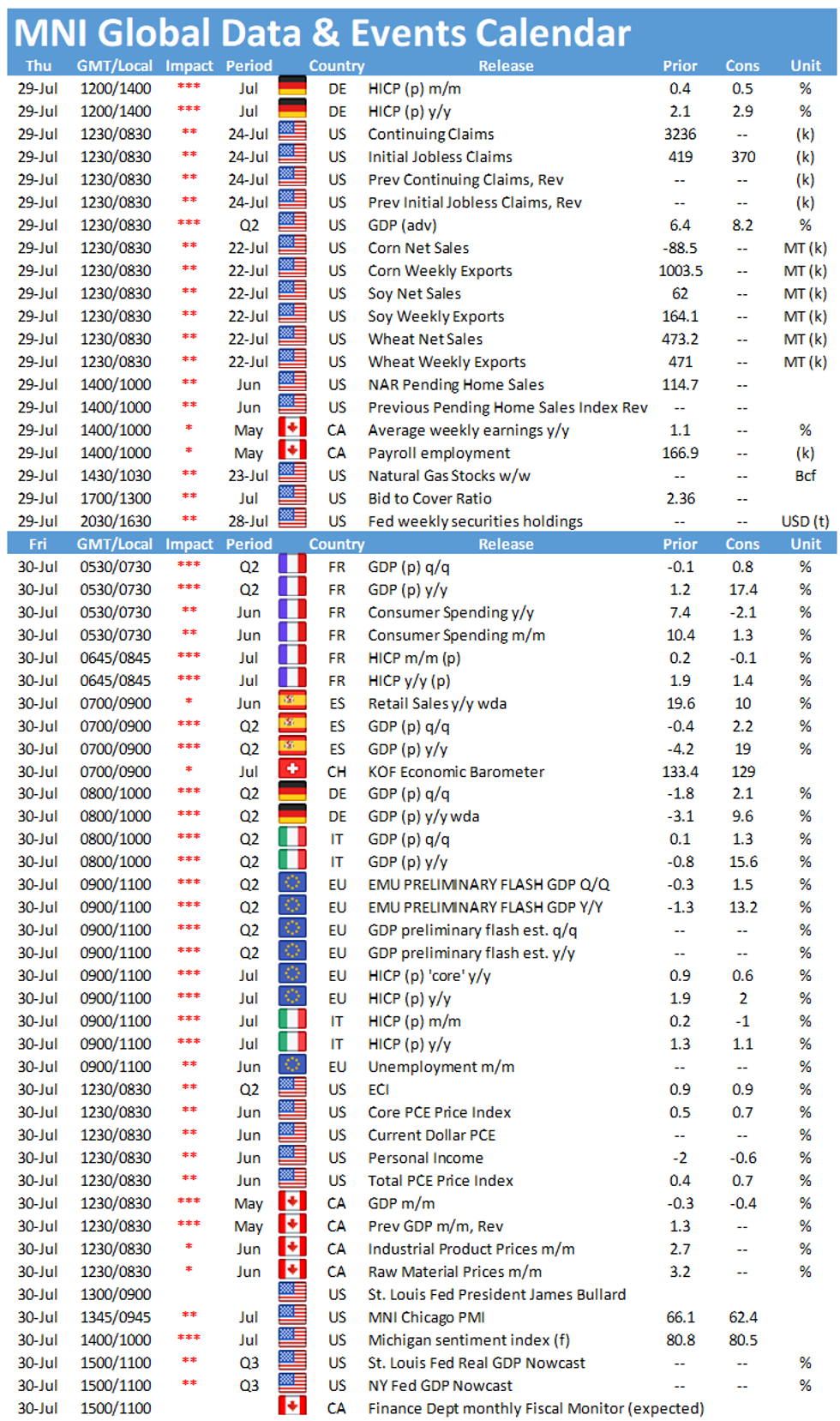

- Looking ahead, US IJC, GDP and Core PCE., and US 7yr note.

- Earnings, include Comcast, Merck, Mastercard and Amazon

FOREX: USD Ebbs in Extension of Post-Fed Trend

- Greenback is extending the post-Fed weakness in early Thursday trade, with the USD comfortably the poorest performer in G10 ahead of NY hours. This puts the USD Index at its lowest level since late June, with 92.00 figure seen providing minor support.

- Haven currencies are following the USD lower, with the main beneficiaries being NOK, AUD and NZD. The upside in NZD/USD is running against the short-term trend indicators (50-dma < 200-dma) and faces first resistance at the late July highs of 0.7010.

- Regional German CPIs have tended to edge higher, supporting the market consensus that the nationwide reading will accelerate to 3.2% from 2.3% later today.

- The advance US GDP release for Q2 is also due, with growth seen accelerating to 8.5% from 6.4% on an annualized basis. Pending home sales data could also take some focus given the sharp miss on expectations in the new home sales figure earlier in the week.

EQUITIES: Positive Tone In Asia Buoys Europe

- Asian stocks closed higher, with Japan's NIKKEI up 200.76 pts or +0.73% at 27782.42 and the TOPIX up 7.78 pts or +0.41% at 1927.43. China's SHANGHAI closed up 50.134 pts or +1.49% at 3411.724 and the HANG SENG ended 841.44 pts higher or +3.3% at 26315.32.

- European equities are higher, with the German Dax up 30.87 pts or +0.2% at 15601.13, FTSE 100 up 48.67 pts or +0.69% at 7065.28, CAC 40 up 48.18 pts or +0.73% at 6658.16 and Euro Stoxx 50 up 10.99 pts or +0.27% at 4114.12.

- U.S. futures are mixed, with the Dow Jones mini up 116 pts or +0.33% at 34950, S&P 500 mini up 5.5 pts or +0.13% at 4399.25, NASDAQ mini down 12.75 pts or -0.08% at 14998.75.

COMMODITIES: Silver Up Sharply As USD Weakens

- WTI Crude up $0.5 or +0.69% at $72.89

- Natural Gas down $0.01 or -0.35% at $3.953

- Gold spot up $12.81 or +0.71% at $1819.9

- Copper up $4.25 or +0.95% at $452.45

- Silver up $0.52 or +2.09% at $25.4845

- Platinum up $8.93 or +0.84% at $1077.57

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.