-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI US Open: Strong Tech Earnings Set Bullish Tone

EXECUTIVE SUMMARY:

- TECH GIANTS DELIVER FOR STOCK MARKET SEEKING SPARK

- EUROZONE ECONOMIC CONFIDENCE RISES IN APRIL AS COVID VACCINATIONS ACCELERATE

- CHINA TO RESTRICT, NOT END, SUPPORT FOR LGFVs (MNI EXCLUSIVE)

- EU SAYS GATEWAY FOR VACCINE PASSPORTS UP AND RUNNING IN JUNE

- GERMAN APRIL STATE INFLATION DATA COMING IN ON HIGH SIDE

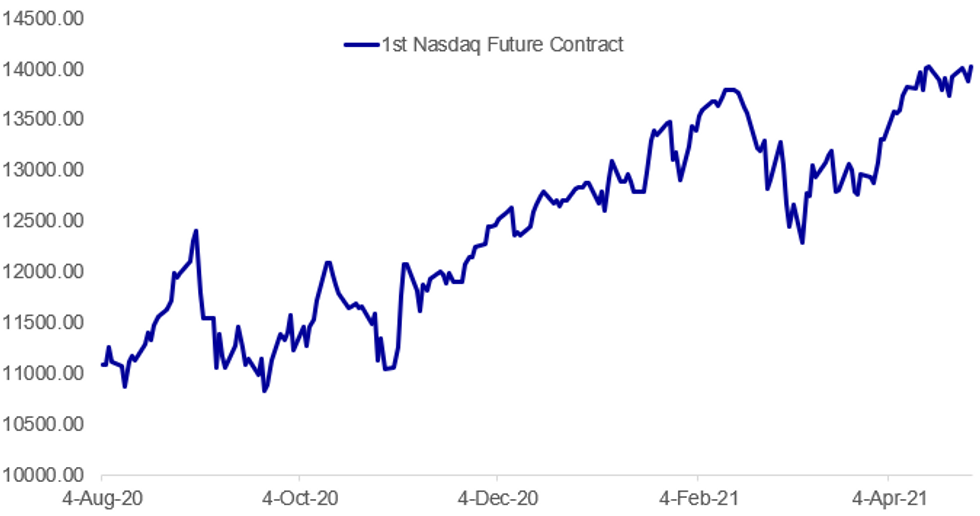

Fig. 1: Earnings Boost

BBG, MNI

BBG, MNI

NEWS:

EQUITIES (BBG): The latest batch of tech earnings provided welcome news for a market paralyzed by a jolt of major events this week. Futures contracts on the tech-heavy Nasdaq 100 Index rose 1% as of 10 a.m. in London, while those on the S&P 500 Index gained 0.7%. The Stoxx Europe 600 Index advanced 0.4%.The gains signaled a positive day for tech stocks. Apple Inc. rose in premarket after its revenue crushed estimates and Facebook Inc. surged after reporting gains in sales and users.

GLOBAL CHIP SHORTAGE (BBG): The global chip shortage is going from bad to worse with automakers on three continents joining tech giants Apple Inc. and Samsung Electronics Co. in flagging production cuts and lost revenue from the crisis.In a dizzying stretch of 12 hours, Honda Motor Co. said it will halt production at three plants in Japan for around five to six days next month; BMW AG flagged it will pause Mini car production at its Oxford, England, factory for three days; and Ford Motor Co. reduced its full-year earnings forecast due to the debilitating chip shortage, which it sees extending into next year.

CHINA (MNI EXCLUSIVE): China will continue to help local government financing vehicles through short-term liquidity crunches despite an official statement seemingly withdrawing implicit guarantees for their debt as any dent in the bonds' safety record could have major ramifications for the regional economy, policy advisors told MNI. For full article contact sales@marketnews.com

EU VACCINE PASSPORT: @vonderleyen Tweets: "We will have the EU gateway up and running by June, while supporting the timely rollout of national systems."

DATA:

EZ ESI Beats Expectations in April

Economic Sentiment Indicator (ESI): 110.3; Prev (Mar): 100.9

Consumer: -8.1(Mar: -10.8); Industry: +10.7 (Mar: +2.1); Services: -2.1 (Mar: -9.6); Retail: -3.1 (Mar: -12.2); Construction: +2.9 (Mar: -2.3)

- The EZ ESI surged by 9.4pt to 110.3 in Apr, beating expectations of an uptick to just 102.0.

- The index now stands at the highest level since Sep 2018, rising above pre-crisis levels for the first time since the start of the pandemic.

- April's increase was broad-based with every industry posting m/m gains, led by an 11.7pt uptick in the service sector with service sentiment recording the first positive and the highest reading since Feb 2020.

- Retail trade confidence gained 9.1pt and rose to a 14-month high of -3.1, while consumer sentiment registered in line with the flash estimate showing an increase to -8.1.

- Industrial sentiment rose further in Apr by 8.6pt, marking the fifth consecutive gain and the highest level on record, while confidence in the construction sector ticked up 5.2pt and recorded the first positive reading since Feb 2020.

- The ESI increased markedly in the six biggest EZ economies, led by Poland (+11.3pt), the Netherlands (+10.7pt) and Spain (+9.1pt), France (+8.5pt), Germany (+5.7pt) and Italy (+5.3pt).

- The employment expectations index increased to 107.1 in Apr, marking the highest level since Jun 2019.

MNI: SAXONY APR CPI +0.8% M/M, +2.2% Y/Y; MAR +1.7% Y/Y

MNI: HESSE APR CPI +0.7% M/M, +1.9% Y/Y; MAR +1.7% Y/Y

MNI: BADEN-W MAR CPI +0.6% M/M, +2.1% Y/Y; MAR +1.9% Y/Y

MNI: BRANDENBURG APR CPI +0.7% Y/Y, +2.2% M/M; MAR +2.0% Y/Y

MNI: BAVARIA MAR CPI +0.6% M/M, +2.0% Y/Y; MAR +1.8% Y/Y

MNI: GERMANY MAR IMPORT PRICES +1.8% M/M, +6.9% Y/Y

MNI: GERMANY APR UE RATE (SA) 6.0%; MAR 6.0%

MNI: EZ MAR M3 10.1% Y/Y; FEB 12.2%r Y/Y

MNI: SPAIN APR FLASH HICP +1.1% M/M, +1.9% Y/Y; MAR +1.2% Y/Y

FIXED INCOME: Curves lean bear steeper

A steady early session for Global Govies, taking their cue from the underpinned risk, following Apple and FB beats yesterday.

- German curve is bear steeper, and the Bund contract has mostly been better offered, but well within the past session's range.

- Peripheral spreads against the German 10yr are mixed, Greece 1bp tighter, and Spain 0.6bp wider.

- Italian 5yr, 10yr supplies, which equated combined to 28k BTP, had no impact on the BTP.

- Gilts have traded inline with EGBs so far today, with the curve also leaning steeper.

- US Treasuries trade on the backfoot, just ahead of initial support at 131.25 (despite printing 131.23 low yesterday).

- US 10yr yield is just short of yesterday's high at 1.6556% (1.6504% today).

- Looking ahead, we get German National CPI, US IJC, Advance GDP, and core PCE.

- Speakers include ECB Weidmann, Holzmann and Fed Quarles.

- Earning Tech season continues, with Twitter and Amazon (after mkt).

- Also, CAT, Comcast, Mastercard, those will be pre mkt..

FOREX: USD Index Sees Small Bounce Off New Multi-Month Lows

- Currency markets started the Asia-Pacific session as the US left off, with prevailing USD weakness extending the trend into the European morning. EUR/USD's strength persisted into 1.2150, although these gains have largely faded into NY hours. This leaves the USD index just above the multi-month lows printed this morning at 90.424.

- JPY remains weaker, with EUR/JPY, USD/JPY holding within their bullish short-term trend. This keeps USD/JPY on track to test yesterday's highs at 109.08, with firmer equity markets this morning adding a further catalyst.

- The e-mini S&P now looks comfortable above the 4,200 mark, with Apple and Facebook's earnings yesterday providing support - both companies trade sharply higher pre-market.

- JPY, AUD are the weakest, GBP, CAD and CHF the strongest at the NY crossover.

- Regional German CPIs, advance Q1 GDP data and initial weekly jobless claims from the US take focus going forward. Central bank speakers today include ECB's Weidmann & Holzmann and Fed's Quarles.

EQUITIES: NASDAQ Futures Bask In Earnings Afterglow

- China/HK markets closed higher (Japan on holiday), with China's SHANGHAI closed up 17.833 pts or +0.52% at 3474.901 and the HANG SENG ended 231.92 pts higher or +0.8% at 29303.26

- European equities are trading mixed, with the German Dax down 47.95 pts or -0.31% at 15245.5, FTSE 100 up 48.41 pts or +0.7% at 7011.5, CAC 40 up 33.94 pts or +0.54% at 6340.56 and Euro Stoxx 50 up 6.29 pts or +0.16% at 4021.99.

- U.S .futures are higher, with the Dow Jones mini up 118 pts or +0.35% at 33842, S&P 500 mini up 26.5 pts or +0.63% at 4202.75, NASDAQ mini up 137 pts or +0.99% at 14029.25.

COMMODITIES: Industrials Outperforming

- WTI Crude up $0.51 or +0.8% at $64.38

- Natural Gas down $0.02 or -0.64% at $2.942

- Gold spot down $4.9 or -0.28% at $1776.99

- Copper up $2.95 or +0.66% at $452.75

- Silver up $0.11 or +0.42% at $26.3201

- Platinum down $2.29 or -0.19% at $1219.15

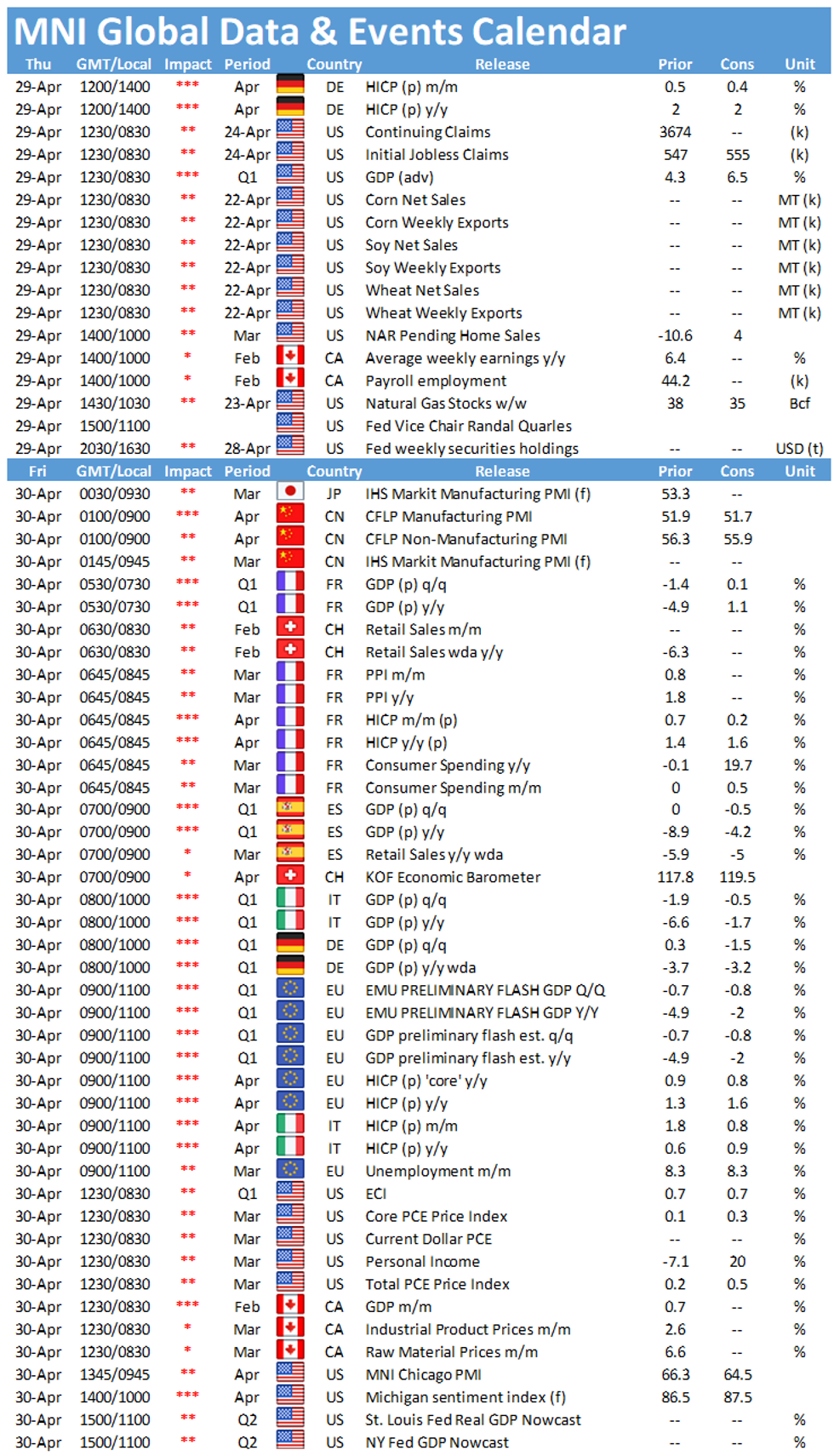

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.