-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Happy New Year So Far For Stocks

EXECUTIVE SUMMARY:

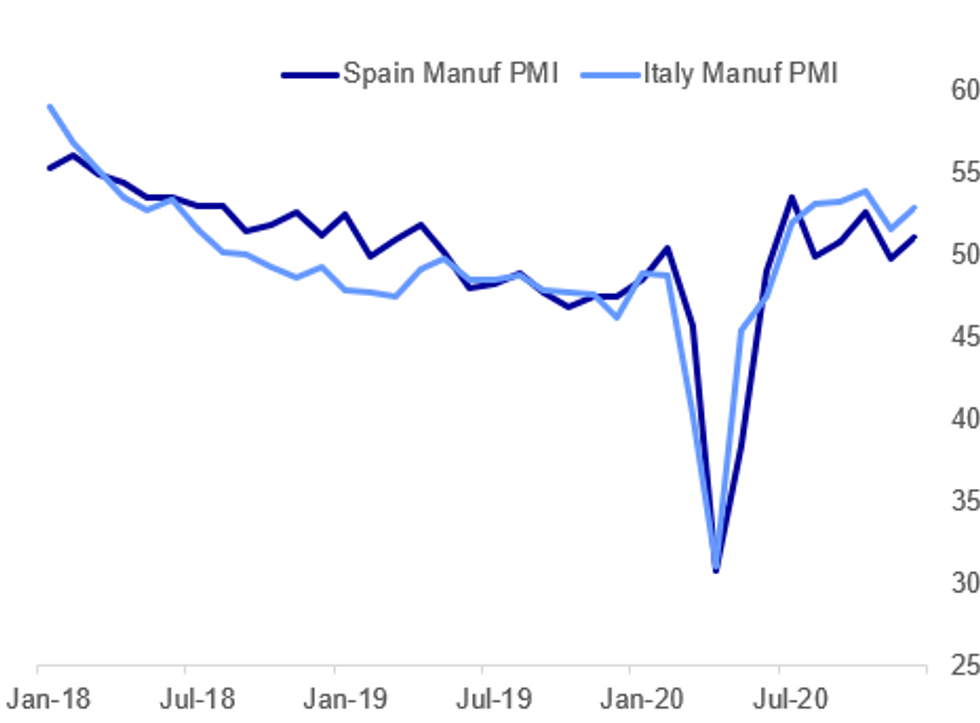

- ITALY AND SPAIN MANUFACTURING PMIS STRONGER BUT BELOW EXPECTATIONS

- P.B.O.C. EASES RULES ON OVERSEAS YUAN REINVESTMENT

- GERMANY TO EXTEND LOCKDOWN; HEALTH MINISTRY EXAMINES DELAYING SECOND COVID-19 VACCINE SHOT (RTRS)

- CHINA 2021 RETAIL SALES SEEN ROBUST: ADVISORS (MNI EXCLUSIVE)

Fig.1: Spain and Italy Manufacturing PMI Disappoints In Dec

IHS Markit, MNI

IHS Markit, MNI

NEWS:

SPAIN DATA: The rise in Spain Dec Manuf PMI to 51.0 from 49.8 in Nov missed expectations of 52.5.

- It was a mixed report: per IHS Markit, optimism on future prospects over the next 12 months hit the best level since Jul 2018 on expectations that the pandemic will be brought under control. But:

- "Whilst output rose it did so only marginally, whilst order books continued to deteriorate thanks to weak domestic demand. Lead times for the delivery of inputs continued to falter noticeably, whilst there was an acceleration of input cost inflation to its highest in nearly three years."

- New order books fell for the 2nd consecutive month, but new export orders were the strongest since July.

- Input prices rose by the most for almost 3 years amid supply shortages, so "several firms saw little option but to increase their own charges"

ITALY DATA: Italy logged its 6th consecutive month of positive Manuf PMI in Dec, at 52.8 vs 51.5 in Nov, "with output growth quickening amid a renewed upturn in order book volumes" per IHS Markit, but this was below expectations of 53.5.

- As with Spain earlier, new export orders impressed amid "looser COVID-19 related restrictions in key markets", while domestic demand remained weak.

- Also similar to the Spanish report was supply chain delays leading to higher cost push inflation, and in response, output costs rose at a 2-year high (though "remained modest").

- The report noted Italy manuf job growth at a 2.5 year high.

- Forward prospects were positive: "the level of positive sentiment climbed to a three-month high, with positive news of a vaccine, improved sales and hopes of a robust economic recovery all cited in anecdotal evidence as reasons to be optimistic."

GERMANY/COVID (RTRS): The German health ministry is seeking advice on whether to delay administering a second dose of the COVID-19 vaccine from BioNTech and Pfizer to make scarce supplies go further, according to a document seen by Reuters on Monday. The ministry is seeking the view of an independent vaccination commission on whether to delay a second shot beyond a 42-day maximum now foreseen, after a similar move by Britain, according to the one-page document.

U.K. DATA (BBG): U.K. mortgage approvals reached the highest since 2007 in November as housing continued to boom in spite of a broader economic downturn. The housing market is surging largely because of a tax cut on house purchases that is worth as much as 15,000 pounds ($20,000) to buyers. That may support demand through March, when the initiative ends.

DATA:

MNI: EZ FINAL NOV MFG PMI 55.2; FLASH 55.5; NOV 53.8

MNI: GERMANY FINAL DEC MFG PMI 58.3; FLASH 58.6; NOV 57.8

MNI: FRANCE FINAL DEC MFG PMI 51.1; FLASH 51.1; NOV 49.6

MNI: ITALY DEC MFG PMI 52.8; NOV 51.5

MNI: SPAIN DEC MFG PMI 51.0; NOV 49.8

FIXED INCOME: Busy morning session

A busy start of the year for EGBs, and elevated volumes.

- Bund spiked throughout the morning session, with buying seen across core and semi core.

- Bunds extended gains post Spanish PMI, to push through the 178.00 figure, to print a 178.37 high.

- Irish 10yr yield is tested new record low at -0.344%, while Spain and Portugal yields look edge back into negative territory

- Given the faster bid move in Bund, peripherals trade wider versus the German 10yr, with Italy the widest by 3.3bps at 114.1bps.

- Gilts took their cue from the better bid in Europe, and despite the vaccine roll-out set to start today, lock down concerns remains.

- US Treasuries remains within overnight ranges, and trade a touch in the red at the time of typing, on the Risk on flow.

- Looking ahead, US Mfg PMI is the notable data, but final reading, so unlikely to move the needle.

- On the speaker front, Fed Evans, Bostic and Mester are scheduled, while for Europe, ECB Lane is the highlight.

- Mar Bund futures (RX) up 61 ticks at 178.25 (L: 177.52 / H: 178.37)

- Mar Gilt futures (G) up 25 ticks at 135.79 (L: 135.32 / H: 135.96)

- Mar BTP futures (IK) up 21 ticks at 152.22 (L: 151.62 / H: 152.29)

- Italy / German 10-Yr spread 2.9bps wider at 114.1bps

- Mar OAT futures (OA) up 51 ticks at 168.37 (L: 167.76 / H: 168.46)

- US 2-Yr yield is unchanged at 0.1211%, 5-Yr is up 0.5bps at 0.3655%, 10-Yr is up 1.5bps at 0.9282%, and 30-Yr is up 1.7bps at 1.6616%.* Mar 10-Yr futures (TY) down 3/32 at 137-31.5 (L: 137-26.5/ H: 138-02)

FOREX SUMMARY

USD saw selling continuation throughout the European morning session, on the back of risk on flow, after vaccine hope roll-outs.

- Despite the Spanish PMI miss, which triggered some safe haven buying in Bonds,

- EURUSD tested through intraday high, mainly on the USD weakness.

- EURUSD printed a 1.2301 high.

- Cable tested the figure at 1.3700 (printed 1.3703 high), ahead of next resistance at 1.3712 Low Mar 1, 2018.

- But seeing better selling interest at these levels, and Cable trades circa 1.3680 at the time of typing.

- PM Boris and his ministers are set to announce this week whether the country could be put into another national lockdown.

- Boris noted on Sunday that further measures will be enforced.

- USDJPY lowest since March and testing immediate support at 102.75 1.00 proj of Oct 7 - Nov 6 downleg from Nov 11 high. Did print a 102.71 low.

- While NOK is the best performing currency in G10 versus the Greenback.

- USDNOK trades at the lowest level since June 2019, with support coming at 8.4687 (24/06/19 low)

- Looking ahead, US Mfg PMI is the notable data, but final reading, Speaker front, Fed Evans, Bostic and Mester are scheduled, and for Europe, ECB Lane

- All eyes on US Georgia elections

EQUITIES: New Year Starts Happy In U.S., Europe

A strong start in the first day of trading in 2021 in Europe and the U.S., with all sectors in the green. Energy leading, with financials lagging in Europe.

- Asian stock markets closed mixed, with Japan's NIKKEI down 185.79 pts or -0.68% at 27258.38 and the TOPIX down 10.09 pts or -0.56% at 1794.59. China's SHANGHAI closed up 29.889 pts or +0.86% at 3502.958 and the HANG SENG ended 241.68 pts higher or +0.89% at 27472.81.

- European equities are higher, with the German Dax up 166.95 pts or +1.22% at 13827.06, FTSE 100 up 199.42 pts or +3.09% at 6569.82, CAC 40 up 103.15 pts or +1.86% at 5626.03 and Euro Stoxx 50 up 52.32 pts or +1.47% at 3589.65.

- U.S. futures are higher, with the Dow Jones mini up 175 pts or +0.57% at 30671, S&P 500 mini up 22 pts or +0.59% at 3770.75, NASDAQ mini up 63.5 pts or +0.49% at 12948.75.

COMMODITIES: Metals Soar On Weak USD

- WTI Crude up $0.33 or +0.68% at $49.52

- Natural Gas up $0.08 or +2.95% at $2.618

- Gold spot up $33.66 or +1.77% at $1933.5

- Copper up $7.75 or +2.2% at $357.85

- Silver up $0.89 or +3.38% at $27.2777

- Platinum up $28.24 or +2.63% at $1106.61

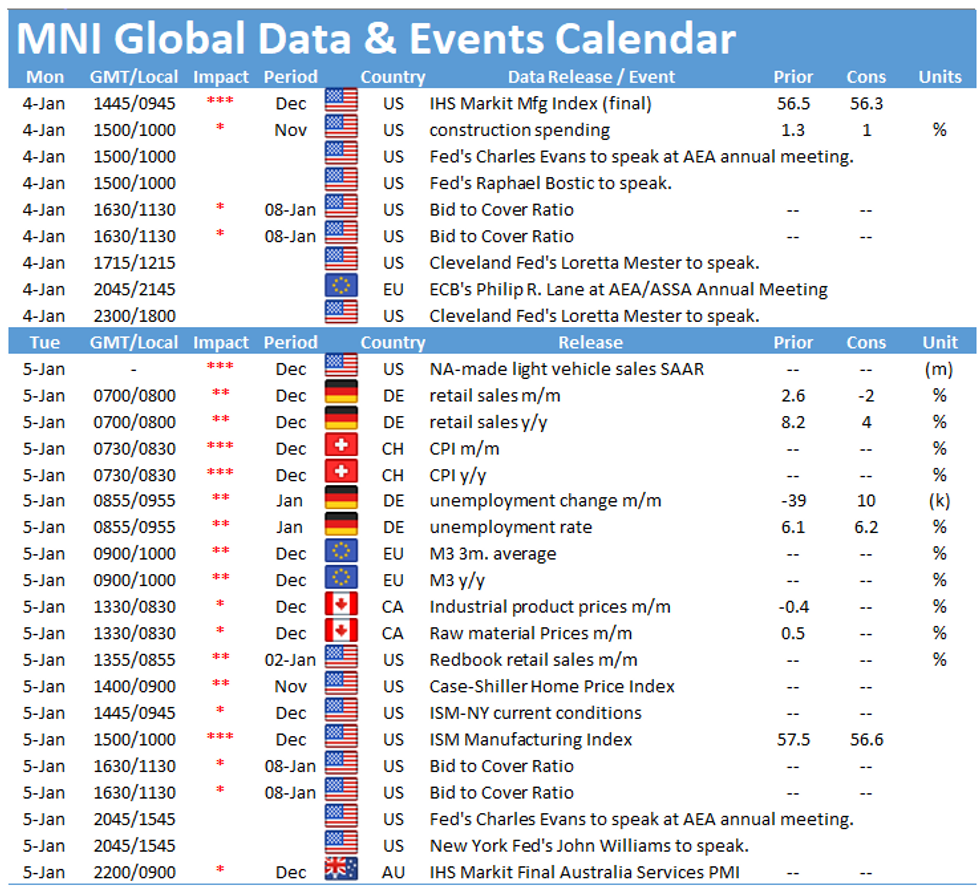

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.