-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: UST Rally Building

MNI US Open: UST Rally Building

HIGHLIGHTS:

- UST CURVE CONTINUES TO FLATTEN POST-FOMC

- UK RETAIL SALES WEAKER THAN EXPECTED

- CHINESE OFFICIALS SAID TO BE CONSIDERING FURTHER LOOSENING OF BIRTH RULES

- LIB DEM WIN EATS INTO TORY BLUE WALL

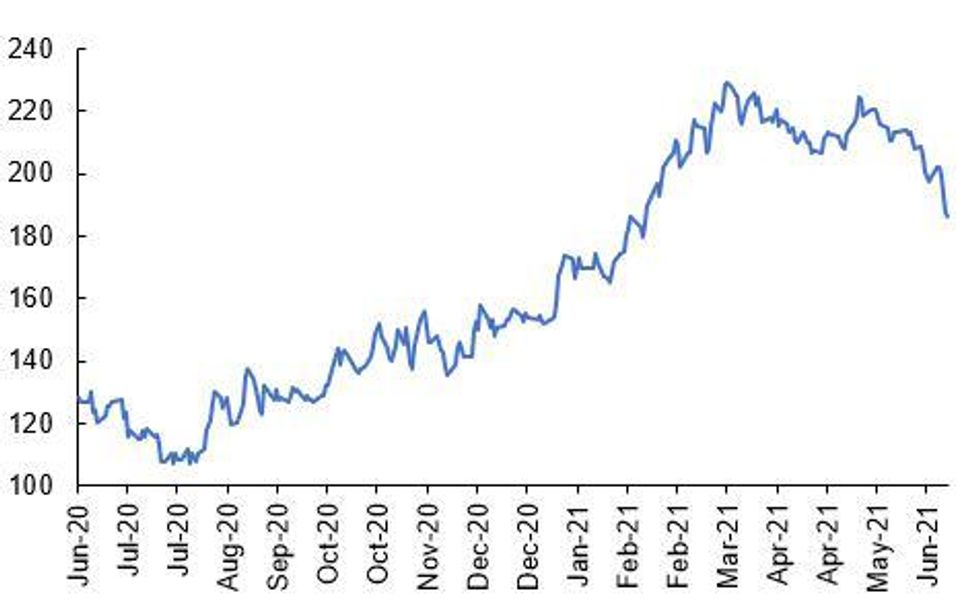

Source: MNI/Bloomberg

NEWS

UK (GUARDIAN): UK exports of food and drink to the EU dropped by almost half in the first three months of 2021 from a year earlier, in what trade groups said was a measure of the impact of post-Brexit trade barriers. Produce to the value of £1.7bn was exported to European countries in the first quarter of the year, down 46.6 per cent from 2020, according to the Food and Drink Federation, an industry body. The decline from 2019, when exports were unaffected by the pandemic, was even greater — a drop of 55.1 per cent, or £2bn. Dominic Goudie, head of international trade at the FDF, said: "The loss of £2bn of exports to the EU is a disaster for our industry, and is a very clear indication of the scale of losses that UK manufacturers face in the longer term due to new trade barriers with the EU."

CHINA (WSJ): Chinese officials are drawing up plans to further loosen birth restrictions and transition toward policies that explicitly encourage childbirth, according to people familiar with the matter, reflecting increased urgency in Beijing as economic growth slows and China's population mix skews older. Policy makers are discussing the possibility of fully doing away with birth restrictions by 2025, the end of the ruling Chinese Communist Party's current five-year economic plan, according to one of the people. According to that person, China will likely begin by eliminating birth restrictions in provinces where the birthrate is the lowest before enacting nationwide changes. The party said late last month that it would allow all couples to have as many as three children, weeks after a once-in-a-decade census showed China, the world's most populous nation, on the cusp of a historic downturn in its population.

UK (BBC): The Liberal Democrats have pulled off a stunning by-election victory, overturning a 16,000 majority in a seat that has always voted Conservative. Lib Dem leader Ed Davey said the Chesham and Amersham result "sends shockwaves through British politics". The party's candidate Sarah Green won by 8,028 votes from the Tories, with the Green Party in third place. Labour had the worst by-election result in the party's history, with just 622 votes. The result is a major boost for the Liberal Democrats after their disappointing performance at the 2019 general election and brings their total number of MPs at Westminster to 12.

HONG KONG (GUARDIAN): Hongkongers queued at city news stands before dawn on Friday to buy the latest edition of the Apple Daily newspaper, a day after national security police arrested its editor-in-chief and four other directors. On Thursday morning hundreds of officers from the Hong Kong police national security department raided the homes of the employees, including editor-in-chef Ryan Law, and the Apple Daily newsroom for the second time in less than a year. It froze millions of dollars in company assets. Police said the raid and arrests were due to alleged breaches of the national security law's clause against foreign collusion, via more than 30 articles calling for international sanctions against Hong Kong and China. Media and rights groups said authorities were using the law to crackdown on a vocal critic.

UK Retail Sales Fell in May

UK MAY RETAIL SALES -1.4% M/M; +24.6% Y/Y

UK MAY RETAIL SALES EX-FUEL -2.1% M/M; +21.7% Y/Y

UK APR TOTAL SALES UNREVISED AT +9.2% M/M

UK MAY RETAIL SALES DEFLATOR +2.2% Y/Y; EX-FUEL +1.2% Y/Y

- UK retail sales declined by 1.4% in May, in contrast to markets looking for an uptick (BBG: 1.5%). This follows a sharp increase in Apr which was impacted by the reopening of shops.

- Nevertheless, sales are 9.1% above the pre-pandemic level.

- Annual sales registered at 24.6%, still reflecting the low sales recorded at the beginning of the pandemic.

- Food store sales saw the largest drop on record, down 5.7% in May. The ONS noted that feedback suggests the reopening led consumers to return to restaurants and bars.

- Non-food stores and particularly household goods stores posted another strong reading in May, rising by 2.3% and 9.0%, respectively, as people continued to improve their homes and gardens.

- Fuel sales rose by 6.2% in May, following two months of double-digit growth rates. However, the level of fuel sales remains below the pre-pandemic level, the ONS noted.

- The proportion of online sales eased further in May to 28.5% with all retail sectors reporting a fall.

FIXED INCOME: Pricing out optimism

Gilt and Treasuries curves are both bull flattening this morning, as the market continues to unwind some of the post-FOMC moves.

- Gilts curves have flattened significantly, led by a rally in the long end. After expectations yesterday that the MPC may follow the Fed and become more hawkish, the market has reevaluated as retail sales disappointed this morning (hampering the consumer-led recovery story). An increase in the daily Covid-19 cases published yesterday afternoon of five figures for the first time since February is also weighing on sentiment (even though the weekly change has slowed from around 50% increases to 33% increases).

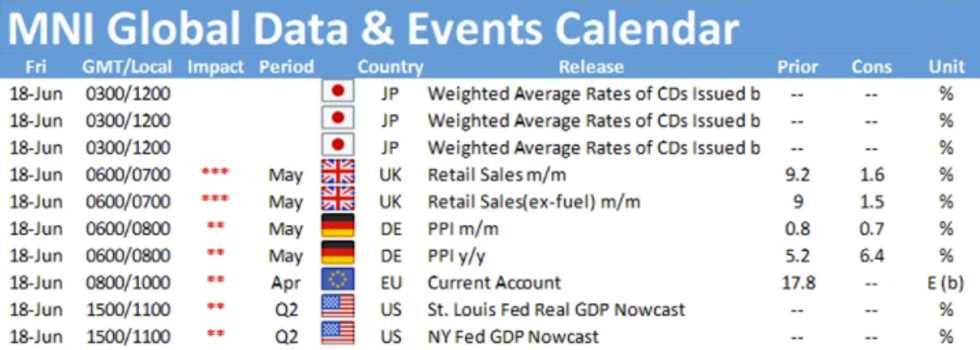

- Other than this morning's UK retail sales data, the calendar is pretty light today. Markets will be watched closely to see if there is any position-squaring ahead of the weekend.

- TY1 futures are up 0-5+ today at 132-06 with 10y UST yields down -1.7bp at 1.490% and 2y yields down -0.2bp at 0.209%.

- Bund futures are up 0.13 today at 172.57 with 10y Bund yields down -0.4bp at -0.201% and Schatz yields down -0.2bp at -0.675%.

- Gilt futures are up 0.28 today at 127.61 with 10y yields down -1.1bp at 0.764% and 2y yields up 0.9bp at 0.120%.

FOREX: Greenback Inches Higher as Post-Fed Rally Extends

- The USD is again among the best performing currencies early Friday, with the post-Fed rally extending into a third session. The USD Index swiftly topped the Thursday highs, hitting new multi-month highs and the best levels since mid-April. This puts the index through key resistance at the 61.8% retracement of the April-May downtick, opening the next key level at 92.516.

- GBP is less fortunate, and is among the poorest performers following a set of weaker-than-expected retail sales. Retail sales fell 1.4% on the month, well below the expected gain of 1.5%, raising questions about the UK's post-pandemic recovery, which has been fuelled by solid consumption.

- By-election results in the UK also went against the ruling Conservative party, adding additional pressure to GBP/USD. The pair touched 1.3855 this morning, the lowest level since early May.

- Data and speakers are light for the rest of the Friday session, with no scheduled releases or central bank speakers.

EQUITIES: Asian and European equities in the red

- Japan's NIKKEI down 54.25 pts or -0.19% at 28964.08 and the TOPIX down 17.01 pts or -0.87% at 1946.56

- China's SHANGHAI closed down 0.507 pts or -0.01% at 3525.097 and the HANG SENG ended 242.68 pts higher or +0.85% at 28801.27

- The German Dax down 42.83 pts or -0.27% at 15686.73, FTSE 100 down 31.64 pts or -0.44% at 7122.07, CAC 40 up 11.62 pts or +0.17% at 6678.03 and Euro Stoxx 50 up 1.37 pts or +0.03% at 4159.78.

- Dow Jones mini up 20 pts or +0.06% at 33825, S&P 500 mini up 0.75 pts or +0.02% at 4223, NASDAQ mini up 28.5 pts or +0.2% at 14194.5.

COMMODITIES: Precious metals up, natgas down

- WTI Crude down $0.20 or -0.28% at $70.87

- Natural Gas down $0.08 or -2.46% at $3.173

- Gold spot up $18.01 or +1.02% at $1792.5

- Copper up $1.85 or +0.44% at $420.5

- Silver up $0.5 or +1.94% at $26.4325

- Platinum up $17.25 or +1.62% at $1084.65

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.