-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: White House Sets Its Sights On China

EXECUTIVE SUMMARY:

- BIDEN ADMINISTRATION SETS UP "STRIKE FORCE" TO GO AFTER CHINA ON TRADE

- PRESIDENT AND SEN CAPITO LIKELY TO TALK INFRA AGAIN TODAY (FOX)

- LONDON METAL EXCHANGE TO RE-OPEN TRADING FLOOR AFTER USER UPROAR

- EUROZONE GDP SEES MODEST UPWARD Q1 REVISION

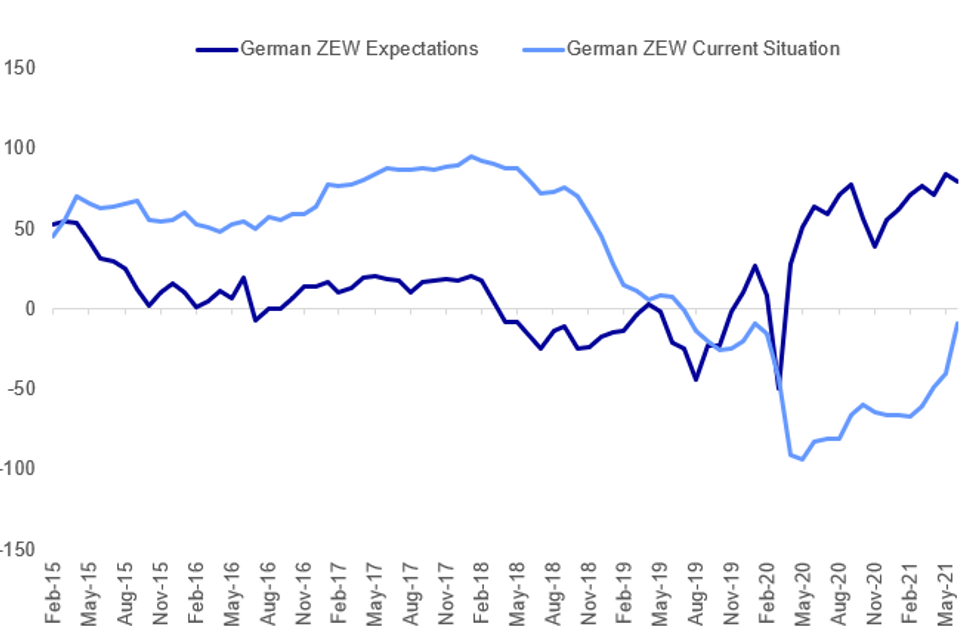

Fig. 1: Miss For German ZEW Expectations, But Current Situation Still Improving

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.S./CHINA (RTRS): The United States will target China with a new "strike force" to combat unfair trade practices, the Biden administration said on Tuesday, as it rolled out findings of a review of U.S. access to critical products, from semiconductors to electric-vehicle batteries. The "supply chain trade strike force," led by the U.S. trade representative, will look for specific violations that have contributed to a "hollowing out" of supply chains that could be addressed with trade remedies, including toward China, senior administration officials told reporters. Officials also said the Department of Commerce was considering initiating a Section 232 investigation into the national security impact of neodymium magnet imports used in motors and other industrial applications, which the United States largely sources from China.

U.S. INFRASTRUCTURE BILL: FOX's Chad Pergram tweets: "Biden/Capito likely to talk again today about infrastructure."

- The announcement of further talks between the president and Republican US Senator Shelly Moore-Capito (R-WV) - who is leading the GOP efforts to reach a bipartisan deal on the multi-trillion dollar infrastructure bill - comes just a day after Capito had stated that "We made a good, robust effort — the biggest infrastructure package ever, with pay-fors we delineated. And instead, it's not enough...We're going to keep talking. But I'm not coming back with anything in the next 24 hours."

- The two sides remain a significant distance apart, with Biden lowering his initial offer from USD2.3trn to USD1.7tr (all new spending), while the Capito-led offer totals USD928bn over seven years, but with just USD257bn of new spending that Congress was not anticipating already authorising.

- Should the Biden-Capito talks fail to make any progress, another bipartisan group of senators, led by former GOP presidential candidate Sen. Mitt Romney (R-UT) have said they have a plan to put forward, although as of yet have not released any details on numbers.

EXCHANGES (BBG): The London Metal Exchange has shelved a plan to close its open-outcry trading floor after a backlash from major users, and will reopen "the Ring" in September.The LME suspended trading in the Ring as the U.K. went into lockdown last March, and switched to an electronic system to establish daily benchmark prices. It announced plans to make the change permanent in January, but the move was met with heavy resistance from brokers and users who said the closing of the floor has hurt trading volumes and made pricing less robust.The LME now plans to reopen the Ring, it said on Tuesday.

CHINA / EVERGRANDE (BBG): Chinese regulators have instructed major creditors of China Evergrande Group to conduct a fresh round of stress tests on their exposure to the world's most indebted developer, according to people familiar with the matter.Authorities led by the Financial Stability and Development Committee, China's top financial regulator, recently told lenders including Industrial & Commercial Bank of China Ltd. to assess the potential hit to their capital and liquidity should Evergrande run into trouble, the people said, asking not to be identified discussing a private matter. It's unclear whether the results will lead to any official action.

BOE: The Bank of England Tuesday launched an 'exploratory scenario' as it looks to 'size up' the risks to the largest banks, insurance companies and the wider financial system. The review will use three differing levels of action to examine 'transition risk' and 'physical risk', the BOE said, allowing policymakers the chance to capture interactions between banks and insurance companies, helping understand the risks presented by climate change across the financial system. "It's a novel exercise as firms will have to engage closely with their counterparties in order to get detailed data on those counterparties' exposures to these risks," BOE Governor Andrew Bailey said.

SWEDEN: Sweden's firms are reporting supply disruptions due to computer chip and freight container shortages, and a rise in cost pressures, suggesting that the central bank's upside inflation scenario may materialise, according to the Riksbank's latest quarterly business survey. The survey found that for manufacturers supply, not demand, had become the key constraint and prices were expected to rise. In its most recent Monetary Policy Report the Riksbank noted the risk of supply shortages and said "this could subdue output slightly but also drive up inflation in Sweden" and if this happened it would take "a shorter time for CPIF inflation to reach 2 per cent more permanently than in the main scenario."

NORWAY: Norwegian wage growth is expected to pick up this year, accelerating faster than expected in the Norges Bank's March Monetary Policy Report, the latest quarterly business survey shows. The survey found that all sectors anticipate activity to rise in the next six months and that the estimate for annual wage growth in 2021 was revised up to 2.7% from 2.3% in the previous, February, report. The March Monetary Policy Report projected 2.4% wage growth in 2021 and 2.6% in 2022, with the survey data suggesting an upward revision is likely in June. Moderate wage growth was one factor cited by policymakers in expecting inflation to fall back to just below the 2.0% target this year, but upside pressure may be emerging.

DATA:

EZ GDP Sees Modest Upward Revision In Q1

The euro area economy contracted less than previously estimated in Q1 2021, but still recorded two consecutive periods of negative growth, confirming the bloc is in a technical recession. Euro Area GDP contracted by 0.3% q/q and 1.3% y/y in the period, both revised higher from the flash readings of -0.6% and -1.8% respectively, Eurostat said Tuesday.

Source: Eurostat

Of the leading economies, Germany contracted 1.8% q/q/ in Q1, while France contracted 0.1% q/q and Italian GDP growth was +0.1% q/q.

FOREX - USD holds onto gains

- USD remains in the green this morning, albeit still trading within ranges in G10.

- The currency is underpinned despite lower US yield.US 10yr, and likely helped by some corrective move lower in risk.

- The Greenback tested session high, breaking out of the overnight tight ranges against NOK, EUR, GBP, CAD, JPY, CHF, AUD, SGD, CNY. PHP, but moves lacked conviction, and the currency has in turn moved off its best levels.

- CHF and NOK are the only currency still holding onto gains against the USD in G10s.

- Scandis, saw a small dip lower for the SEK, following a miss on MoM Industrial orders as well as MoM GDP indicator.

- Although both set of data saw a decent beat on the YoY print.

- EURSEK is trending at the upper side of the range.

- Better USD buying has also been a factor.

- USDSEK has formed a small base at 8.2458, which was the 26/05 low, the lowest level since 25/02, and failed to break below the latter on the 1st and 7th June.

- USDJPY is up 0.23%, and in a 35 pips ranges, trading at 109.50 at the time of typing, with 1.07bn worth of expiry at that 109.50 strike, which may act as a magnet.

- Looking ahead, very little in terms of tier 1 data left on the calendar.

- Most desk remains on the sideline ahead of key events (ECB), and data (US CPI) on Thursday

FIXED INCOME: Supply in focus this morning

After some strength shortly after the open for Bunds and gilts, gains have largely been retraced and core fixed income is now only marginally higher on the day.

- With the ECB and US CPI, the main market events of the week, both scheduled for Thursday and a relatively light economic data calendar until then, focus today turns to supply.

- The US is set to sell USD58bln of 3-year Notes while Italy is holding a 10-year BTP syndication (we look for the lower end of a E10-14bln range with books over E50bln). In addition, the Netherlands has sold E2.2bln of the 10-year DSL, the UK looks to sell up to GBP4.25bln 5/50-year gilts, Austria looks to sell E1.4bln 4/10-year RAGBs. There are also bill sales from the US, Spain, Belgium, Finland and the ESM.

- As mentioned, data is generally not top tier. German IP and Italian retail sales were both a bit disappointing. The German ZEW and final print of Eurozone Q1 GDP data complete the European highlights. US trade and JOLTs are the US highlights.

- TY1 futures are up 0-2 today at 132-05+ with 10y UST yields down -0.9bp at 1.561% and 2y yields unch at 0.156%.

- Bund futures are up 0.03 today at 171.78 with 10y Bund yields down -0.3bp at -0.202% and Schatz yields down -0.2bp at -0.671%.

- Gilt futures are up 0.01 today at 127.17 with 10y yields down -0.2bp at 0.803% and 2y yields up 0.6bp at 0.087%.

EQUITIES: US Futures Off Overnight Highs

- Asian stocks closed mixed, with Japan's NIKKEI down 55.68 pts or -0.19% at 28963.56 and the TOPIX up 1.8 pts or +0.09% at 1962.65. China's SHANGHAI closed down 19.435 pts or -0.54% at 3580.106 and the HANG SENG ended 5.9 pts lower or -0.02% at 28781.38.

- European markets are slightly higher, with the German Dax up 1.91 pts or +0.01% at 15659.08, FTSE 100 up 8.71 pts or +0.12% at 7091.58, CAC 40 up 6.45 pts or +0.1% at 6557.23 and Euro Stoxx 50 up 4.08 pts or +0.1% at 4099.55.

- U.S. futures are mixed, with the Dow Jones mini down 38 pts or -0.11% at 34578, S&P 500 mini up 1.5 pts or +0.04% at 4227, NASDAQ mini up 22.25 pts or +0.16% at 13827.

COMMODITIES: Oil Continues To Slide

- WTI Crude down $0.62 or -0.9% at $68.73

- Natural Gas up $0.05 or +1.6% at $3.124

- Gold spot down $6.21 or -0.33% at $1893.96

- Copper down $0.95 or -0.21% at $450.75

- Silver down $0.19 or -0.69% at $27.7282

- Platinum down $8.31 or -0.71% at $1168.06

LOOK AHEAD:

US Data/Speaker Calendar (prior, estimate)- Jun-08 0600 NFIB Small Business Optimism May (99.8, 100.9)

- Jun-08 0830 Revisions: Trade Balance

- Jun-08 0830 Trade Balance Apr (-$74.4B, -$68.5B)

- Jun-08 1000 JOLTS Job Openings Apr (8.123M, --)

- Jun-08 1030 NY Fed buy-op: TIPS 1-7.5Y, appr $2.425B

- Jun-08 1130 US Tsy $40B 42D CMB bill auction

- Jun-08 1300 US Tsy $58B 3Y Note auction

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.