-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Underwhelming Reaction To Biden Plan

EXECUTIVE SUMMARY:

- U.K. NOVEMBER GDP DECLINES AMID SECOND LOCKDOWN

- CLOCK TICKS FOR ITALY'S CONTE AS HE BRACES FOR SENATE VOTE

- U.S. DEC RETAIL SALES GROWTH SEEN STALLING (MNI REALITY CHECK)

- E.C.B. WARNS BANKS HAVE YET TO FULLY FEEL PANDEMIC'S IMPACT

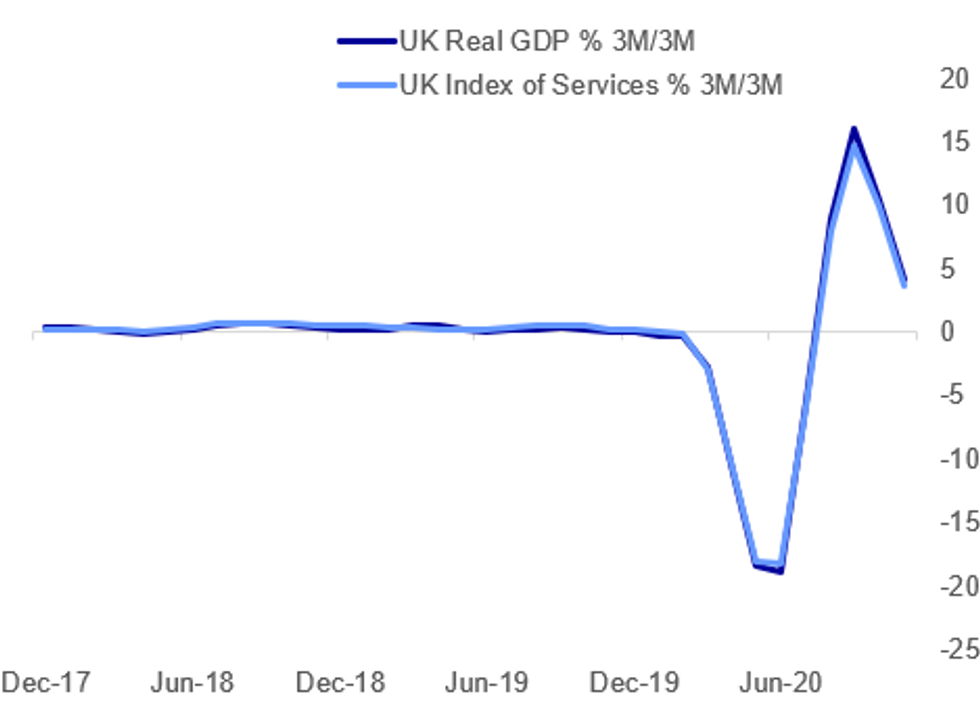

Fig. 1: U.K. GDP Contracts Less Than Expected In November

ONS, MNI

ONS, MNI

NEWS:

U.K. DATA: The UK economy contracted in November as the second lockdown in England came into force. Tighter restrictions weighed particularly on the service sector with pubs, restaurants and hairdressers seeing the largest impact on business. However, GDP outperformed expectations looking for a bigger drop. GDP contracted by 2.6% in November, the first monthly decline since April, but sill managed to exceed expectations as manufacturing and construction held up well and schools remained open, limiting the impact of the restrictions on the economy compared to the first lockdown. Nevertheless, output remains 8.5% below the pre-pandemic level. December would need to record a 0.9% drop to yield a flat reading in Q4. Annual output decreased by 8.9%, marking the largest decline since July.

ITALY (BBG): Italian Prime Minister Giuseppe Conte is racing to forge a new majority that would keep him in power after a junior ally abandoned him, with the day of reckoning set for Tuesday in a Senate vote. But the premier's options -- and his room for maneuver -- are limited.Conte, a two-time premier who until 2018 was an obscure law professor, is scrambling to win over enough lawmakers to revive his majority after ex-Premier Matteo Renzi on Wednesday pulled his party's ministers from the ruling coalition. The task will be particularly challenging with a confidence vote due Tuesday in the Senate, where Conte's government already had a razor-thin majority, according to officials who asked not to be named discussing a confidential issue. A vote is also due in the lower house Monday.

U.S. (MNI REALITY CHECK): U.S. retail sales growth was likely stagnant in December, figures due Friday should show, as increasing virus cases and still-dampened consumer confidence muted holiday spending and mobility, industry experts told MNI. For full article contact sales@marketnews.com

U.K. (BBG):: Insurers lost a last-ditch attempt to dodge payouts to thousands of small businesses that were forced to close during lockdown, as the U.K.'s top court ruled in favor of policyholders in a dispute over Covid-19 claims. The U.K. Supreme Court ruled Friday that policies sold by six firms including RSA Insurance Group Plc and Hiscox Ltd. cover losses sustained when businesses were shut down to help slow the spread of the outbreak. The firms had appealed a lower-court decision in September that found some policies in a test case brought by the U.K.'s top markets regulator should pay out.

E.C.B/BANKS (BBG): The full effect of the pandemic crisis on euro-area banks has yet to be felt as policy support so far has masked losses, several European Central Bank officials warned."The crisis is not over, and its economic impacts have still to fully emerge," Irish governor Gabriel Makhlouf said on a panel Friday. "Euro-area banks are likely to face significant losses and further pressure on their already weak profitability prospects" and must be "extremely prudent" on issuing dividends and ensure their capital is able to absorb those losses, he added.Makhlouf spoke alongside several of his Governing Council colleagues, including Lithuania's Vitas Vasiliauskas, who warned of similar risks.

E.C.B./BANKS: The euro area needs a harmonised, fit-for-purpose crisis management framework for small and medium-sized banks, the head of the European Central Bank's banking supervision arm said Friday, with "significant" deterioration in banks' asset quality a possibility once government pandemic support measures are lifted. The impact of the COVID-19 pandemic on banks' balance sheets has so far remained limited, Andrea Enria said in a speech, but he cautioned against complacency and said a crisis management framework model similar to the US Federal Deposit Insurance Corporation (FDIC) "is the model to look at."

B.O.J.: The Bank of Japan will remain committed to an upper limit of exchange-traded fund purchases as it doesn't want to spook equity market investors who could incorrectly see a scaling back as a sign of policy tightening by the central bank, MNI understands. For full article contact sales@marketnews.com

DATA:

UK OCT GDP -2.6% (MEDIAN -4.0%, OCT 0.4%,)

MNI: FRANCE DEC FINAL HICP +0.2% M/M, 0.0% Y/Y; NOV +0.2% YY

MNI: SPAIN DEC FINAL HICP +0.2% M/M, -0.6% Y/Y; NOV -0.8% Y/Y

FIXED INCOME: Continuing to digest political events

With little in the way of new news this morning other than better expected economic activity during the UK's November lockdown, markets have continued to digest the events of yesterday and overnight.

- During the Asian session Treasuries rallied as the market reacted to little new news from Biden's stimulus plan. Bunds and gilts showed little reaction to this news however and through the European morning session core bond yields have declined as risk sentiment seems to have improved.

- We have also seen most peripheral spreads in the Eurozone tighten, led by BTP spreads. 10-year BTP-Bund spreads are 4bp tighter on the day at writing, reversing some of the politically-driven spread widening seen over the past few days. Consensus has shifted to thinking that the PM Conte can continue on in his current role for at least the short-term with support from across the political spectrum.

- TY1 futures are up 0-3+ today at 136-21+ with 10y UST yields down -1.8bp at 1.112% and 2y yields up 0.1bp at 0.142%.

- Bund futures are down -0.25 today at 177.59 with 10y Bund yields up 1.0bp at -0.540% and Schatz yields up 0.3bp at -0.729%.

- Gilt futures are down -0.16 today at 134.28 with 10y yields up 1.0bp at 0.300% and 2y yields down -0.2bp at -0.129%.

FOREX: Markets Sluggish Post-Biden Stimulus Plan

Early trade in FX favouring USD, JPY and haven currencies more generally - growth proxies suffering a little, with CNH, AUD, CAD all hitting the day's lows just ahead of the NY crossover.

The outlining of Biden's plans for a $1.9trl stimulus package has raised concerns of swift, sharp opposition from Republican lawmakers over spending on Democratic priorities including aid to state and local governments. More details are expected at a joint session of Congress in February.

CAD, AUD and NZD are among the poorest performers early Friday as WTI and Brent roll off their respective cycle highs printed earlier n the week. Both benchmark oil contracts are off close to 1.5% apiece ahead of the final COMEX open of the week.

Earnings season gets underway in earnest Friday, with reports due from Wells Fargo, Citigroup and JPMorgan later today. US PPI and retail sales and industrial production for December also cross as well as the prelim Uni. of Michigan sentiment numbers.

EQUITIES: Weak Start to Friday, US Bank Earnings Eyed

- Asian stocks closed mixed, with Japan's NIKKEI down 179.08 pts or -0.62% at 28519.18 and the TOPIX down 16.67 pts or -0.89% at 1856.61. China's SHANGHAI closed up 0.473 pts or +0.01% at 3566.378 and the HANG SENG ended 77 pts higher or +0.27% at 28573.86.

- European stocks are weaker, with the German Dax down 87.48 pts or -0.63% at 13955.98, FTSE 100 down 21.35 pts or -0.31% at 6772.07, CAC 40 down 27.18 pts or -0.48% at 5646.69 and Euro Stoxx 50 down 20.93 pts or -0.57% at 3629.46.

- U.S. futures are lower, with the Dow Jones mini down 118 pts or -0.38% at 30791, S&P 500 mini down 15.5 pts or -0.41% at 3775.75, NASDAQ mini down 33 pts or -0.26% at 12868.

- Earnings season continues today - larger reports due are:

* JPMorgan at 1200GMT/0700ET

* Wells Fargo at 1300GMT/0800ET

* Citigroup at 1300GMT/0800ET

COMMODITIES: Oil Weaker In Mild Risk-Off Session

- WTI Crude down $0.73 or -1.36% at $53.11

- Natural Gas up $0.06 or +2.36% at $2.728

- Gold spot up $7.27 or +0.39% at $1852.44

- Copper down $3.05 or -0.83% at $362.15

- Silver down $0.09 or -0.36% at $25.3819

- Platinum down $22.27 or -1.98% at $1097.78

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.