-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI US Open: Inauguration Day

EXECUTIVE SUMMARY:

- BIDEN PREPARES TO TAKE OATH OF OFFICE IN CAPITAL UNDER LOCKDOWN

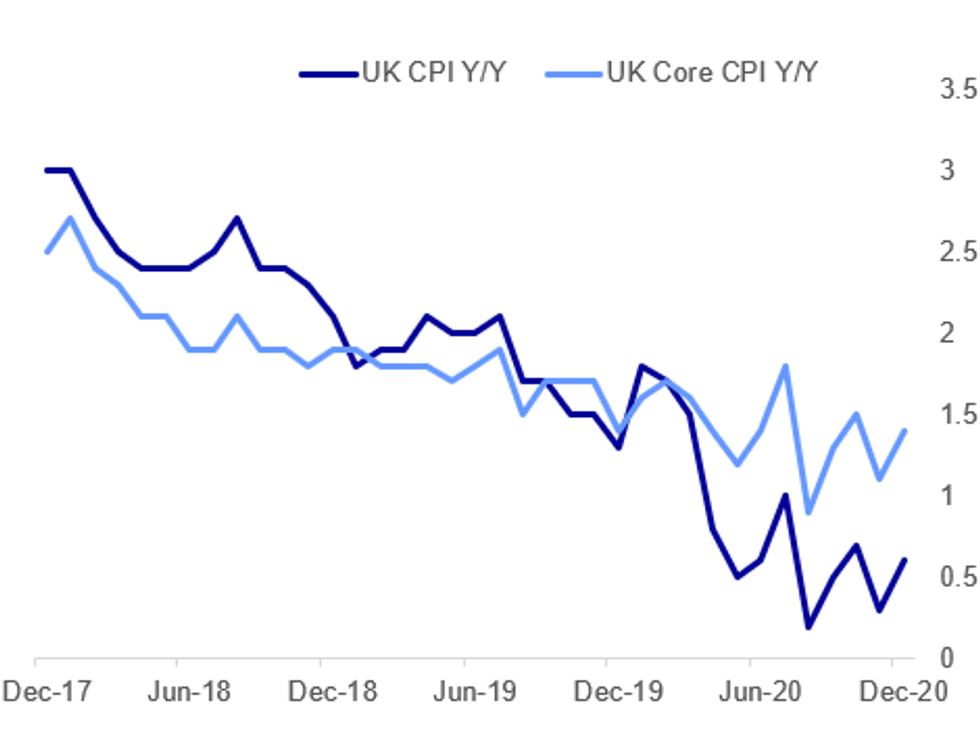

- U.K. INFLATION OUTPACES FORECASTS, BUT BELOW B.O.E. GOAL

- CHINA EYES U.S. TALKS, MAY WAIVE TARIFFS: ADVISORS (MNI EXCLUSIVE)

- ITALY'S CONTE SURVIVES AS P.M., BUT LACK OF MAJORITY BODES ILL FOR STABILITY

- MNI CENTRAL BANK PREVIEW: E.C.B. ON AUTOPILOT

Fig. 1: U.K. Inflation Picks Up More Than Expected, But Still Below BOE Target

ONS, MNI

ONS, MNI

NEWS:

U.S. (BBG): Joe Biden will be sworn in as the 46th U.S. president on Wednesday in an inaugural ceremony set to unfold under heavy security after weeks of tumult and unrest stoked by Donald Trump. Biden will take the oath at noon on the steps of the U.S. Capitol, making a plea for national unity from the very spot that was overrun by Trump supporters just two weeks ago in a deadly attempt to derail the transfer of power. The event -- themed "America United" -- will be nearly devoid of the customary pomp that surrounds a presidential inauguration as the recent violence and ongoing coronavirus pandemic preclude any large gatherings. Instead of throngs of supporters crowding the National Mall, Biden will see thousands of National Guard soldiers and barricades -- a grim reminder of the deep national rift he wants to mend.

U.S. (BBG): In in address after he's sworn in, Biden will call on Americans to bring the country together during an unprecedented crisis, according to advisers to the president-elect who asked not to be identified ahead of the speech. He'll ask every citizen to meet what the advisers called an extraordinary challenge facing the nation, in a speech they said would be built around the theme of unity. The address will be 20 to 30 minutes long, according to a person familiar with the matter who also asked not to be identified.

U.S.: Headlines from wires confirming the well-trailed stories that after his inauguration as president later today, Joe Biden will sign 17 executive orders reversing some of President Donald Trump's key policies, as well as implementing some of his own. These include: the US rejoining the WHO and becoming a signatory to the Paris Climate Agreement once again, reversing the Muslim travel ban, halting construction on the Mexico border wall, halting the Keystone XL oil pipeline(much to Canada's chagrin), requiring face masks to be worn in all federal buildings. Other executive orders will seek to revoke Trump policies on immigration enforcement, environmental standards, and to promote racial equality. Notably, the slew of executive orders does not include the rejoining of the Joint Comprehensive Plan of Action (JCPoA, the Iran nuclear deal), which Trump withdrew the US from in 2018.

UK DATA: UK CPI exceeded expectations in December, lifted by unexpected rises in clothing and transport costs, but remained stubbornly below the Bank of England's inflation target, the Office for National Statistics said Wednesday. Consumer price inflation rose to an annual rate of 0.6% in December, topping analysts' forecasts of a 0.5% rise, accelerating from the 0.3% gain in November. Despite the increase, inflation remained below the bank of England's 2.0% target for the 17th-straight month, suggesting that persistently-low inflation will remain a concern for the Bank of England.

UK DATA: Given restrictions in place due to parts of the country being in tier 3 and later tier 4 restrictions, the ONS said the number of price quotes usually collected in store used in constructing the December 2020 indices was 74.7% of the number of price quotes collected in February 2020 (excluding unavailable items). Despite the changes to methodology and collection due to virus restriction, the ONS said correspondence with the Bank of England determined that none of the temporary changes outlined "were both fundamental changes to the coverage or basic calculation of the RPI, and also materially detrimental to the holders of relevant index-linked gilts".

CHINA (MNI EXCLUSIVE): China is better prepared for trade discussions with the U.S. after making crucial concessions in the recent pact: with the EU and could show goodwill by exempting more American products from tariffs in the hope of reciprocity and dialogue, policy advisors told MNI.

CHINA (MNI INTERVIEW): China's GDP may expand 11.4% in the first quarter from a year ago, the fastest pace in more than a decade, riding the tailwind from pro-growth measures introduced to counter the pandemic's impact and necessitating greater policy focus on preventing asset bubbles, a prominent advisor to the government told MNI. For full article contact sales@marketnews.com

ITALY (MNI POLITICS): While PM Giuseppe Conte's gov't avoided being ousted in a vote of no confidence in the Senate last night, the lack of an overall majority in the upper chamber hints at difficulties further down the line for the gov't. In the event, 156 senators voted in favour of Conte's gov't with 140 against and crucially 16 abstaining. While this avoided a gov't defeat, the numbers fell short of the 161 senators required to hold an absolute majority in the chamber. As such, if the Conte gov't does not repair relations with former PM Matteo Renzi's Italia Viva party it will be at risk of losing votes. 16 IV senators voted to abstain last night, should they switch to voting against the gov't it could see the gov't defeated. The gov't cannot be assured of reaching 156 senators in future votes, with two of those coming from centre-right Forza Italia senators voting against party lines.

E.C.B. (MNI PREVIEW): The January ECB meeting will likely be a non-event given that the GC delivered a significant easing package in December. With staff macroeconomic projections also updated at the December meeting and few additional data inputs since then, there is little for the ECB to react to for now. While it is the case that lockdown measures have been tightened across Europe, the path of Covid-19 remains inherently uncertain, making it difficult to tailor monetary policy. The ECB will take time to assess incoming data in order to gauge the impact on economic conditions of the latest Covid setback. In any case, the December PEPP expansion gives the ECB a sufficient buffer to maintain favourable financing conditions in the coming months even if economic activity is dealt a further heavy blow. Full MNI Preview at this link: https://marketnews.com/mni-ecb-preview-january-202...

RIKSBANK (BBG): The Swedish central bank's experience of negative policy rates "was on the whole benign," First Deputy Governor Cecilia Skingsley says at an online seminar organized by the American Chamber of Commerce in Sweden. "If you want to have an inflation target framework, you have to walk the talk and we were in a situation were we had to throw in what we could in terms of bringing inflation back to target," Skingsley says.

COVID (BBG): Pfizer Inc. and BioNTech SE built the case that their Covid-19 vaccine will protect against the new variant of the coronavirus that emerged in the U.K. with results of another lab trial.Like previous work out of the University of Texas Medical Branch, the results published on Wednesday showed that antibodies in the blood of people who had been vaccinated were able to neutralize a version of the mutant virus that was created in the lab. The study was published on preprint server BioRxiv prior to peer review.

MNI POLITICAL RISK EVENT: MNI is hosting a webcast is titled " Political Risk Flash Points In 2021" on January 21.

The event will begin with a talk from Tom Lake, Head of Political Risk at MNI, followed by a Q+A session moderated by MNI Senior Markets Analyst, Tim Cooper.T opics to be covered:- 'Joebama' Administration To See US Re-forge Old Alliances, Leaving TrumpAllies Out In The Cold* Light At The End Of The Tunnel As COVID-19 Beaten Back By Vaccine

- Developed Market Elections in 2021: Germany, Japan, the Netherlands

- UK Goes It Alone, even with a deal in place

- EU Looks Towards A More Cohesive 2021 After Cracks Exposed In MFF Talks

- Key Geopolitical Flashpoints in 2021

This webcast will be held for the following timezones:

- APAC: 1500 Hong Kong Time/1600 Tokyo Time - APAC Registration Link: https://www.eventbrite.co.uk/e/130692507809

- EMEA/NASA: 1030ET/1530 London Time -EMEA/NASA Registration Link:https://www.eventbrite.co.uk/e/132832949929

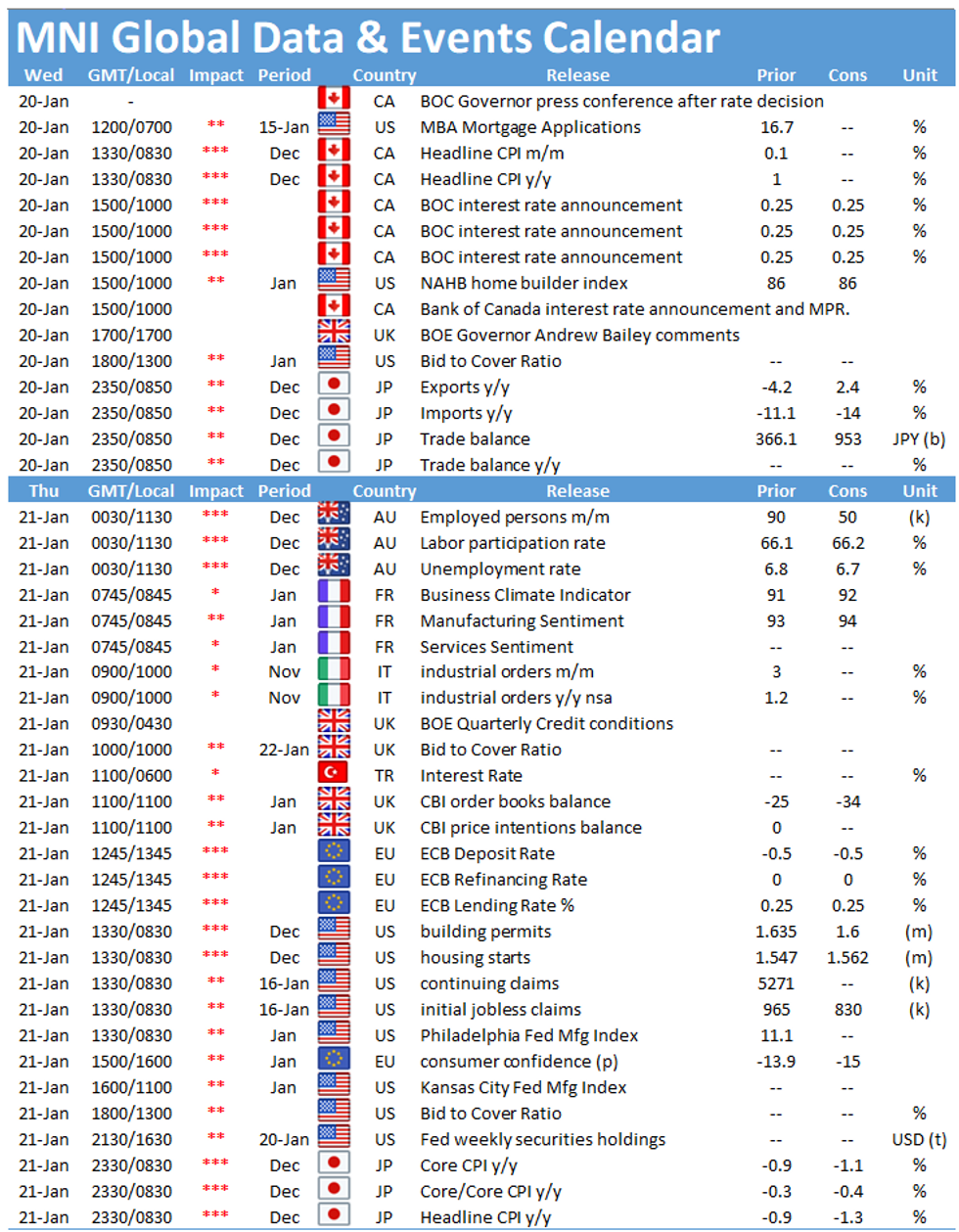

DATA:

MNI: UK DEC CPI 0.3% M/M, +0.6% Y/Y VS +0.6% Y/Y OCT

MNI: GERMANY DEC PPI +0.8% M/M, +0.2% Y/Y; NOV -0.5% Y/Y

FIXED INCOME: Bunds a bit higher but USTs and gilts a bit lower

- The inauguration of Biden as US President today will be the most watched event of the day. It has already been confirmed that he will sign a number of executive orders today (Bloomberg report 15) reversing decisions to leave the WHO, rejoin the Paris Accord and revoke Keystone XL amongst others.

- Elsewhere a lab trial by Pfizer/Biontech has shown that its vaccine is effective against the UK strain of Covid-19. This follows some third party preliminary findings and also echoes early data regarding the AZ/Oxford vaccine. This has helped risk sentiment today.

- Peripheral spreads are little changed on the day, reversing the widening seen on the open of BTP-Bund spreads.

- The calendar so far this morning has been rather light with UK inflation a bit higher than expected but Eurozone CPI unrevised from the flash.

- TY1 futures are down -0-3 today at 136-27 with 10y UST yields up 0.7bp at 1.096% and 2y yields up 0.2bp at 0.134%.

- Bund futures are up 0.05 today at 177.45 with 10y Bund yields down -0.5bp at -0.532% and Schatz yields unch at -0.712%.

- Gilt futures are down -0.04 today at 134.41 with 10y yields up 0.1bp at 0.289% and 2y yields up 0.1bp at -0.131%.

FOREX: USD A Touch Lower as Markets Await Inauguration

With outgoing President Trump concluding his final day in office, markets await the inauguration of President-Elect Biden. Reports have already made clear Biden's intentions on assuming office - namely reversing Trump's previous actions on climate change, border walls and the revocation of a permit for the Keystone XL pipeline. The USD is a touch softer early Wednesday, but recent ranges have largely been respected.

GBP outperforms slightly, helping GBP/USD challenge, but not quite top, the Jan14 highs at 1.3710. The gains come as inflation numbers came in ahead of expectations and as house price growth continues to surge higher.

GBP is the firmest currency in G10, while SEK, EUR and USD underperform. Equities are generally higher, with the e-mini S&P trimming the gap with alltime highs to just 20 points.

Canadian CPI and the Bank of Canada rate decision take focus going forward. An appearance from BoE's Bailey is scheduled at 1700GMT/1200ET.

EQUITIES: Tech Outperforming

Tech is outperforming overnight, with Netflix beating expectations and Alibaba soaring after founder Jack Ma resurfaced for the first time in public in months. US earnings today include Morgan Stanley and Procter & Gamble.

- Asian stocks closed mixed, with Japan's NIKKEI down 110.2 pts or -0.38% at 28523.26 and the TOPIX down 6.26 pts or -0.34% at 1849.58. China's SHANGHAI closed up 16.711 pts or +0.47% at 3583.092 and the HANG SENG ended 320.19 pts higher or +1.08% at 29962.47.

- European equities are flat/higher, with the German Dax up 74.67 pts or +0.54% at 13845.56, FTSE 100 down 0.36 pts or -0.01% at 6712.95, CAC 40 up 24.89 pts or +0.44% at 5598.61 and Euro Stoxx 50 up 20.06 pts or +0.56% at 3607.11.

- U.S. futures are rising, with the Dow Jones mini up 46 pts or +0.15% at 30874, S&P 500 mini up 11.5 pts or +0.3% at 3802, NASDAQ mini up 90.75 pts or +0.7% at 13075.5.

COMMODITIES: Precious Metals, Oil Rising With USD On Back Foot

- WTI Crude up $0.51 or +0.96% at $53.5

- Natural Gas down $0.05 or -1.85% at $2.501

- Gold spot up $14.7 or +0.8% at $1854.57

- Copper up $1.35 or +0.37% at $365.75

- Silver up $0.21 or +0.84% at $25.5152

- Platinum up $6.24 or +0.57% at $1099.41

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.