-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Delta Testing Global Economic Confidence

EXECUTIVE SUMMARY:

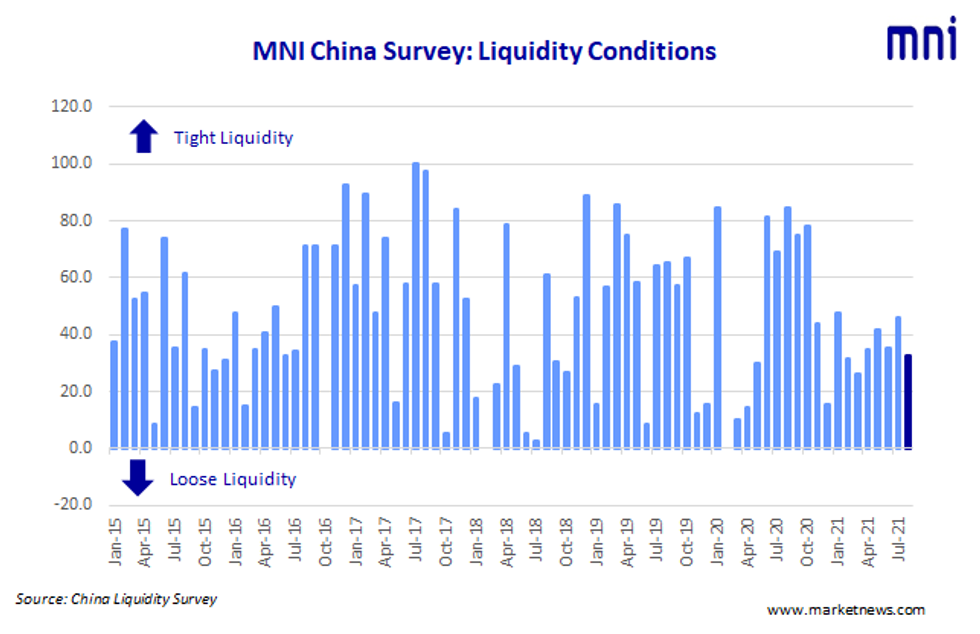

- MNI CHINA LIQUIDITY INDEX: CONDITIONS SEEN EASING IN AUGUST

- GERMAN IFO BUSINESS CONFIDENCE FALLS MORE THAN EXPECTED

- BOJ NAKAMURA: JAPAN'S ECONOMY FACES LONGER ROAD TO RECOVERY

- CREDIT SUISSE POSTPONES U.S. OFFICE RETURN FOR UNVACCINATED

- CHINA REOPENS TERMINAL AT WORLD'S THIRD-BUSIEST PORT

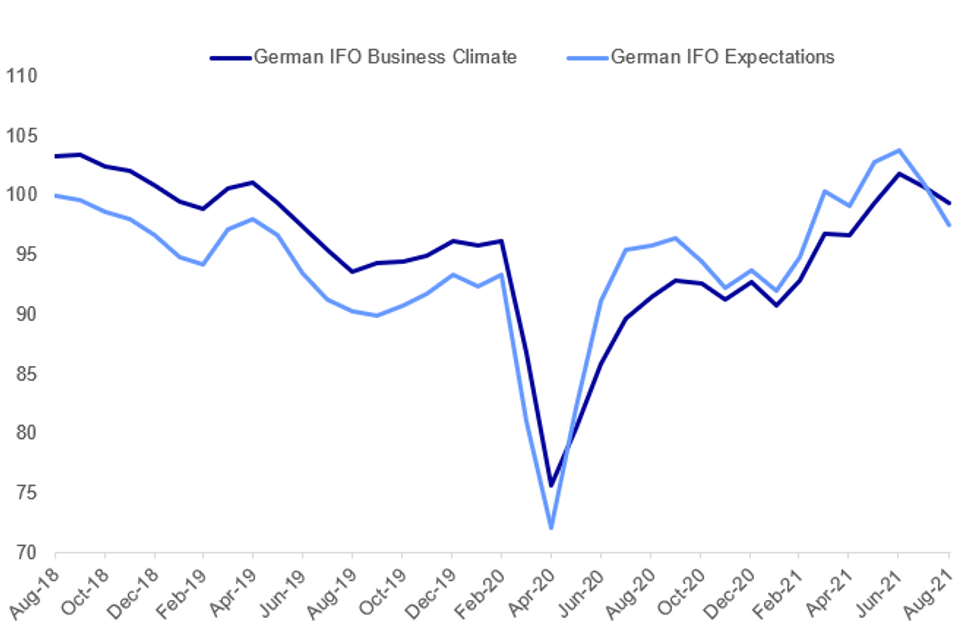

Fig. 1: German IFO Falls More than Expected In August

Source: IFO, MNI

Source: IFO, MNI

NEWS:

GERMAN IFO (BBG): German businesses are growing increasingly concerned that a global supply squeeze and rising infections will damp the economic recovery. A gauge by the Munich-based Ifo Institute fell to 99.4 in August from 100.7 in July, more than economists predicted in a Bloomberg survey. An index measuring expectations also fell, while current conditions were judged more favorably. Strong consumer spending boosted Europe's largest economy more strongly than initially expected in the second quarter, as services came roaring back after pandemic curbs were loosened. Germany's strong manufacturing sector though is being held back by a stubborn shortage of parts and raw materials, caused in part by coronavirus outbreaks in Asia. Most businesses expect these problems to persist until next year.

BOJ: Bank of Japan board member Toyoaki Nakamura said that the recovery path will be slower than the pace seen in July in updated comments on Wednesday of the growing downside risks to economy caused by the spread of Covid-19. "The recent spread of coronavirus is beyond the view made in July and downward pressure on the economy will continue for the time being," Nakamura told reporters, elaborating on remarks made earlier in the day to business leaders in Miyazaki City via an online conference.

CREDIT SUISSE / COVID (BBG): Credit Suisse Group AG has pushed back the date from which it will require all U.S. staff to return to the office to Oct. 18, as the Delta variant of Covid-19 continues to spread, according to a memo sent to staff and seen by Bloomberg. A Sept. 7 return-to-office date remains in place for vaccinated workers, with those who have already returned told they should continue to come in, according to the memo which was signed by managers including investment bank division head Christian Meissner, Jay Kim and David Miller who head up trading and investment banking activities respectively.

CHINA / GLOBAL SHIPPING (BBG): The Meishan terminal at China's second-busiest port reopened Wednesday following a two-week shutdown that further snarled already stressed shipping routes in Asia. The terminal will start the resumption of normal operations Wednesday, a port official said at a press conference in the city of Ningbo. The terminal was about a quarter of the Ningbo-Zhoushan port's capacity and was shut from Aug. 11 after a worker was found to be infected with Covid-19.

ECB (RTRS): The European Central Bank could revise up its macroeconomic projections for the eurozone again in September after recent solid activity indicators in the third quarter, ECB Vice President Luis de Guindos said on Wednesday. "In a few days, the ECB will release its economic forecasts again, every time we have updated it has been for the better and this may happen again," De Guindos told a financial event in Spain.

U.S. / TECH / CYBERSECURITY (AP): President Joe Biden is meeting Wednesday with top executives from some of the country's leading technology companies and financial institutions as the White House works to enlist the private sector's help in firming up cybersecurity defenses against increasingly sophisticated attacks.The summit comes during a relentless stretch of ransomware attacks that have targeted critical infrastructure, in some cases extorting multi-million-dollar payments from major corporations, as well as other illicit cyber operations that U.S. authorities have linked to foreign hackers.

U.S. TAX (BBG): American companies would face steeper penalties for shifting profits abroad in a plan from Senate Democrats that offers the clearest picture yet of the higher levies that big firms could be paying from next year.In draft legislation released Wednesday, Senate Finance Committee Chairman Ron Wyden is outlining his vision for how to reform the global tax system for multinational corporations, which Democrats say have been subject to lax rules that for decades have allowed them to shift profits and jobs outside the U.S."Overhauling the international tax code is central to our efforts to restore fairness," Wyden said in a statement on the legislation, which was co-authored by fellow Finance Committee members Sherrod Brown and Mark Warner. Increased corporate-tax levies will "fund critical investments like the paid leave and the expanded child tax credit—Social Security for our children" Democrats are planning, he said.

CHINA/TAIWAN/JAPAN: Wires and social media reporting comments from the Chinese Foreign Ministry criticising the proposed talks between Japan's governing Liberal Democratic Party (LDP) and Taiwan's governing Democratic People's Party (DPP). Comments state that Japan should stop meddling in China's internal affairs. Talks due to take place on Friday to discuss regional security and are the first bilateral talks between the two parties.

NORD STREAM II: A ruling from the Duesseldorf Higher Regional Court, delivered earlier this morning, could complicate the eventual operation of the Nord Stream II gas pipeline, currently under construction between Russia and Germany. The ruling states that EU rules on energy supply apply to the pipeline, specifically that the owner of the pipeline must be a separate entity to that supplying the gas in order to ensure fair competition. The net effect of the ruling will not be to stop the completion of the pipeline, but, as Stephen Stapczynski at BBG tweets: "In order to comply with the rules, Nord Stream 2 must be certified as an independent transmission or system operator under the EU regulation. While that doesn't require Gazprom to sell ownership rights in the unit, it must give up control and command rights toward its leadership". This in turn will take time and additional funds (the project has so far cost USD11bn).

UK DATA (BBG): Britain's construction, manufacturing and food preparation industries are pushing wages higher across the economy due to a shortage of workers to fill available jobs. Building companies increased advertised pay by 6.7% from February to July 2021 to draw more workers into the industry, according to data from jobs site Indeed. That compares with wage growth of just 0.8% across all jobs.

DATA:

MNI China Liquidity Index™ – Eases To 32.7 in August

Liquidity across China's interbank money market eased modestly in August, the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index stood at 32.7 in August, down from the 46.0 recorded in July. The higher the index reading, the tighter liquidity appears to survey participants.

- The Economy Condition Index stood at 5.8, the lowest time since dropping to 0 in February 2020, the economy's pandemic-era low point.

- The PBOC Policy Bias Index edged lower, still sitting below the 50 mark.

- The Guidance Clarity Index also edged lower, although was overall little changed on the July level.

- With the economy seen slowing, long-term bond yields are seen lower over the next 3 months

Interviews were conducted August 11 – July 20.

Click below for the full press release:

MNI_China_Liquidity_Index_July_2021 (2).pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

FIXED INCOME: EGBs Bear Steepening

European sovereign bond curves have bear steepened this morning, while USTs are a touch firmer.

- UST cash yields are marginally below yesterday's close. TYU1 trades at 133-30+, near the middle of the day's range (L: 133-28+ / H 134-01+)

- Gilts have traded weaker with cash yields broadly 1-2bp higher on the day.

- It is a similar story for bunds with the curve 2bp steeper.

- OATs trade in line with bunds, with the 2s30s spread widening 2bp

- The German IFO report for August was a little mixed. The current assessment was slightly stronger than expected and marked an improvement on the previous month, while the expectations component undershot (97.5 vs 100.0 survey).

- The IGCP will organise an exchange of Portuguese OTs this morning. The IGCP will buy the 4.95% Oct-23 OT and the 5.65% Feb-24 OT, and will sell an equal amount of the 2.1255 Oct-28 OT and the 4.1% Apr-37 OT.

- Despite pressure from American allies, US President Joe Biden appears to be sticking with his end of month deadline for withdrawing US troops from Afghanistan.

FOREX: USD pares some gains

The dollar has given back some of its overnight and early European trading gains.

- The dollar was mostly in the green against most G10s, but now down 0.1% against the Kiwi and up 0.14% versus the CAD.

- CAD has been the early worst performer against the USD in G10, but all things considered, it's been a limited move, after the CAD gained 2.86% since Friday, in line with the $6 rally in WTI from Friday to yesterday.

- Initial support at 1.2579 Low Aug 24, has held, printed a 1.2588 low.

- AUDUSD has paused its 2.31% rally since Friday, as Covid spread shows no signs of slowing down, with new daily record for New South Wales.

- AUDUSD is now flat in the early session.

- EUR trades on the back foot against the Scandis this morning, and we pointed out the EURNOK support at 10.3509, as the initial level to watch.

- Market participants faded the move at that level, printing a 10.3498 low, and now at 10.3764 at the time of typing.

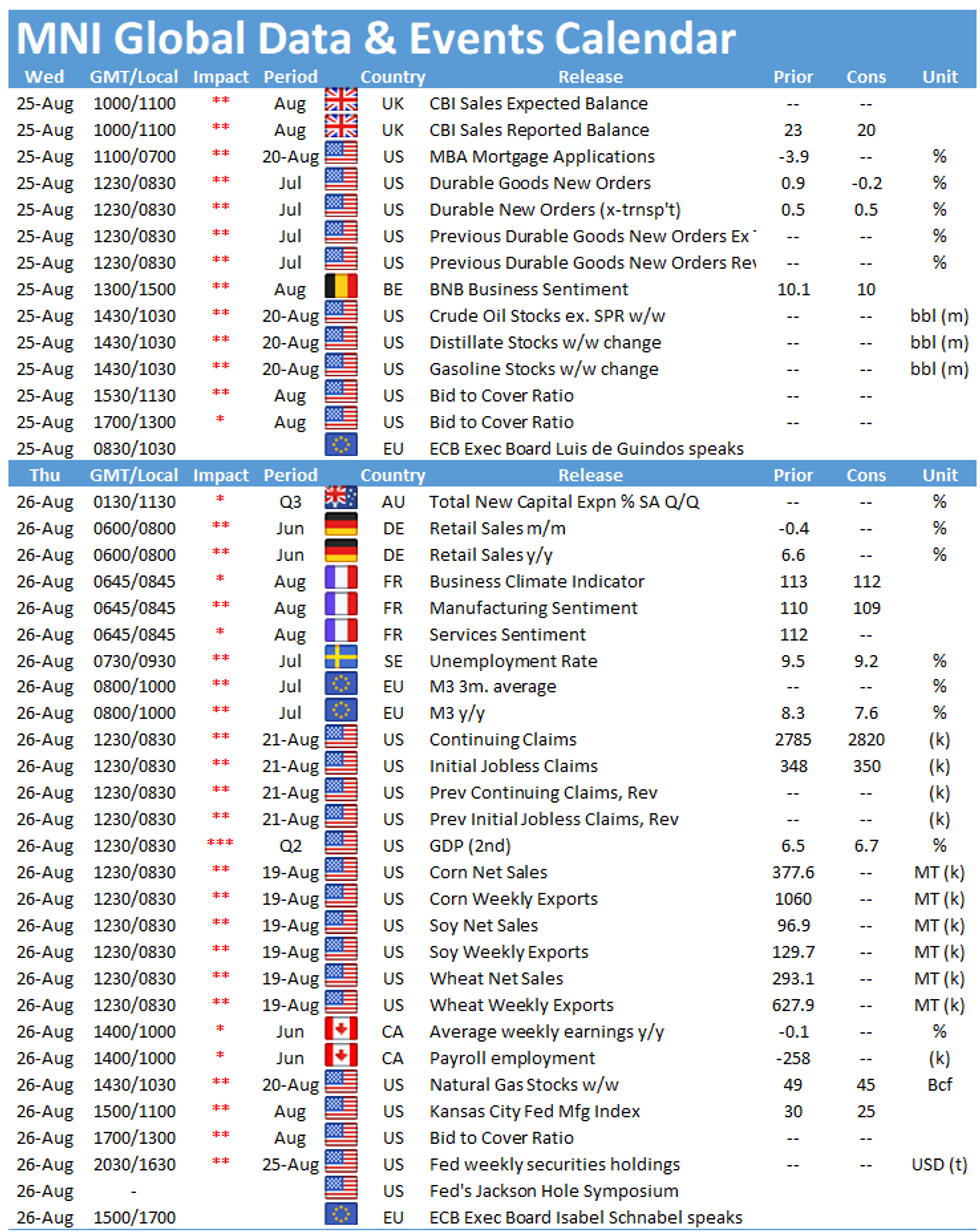

- Looking ahead, US prelim Durable Goods Orders is the notable data release.

- Fed Mary Daly (takes part in a panel discussion on "Fintech, Racial Equity, and an Inclusive Financial System)

EQUITIES: Financials, Tech Lead Modest European Gains

- Asian stocks closed mixed, with Japan's NIKKEI down 7.3 pts or -0.03% at 27724.8 and the TOPIX up 1.46 pts or +0.08% at 1935.66. China's SHANGHAI closed up 25.913 pts or +0.74% at 3540.384 and the HANG SENG ended 33.97 pts lower or -0.13% at 25693.95.

- European equities are mostly higher, with the German Dax down 5.99 pts or -0.04% at 15905.85, FTSE 100 up 7.61 pts or +0.11% at 7125.78, CAC 40 up 14.71 pts or +0.22% at 6664.31 and Euro Stoxx 50 up 4.42 pts or +0.11% at 4181.34.

- U.S. futures are flat, with the Dow Jones mini up 2 pts or +0.01% at 35316, S&P 500 mini up 1.75 pts or +0.04% at 4484.25, NASDAQ mini up 23.25 pts or +0.15% at 15379.5.

COMMODITIES: Crude Cools After Near-10% Rally

- WTI Crude down $0.44 or -0.65% at $67.33

- Natural Gas down $0.01 or -0.18% at $3.892

- Gold spot down $9.12 or -0.51% at $1794.06

- Copper up $2.5 or +0.59% at $427.85

- Silver down $0.08 or -0.32% at $23.7248

- Platinum down $13.02 or -1.28% at $999.62

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.