-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Surprisingly Strong Eurozone PMIs

EXECUTIVE SUMMARY:

- EUROZONE PMIS SURPRISE TO THE UPSIDE IN MARCH

- U.K. INFLATION UNEXPECTEDLY FELL IN FEB

- MERKEL, STATE LEADERS TO DISCUSS LOCKDOWN MEASURES

- ASTRAZENECA MAY HOLD IN ITALY 29M DOSES FOR U.K. MKT: STAMPA

- SHIP STUCK IN SUEZ CANAL RISKS BLOCKING KEY TRADE ROUTE FOR DAYS

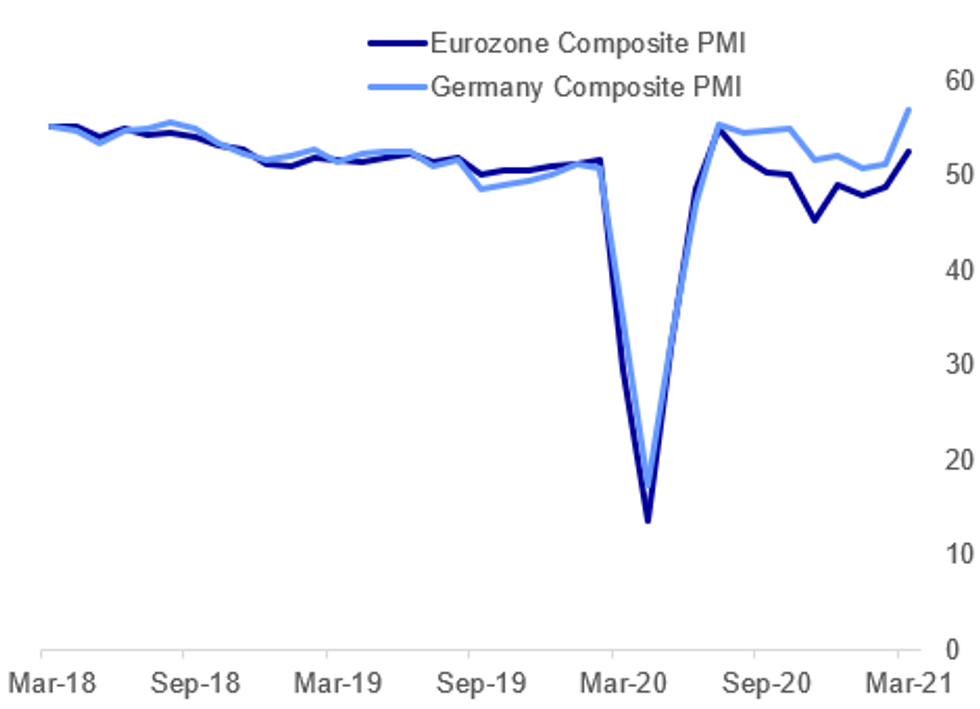

Fig. 1: Eurozone PMIs Surprise To The Upside

IHS Markit, MNI

IHS Markit, MNI

NEWS:

FRANCE PMI: Highlights from the press release which seem largely positive. First stabilisation in new orders for 60months, new export orders fastest for 3 years, additional hiring of staff and outlook strong for year ahead.

- "The softer contraction in overall activity came amid a stabilisation in new orders during March. The result ended a six-month sequence in which demand conditions had deteriorated. Underlying data pointed to a sharp improvement at manufacturers which was offset by a further decrease among service providers. Some panellists commented that demand was building amid anticipation for the reopening of the economy, while others noted that ongoing restrictions continued to hinder sales."

- "Overall stabilisation in new work was supported by an improvement in international demand conditions during March. In fact, new export orders increased for the second month running and the fastest rate for just over three years."

- "Continuing the trend seen in the first two months of the year, French businesses took on additional staff at the end of the first quarter. Moreover, the rate of increase was the strongest for almost two-and-a-half years and solid overall. Sector data indicated that hiring was broad-based"

- "Finally, despite the degree of positivity easing slightly from February, confidence towards the one year business outlook remained strong. Anecdotal evidence indicated that firms expect an improvement in demand once COVID-19 restrictions are relaxed."

GERMAN PMI: Strong demand from China for manufactured exports, upbeat about the outlook but prices increased (with biggest rate of factory gate price inflation on record - since September 2002). Note most responses received before the lockdown was extended.

- Manufacturing "firms reported rising sales to Asia (particularly China), Europe and the US leading to record growth in goods export orders."

- "Manufacturers remained strongly upbeat about the year-ahead outlook for output. The degree of optimism was down slightly since February but still the third-highest on record (since July 2012). Service providers meanwhile raised their expectations for future activity, recording their highest level of confidence since March 2018."

- "Average prices charged for goods and services meanwhile rose to the greatest extent for two years in March. While services firms increased their output prices for the first time in three months, the main driver was a further acceleration in the rate of factory gate price inflation to a series record high (since September 2002)."

EUROZONE PMI: Most of the rest of the Eurozone grew in line with France (rather than Germany), according to the PMI press release. Other highlights:

- "Divergent trends were seen by sector. While manufacturing output growth accelerated sharply to the highest since data were first available in 1997"

- "The rate of contraction in the service sector nevertheless moderated to the slowest seen over this period, thanks to spill-over benefits from strong manufacturing growth, a modest easing of virus containment measures and encouraging prospects for the year ahead."

GERMANY (BBG): German Chancellor Angela Merkel to discuss lockdown measures with state leaders at a 11 a.m. meeting, DPA reports, without saying where it got the information. Meeting to focus on criticisms of recent lockdown decisions.

CHINA/TECH (BBG): China's government has proposed establishing a joint venture with local technology giants that would oversee the lucrative data they collect from hundreds of millions of consumers, according to people familiar with the matter. The preliminary plan, which is being led by the People's Bank of China, would mark a significant escalation in regulators' attempts to tighten their grip over the country's internet sector. It envisions the creation of a government-backed entity along with some of China's biggest e-commerce and payments platforms, the people said, asking not to be identified as the discussions are private.

GLOBAL (BBG): It may take days for salvage crew to move the giant container vessel that's clogging the Suez Canal out of the way, according to two people familiar with the situation. The vessel, Ever Given, is well and truly stuck in the embankment along the canal, according to two people familiar with the situation, who asked not to be identified discussing private details. The ship has been jammed length-ways across the canal early Tuesday in Egypt, leaving at least 100 vessels gridlocked.

ITALY/ASTRAZENECA/UK (BBG): A stock of 29 million doses of the AstraZeneca Plc vaccine is ready for export to the U.K. at an Italian plant, according to a report by Italian daily La Stampa. The doses at the Catalent Inc. vial filling plant in Anagni, near Rome, were found by Italian authorities after a report by the European Commission, the executive arm of the European Union, the paper said. At least some of them were allegedly produced by Astra sub-contractor Halix in the Netherlands, according to the paper, which can produce some 5 million doses per month.

DATA:

FRANCE FLASH MAR MFG PMI 58.8; FEB 56.1

GERMANY FLASH MAR MFG PMI 66.6; FEB 60.7

EZ FLASH MAR MFG PMI 62.4; FEB 57.9

UK Inflation Fell In Feb In Contrast To Forecasts

FEB CPI +0.1% M/M, +0.4% Y/Y VS +0.7% Y/Y JAN

FEB CORE CPI 0.0% M/M, +0.9% Y/Y VS +1.4% Y/Y JAN

FEB OUTPUT PPI +0.6% M/M; +0.9 % Y/Y VS +0.1% Y/Y JAN

FEB INPUT PPI +0.6% M/M; +2.6% Y/Y VS +1.6% Y/Y JAN

The headline annual CPI ticked down in Feb to 0.4%, below market median predictions (0.8%) and marking the lowest level since Nov. This marks the 19th straight reading below the BOE's 2.0% target. Core inflation edged down to 0.9% in Feb, coming in weaker than expectations (1.4%) as well. The divergence of seasonal patterns, especially for clothing, led to the decline in Feb. The largest downward contribution came from clothing and footwear, shaving off 0.17pp from CPI growth. Prices for these products would traditionally rise in Feb following Jan discounting due to winter sales, the ONS noted. However, this year discounting continued due to the pandemic. The biggest upward contribution was seen from transport, adding 0.04pp to price growth. The ONS noted that prices at the pump increased in Feb, in contrast to declines recorded in the previous year at this time. Output inflation ticked up to 0.9%, while input inflation rose to 2.6%.

FIXED INCOME: Rally stalled by strong European PMI data

Core fixed income had been on a relentless march higher, although the slightly better than expected French flash PMI followed by the much better than German flash PMI has seen bonds retreat from their highs.

- Both the French and German PMI surveys were largely compiled before lockdowns were extended, so can both be taken with a pinch of salt. The French PMI showed the first stabilization in new orders for 60months, new export orders at their fastest rate for 3 years, additional hiring of staff and a strong outlook for year ahead. The German PMIs were also upbeat but note that factory prices increased at a record pace (since the series began in September 2002). The pan-Eurozone PMIs were more in line with the French numbers but did show manufacturing growth at the fastest pace since data began in 1997, with services still contracting, but at the slowest pace since the pandemic began.

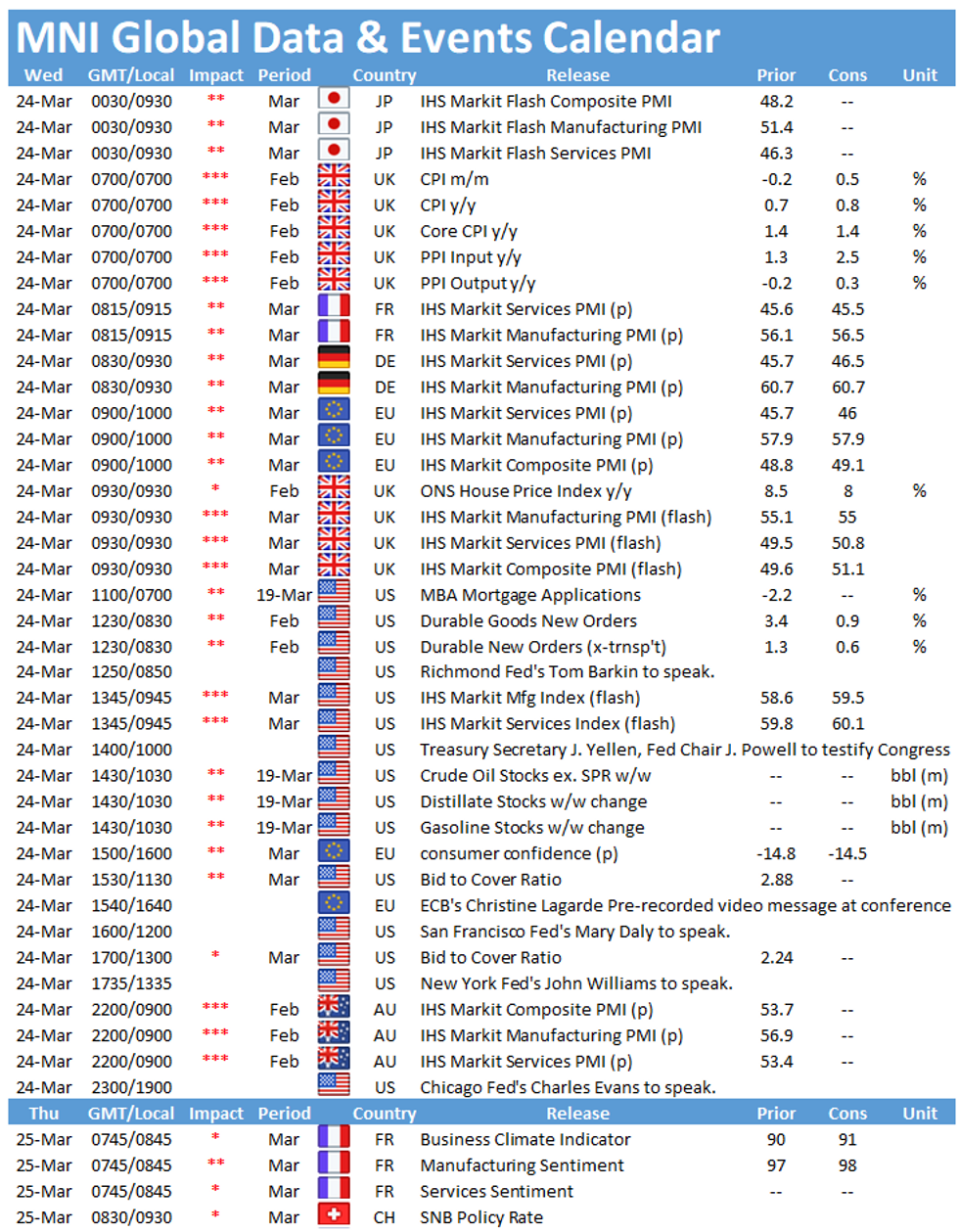

- There is still a fairly heavy data calendar to look forward to with flash PMI prints from the UK and US and durable goods in the US the highlights. There is another busy day of central bank speakers scheduled, too.

- TY1 futures are up 0-5 today at 132-02+ with 10y UST yields down -0.7bp at 1.615% and 2y yields down -0.3bp at 0.146%.

- Bund futures are up 0.30 today at 172.22 with 10y Bund yields down -1.8bp at -0.361% and Schatz yields down -0.1bp at -0.717%.

- Gilt futures are up 0.29 today at 128.58 with 10y yields down -2.2bp at 0.739% and 2y yields down -0.2bp at 0.038%.

FOREX: Lower Than Expected Inflation Knocks GBP

- GBP is soft, trading lower against all others in G10, as GBP/USD continues the recent downtrend after yesterday's close below the 50-dma. The rate now targets the 100-dma at 1.3619, a level not closed below since late June last year. Soft inflation numbers were largely responsible, with CPI and RPI both missing expectations for February.

- Elsewhere, commodity-tied FX is firmer, with NOK and CAD improving as equity futures and oil markets bottom out and point higher ahead of NY hours.

- Focus turns to prelim February US durable goods orders, which are expected to slow to 0.5% from 3.4% previously. Prelim March PMI data also could prove interesting, with the US release due just after the Wall Street opening bell.

- The speaker slate is again busy, with Fed's Powell appearing in front of the Senate alongside Treasury Secretary Yellen. Fed's Williams, Daly, Evans & Barkin are due, as well as ECB's Lagarde on climate change.

EQUITIES: Strong Bounce Off Lows For Europe And US

- Asian stocks closed weaker, with Japan's NIKKEI down 590.4 pts or -2.04% at 28405.52 and the TOPIX down 42.9 pts or -2.18% at 1928.58. China's SHANGHAI closed down 44.448 pts or -1.3% at 3367.061 and the HANG SENG ended 579.24 pts lower or -2.03% at 27918.14.

- European stocks are lower, with the German Dax down 64 pts or -0.44% at 14570.19, FTSE 100 down 7.62 pts or -0.11% at 6683.55, CAC 40 down 17.92 pts or -0.3% at 5912.92 and Euro Stoxx 50 down 0.23 pts or -0.01% at 3820.83.

- U.S. futures are advancing, with the Dow Jones mini up 85 pts or +0.26% at 32392, S&P 500 mini up 14.75 pts or +0.38% at 3914.5, NASDAQ mini up 126.5 pts or +0.97% at 13133.75.

COMMODITIES: Oil Leads Broad-Based Bounce

- WTI Crude up $1.27 or +2.2% at $58.8

- Natural Gas up $0.02 or +0.76% at $2.529

- Gold spot up $5.11 or +0.3% at $1730.54

- Copper up $0.65 or +0.16% at $408.65

- Silver up $0.2 or +0.8% at $25.1916

- Platinum up $10.09 or +0.86% at $1175.29

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.