-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US Open: Job Gains Seen Accelerating In October

EXECUTIVE SUMMARY:

- OCT NONFARM PAYROLLS SEEN +450K IN MNI DEALER MEDIAN

- HOUSE SET TO VOTE FRIDAY ON BIDEN'S $1.75TRN ECONOMIC PLAN

- GROWING EXPECTATION U.K. WILL TRIGGER ARTICLE 16 OVER BREXIT DISPUTE: RTE

- MEDIA REPORTS SUGGEST RISING PROBABILITY OF FED CHAIR POWELL RE-NOMINATION

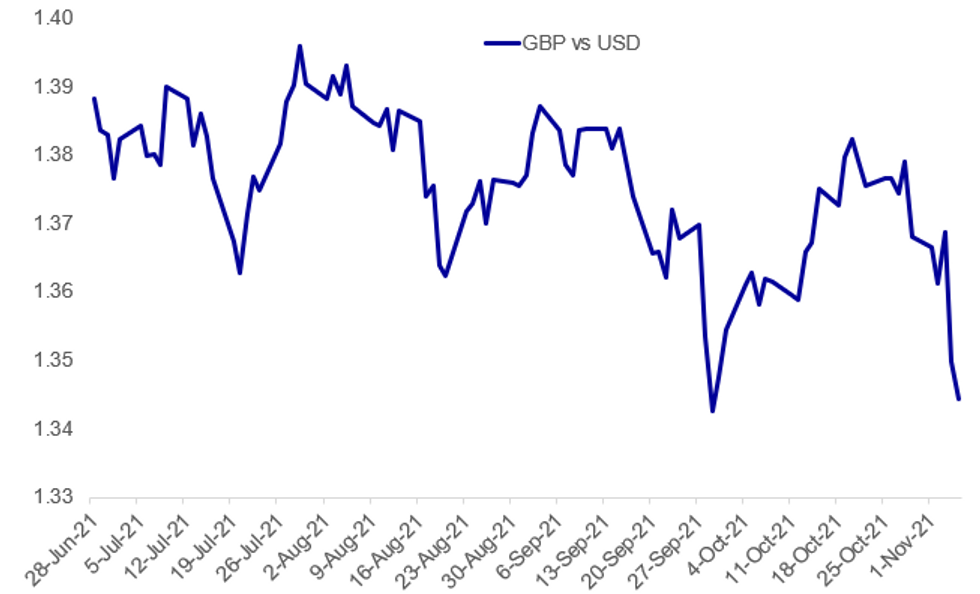

Fig. 1: British Point Continues To Fall After BoE Surprise Hold

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.S. NONFARM PAYROLLS: October nonfarm payrolls are expected to have risen by 450k, vs 194k in September, per both the MNI Dealer Median and Bloomberg survey median; the MNI dealer median range is 350k to 675k. The Bloomberg "whisper" number is 500k, up from 450k Thursday morning. The unemployment rate is seen dipping to 4.7%, (4.8% prior), with average hourly earnings +0.4% M/M (vs +0.6% prior).

U.S. FISCAL (BBG): The House plans to vote Friday on President Joe Biden's $1.75 trillion economic package and a separate infrastructure bill, after intense 11th-hour negotiations by Speaker Nancy Pelosi appeared to settle lingering differences. A vote on the massive tax and spending measure follows months of intra-party tension and disputes that carried into late Thursday night. Although much of the bill had been written, there were last- minute changes on modifying the state and local income tax deduction and a provision allowing Medicare to negotiate drug prices. Approval of the infrastructure measure, already passed by the Senate, will send it directly to Biden's desk.

UK / IRELAND /EU (RTRS): There is a growing expectation that Britain will trigger Article 16, a clause which allows for unilateral action if the Northern Irish Protocol, governing post-Brexit trade with the EU, is deemed to be having a negative impact, RTE reported on Friday. "Article 16 update: growing expectation that the UK will trigger. Much more intense discussion in the European Commission about how the EU shd respond," RTE Europe Editor Tony Connelly wrote on Twitter.

FED (WSJ - PUBLISHED OVERNIGHT): Federal Reserve Chairman Jerome Powell was seen visiting the White House on Thursday, according to people familiar with the matter. Mr. Powell's term leading the central bank is set to expire next February. President Biden told reporters on Tuesday that he would announce decisions "fairly quickly" on whether he was offering Mr. Powell another term or tapping someone else to succeed him.

FED (AXIOS - PUBLISHED OVERNIGHT): The White House is asking Democratic senators to meet with Federal Reserve chair Jerome Powell before Thanksgiving — leading some to believe President Biden will renominate him this month, people familiar with the matter tell Axios.

FED: These reports (particularly the WSJ story) boosted the odds of Fed Chair Powell being nominated to serve a second term, per Predictit markets (now 87%, vs 76% prior).

EUROPE ENERGY (BBG): European natural gas futures moved higher after a retreat on Thursday, with traders closely watching flows from Russia. Europe's biggest supplier of the fuel has promised to send more gas to the region starting Monday, following the completion of Russia's domestic stockpiling campaign. Yet, there's still no clarity on exact volumes and exports this month remain low.Russian gas shipments through a major transit link to Germany, which restarted Thursday after a five-day halt, continue. But flows via the Mallnow station, where the Yamal-Europe pipeline ends, remain far below capacity, according to grid data.

ECB (BBG): The slowdown in inflation next year may not be as intense and quick as the European Central Bank had anticipated a few months ago, ECB Vice President Luis de Guindos says. Factors behind quickening inflation to be transitory, but lasting longer than expected, Guindos says. Guindos sees no "important" second-sound effects for now, but says the ECB needs to remain attentive. ECB to decide in December if there will be alternatives to PEEP program due to end in March

DATA:

PREVIEW: MNI Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimat |

|---|---|---|---|

| Scotiabank | 675K | Amherst Pierpoint | 650K |

| Nomura | 650K | TD Securities | 550K |

| Goldman Sachs | 525K | Jefferies | 525K |

| Societe Generale | 520K | Daiwa | 500K |

| RBC | 480K | Morgan Stanley | 460K |

| Bank of America | 450K | Barclays | 450K |

| BMO | 450K | BNP | 450K |

| J.P.Morgan | 450K | Citi | 410K |

| Deutsche Bank | 400K | HSBC | 400K |

| Wells Fargo | 390K | UBS | 355K |

| Credit Suisse | 350K | Mizuho | 350K |

| NatWest | 350K | -- | -- |

| Dealer Median | 450K | BBG Whisper Number | 500K |

MNI: GERMANY SEP IND PROD -1.1% M/M, -1.0% Y/Y; AUG -3.5% M/M

MNI: FRANCE SEP IP -1.3% M/M, +0.8% Y/Y; AUG +1.0% M/M

FIXED INCOME: BOE Digestion Continues

Gilts continue to lead core fixed income higher with Bunds also above yesterday's highs but Treasuries largely in line with yesterday's highs.

- The market continues to adjust to yesterday's BOE decision to leave rates on hold and push back on market rate expectations. The short sterling strip is continuing to move a bit higher but Eurodollar and Euribor strips have stabilised somewhat.

- Today's Agency Briefing by Ramsden and Pill will be closely watched (although it is unclear whether they will have to speak for the Committee rather than convey their personal views).

- We also have the US employment report. Nonfarm payrolls are expected to come in at 450k on the Bloomberg survey, but there is a large range of forecasts.

- TY1 futures are down 0-0+ today at 131-09+ with 10y UST yields down -0.5bp at 1.524% and 2y yields up 0.7bp at 0.433%.

- Bund futures are up 0.24 today at 170.45 with 10y Bund yields down -1.4bp at -0.241% and Schatz yields up 0.1bp at -0.757%.

- Gilt futures are up 0.45 today at 126.52 with 10y yields down -4.0bp at 0.897% and 2y yields down -4.6bp at 0.432%.

FOREX: It's all about the Pound

- Its all about the Pound this morning given the BoE debacle yesterday.

- New lows across the board for the GBP against JPY, USD, EUR.

- The pound is in the red across G10.

- In terms of technical for the currency, GBPJPY next immediate support is now seen at 15.733.

- Cable is through yesterday's low at 1.3471.

- Further downside traction, opens to 1.3423 2.0% 10-dma env

- Next resistance in EURGBP is seen at 0.8598 76.4% retracement of the Sep 29 - Oct 26 sell-off

- Surprisingly, USD is seeing some buying and that's despite the lower US yields and the Risk On tone, so some divergence/dislocation here.

- The USD is up against all majors, beside the Yen and the SEK.

- Most of the attention turns to the BoE speakers, with Pills Ramsden and Tenreyro.

- On the data front, sees the US NFP, but given the spillovers over from the UK, short term focus is on the speakers

EQUITIES: S&P Futs Holding Near All-Time Highs

- Asian equities closed weaker, with Japan's NIKKEI down 182.8 pts or -0.61% at 29611.57 and the TOPIX down 14.14 pts or -0.69% at 2041.42. China's SHANGHAI closed down 35.298 pts or -1% at 3491.568 and the HANG SENG ended 354.68 pts lower or -1.41% at 24870.51.

- European stocks are trading mixed, with the German Dax down 16.15 pts or -0.1% at 16029.65, FTSE 100 up 27.36 pts or +0.38% at 7279.91, CAC 40 up 20.39 pts or +0.29% at 6987.79 and Euro Stoxx 50 up 4.38 pts or +0.1% at 4333.34.

- U.S. futures are flat, with the Dow Jones mini down 28 pts or -0.08% at 35981, S&P 500 mini up 0.25 pts or +0.01% at 4673.5, NASDAQ mini up 16 pts or +0.1% at 16346.75.

COMMODITIES: Oil Gains, Gas Pulls Back

- WTI Crude up $0.9 or +1.14% at $79.3

- Natural Gas down $0.12 or -2.15% at $5.583

- Gold spot up $4.24 or +0.24% at $1796.36

- Copper up $3.05 or +0.71% at $432.1

- Silver up $0.04 or +0.18% at $23.8369

- Platinum up $6.27 or +0.61% at $1033.65

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.