-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Global PMIs Point To Moderating Growth

EXECUTIVE SUMMARY:

- SPANISH AND ITALIAN MANUFACTURING PMIS DISAPPOINT IN JULY

- CAIXIN CHINA MANUFACTURING PMI HITS 15-MONTH LOW

- S. AFRICA PMI PLUNGES BY A RECORD AFTER RIOTS

- U.K. GOVERNMENT CONSIDERS REMOVING CAP ON BANKERS' BONUSES (TIMES)

- ST.LOUIS FED MODEL SEES PAYROLLS SLOWDOWN IN JULY (MNI BRIEF)

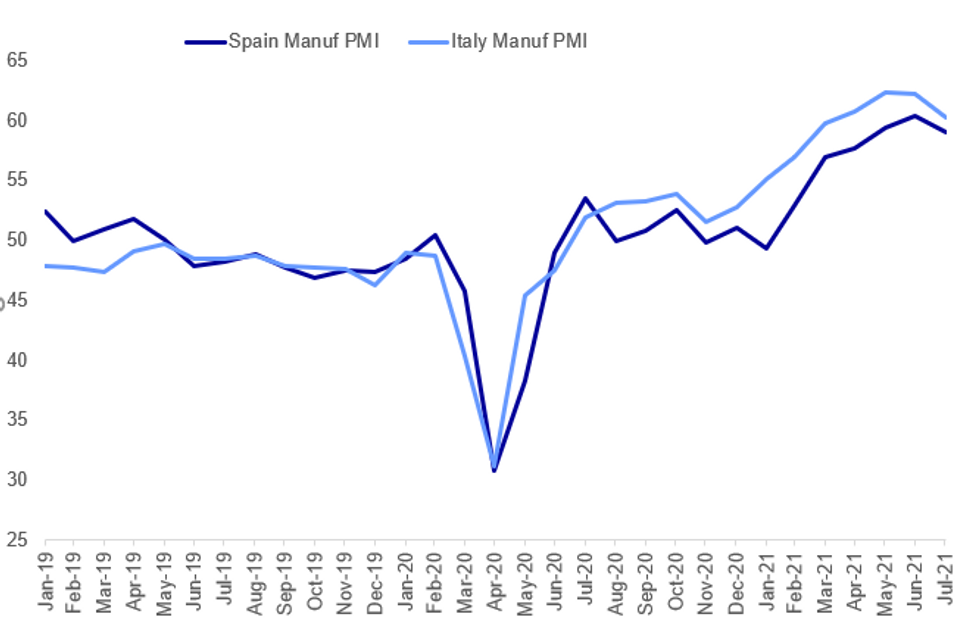

Fig. 1: Spanish And Italian Manufacturing PMIs

Source: IHS Markit

Source: IHS Markit

NEWS:

U.K. (TIMES): The government is considering removing restrictions on bankers' bonuses as part of its plan to ditch EU rules and to make the City more competitive. The idea is at an early stage and not yet part of any public consultations, as officials fear scrapping the bonus cap could trigger a public backlash. But the move has support among some within the Treasury as a way to make London more attractive for senior bankers than Frankfurt, Paris or Dublin, boosting the capital's prospects for retaining its key role in financial services.

SOUTH AFRICA (BBG): An index measuring South African factory sentiment plunged by a record in July, after a week of deadly riots, looting and arson disrupted supply chains, industrial output and demand for manufactured goodsAbsa Group Ltd.'s purchasing managers' index, compiled by the Bureau for Economic Research, fell to 43.5 from 57.4 in June, the Johannesburg-based lender said Monday in an emailed statement. The median of four economists' estimates in a Bloomberg survey was 54.The monthly decline was the largest since record keeping began almost 22 years ago.

U.S. (MNI BRIEF): U.S. employers in July added jobs at just half the pace they did in June, according to a St. Louis Fed analysis of high-frequency data from the scheduling software company Homebase, signaling a slowdown in the labor market recovery. "The index continued its upward trend, albeit at a slower rate," St. Louis Fed economist Max Dvorkin told MNI, and "it's not clear whether the effects of the Delta variant are noticeable in the data." The Homebase model predicts up to 880,000 jobs added this month, far lower than the 1.5 million job gain forecast by the index last month. For full article contact sales@marketnews.com

CHINA DATA: Caixin China's manufacturing PMI for July eased one point on month to 50.3, the lowest level since May 2020 as demand contracted for the first time in more than a year, the financial publisher said on Monday. The lower PMI was due to weaker production and contracted demand, even though it was the 15th straight month above the breakeven 50.0 level that separates expansion from contraction.

ECB/EUROZONE: Private consumption is not expected to surge as Europe's economy reopens following months of pandemic lockdown, according to the European Central Bank's latest Economic Bulletin, with household spending on major items likely to be at or below the pre-Covid levels despite a build-up in liquid excess savings, particularly among those in higher income brackets.

CHINA / U.S. (BBG FROM AUG 1): China's securities regulator called for talks with its American counterpart after the U.S. Securities and Exchange Commission increased disclosure requirements for initial public offerings of Chinese companies amid nearly a $1 trillion share selloff last week. The China Securities Regulatory Commission is seeking to step up communication with the SEC to find a suitable resolution, it said in a statementSunday, after the U.S. regulator said it would require Chinese companies seeking listings to improve risk disclosures. The Chinese watchdog called for mutual respect and collaboration on the issue.

JAPAN/COVID: New COVID-19 cases in the Japanese capital, Tokyo, came in at 2,195 in the past 24 hours, continuing the trend of a spike in cases but breaking a five-day run of new case numbers coming in at above 3,000. There remain significant concerns in the Japanese healthcare sector and wider society about the rise in cases, which takes place as the Tokyo Olympic Games enters its final week.It should be noted that Tokyo new cases reported on Monday are usually lower than other days in the week due to lower levels of testing being carried out on Sundays. In some other prefectures - Ibaraki and Okinawa - new cases recorded on Sunday and reported today were their highest on record.

BELARUS (BBG): A Belarusian sprinter who said she was pressured to leave Tokyo halfway through the games for criticizing sporting officials from her country is seeking to go to Poland for protection, Jiji Press reported."I am afraid I might be sent to prison in Belarus," Krystsina Tsimanouskaya, 24, said in an interview to sports news website Tribuna.com published Sunday. Sky News posted a video it said shows her entering the Polish Embassy in Tokyo.Polish authorities offered her a humanitarian visa, saying she's free to continue her athletic career there if she chooses.

DATA:

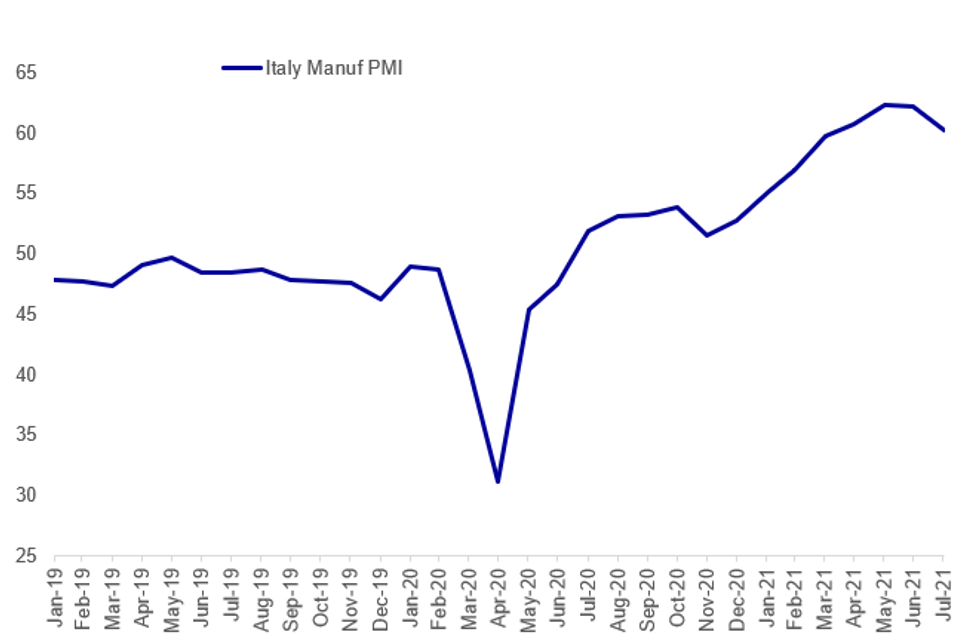

MNI: ITALY JUL MFG PMI 60.3; JUN 62.2

ITALY Jul Manuf PMI: Capacity Pressures And Supply Disruptions Weigh

Italy Manufacturing PMI slipped more than expected in July, to 60.3 (vs 61.5 exp., 62.2 prior), amid what the IHS Markit report described as "capacity pressures and supply disruptions".

- IHS Markit provides some colour behind demand conditions: "Strong rates of increase in both factory production and orderbook volumes remained key to overall growth in July. Output rose for the fourteenth straight month, with the latest rise marked, albeit the slowest for five months. According to respondents, looser COVID-19 restrictions and the reopening of some sectors of the economy had boosted demand."

- Employment was strong: "The rate of job creation was the jointfourth quickest on record, despite slowing on the month."

- But so were price pressures: "Inflationary pressures remained severe in July. Input prices rose at the second quickest pace on record, amid widespread reports of shortages and price hikes at suppliers. In response, firms increased their average charges at the steepest rate in the series history."

- The outlook was mixed, with firms citing upbeat expectations for output in the year ahead, but some noting concerns over COVID cases rising and "potential for further containment measures".

Source: IHS Markit, MNI

Source: IHS Markit, MNI

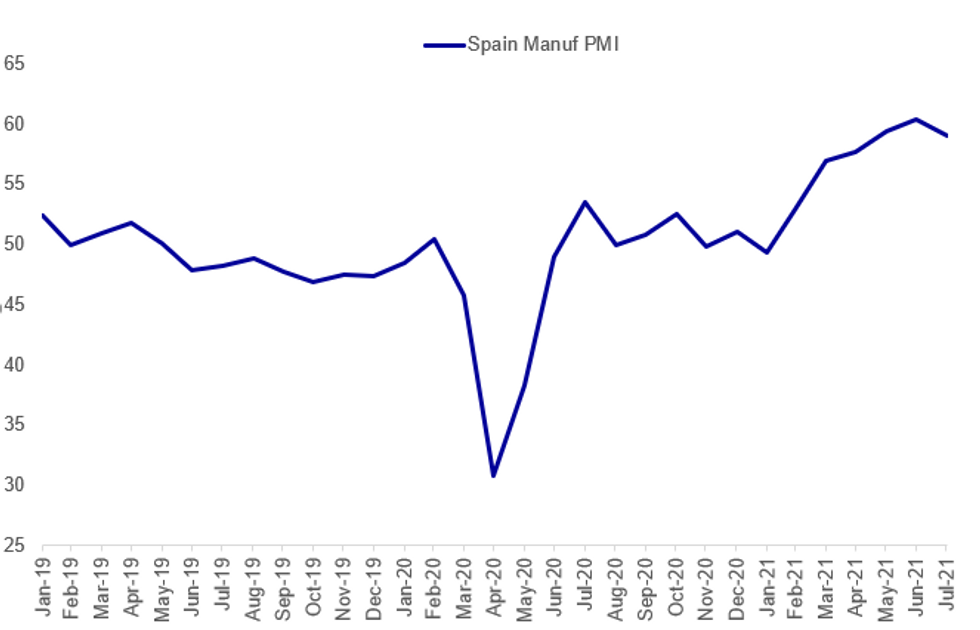

MNI: SPAIN JUL MFG PMI 59.0; JUN 60.4

SPAIN Jul Manuf PMI: Slightly Weaker Than Expected Amid Bottlenecks

July Spain Manufacturing PMI came in at 59.0 (vs 59.5 expected, 60.4 prior).

- IHS Markit notes: "backlogs continued to rise sharply, and production was constrained in part by ongoing supply-side delays amid widespread reports of product shortages and transportation difficulties. Price inflation subsequently remained elevated, and was a factor depressing confidence about the future."

- Demand is picking up strongly, with foreign sales a key factor: "Production and new order book growth remained considerable in July amid reports that market demand had improved, with producers of consumer goods notably buoyed by the reopening of the economy (hospitality especially)... International sales were also noticeably higher, with growth the best in over three-and-a-half years. "

- Confidence was mixed, with companies "concerned over recent rises in COVID-19 infection numbers and the potential for the economic recovery to be derailed. That said, firms remain positive overall that sales and output will rise further in the coming 12 months, with confidence remaining comfortably in positive territory despite dropping to a half-year low."

- Fairly minimal market reaction - Spanish spreads have been tightening vs Germany all morning.

Source: IHS Markit, MNI

Source: IHS Markit, MNI

MNI: FRANCE FINAL JUL MFG PMI 58.0; FLASH 58.1; JUN 59.0

MNI: GERMANY FINAL JUL MFG PMI 65.9; FLASH 65.6; JUN 65.1

MNI: EZ FINAL JUL MFG PMI 62.8; FLASH 62.6; JUN 63.4

FIXED INCOME: ISM setting up the week

It has been a mixed morning for core fixed income with yields on 10-year Treasuries and Bunds higher but Schatz yields rising while 2-year UST yields have fallen. The gilt curve is little changed.

- Risk appetite generally seems to be fairly positive, with Asian, European and US equity index futures all moving higher and Eurozone peripheral spreads narrowing.

- This morning's PMI data showed the Italian and Spanish manufacturing PMIs disappointing marginally but not enough to move the market.

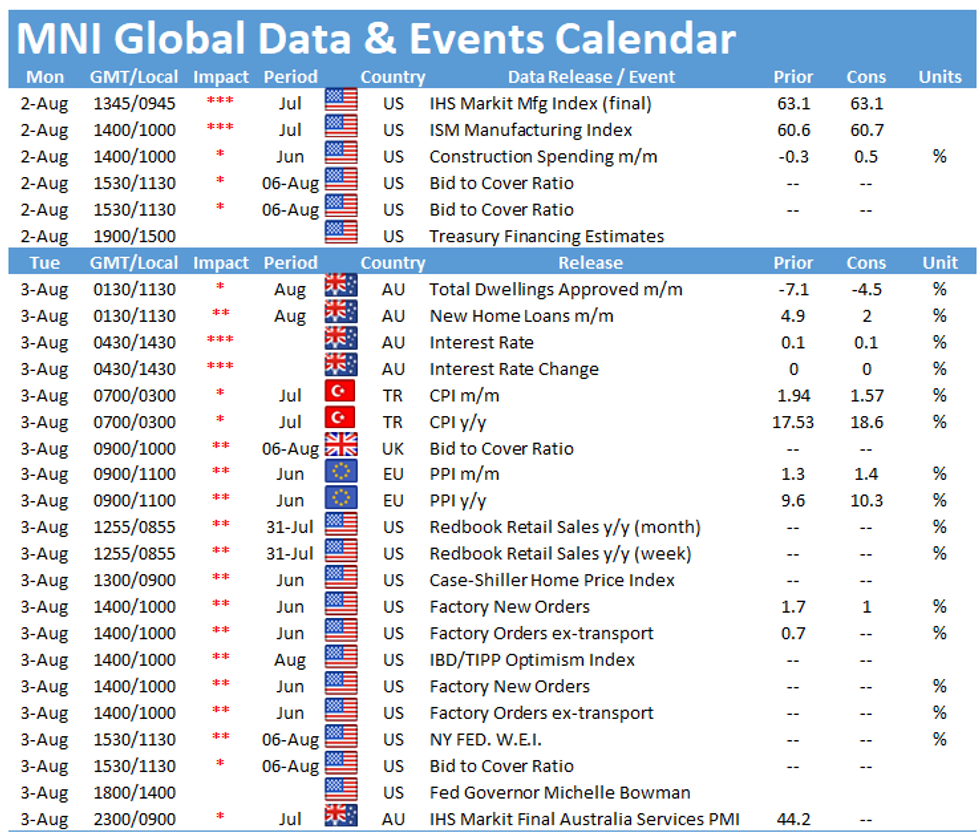

- Focus now turns to the ISM manufacturing survey later today, the highlight of the calendar for the day. There are no major central bank speeches planned.

- Focus for the rest of the week will be on the labour market report in the US on Friday and the BOE meeting on Thursday in which 1-2 members are expected to vote to end QE early, but ultimately for policy to remain steady. Although there will be focus on the expected outcome of the review into the sequencing of tightening (i.e. what guidance will replace that which states QT will not begin until Bank Rate reaches 1.50%).

- TY1 futures are up 0-2+ today at 134-17 with 10y UST yields up 1.4bp at 1.238% and 2y yields down -0.3bp at 0.183%.

- Bund futures are down -0.16 today at 176.41 with 10y Bund yields up 1.3bp at -0.449% and Schatz yields up 0.4bp at -0.763%.

- Gilt futures are down -0.03 today at 129.76 with 10y yields up 0.4bp at 0.568% and 2y yields up 0.2bp at 0.056%.

FOREX: ISM Manufacturing Eyed for NFP Clues

- Markets have seen inside moves so far Monday, with the USD index relatively mixed while AUD, NZD and CAD inch higher. Equities are in the green across the continent, rebuffing against Friday's negative close on Wall Street.

- Markets remain focused on a number of key risk events this week, with rate decisions from the Australian and UK central banks as well as Nonfarm Payrolls on Friday.

- The broad technical outlook is unchanged, with EURUSD focus on the 50-day EMA at 1.1916. This represents a short-term pivot resistance. GBPUSD is holding onto recent gains. The pair has cleared its 50-day EMA strengthening the current bullish recovery.

- Focus turns to the July ISM manufacturing reading later today, with markets expecting a minor uptick for the headline, with prices paid subindex seen edging off last month's 92.1. There are no central bank speakers of note.

EQUITIES: European Indices At/Near All Time Highs

Asian markets closed higher, with Japan's NIKKEI up 497.43 pts or +1.82% at 27781.02 and the TOPIX up 38.97 pts or +2.05% at 1940.05. China's SHANGHAI closed up 66.928 pts or +1.97% at 3464.285 and the HANG SENG ended 274.77 pts higher or +1.06% at 26235.8.

European equities are stronger, with the Eurostoxx 600 and FTSE 250 for example hitting all-time highs. All major indices are up, with the German Dax up 53 pts or +0.34% at 15544.39, FTSE 100 up 70.85 pts or +1.01% at 7032.3, CAC 40 up 64.29 pts or +0.97% at 6612.76 and Euro Stoxx 50 up 30.54 pts or +0.75% at 4089.3.

U.S. futures are gaining, with the Dow Jones mini up 174 pts or +0.5% at 35006, S&P 500 mini up 25.5 pts or +0.58% at 4415, NASDAQ mini up 81 pts or +0.54% at 15036.75.

COMMODITIES: Precious Metals Fail To Take Advantage Of Weaker Dollar

- WTI Crude down $0.66 or -0.89% at $73.35

- Natural Gas up $0.07 or +1.81% at $3.99

- Gold spot down $7.01 or -0.39% at $1808.85

- Copper up $2.2 or +0.49% at $451.1

- Silver down $0.09 or -0.34% at $25.4785

- Platinum up $2.55 or +0.24% at $1057.97

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.