-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Mixed Start Ahead Of Georgia Runoff

EXECUTIVE SUMMARY:

- U.K. CHANCELLOR SUNAK ANNOUNCES LOCKDOWN GRANTS FOR BUSINESSES

- ITALY BOOSTS COVID LOCKDOWN MEASURES TO AVOID DEADLY RESURGENCE

- GERMAN UNEMPLOYMENT UNEXPECTEDLY FELL DURING DECEMBER LOCKDOWN

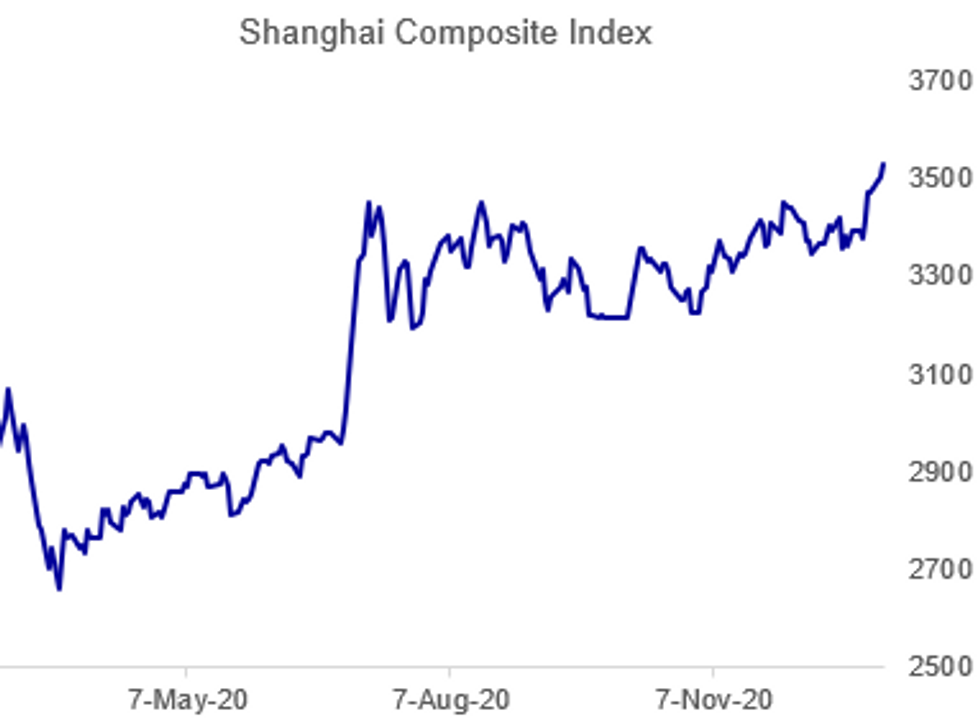

Fig. 1: China Stocks Hit Multi-Year Highs

BBG, MNI

BBG, MNI

NEWS:

U.K.: Chancellor Rishi Sunak is set to announce a new one-off grant for businesses in the retail, hospitality and leisure sectors up to GBP9,000 to assist with the impact of England's new COVID-19 lockdown announced last night by PM Boris Johnson. The pot for these grants will total GBP4.6bn. * Reports there will also be a GBP594mn discretionary fund made available to support other affected businesses.

U.K.: The focus for the UK will be on the announcement last night from Prime Minister Boris Johnson that England would enter a national lockdown until at least the middle of February. The prime minister's hope is that the pressure on the NHS will have receded somewhat by then and that all over 70-year-olds, all of the clinically vulnerable and all NHS and care home workers will have received the first dose of a vaccination by this point. If the timeframe for either the vaccination schedule or the pressure on the NHS lasts longer than expected, the lockdown will likely last longer. Unlike the November lockdown, both primary schools and secondary schools will be closed. The length of the lockdown and the fact that all primary schools will close as well as secondary schools makes the announcement more stringent than many had expected at this point (although even if a shorter lockdown had been announced, it would have been widely expected to have been extended anyway). Similar lockdowns have been announced across the other UK nations (Scotland, Wales and Northern Ireland).

U.K. (BBG): The U.K. government is looking at measures to restrict international travel into the country and is in talks with governments in Scotland, Wales and Northern Ireland, Cabinet Office Minister Michael Gove says. Gove tells LBC Radio government wants to act in a "coordinated way" on border measures. Gove: "I talked to the first ministers of Scotland, Wales and Northern Ireland last night so that we can try to do as quickly as possible whatever is necessary to keep our ports and airports safe"

ITALY (BBG): Italy will extend lockdown measures while also imposing stricter restrictions in an effort to avoid a deadly resurgence of the coronavirus. The government of Italian Prime Minister Giuseppe Conte decided to extend through mid-January some curbs imposed during the holiday season, including a limit of two guests per household, according to a Tuesday statement. There will also be a ban on people leaving their home region.

GERMAN DATA (BBG): German joblessness unexpectedly declined in December, though companies were heavily dependent on government subsidies to keep workers employed through the latest lockdowns. A decrease of 37,000 left the total number of unemployed people at 2.776 million and the rate unchanged at 6.1%, according to the Federal Labor Agency. Economists surveyed by Bloomberg had expected a gain of 10,000.

GERMAN DATA: Germany's auto industry saw a dip in sentiment in December as the renewed lockdowns across Europe weighed, the latest Ifo Business Survey showed. The index, published Tuesday, showed the current situation in the sector fell to -5.4 points in December from +5.0 in the previous month. However, the expectations index rose to +10.1 from -1.6 in November.

OIL (BBG): Oil extended losses after dropping the most in almost two weeks as OPEC+ talks were unexpectedly suspended due to a disagreement over whether to raise output in February as the coronavirus continues to surge. Futures in New York fell toward $47 a barrel after slumping 1.9% on Monday though have subsequently rebounded. Discussions will resume Tuesday after a majority of members, including Saudi Arabia, opposed Russia's proposal for another supply hike. The rift between Riyadh and Moscow brings back memories of last year's crippling price war.

MIDEAST (BBG): Saudi Arabia opened its borders with Qatar for the first time in three years, a leap toward easing a dispute that split the energy-producing region and complicated U.S. efforts to isolate Iran. The decision to open land, air and sea borders comes ahead of a summit of regional leaders in Saudi Arabia on Tuesday. Qatar's ruler will attend for the first time since the 2017 row that cut trade, travel and diplomatic ties with the kingdom, the United Arab Emirates, Bahran and Egypt.

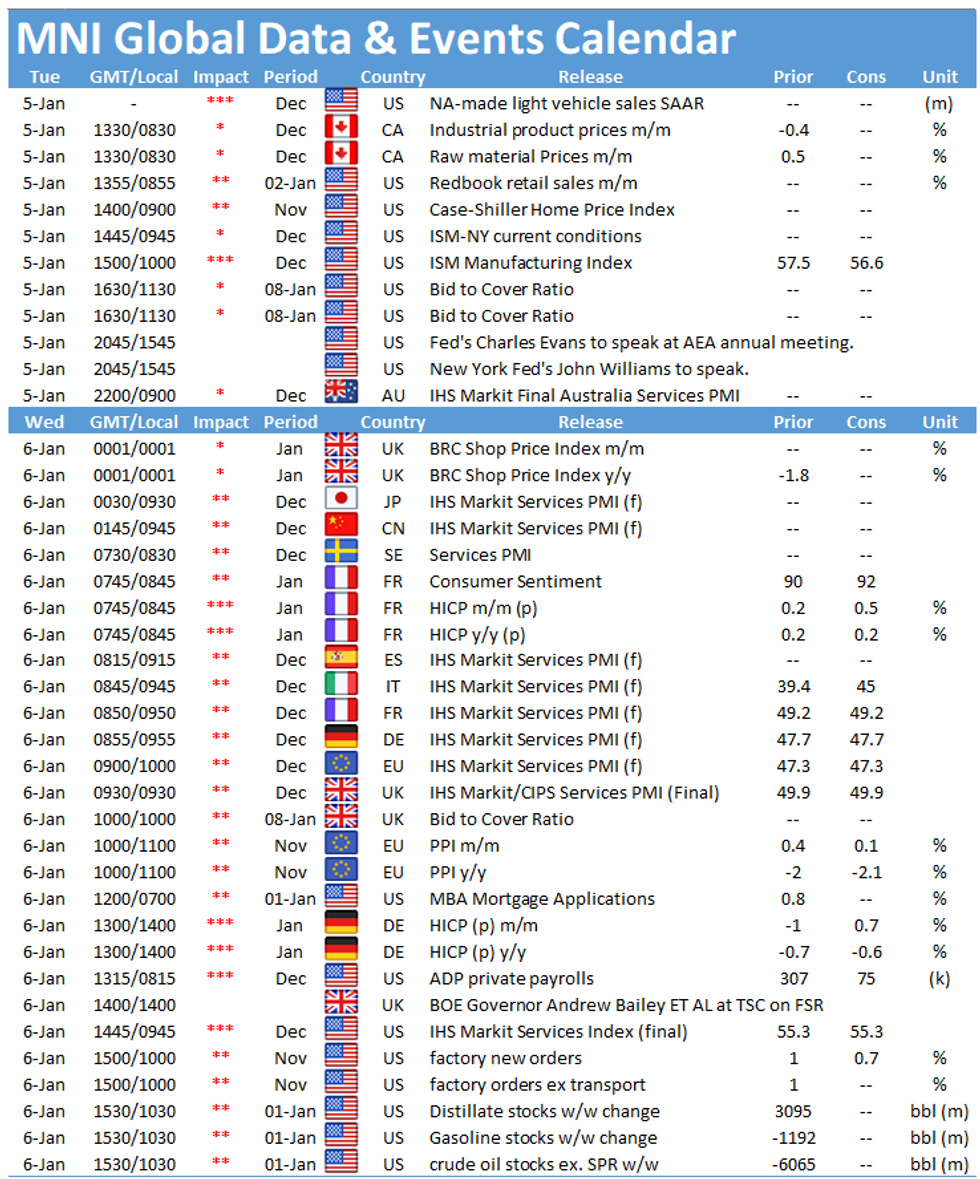

DATA:

MNI: BADEN-W DEC CPI +0.6% M/M, +0.1% Y/Y; NOV +0.1% Y/Y

MNI: GERMANY DEC UE RATE (SA) 6.1%; NOV 6.1%

FIXED INCOME: Large Supply and Georgia Senate Run-Offs in Focus

Market moves have been rather muted this morning with Treasuries and Bunds a little lower on the day but little movement in gilts. However, it has still be a busy day in terms of market activity and interest.

- Supply in the Eurozone is catching the eye with Italy holding a syndicated launch for a new 15-year BTP (with IPTs in excess of E72bln) and Ireland launching a new 10-year bond also via syndication with books over E40bln at writing. Germany will hold the first EGB auction of the year with a E6bln Schatz tap while Slovenia will launch a new 10-year and tap its 30-year in a dual-tranche syndication. In addition, we have seen a number of SSA and corporate borrowers kick off their 2021 funding.

- Voters will go to the polls today for the Georgia Senate run-offs. Results are unlikely to come instantly and a close contest could see us waiting until Thursday or Friday for a result. The counting is likely to follow the process seen in November with in-person votes from mainly Republican areas counted first before areas with large postal votes which are generally more Democrat-leaning likely to take longer to count.

- German retail sales came in stronger than expected this morning and the US data focus will be on the ISM later today.

- TY1 futures are down -0-3 today at 138-01 with 10y UST yields up 1.8bp at 0.932% and 2y yields up 0.2bp at 0.117%.

- Bund futures are down -0.04 today at 178.08 with 10y Bund yields up 1.0bp at -0.596% and Schatz yields up 0.3bp at -0.725%.

- Gilt futures are unch today at 135.60 with 10y yields up 1.4bp at 0.185% and 2y yields up 0.8bp at -0.155%.

FOREX SUMMARY

A mix early start for FX today, with USD taking its cue from Equity price movements.

- USD remains in negative territory against all majors, ahead of the two Georgia Senate run-off.

- GBP trades within ranges, despite the UK new lockdown measures, more of a USD function.

- Cable is flat on the day at 1.3570.

- EURUSD tested session high at 1.2284, but still short of the big 1.2310 High Dec 30 and the bull trigger.

- We have a small triple top here, with the pair also printing 1.2309 on the 31st Dec and yesterday.

- Yuan has given back some of its overnight gains, which were driven by the NYSE scrapping plans to delist China's 3 biggest state owned communication firms.

- Overnight desk, noted USD local demand for the initial reversal.

- AUD is the best performer in G10 against the Greenback, up 0.69% at the time of typing.

- Looking ahead, US ISM Manufacturing is the data of note, and Fed Williams, Evans are the scheduled speakers.

- Short term focus (this week), is on the US election run-offs results.

EQUITIES: Mixed Start To Tuesday Trade

- Asian stocks closed mixed, with Japan's NIKKEI down 99.75 pts or -0.37% at 27158.63 and the TOPIX down 3.37 pts or -0.19% at 1791.22. China's SHANGHAI closed up 25.719 pts or +0.73% at 3528.677 and the HANG SENG ended 177.05 pts higher or +0.64% at 27649.86

- European equities are likewise trading mixed, with the German Dax down 5.22 pts or -0.04% at 13726.74, FTSE 100 up 31.14 pts or +0.47% at 6571.88, CAC 40 down 1 pts or -0.02% at 5588.96 and Euro Stoxx 50 up 1.08 pts or +0.03% at 3564.39.

- U.S. futures are slightly higher, with the Dow Jones mini up 69 pts or +0.23% at 30172, S&P 500 mini up 8.75 pts or +0.24% at 3701, NASDAQ mini up 26.5 pts or +0.21% at 12711.75.

COMMODITIES: Oil Recovers From The Lows

WTI oil prices have risen from Monday's lows (just above $47) as OPEC+ continues to weigh the potential for output cuts.

- WTI Crude up $0.42 or +0.88% at $47.65

- Natural Gas up $0.11 or +4.18% at $2.682

- Gold spot up $3.34 or +0.17% at $1941.54

- Copper up $4.95 or +1.39% at $359.15

- Silver up $0.19 or +0.71% at $27.3004

- Platinum down $0.54 or -0.05% at $1071.46

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.