-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: December CPI Housing & Core Goods in Focus

MNI ASIA MARKETS ANALYSIS: Post-PPI Highs Rejected

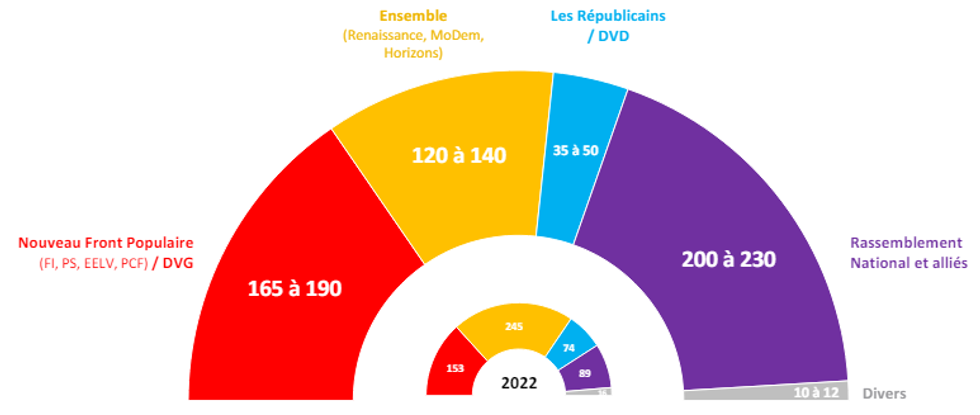

National Rally On Course For 200-230 Seats: Elabe

The latest opinion poll from Elabe ahead of the 7 July legislative election run-off shows the right-wing nationalist Rassemblement National (National Rally, RN) on course to win between 200 and 230 seats in the 577-member National Assembly, well below the 289 seats required for a majority. The poll, carried out between 3-4 July, shows the left-wing New Popular Front (NFP) on course to win 165-190 seats, with the centrist Ensemble bloc of President Emmanuel Macron projected to take between 120 and 140 seats. The centre-right Les Republicains are projected to win between 35 and 50 seats.

- The 'republican front' of NFP candidates standing down in three-way contests if they are in third place in order to avoid splitting the anti-RN vote with Ensemble (and vice versa) has seemingly dented the prospect of an RN majority.

- In the likely event of a hung parliament, focus will turn to the formation of a gov't. While NFP and Ensemble have been willing to work together to stop RN gains in parliament they remain bitter opponents and the prospect of an unworkable parliament, with three sizeble blocs all unwilling to work with one another is very possible.

- In such a scenario it is unclear who Macron could appoint as PM (RN have said they will not govern without an absolute majrotiy). Any gov't would likely need to use Art 49.3 to push through legislation without a vote, but thereby opening itself up to no-confidence votes.

Source: Elabe

Source: Elabe

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.