-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Brainard Still In The Race?

EXECUTIVE SUMMARY

- BRAINARD INTERVIEWED BY BIDEN FOR FED CHAIR AS SEARCH HEATS UP (BBG)

- EXPECT BIDEN'S FED CHAIR NOMINATION BY THANKSGIVING AT THE LATEST, POWELL THE FAVORUTIE (POLITICO)

- CHINA STATE COUNCIL THINK-TANK MET DEVELOPERS & BANKS (RTRS SOURCE)

- TAIWAN OUTLINES PLANS TO COUNTER CHINA'S 'GRAY ZONE THREATS' (BBG)

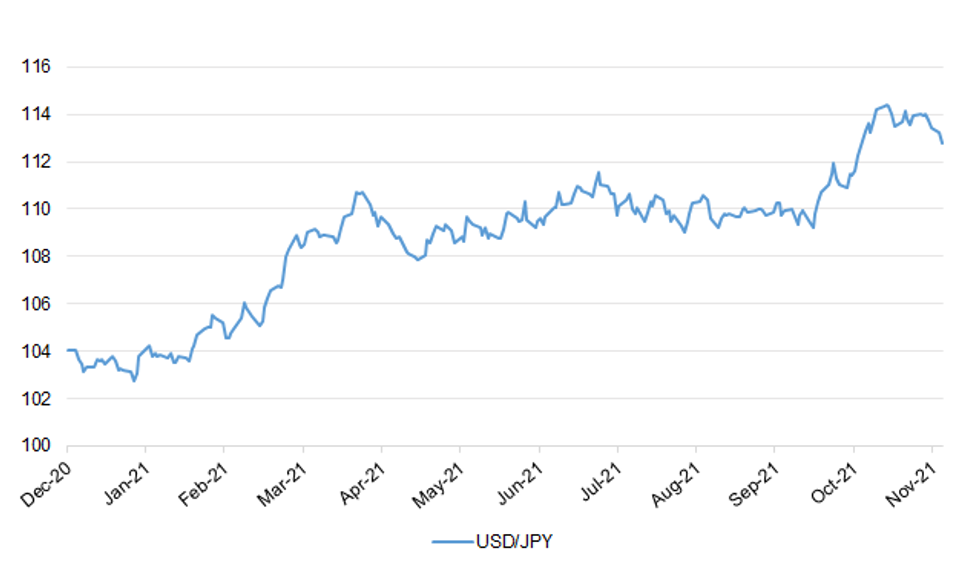

Fig. 1: USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Democratic Unionist party (DUP) leader Sir Jeffrey Donaldson has said little progress appears to have been made in talks between the UK government and EU on the Northern Ireland Protocol. He was speaking after meeting Brexit Minister Lord Frost on Monday. The Northern Ireland Protocol is the Brexit trade deal aimed at avoiding a hard Irish border. Sir Jeffrey said the update from Lord Frost revealed that "significant gaps" on the issue are yet to be resolved. "I have again reiterated that Northern Ireland's place in the UK internal market must be restored and we cannot continue to be subject to laws in Northern Ireland upon which we have no say or input," he said. (BBC)

BREXIT: Pan-European exchange Euronext said on Monday it will clear all trades on its newly acquired Italian platform by 2024, helping the European Union cut its reliance on the London Stock Exchange for core financial activities after Brexit. Currently most Euronext clearing in stocks, derivatives and commodities is handled by the LSE's LCH unit in Paris, which Euronext has not been able to buy outright. Setting out Euronext's strategic priorities to 2024, its Chief Executive Stephane Boujnah said the group, which operates seven stock markets across Europe, would build on its acquisition of the Milan exchange earlier this year. (RTRS)

POLITICS: Boris Johnson faced calls from Tory MPs last night to show leadership and apologise for attempting to block the suspension of a senior backbencher who breached lobbying rules. The prime minister failed to attend a debate in the Commons after whipping Tory MPs, many against their will, to stay the suspension of the former cabinet minister Owen Paterson and overhaul the standards system. (The Times)

POLITICS: Sir Keir Starmer says Boris Johnson has "corroded trust" in MPs after a U-turn on reforming the Commons disciplinary system and veteran Tory Owen Paterson's breach of lobbying rules. The Labour leader told an emergency debate in the Commons that the prime minister gave the "green light to corruption" last week when Conservatives were given a three-line whip to support a proposal to set up a new committee, chaired by a Tory MP, to draw up plans for a new appeals system. (Sky)

EUROPE

ECB: ECB President Lagarde tweeted the following on Monday: "At today's Eurogroup meeting we discussed the positive economic outlook in the euro area, with monetary and fiscal policies supporting a strong recovery. We are confident that the current higher inflation is transitory. We also exchanged views on the goals of a digital euro. I also met shortly with Austrian finance minister @Gernot_Bluemel in the margins of the Eurogroup meeting. We discussed some technical issues, among them the implementation of Basel III rules." (MNI)

FISCAL: European Union nations shouldn't use energy transition as a pretext for raising debt levels, but rather focus on reining in deficits to prepare for future crises, according to Austria's finance chief. Most green investments will have to come from the private sector, Finance Minister Gernot Bluemel told Bloomberg Television on Monday. States should focus on facilitating that change, but shouldn't necessarily be funding it, he said. (BBG)

CORONAVIRUS: The European Union's medicines regulator said on Monday it will give region-wide recommendations for the COVID-19 antiviral pill jointly developed by Merck and Ridgeback Biotherapeutics in the "shortest possible" time-frame. (RTRS)

FRANCE: French economic activity reached a level in August not seen since before the Covid-19 pandemic and has continued rising since, aided by a strong recovery in the service sector, according to a Bank of France's survey of businesses. Economic output was about 0.5% above early 2020 levels in October and will rise again in November, putting the euro area's second-largest economy on track for roughly 0.75% growth in the final quarter of the year, the estimates show. "This return to pre-crisis levels has come sooner than we expected previously -- we've gained about one quarter in time," the central bank's chief economist Olivier Garnier said. If the fourth quarter forecast holds up, growth for the year would be around 6.75%, he added. (BBG)

ITALY: Monte Paschi CEO Guido Bastianini says in a parliamentary hearing in Rome on Monday that the bank's revised plan to be submitted to EU authorities may include higher job cuts. (BBG)

ITALY: Banca Monte dei Pasch di Siena SpA needed more capital to meet the conditions for a sale to UniCredit SpA than Italy's Finance Ministry expected, UniCredit's Chief Executive Officer Andrea Orcel said. "We tried to find and proposed several alternatives that were in our view useful in reducing the need for capital," Orcel said in hearing with lawmakers in Rome on Monday. "None of them were sufficient to allow talks to continue." (BBG)

ITALY/BTPS: Italy to sell the following at 11 Nov M/T and L/T auction:

- EUR1.5-2.0bn of 3-Year 0.00% Aug-24 BTP

- EUR3.25-3.75bn of 7-Year 0.45% Feb-29 BTP

ITALY/BTPS: Orders for BTP Futura retail bonds were EU957.8m on Monday, according to Borsa Italiana website. (BBG)

U.S.

FED: Federal Reserve Governor Michelle Bowman on Monday flagged a range of economic and financial stability risks posed by the housing market, particularly noting that rising demand and a slow pace of construction are putting upward pressure on prices. "The supply of new homes has been held back by shortages of materials, labor, and developed lots," Bowman said in remarks prepared for delivery to a Women in Housing and Finance gathering. "I anticipate that these housing supply issues are unlikely to reverse materially in the short term, which suggests that we are likely to see higher inflation from housing for a while." (RTRS)

FED: MNI: Harker Prepared To Hike Before Taper Ends If Prices Surge

- Philadelphia Federal Reserve President Patrick Harker indicated Monday that it is possible that interest rates could rise before tapering of bond purchases is finished, but only if inflation fails to subside next year as he expects. "I don't expect that the federal funds rate will rise before the tapering is complete, but we are monitoring inflation very closely and are prepared to take action, should circumstances warrant it," he said in the text of a speech to the Economics Club of New York. The Fed last week began a taper that at the current pace could end around mid-2022 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Evans Sees Low Fed Rates For Some Time, Inflation Ebbing

- Chicago Fed President Charles Evans said Monday that policy interest rates could remain low for some time and even with some recent upside risks inflation should moderate as workers and firms restore supply networks. "There are many uncertainties to the outlook and changing circumstances could lead the FOMC to move up or delay rate increases. But judging from where the economy stands today, it looks like we are in for a low rate environment for some time to come," Evans said in prepared remarks to the OESA automotive suppliers' conference - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The White House declined to confirm on Monday that President Joe Biden met with Federal Reserve Chair Jay Powell and Governor Lael Brainard recently as he ponders whether to reappoint Powell. CNBC said he met Powell and Brainard last week. "I don't have any announcements for you today. The president will continue to engage with his senior economic team in a careful and thoughtful process to appoint a Federal Reserve chair," said White House spokesperson Karine Jean-Pierre. (RTRS)

FED: Federal Reserve Governor Lael Brainard was interviewed for the top job at the U.S. central bank when she visited the White House last week, according to people familiar with the discussions, signaling that Chair Jerome Powell has a serious rival as President Joe Biden considers who will lead the Fed for the next four years. Powell and Brainard are the only people who have publicly surfaced as being in the running for chair. Powell's current term in that post expires in February and Biden said on Nov. 2 that he'd make a decision "fairly quickly." Bloomberg News has previously reported that Brainard was also under consideration for the position of Fed vice chair for supervision. The White House and Fed both declined to comment. (BBG)

FED: President Biden last week said he intended to announce his nominees to the Federal Reserve board - another vacancy opened up today with Vice Chair Randall Quarles' announcement that he is resigning - "fairly quickly," but he wouldn't say whether he planned to replace Chair Powell. Powell's seat is up in February, but there are whispers the announcement is coming soon. Two sources with knowledge of the process said they expect a decision to be made by Thanksgiving at the latest. Fed officials will be in their so-called blackout period - in which officials refrain from making any public remarks or appearances - from Dec. 4 through their next policy meeting on Dec. 14-15. An announcement would likely need to come before then to leave enough time for the Senate to consider the nomination before Powell's current term expires in February. Given the market jitters that can accompany such a nomination, previous administrations have forecast a potential successor at the central bank well in advance. This White House, however, has dragged out the "will he, won't he" anticipation surrounding Powell, a Trump nominee, while remaining largely mum on it's timeline and leanings, both in public and private. A Democratic consultant with close ties to the administration, meanwhile, seemed dubious that Brainard, who was also mentioned as a possible pick to lead the Treasury Department under Biden, would get the nod. "Seems like the only push is coming from Lael herself," the consultant said, although some progressive groups have also advocated for Brainard to replace Powell. (POLITICO)

FED: The Federal Reserve is warning that prices of risky assets keep rising, making them more susceptible to perilous crashes if the economy takes a turn for the worse, and cited stablecoins as an emerging threat. "Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall," the Fed said in its twice-yearly Financial Stability Report released Monday. The central bank also said stablecoin threats are growing, that fragility in China's commercial real-estate sector could spread to the U.S. if it deteriorated dramatically, and that "difficult-to-predict" volatility similar to this year's meme-stock frenzy could become more frequent as social media increasingly influence trading. (BBG)

FED: While banks continued to remain in a posture of easing standards on commercial, mortgage and personal loan products, the easing trend slowed in the third quarter from the prior two quarters, according to the Federal Reserve's senior loan officer opinion survey released today. (ABA)

FISCAL: U.S. President Joe Biden will visit the Port of Baltimore on Wednesday to discuss how the $1 trillion infrastructure bill passed by the U.S. Congress helps the American people by upgrading ports and strengthening supply chains. (RTRS)

CORONAVIRUS: New Jersey Governor Phil Murphy said he expects to lift school-mask requirements in phases, beginning with older students who are further along getting vaccinations. He gave no timeline for when the mandates would be lifted. (BBG)

CORONAVIRUS: The Chicago Police Department's share of employees reporting their Covid-19 vaccination status as required by the city rose to 78%, Superintendent David Brown said Monday. The figure has climbed in recent days, Brown said. (BBG)

US TSYS: MNI BRIEF:US Regulators' Report Offers Treasury Reform Options

- A U.S. Treasury Department-led regulatory body Monday released a report looking at reform options for the Treasury market, including modifications to the supplementary leverage ratio and expanded central clearing - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BANKS: Wall Street banks should be ready to answer key questions about their exposure to climate change by next year, said Michael Hsu, the acting chief of the Office of the Comptroller of the Currency. "Time is running out," Hsu said Monday in a speech that outlined how U.S. banks will be required to report the risks they face from a warming planet. "We are racing against increasing numbers of costly extreme weather events." Hsu encouraged bank boards to grill executives about how exposed their firms are to volatile weather events and how vulnerable their data infrastructure may be. (BBG)

OTHER

GLOBAL TRADE: Every major semiconductor company has pledged to comply with a U.S. request for information pertaining to the global chip shortage, Commerce Secretary Gina Raimondo said on the day of a deadline set by the government. "The past two weeks, I personally have called the CEOs of all the major chip producers in the U.S. and overseas, and every CEO has assured me that they will be complying and will be giving us the data that we've asked for," Raimondo said in an interview Monday. While she hadn't yet seen the information provided by the companies, Raimondo said she's "optimistic that they are giving us robust submissions" and that the U.S. won't need to invoke the Defense Production Act -- a Cold War-era national-security law -- to force manufacturers to comply, a threat she reiterated on Monday. (BBG)

U.S./CHINA: The U.S. State Department on Monday said it is deeply concerned about the deteriorating health of detained Chinese citizen journalist Zhang Zhan, who last year was sentenced to four years in prison over her reporting on the coronavirus outbreak in Wuhan. (RTRS)

TAIWAN/CHINA: Taiwan laid out plans to challenge what it described as China's "gray zone threats" to shift the balance of power in the region and possibly take the democratically ruled island without fighting a battle. The Taiwanese Ministry of National Defense described Beijing's pressure campaign in a biennial military strategy report released Tuesday in Taipei, citing warplane incursions, as well as speedboats ramming its coast guard vessels. The ministry also accused China of engaging in "cognitive warfare" to sway Taiwanese public opinion. "The first and foremost defense undertaking is to prevent war and deter any external military threats, and our overall defense power shall be employed to defend our homeland, magnify the costs and risks entailed by the PRC's invasion, and ultimately protect the lives and properties of the people," the ministry said, referring to the People's Republic of China government on the mainland. (BBG)

GEOPOLITICS: President Joe Biden will participate in the Asia-Pacific Economic Cooperation Leaders' meeting on Friday to discuss ongoing efforts to address the Covid-19 pandemic and support the global economy, White House said in a statement. (BBG)

JAPAN: The approval rating of the Kishida Cabinet increased by 5pp to 53% in the latest NHK survey. The share of respondents who said they disapproved of the administration slipped 2pp to 25%. The previous poll was taken a week before the general election. The ruling Liberal Democratic Party's approval rating rose 0.9pp to 39.5%, with support for the main opposition Constitutional Democratic Party of Japan. standing at 8.2%. This comes after Asahi released the results of their poll over the weekend, which showed that approval of the Kishida Cabinet rose by 4pp to 45%. It was the lowest score of a newly inaugurated administration since the newspaper adopted its current methodology in 2001. (MNI)

JAPAN: Japanese Prime Minister Fumio Kishida ordered for an economic package to be drawn up by Nov. 19, Jiji reports in a flash headline. Kishida, speaking to ruling Liberal Democratic Party executives, said he wants an outline of Covid-19 measures to be drawn up by Nov. 12. (BBG)

JAPAN: Japan ruling Liberal Democratic Party and coalition partner Komeito agree to give 50,000 yen in cash and 50,000 yen in coupons for every child 18 or younger, Kyodo reports, without attribution. Cash to be handed out at "an early date" and coupons next spring. LDP proposed setting an annual household income cap of 9.6m yen on the handout; Komeito still hasn't agreed. (BBG)

JAPAN: Former Japanese Prime Minister Shinzo Abe is poised to rejoin the ruling Liberal Democratic Party's largest faction as the group's new leader in a matter of days, several senior members told Nikkei. Abe would replace former LDP Secretary-General Hiroyuki Hosoda, who is expected to become the lower house speaker at an extraordinary parliament session on Wednesday. The Hosoda faction also would be renamed after Abe. (Nikkei)

NORTH KOREA: North Korea continues to operate its key uranium plant, a U.S. think tank said Monday, suggesting a steady growth in North Korea's stockpile of the material used to build nuclear weapons. Citing recent satellite imagery, Beyond Parallel, a project of the Washington-based Center for Strategic and International Studies, reported the North's Pyongsan Uranium Concentrate Plant remains operational and is producing uranium concentrate. (Yonhap)

NORTH KOREA: The United States and South Korea fully agree on the need to denuclearize the Korean Peninsula through diplomacy, a state department spokesperson said Monday, reaffirming U.S. commitment to engage with North Korea. Ned Price, however, declined to comment on whether the U.S. agrees with a Seoul-proposed declaration of an end to the Korean War. (Yonhap)

TURKEY: Turkey central bank raises reserve requirement ratios for foreign currency deposits by 200 basis points, according to a decree published in the Official Gazette. Reserve requirement ratio for FX deposits/participation funds up to one year maturity raised to 25% from 23% and ratio for those with one year or longer maturity raised to 19% from 17%. Reserve requirement ratio for precious metal deposit accounts up to one year maturity raised to 26% from 24% and the ratio for those with one year or longer maturity raised to 22% from 20%. (BBG)

MEXICO: Mexico's central bank to hold a $200m auction from its swap line with the U.S. Federal Reserve on Nov. 10 at 10:30am, according to a statement from the country's currency commission. Line maturity of 84 days. (BBG)

IRAN: Iran said on Monday that the United States should provide guarantees that it will not abandon Tehran's 2015 nuclear deal with world powers again, if talks to revive the agreement succeed. (RTRS)

LIBOR: MNI INTERIVEW: Synthetic Yen LIBOR Must Be The Exception: BOJ Aide

- Financial institutions should complete their transition away from LIBOR, as a year-end deadline to switch away from the interbank lending tool nears, a senior Bank of Japan official said. "The most important thing is that financial institutions should not thoughtlessly rely on synthetic yen LIBOR and they are required to complete the transition from yen LIBOR by the end of this year," Akira Otani, the head of the BOJ's Financial Markets Department told MNI in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OIL: The White House said it's waiting on a study by the U.S. Army Corps of Engineers before deciding on the controversial pipeline that carries Canadian oil across the Great Lakes into Michigan. The idea that the Biden administration is considering shutting Enbridge Inc.'s Line 5 is "inaccurate," White House Spokeswoman Karine Jean-Pierre told reporters Monday, in response to news reports. Speculation that President Joe Biden was considering killing Line 5, like he did with TC Energy Corp.'s Keystone XL project, prompted angry reactions among Republicans as the country grapples with surging prices for everything from propane to gasoline. Line 5 supplies crude and propane to Michigan homes, as well as refineries in the U.S. Midwest and Ontario. (BBG)

CHINA

PBOC: The PBOC's new lending tool introduced on Monday, which carries a below-market rate, was aimed at facilitating banks' lending to carbon-neutral transition and not a short-term credit stimulus, the Securities Times reported citing Zhang Xu, chief fixed-income analyst with Everbright Securities. The new tool will focus on supporting three key areas of clean energy, energy conservation, and emission-reduction technologies, with a one-year lending rate of 1.75%. Though the rate is lower than other structural tools like re-lending and rediscounting, Zhang noted it does not represent a change in the direction of monetary policy, the newspaper said. This structural tool is limited in scale and impact, the newspaper cited Zhang as saying. (MNI)

ECONOMY: China's infrastructure investment may only provide "moderate" support to the economy in the short term, the Securities Times reported citing experts. The newly launched large projects may not translate into a substantial volume of work right away, and the overall size of the new-energy and new-infrastructure projects is relatively small, said the newspaper, one of the officially run securities dailies. Infrastructure could possibly register a noticeable rebound by H1 of 2022, the newspaper said. Q4 growth faces increasing "downward pressure" given the risk of slowing property demand and exports, making the countercyclical infrastructure building more necessary, the newspaper said. While the size of the projects started in Q4 may exceed CNY1 trillion, the impact from large projects usually takes 3-5 years to materialize, it said. (MNI)

PROPERTY: A growing number of cities in China have tightened supervision over the use of presold property proceeds, a move likely to deepen the cash crunch at many of the country's real estate developers. Major cities including Beijing, Tianjin and Shijiazhuang as well as smaller municipalities like Suzhou and Nantong in the eastern province of Jiangsu, and Luohe in central Henan province have issued rules tightening oversight of the proceeds, China Business News reported. The measures are designed to ensure the timely completion and delivery of property projects as the number of suspended projects rises amid a severe downturn in the nation's real estate market, the report cited Yan Yuejin, research director at Shanghai-based E-house China Research and Development Institute, as saying. (BBG)

PROPERTY: China's state council think tank has held a meeting with property developers and banks in the southern city of Shenzhen, a source with direct knowledge of the meeting told Reuters. Participants at the meeting, which took place on Monday, included China Vanke, Kaisa Group, Ping An Bank, China Citic Bank, China Construction Bank and CR Trust, according to the source. Investors are concerned about a broadening liquidity crisis in China's property sector, with a string of offshore debt defaults, credit rating downgrades and sell-offs in some developers' shares and bonds in recent weeks. (RTRS)

PROPERTY: Chinese property developer Kaisa Group Holdings Ltd said it is taking measures to solve its liquidity issues and was consulting investors in wealth management products about better payment solutions. The company said in a statement on its official WeChat account that it was accelerating asset disposals in Shanghai and Shenzhen and using the proceeds for repayments, as well as accelerating its sales of existing properties. "We sincerely ask investors to give Kaisa Group more time and patience," it said late on Monday. (RTRS)

PROPERTY: The Hong Kong Monetary Authority told banks recently that it would require them to disclose more details about their exposure to the Chinese real estate sector. Hong Kong banks will be required to disclose their loans and credit issued to mainland developers, treasury units' securities holdings in the sector as well as the percentage of exposed assets as of total assets. Lenders have always submitted information about their lending in China but they don't routinely report details of their exposure to the mainland property sector, or an individual company. (BBG)

MARKETS: China is devising new measures to further widen the opening of the capital market, including expanding channels for foreign investments in domestic futures, expanding the Shanghai-London Stock Connect, and making it easier for global companies to list domestically, the newspaper said. China's economic and capital market growths should attract much greater capital, the journal said. Foreign funds purchased over CNY320 billion A-shares through Stock Connect in the first 10 months of this year, near the record reached in 2019, it said. (MNI)

OVERNIGHT DATA

JAPAN SEP BOP CURRENT ACCOUNT BALANCE +Y1.0337TN; MEDIAN +Y1.0523TN; AUG +Y1.5030TN

JAPAN SEP BOP CURRENT ACCOUNT BALANCE ADJ +Y762.7BN; MEDIAN +Y847.2BN; AUG +Y880.0BN

JAPAN SEP TRADE BALANCE BOP BASIS -Y229.9BN; MEDIAN -Y358.7BN; AUG -Y372.4BN

JAPAN OCT ECO WATCHERS SURVEY CURRENT 55.5; MEDIAN 48.5; SEP 42.1

JAPAN OCT ECO WATCHERS SURVEY OUTLOOK 57.5; MEDIAN 57.0; SEP 56.6

JAPAN SEP LABOUR CASH EARNINGS +0.2% Y/Y; MEDIAN +0.6%; AUG +0.6%

JAPAN SEP REAL CASH EARNINGS -0.6% Y/Y; MEDIAN -0.1%; AUG +0.1%

JAPAN OCT BANK LENDING INC-TRUSTS +0.9% Y/Y; SEP +0.6%

JAPAN OCT BANK LENDING EX-TRUSTS +0.8% Y/Y; SEP +0.4%

JAPAN OCT BANKRUPTCIES -15.86% Y/Y; SEP -10.61%

AUSTRALIA OCT NAB BUSINESS CONFIDENCE 21; SEP 10

AUSTRALIA OCT NAB BUSINESS CONDITIONS 11; SEP 5

Business conditions and confidence rose in October as lockdowns came to an end in both NSW and Victoria. Each of the trading conditions, profitability and employment subcomponents contributed to the improvement in conditions, which was driven by gains in NSW. Confidence also rose, building on the turnaround seen in September, driven by Victoria as businesses anticipated reopening at the end of the month (largely after the survey period). Retail, business, finance & property, and personal & recreation services all saw large confidence improvements. Capacity utilisation also rebounded to 81.5% and forward orders rose strongly – with both now back above average. The survey also continues to show a build-up in price pressures in the economy with the impact of elevated goods demand alongside supply chain disruptions and border restrictions pushing input cost inflation to the highest level in a decade. On the output side, products prices continue to track at a high rate, although retail price growth eased considerably. These pressures could well persist over coming months before goods demand and the labour market normalise. Overall, the results provide first indications of a strong rebound in activity as the major states emerge from lockdowns, with more improvement likely in November as Victorian restrictions continue to ease. While the demand-side is seeing a healthy rebound the supply side will likely recover more gradually, and amidst strong growth the ability of business to pass on costs will have notable implications for margins and inflationary pressure more generally. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 109.0; PREV. 108.4

Consumer confidence increased 0.6% last week. There was an improvement in Sydney (4.1%), but confidence declined in regional NSW (-1.0%). Confidence in Melbourne dropped -4.4%, while for the rest of Victoria it was up 9.4%. Among the other states, confidence declined in Queensland (-6.0%) but rose in South Australia (5.2%) and Western Australia (11.9%). Since its recent low in early August, consumer confidence is up a touch over 10% and is getting close to its long-run average. There is quite a divergence across states, with sentiment unsurprisingly highest in WA but now lowest in Queensland. While the four-week average for inflation expectations edged higher, the weekly reading hasn't shown any real upward movement since September's jump. (ANZ)

NEW ZEALAND OCT CARD SPENDING RETAIL +10.1% M/M; SEP +1.0%

NEW ZEALAND OCT CARD SPENDING TOTAL +9.5% M/M; SEP +1.6%

NEW ZEALAND OCT ANZ TRUCKOMETER HEAVY +1.0% M/M; SEP +12.9%

October was messy, with restrictions tightened in the Waikato area, and coming and going in parts of Northland. The Light Traffic Index fell 6.4%, while the Heavy Traffic Index rose 1.0%. Both light and heavy traffic remain well short of pre-Delta levels. The weight on various roads in the Truckometer indexes is chosen to maximise how well it matches GDP, not to necessarily attain a populationweighted geographical spread. The Light Traffic Index in particular has a northern skew, and so with the Auckland border closed, and Waikato and Northland also under various restrictions in October, the traffic indexes remain under pressure. Overall, heavy traffic has bounced back more than light traffic, reflecting that the supply chain is permitted to cross the Auckland boundary whereas personal travel is highly restricted. Neither light nor heavy traffic fell nearly as much as in lockdown last year in terms of either monthly changes or activity lows, but the disruption has been prolonged (ANZ)

UK OCT BRC SALES LIKE-FOR-LIKE -0.2% Y/Y; MEDIAN +1.0%; SEP -0.6%

MARKETS

SNAPSHOT: Brainard Still In The Race?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 221.59 points at 29285.46

- ASX 200 down 18.01 points at 7434.2

- Shanghai Comp. up 8.769 points at 3507.558

- JGB 10-Yr future up 2 ticks at 151.87, yield down 0bp at 0.061%

- Aussie 10-Yr future down 3.0 ticks at 98.195, yield up 2.8bp at 1.781%

- U.S. 10-Yr future +0-07+ at 131-17, yield down 1.57bp at 1.474%

- WTI crude up $0.06 at $81.98, Gold up $0.89 at $1825.1

- USD/JPY down 45 pips at Y112.78

- BRAINARD INTERVIEWED BY BIDEN FOR FED CHAIR AS SEARCH HEATS UP (BBG)

- EXPECT BIDEN'S FED CHAIR NOMINATION BY THANKSGIVING AT THE LATEST, POWELL THE FAVORUTIE (POLITICO)

- CHINA STATE COUNCIL THINK-TANK MET DEVELOPERS & BANKS (RTRS SOURCE)

- TAIWAN OUTLINES PLANS TO COUNTER CHINA'S 'GRAY ZONE THREATS' (BBG)

BOND SUMMARY: Brainard-Inspired Bid In Asia

A BBG source report pointed to current Fed Governor Lael Brainard being a "serious rival" to the incumbent when it comes to the race to become the next Fed Chair, after an interview with President Biden last week. A reminder that Brainard is seen as a more dovish alternative when compared to Jerome Powell, this meant that the Tsy market richened a little in the wake of the story crossing (note that the meeting was already reported by the wires last week). An earlier POLITICO sources piece pointed to Powell being the clear frontrunner in the race, while indicating that a decision will likely be made by Thanksgiving at the latest. TYZ1 +0-07 at 131-16+, 0-03 off highs, while cash Tsys run 1-3bp richer across the curve, with the belly leading. Asia-Pac flow was headlined by a 5K block buy of the FVZ1 122.50 calls, with a 2,410 lot block seller of TU futures seen as we moved towards London trade. PPI data, a raft of Fedspeak & 10-Year Tsy supply headline the local docket on Tuesday.

- The bid in U.S. Tsys and smooth passage of 30-Year JGB supply facilitated some light flattening of the JGB curve during early afternoon trade in Tokyo, while JGB futures ticked higher. In terms of auction specifics, the supply saw the low price meet broader dealer expectations (as proxied by the BBG dealer poll), while the cover ratio recovered from the multi-month low witnessed at last month's auction as the tail saw some marginal narrowing (demand from the domestic life insurance community likely helped takedown). More details surrounding the Y100K payments to children were fleshed out via local media outlets later in the day, which saw JGB futures back from Tokyo highs and applied some pressure to the longer end of the curve, leaving the former +1.

- Aussie bond futures recovered from their early Sydney lows, leaving YM -1.5 and XM -3.0 at the bell. For XM, TCV priced a $1.0bn tap of its Nov '34 line, with the passage of the pricing removing one source of pressure. Nov-27 index linked supply from the AOFM passed smoothly, with the cover ratio moving higher vs. prev. auction and pricing printed comfortably through prevailing mids, given the well-documented inflation dynamic in play at present.

JGBS AUCTION: Japanese MOF sells Y726.4bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y726.4bn 30-Year JGBs:

- Average Yield 0.683% (prev. 0.702%)

- Average Price 100.42 (prev. 99.94)

- High Yield: 0.685% (prev. 0.706%)

- Low Price 100.35 (prev. 99.85)

- % Allotted At High Yield: 24.8033% (prev. 32.0181%)

- Bid/Cover: 3.449x (prev. 2.904x)

JGBS AUCTION: Japanese MOF sells Y2.8189tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8189tn 6-Month Bills:

- Average Yield -0.1168% (prev. -0.1062%)

- Average Price 100.058 (prev. 100.053)

- High Yield: -0.1128% (prev. -0.1062%)

- Low Price 100.056 (prev. 100.053)

- % Allotted At High Yield: 21.0665% (prev. 36.7494%)

- Bid/Cover: 3.765x (prev. 5.417x)

AUSSIE BONDS: The AOFM sells A$150mn of the 0.75% 21 Nov ‘27 I/L Bond, issue #CAIN414:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.75% 21 November 2027 I/L Bond, issue #CAIN414:

- Average Yield: -0.8456% (prev. -0.9085%)

- High Yield: -0.8425% (prev. -0.9000%)

- Bid/Cover: 4.8533x (prev. 3.8267x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 44.4% (prev. 19.0%)

- Bidders 43 (prev. 38), successful 6 (prev. 12), allocated in full 3 (prev. 9)

EQUITIES: Equities Nudge Lower In Asia

The major Asia-Pac equity indices lodged marginal losses during Tuesday trade, while U.S. e-minis nudged lower. There wasn't much in the way of notable headline flow to observe, with continued focus on the Evergrande situation (and spill over/other risks within the sector) evident. Note that the troubled property developer needs to satisfy missed USD-denominated bond coupon payments on Wednesday, when the grace period on the missed payments will elapse.

OIL: Crude Little Changed In Asia

WTI & Brent futures print at virtually unchanged levels into European hours. This comes after crude firmed on Monday, although the major benchmarks finished a little shy of best levels, adding ~$0.70 on the session, with the potential U.S. response to the recent rally in oil prices via the release of some of its SPR holdings limiting gains (an announcement on such a move could come as soon as this week, per media reports). Tuesday will see focus fall on the latest STEO from the EIA (outlined as a key input re: any SDR decision, per U.S. Energy Secretary Granholm) and the weekly API inventory release.

GOLD: Still Not Able To Test Key Resistance

Rangebound Asia-Pac trade for bullion leaves spot little changed around the $1,825/oz mark. Monday's downtick in U.S. real yields (driven by a widening in breakevens) leaves our weighted U.S. real yield monitor within touching distance of the all-time lows witnessed earlier this year, with the downtick in the DXY adding further support for gold. Still, a test of key resistance in the form of the Sep 3 high ($1,834.0/oz) hasn't been forthcoming.

FOREX: On The Defensive

Defensive flows dominated, lending support to the yen, which comfortably outperformed its peers from the G10 basket. Fresh safe haven demand resulted in USD/JPY sales, which took the rate past the Y113.00 mark and to its lowest point in a month.

- The Antipodeans went offered across the board, with a BBG trader source flagging the trimming of leveraged long positions in these currencies. AUD/NZD bottomed out at its worst level since Sep 24, before trimming some losses.

- USD/CNH posted a sudden spike higher, which did not seem timed with any notable headline catalyst. Earlier, the PBOC delivered another softer than expected yuan fixing.

- German ZEW Survey & U.S. PPI provide the main points of note on the global data docket today. Central bank speaker slate features PBOC Gov Yi, Fed Chair Powell, ECB Pres Lagarde, BoE Gov Bailey and others.

FOREX OPTIONS: Expiries for Nov09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550(E1.3bln)

- USD/JPY: Y113.70($2.0bln)

- EUR/GBP: Gbp0.8500(E593mln)

- USD/CAD: C$1.2400-05($700mln), C$1.2460($1.1bln)

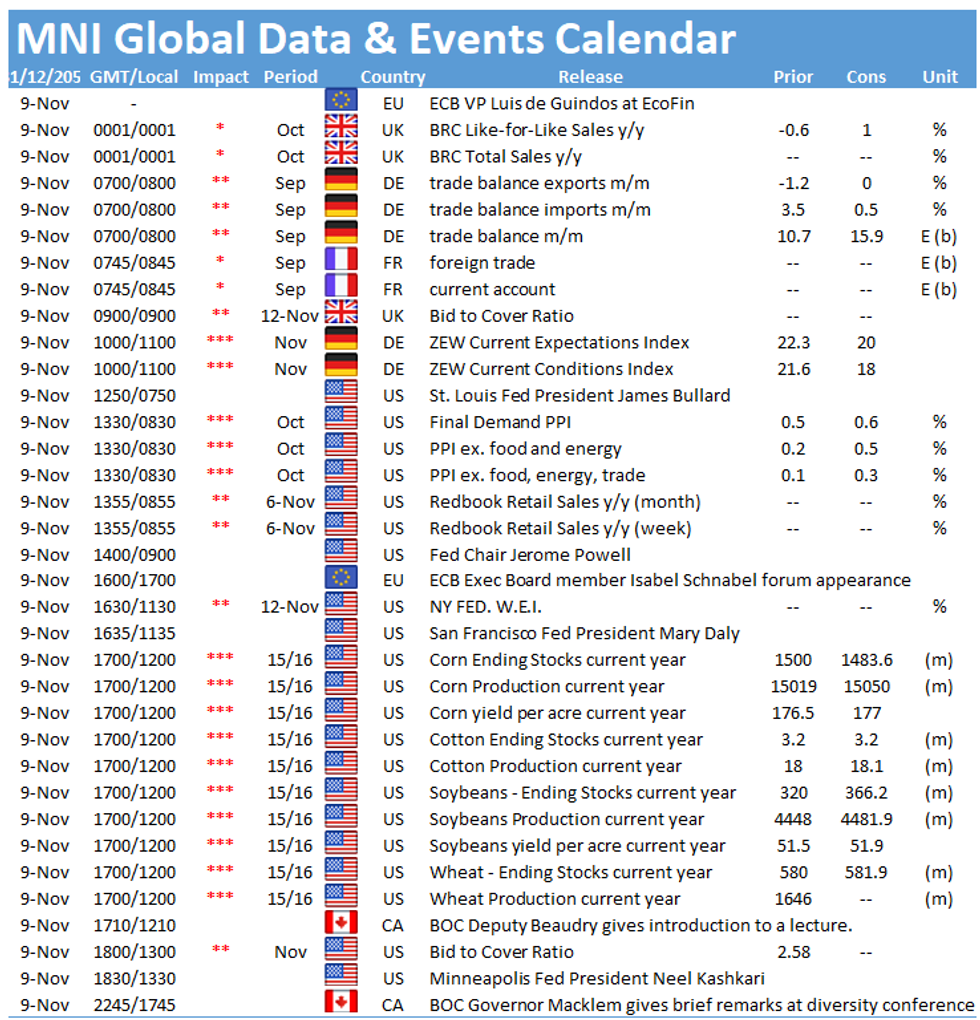

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.