-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Curbed Enthusiasm For E.C.B. Easing

EXECUTIVE SUMMARY:

- E.C.B.'S SCHNABEL WARNS AGAINST HOPES FOR BLOCKBUSTER STIMULUS

- EUROZONE SEES WEAK PMIS, DEFLATION IN NOVEMBER

- BOE TENREYRO: NEGATIVE RATES EFFECTIVE ECON BOOST

- O.E.C.D. SEES GLOBAL ECONOMY TURNING THE CORNER ON CORONAVIRUS CRISIS

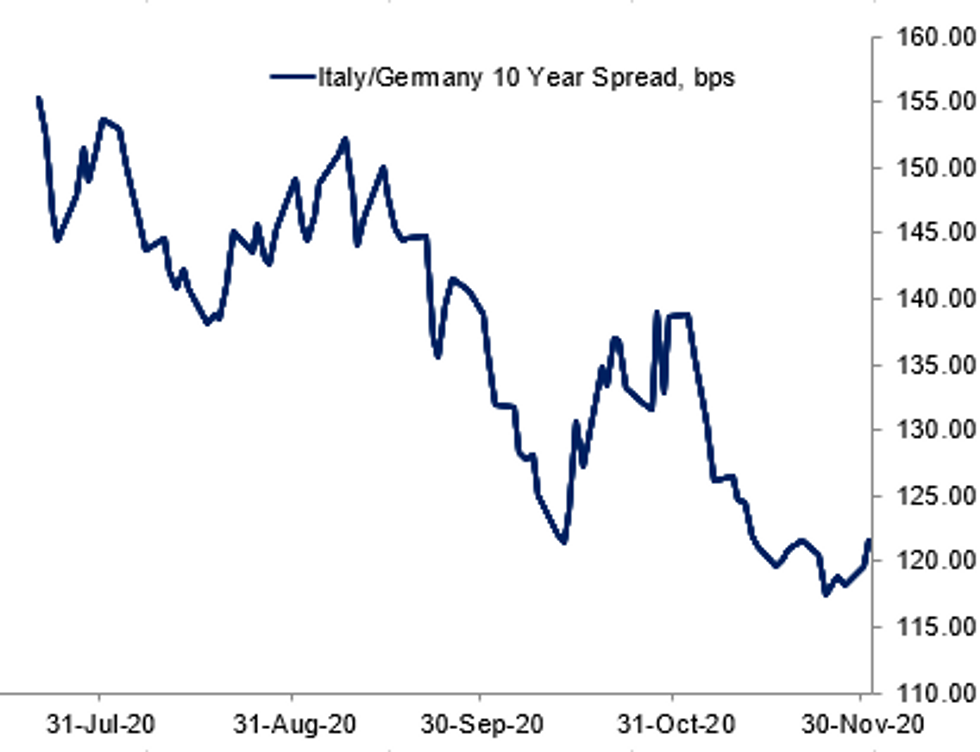

Fig.1: Taming Expectations For ECB Stimulus Package In December

BBG, MNI

BBG, MNI

NEWS:

ECB (BBG): The European Central Bank should focus on keeping financial conditions at current levels through the crisis rather than announcing a blockbuster stimulus package that beats market expectations, according to Executive Board member Isabel Schnabel. Just over a week before the ECB Governing Council's policy decision, Schnabel confirmed that more support is likely because the pandemic will be more protracted than expected. "This has to be reflected in our policy decisions," she said in an interview on Monday. But she also noted that borrowing costs have dropped to record lows because of monetary and fiscal aid, and what is most important is sustaining that state of affairs until the crisis is past."It is appropriate to focus on preserving these conditions rather than easing much further," she said. "If it's necessary to do something that doesn't meet market expectations, we have to do that nevertheless."

EUROZONE DATA: The headline EZ HICP remained in negative territory and registered at Oct's level of 0.3% in Nov, coming in slightly weaker than markets expected. Core inflation remained at 0.2% in Nov which is in line with marketforecasts.* Food prices decelerated to 1.9% in Nov following Oct's uptick to 2.0%. Service inflation picked up to 0.6%, while non-energy industrial goods prices declined by 0.3% Energy prices showed the largest annual decrease, plunging by 8.4%. Among the member states for which data is available, Greece (-2.0%) and Estonia (-1.3%) recorded the largest declines, while Slovakia (1.5%) and the Netherlands (0.7%) posted the highest rates.

BOE: Evidence shows "negative rates have been very effective in boosting the economy," Bank of England Monetary Policy Committee Silvana Tenreyro said Monday, reaffirming her sympathy for sub-zero rates. According to Tenreyro, NIRP should work through both the wealth and FX channels and research has downplayed their impact on banks' profitability. On prices, she said there are no signs of pressure from domestically generated inflation, at least in the near-term, with the low interest rate environment set to persist and the likelihood of subdued wage inflation.

ITALY PMI DATA (IHS MARKIT): The seasonally adjusted IHS Markit Italy ManufacturingPurchasing Managers' Index (PMI) registered 51.5 in November and signalled a fifth successive monthlyimprovement in the health of the Italian manufacturing sector. Falling from 53.8 in October, however, the headline PMI signalled a slower rate of improvement.

SPAIN PMI DATA (IHS MARKIT): Manufacturing PMI fell from October's 52.5 to record 49.8 in November. Slipping below the 50.0 no-change mark, the index marked the first deterioration in operating conditions for three months. A drop in new orders was the primary reason behind November's fall in the PMI.

CHINA (MNI EXCLUSIVE): The world's biggest trade deal will help China's foreign trade grow by double-digits in the next five to 10 years and allow the country to rival Japan at the top of Asian supply chains by 2040, Wei Jianguo, former vice minister of commerce, told MNI. For full interview contact sales@marketnews.com

GLOBAL ECONOMY (RTRS): The outlook for the global economy is improving despite a second wave of coronavirus outbreaks in many countries as vaccines emerge and a Chinese-led recovery takes hold, the OECD said on Tuesday.The global economy will grow 4.2% next year and ease to 3.7% in 2022, after shrinking 4.2% this year, the Organisation for Economic Cooperation and Development said in its latest Economic Outlook.After a second wave of infections hit Europe and the United States, the Paris-based policy forum trimmed its forecasts from September, when it expected a global contraction of 4.5% before a 5% recovery in 2021. It did not have a 2022 forecast at the time.

OPEC: The OPEC+ meeting due to take place today to reach a decision on the prolonging of oil production cuts or a ramp up in Q121 has been postponed until Thursday 3 Dec to allow ministers more time to reach a consensus.

COVID/EUROPE (BBG): Pfizer Inc. and partner BioNTech SEsought regulatory clearance for their Covid-19 vaccine in Europe, putting the shot on track for a potential approval there before the end of the year. The formal application submitted on Monday caps a rolling review process that started on Oct. 6 and allowed Europe's drugs regulator to examine data on the vaccine as it emerged.

RBA: The Reserve Bank of Australia said Tuesday it remains prepared to expand its quantitative easing program based on the outlook for jobs and inflation although it left policy settings unchanged, citing the recovery underway. In its statement, the central bank said it is keeping the size of its bond purchase program "under review, particularly in light of the evolving outlook for jobs and inflation." "The Board is prepared to do more if necessary," the statement said.

DATA:

MNI: UK FINAL NOV MFG PMI 55.6; FLASH 55.2; OCT 53.7

MNI: EZ FINAL NOV MFG PMI 53.8; FLASH 53.6; OCT 54.8

MNI: GERMANY FINAL NOV MFG PMI 57.8; FLASH 57.9; OCT 58.2

MNI: FRANCE FINAL NOV MFG PMI 49.6; FLASH 49.1; OCT 51.3

MNI: ITALY NOV MFG PMI 51.5; OCT 53.8

MNI: SPAIN NOV MFG PMI 49.8; OCT 52.5

MNI: ITALY Q3 FINAL GDP +15.9% Q/Q, -5.0% Y/Y WDA

MNI: SWISS Q3 GDP +7.2% Q/Q (SA), -1.6% Y/Y

FIXED INCOME: Under pressure

Despite a strong start to the European morning session, core fixed income has reversed course with Treasury and Bund curves bear steepening while the gilt curve is now pretty much unchanged versus yesterday's close.

- There had been little catalyst for earlier moves, but ECB Executive Board member Schnabel has now made some hawkish comments which seem aimed at dampening market expectations. She is reported as saying that stimulus should maintain but not ease the ECB's stance and that the ECB "isn't obliged" to do what markets want it to do. These comments saw another leg lower for Bunds and BTPs.

- Data this morning have not seen big surprises.

- Looking ahead the highlight of the day will likely be the ISM manufacturing while Fed Chair Powell will appear ahead of the Senate Banking Committee.

- TY1 futures are down -0-4 today at 138-01+ with 10y UST yields up 2.0bp at 0.861% and 2y yields up 0.1bp at 0.150%.

- Bund futures are down -0.21 today at 175.04 with 10y Bund yields up 1.5bp at -0.557% and Schatz yields up 0.6bp at -0.742%.

- Gilt futures are down -0.03 today at 134.16 with 10y yields up 0.7bp at 0.311% and 2y yields up 0.8bp at -0.22%.

FOREX: Dollar Offered as Markets Reverse Late Monday Move

Asia-Pac markets took the opportunity to sell into USD strength in the early hours Tuesday - a trend that Europe's been happy to extend as EUR/USD inches back towards the week's best levels and closer to the psychologically important 1.20 handle. This has pressured the greenback throughout, resulting the USD being the worst performing currency (as was the case yesterday morning) in G10.

The single currency is (modestly) outperforming, rising against most others while peripheral European government bond yields widen vs. Germany - moves accelerated following a speech from ECB's Schnabel, who stated that the ECB is not obliged to do what the markets expect from the central bank, pouring some cold water on expectations of a blow-out stimulus package at December's meeting.

The USD index is yet to slip through yesterday's multi-year lows at 91.506, but this will remain a focus headed into NY hours.

Focus turns to Canadian GDP, and US November ISM manufacturing numbers. Speakers include ECB's Lagarde, Fed's Powell and BoE's Bailey.

EQUITIES: Month Opens With Sea Of Green

Equities are higher across the board to start December.

- Asian equities closed higher, with Japan's NIKKEI up 353.92 pts or +1.34% at 26787.54 and the TOPIX up 13.46 pts or +0.77% at 1768.38. China's SHANGHAI closed up 60.183 pts or +1.77% at 3451.938 and the HANG SENG ended 226.19 pts higher or +0.86% at 26567.68.

- European stocks are up sharply, with the German Dax up 118.89 pts or +0.89% at 13409.68, FTSE 100 up 114.21 pts or +1.82% at 6380.45, CAC 40 up 49.8 pts or +0.9% at 5567.78 and Euro Stoxx 50 up 33.79 pts or +0.97% at 3526.36.

- U.S. futures are gaining, with the Dow Jones mini up 332 pts or +1.12% at 29961, S&P 500 mini up 36.5 pts or +1.01% at 3659.75, NASDAQ mini up 93 pts or +0.76% at 12370.5.

COMMODITIES: Silver Gaining

A weaker dollar (down ~0.1-0.4% against the majors) has helped precious metals regain some ground, with silver leading today.

- WTI Crude up $0.07 or +0.15% at $45.43

- Natural Gas up $0 or +0.03% at $2.883

- Gold spot up $19.67 or +1.11% at $1796.76

- Copper up $4.8 or +1.4% at $348.6

- Silver up $0.51 or +2.26% at $23.1622

- Platinum up $16.38 or +1.69% at $984.56

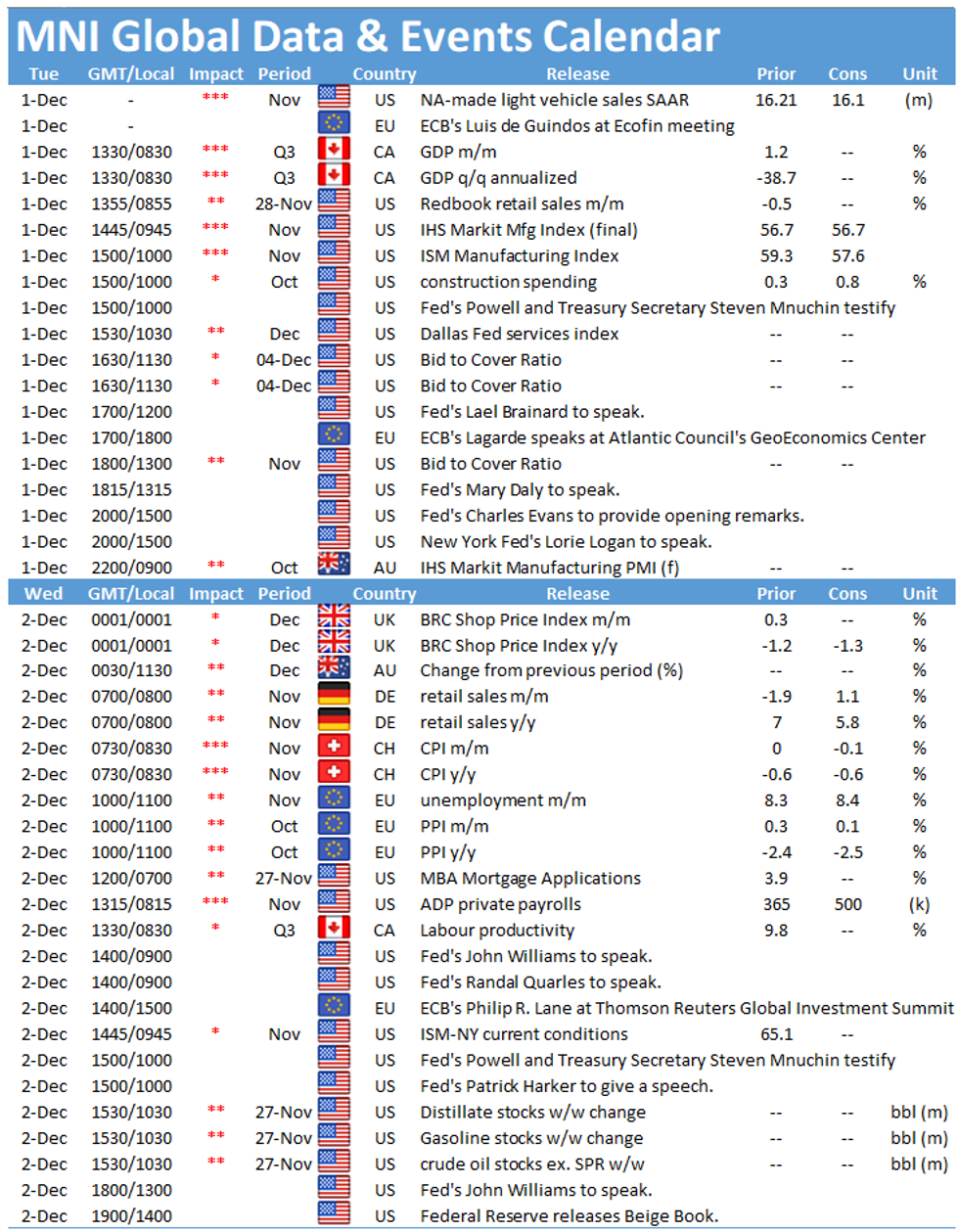

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.