-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Kyiv Ready for Ceasefire, Russia Sceptical

MNI China Daily Summary: Wednesday, March 12

MNI BRIEF: EU Targets Retaliation Tariffs On US Red States

MNI ASIA OPEN: Hawkish Fed Exacerbates Month End Rebalancing

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Likely To Hike Another 75BPs In Sept-Haslag

- MNI BRIEF: St. Louis Fed Model Sees Solid August Hiring

- MNI BRIEF: FED Mester Says Fed Policy Must Be Restrictive

- MNI US: New ADP Data Shows Pay Gains Running Hot But Off Peak

- MNI: Canada GDP Less Than Forecast +3.3% in Q2, Shrinks in July

- MNI: Inflation Strengthens Hawks' Resolve In EU Debt Talks

- Russia Halts Nord Stream Gas Pipeline, Ratcheting Up Pressure on Europe, DJ

US

FED: The Federal Reserve is likely to deliver another aggressive 75 basis point rate hike in September to catch up with an inflation problem that officials failed to foresee, ex-Dallas Fed economist Joseph Haslag told MNI’s FedSpeak podcast.

- That kind of move is needed “just to get to the path that almost everybody agrees they’re going have to get to," Haslag said. "So why hold off – that’s going to be the essential driving force around the table.” (See MNI INTERVIEW: Fed's Harker Wants Rates Above 3.4% By Year-End)

- “Fifty basis points is a possibility – I wouldn’t rule it out completely – I’d just put less probability on that than I do on 75 at this stage. I think it’s cooked in, I think the markets are ready for it and the past couple weeks have reflected that painful updating process.” For more see MNI Policy main wire at 1528ET.

FED High and persistent inflation means it will "take some time" for the Federal Reserve to restore price stability, Cleveland Fed President Loretta Mester said Wednesday in remarks that echoed hawkish recent comments from Chair Jerome Powell and other FOMC members that have battered stocks and sent bond yields higher.

- "The return to price stability will take some time and a lot of fortitude," she told a business conference in Dayton, Ohio. "Financial markets could well remain volatile as financial conditions tighten further; growth could slow more than expected; and the unemployment rate could move above estimates of its longer-run level."

- "I anticipate that policy will need to move into a restrictive stance in order to put inflation on a sustained downward trajectory to 2%. In my view, that means that short-term interest rates adjusted for expected inflation, that is, real interest rates, will need to move into positive territory and remain there for some time. Right now, nominal short-term interest rates are lower than expected inflation, so short-term real interest rates are still negative and monetary policy is still accommodative."

- The St. Louis Fed's Coincident Employment Index has remained "roughly flat" before seasonal adjustments over the last few weeks, "which suggests that non-seasonally adjusted employment has not changed much recently," Dvorkin said. But strong positive seasonality factors lifted the -100,000 unadjusted number to a solid employment gain for the month. The figures correspond to the BLS's household survey.

CANADA

BOC: Canada's GDP grew at a less-than-expected 3.3% annualized second-quarter pace and a flash estimate for July showed the first contraction in six months, weakness that may erase bets the central bank will bring another 100bp rate hike next week.

- Statistics Canada said Wednesday preliminary evidence points to 0.1% contraction in July, while the official figure for June showed a 0.1% expansion. The June gain matched economist forecasts while the Q2 figure lagged the expected 4.5% increase.

- Consumer spending on clothing, autos and travel as the economy re-opened along with a major boost in business inventories led second-quarter growth. Statistics Canada also said the July setback came from factories, wholesaling and retailing. For more see MNI Policy main wire at 0830ET.

EUROPE

EU: High inflation and additional government spending to help consumers and business cope with higher prices are strengthening the resolve of more fiscally conservative European Union states to resist any further extension of the waiver on the bloc’s borrowing limits and to press for a prompt resumption of talks to reform the rules, officials told MNI.

- While officials cannot rule out the possibility that the so-called Escape Clause from the Stability and Growth Pact’s borrowing rules, first enacted to help member states cope with the Covid pandemic and now due to run until next year, will be extended once again by the European Commission in response to soaring energy prices, they insisted that this is very unlikely.

- “From what we are hearing, the Commission has decided that you can no longer postpone because of uncertainty, because we have been operating in an uncertain environment for the past three years and it seems like it will stay there for months or even years,” one source said.

US TSYS

Month end portfolio rebalancing/position extensions added to session volatility Wednesday, Bonds extending well past pre-NY session lows after the close, 30YY tapping 3.2926% high compared to 3.2063% midmorning low.

- Perhaps markets also reacted to late MNI Fed podcast the Federal Reserve is likely to deliver another aggressive 75 basis point rate hike in September to catch up with an inflation problem that officials failed to foresee, ex-Dallas Fed economist Joseph Haslag told MNI’s FedSpeak podcast.

- That kind of move is needed “just to get to the path that almost everybody agrees they’re going have to get to," Haslag said. "So why hold off – that’s going to be the essential driving force around the table.”

- Tsys blipped off lows after latest ADP came out lower than expected (+132k vs. +300k est) - quickly discounted, however, as Tsys reverse move back to pre-release levels.

- That was followed by Chicago Business Barometer: PMI 52.2, in-line w/ market estimate, stocks taking the over 50.0 expansionary read positively, ESU2 +27.5 at 4015.0 in early trade.

- Meanwhile, Equities extended session lows by the bell as well, ESU2 -30.0 at 3957.5, Crude weaker (WTI -2.64 ay 89.0), Gold weaker -13.82 at 1710.20.

- Focus turns to Thursday's Weekly Claims, Unit Labor Costs, ISMs ahead Friday's headline August employment data (+300k est).

- Currently, 2-Yr yield is up 3.7bps at 3.4786%, 5-Yr is up 6bps at 3.325%, 10-Yr is up 7.1bps at 3.1738%, and 30-Yr is up 6.6bps at 3.2815%.

OVERNIGHT DATA

US ADP: The August ADP private sector employment report,: https://adpemploymentreport.com the first to be produced under the new methodology, shows continued strong growth in private sector wages in August, though job creation itself was fairly muted, especially outside of the Leisure & Hospitality sector (which also led the way on pay).

- On pay growth (a new series produced by ADP): "Year-over-year change in annual pay was 7.6 percent in August, in line with monthly readings since Spring 2022. In early 2021, annual pay increases were running at about 2 percent. While the pace of pay increases is elevated, its growth has flattened."

- Leisure and Hospitality employees saw by far the highest median pay change (+12.1%) though well off the 16.9% peak in March 2022.

- Notably in the context of the tight job market and still-elevated job openings (as seen in Tuesday's JOLTS): Job changers have seen a 16.1% median increase in changes, job stayers "just" 7.6%.

- Small businesses (1-49) saw employment rise 25k on net; mid-sized by 53k; large (500+) by 54k.

- Major job gains were in Leisure & Hospitality (+96k), Trade, Transportation, & Utilities (+53k) and Construction (+21k); losses were notable in Financial Activities (-20k), Education & Health Services (-15k), Professional & Business Services (-14k).

- MNI AUG CHICAGO BUSINESS BAROMETER 52.2 VS 52.1JUL

- MNI CHICAGO: AUG PRICES PAID EDGES 81.8 VS 81.9 JUL

- MNI CHICAGO: AUG EMPLOYMENT 54.6 VS 56.1 JUL

- MNI CHICAGO: AUG PRODUCTION 54.9 VS 48.2 JUL

- MNI CHICAGO SURVEY PERIOD AUG 1 TO 15

- US MBA: MARKET COMPOSITE -3.7% SA THRU AUG 26 WK

- US MBA: REFIS -8% SA; PURCH INDEX -2% SA THRU AUG 26 WK

- US MBA: UNADJ PURCHASE INDEX -23% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.80% VS 5.65% PREV

- US EIA: CRUDE OIL STOCKS EX SPR -3.33M TO 418.3M AUG 26 WK

- US EIA: DISTILLATE STOCKS +0.11M TO 111.7M IN AUG 26 WK

- US EIA: GASOLINE STOCKS -1.17M TO 214.5M IN AUG 26 WK

- US EIA: CUSHING STOCKS -0.52M TO 25.3M BARRELS IN AUG 26 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 166.38 points (-0.52%) at 31616.17

- S&P E-Mini Future down 16.75 points (-0.42%) at 3969.5

- Nasdaq down 29 points (-0.2%) at 11850.2

- US 10-Yr yield is up 3.2 bps at 3.1344%

- US Sep 10Y are down 4.5/32 at 116-27.5

- EURUSD up 0.0036 (0.36%) at 1.0051

- USDJPY down 0.05 (-0.04%) at 138.74

- WTI Crude Oil (front-month) down $2.4 (-2.62%) at $89.16

- Gold is down $11.82 (-0.69%) at $1712.11

- EuroStoxx 50 down 44.67 points (-1.25%) at 3517.25

- FTSE 100 down 77.48 points (-1.05%) at 7284.15

- German DAX down 126.18 points (-0.97%) at 12834.96

- French CAC 40 down 85.12 points (-1.37%) at 6125.1

US TSY FUTURES CLOSE

To show extent of late market selling as 30Y bond futures extending past late overnight lows after the bell. Currently:- 3M10Y +10.334, 23.584 (L: 10.992 / H: 23.584)

- 2Y10Y +4.125, -30.194 (L: -36.415 / H: -29.784)

- 2Y30Y +4.621, -18.396 (L: -24.772 / H: -17.56)

- 5Y30Y +1.879, -3.407 (L: -6.205 / H: -2.346)

- Current futures levels:

- Dec 2Y down 0.875/32 at 104-03.75 (L: 104-02.125 / H: 104-06.5)

- Dec 5Y down 5.25/32 at 110-21 (L: 110-20 / H: 110-30.25)

- Dec 10Y down 15/32 at 116-19.5 (L: 116-19 / H: 117-07.5)

- Dec 30Y down 31/32 at 135-09 (L: 135-08 / H: 136-14)

- Dec Ultra 30Y down 1-28/32 at 148-18 (L: 148-17 / H: 150-22)

US 10YR FUTURE TECHS: (Z2) Southbound

- RES 4: 120-02+ High Aug 15

- RES 3: 119-18 High Aug 17

- RES 2: 118-23 50-day EMA

- RES 1: 118-00/13 High Aug 26 / 20-day EMA

- PRICE: 117-01 @ 1100ET Aug 31

- SUP 1: 116-22+ Low Aug 30

- SUP 2: 116-08 Low Jun 28

- SUP 3: 116-01+ 76.4% retracement of the Jun 14 - Aug 2 bull run

- SUP 4: 114-26 Low Jun 16

A bearish Treasuries theme remains intact and the contract continues to weaken. The recent breach of 117-11+, Jul 21 low, strengthened the case for bears. Potential is seen for weakness towards 116-08 next, the Jun 28 low. Further out, attention is on 116-01+, a Fibonacci retracement. Initial firm resistance has been defined at 118-00, Friday’s high, ahead of the 50-day EMA at 118-23.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.025 at 96.620

- Dec 22 +0.035 at 95.930

- Mar 23 +0.015 at 95.870

- Jun 23 +0.020 at 95.905

- Red Pack (Sep 23-Jun 24) +0.015 to +0.025

- Green Pack (Sep 24-Jun 25) +0.010 to +0.030

- Blue Pack (Sep 25-Jun 26) -0.03 to steady

- Gold Pack (Sep 26-Jun 27) -0.05 to -0.035

SHOR TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N +0.00800 to 2.31629% (+0.00715/wk)

- 1M -0.01057 to 2.55343% (+0.02957/wk)

- 3M +0.01757 to 3.09971% (+0.03014/wk) * / **

- 6M +0.06514 to 3.66057% (+0.09414/wk)

- 12M +0.06328 to 4.22314% (+0.09985/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.08214% on 8/30/22

- Daily Effective Fed Funds Rate: 2.33% volume: $90B

- Daily Overnight Bank Funding Rate: 2.32% volume: $266B

- Secured Overnight Financing Rate (SOFR): 2.29%, $948B

- Broad General Collateral Rate (BGCR): 2.26%, $387B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $377B

- (rate, volume levels reflect prior session)

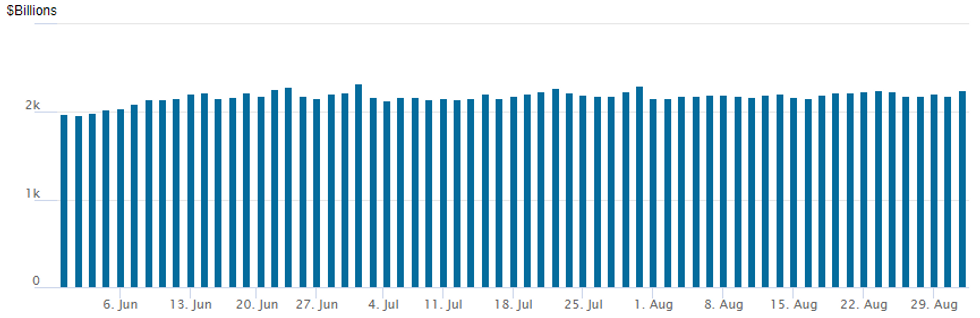

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usages recedes to $2,251.025B w/ 108 counterparties vs. $2,188.975B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $1.45B Korea Development Bank 2Pt Priced

- Date $MM Issuer (Priced *, Launch #)

- 08/31 $1.45B *Korea Development Bank (KDB) $1B 3Y +60, $450M 10Y +115

- 08/31 $1.25B *Nordic Investment Bank 5Y SOFR+36

- Rolled to Thursday:

- 09/01 $1B OKB WNG 5Y SOFR+45a

EGBs-GILTS CASH CLOSE: Bear Flattening With 75bp Sept Hikes Eyed

Wednesday’s main development was continued pressure at the front end of European curves as near-term central bank hike pricing ratcheted higher. The UK and German curves bear flattened, with Gilts underperforming.

- Today’s catalysts were higher-than-expected Italian and Eurozone August inflation, with multiple analysts changing their calls for next week's meeting to reflect a 75bp hike (the market is now pricing in 67bp, vs 54bp last week). BoE currently 62bp for September.

- Plenty of attention on the monthly closes, with yields across the German and UK curves rising by their most in decades - 2s and 5s in both the UK and Germany saw their biggest monthly rises since at least the early 1990s. 2Y UK yields rose a total of 131bp in August.

- High-beta periphery instruments underperformed, with 10Y Italian and Greek spreads widening 3/4bp on the day.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.9bps at 1.202%, 5-Yr is up 5bps at 1.391%, 10-Yr is up 3bps at 1.541%, and 30-Yr is up 2.4bps at 1.627%.

- UK: The 2-Yr yield is up 10.1bps at 3.021%, 5-Yr is up 9.4bps at 2.764%, 10-Yr is up 9.7bps at 2.801%, and 30-Yr is up 9.9bps at 3.078%.

- Italian BTP spread up 3.2bps at 235.2bps / Greek up 4.2bps at 256.6bp.

FOREX: EURGBP Maintains Upward Trajectory, EURNOK Extends Gains To 1.5%

- The Euro maintained its more supportive price action that has seen some Euro crosses extend on impressive recoveries since Friday, following a slew of central bank speakers at and following the Jackson Hole Symposium.

- EURGBP stood out on Wednesday, having rallied to near two-month highs and extending the bounce to roughly 3% from last week’s lows. The cross has cleared a number of short-term resistance points, strengthening the current bullish outlook and attention now turns to 0.8679, the Jul 1 high and a key resistance.

- Price action coincided with a notable bounce in EURUSD approaching the WMR month-end fix, breaking a short-term downtrend in the process and trading within 10 pips of the post ECB sources high of 1.0090 from last Friday.

- NOK was the notable underperformer in G10 on Wednesday, following confirmation from the Norges Bank that they are to sell NOK 3.5bln per day across September (effectively buying more FX for the sovereign wealth fund). This is a notable uptick in FX activity from the August rate of NOK 1.5bln per day, as announced at end-July. EUR/NOK now through 9.90 and trading at highest levels since early-August, narrowing the gap with next key resistance at the 200-dma of 10.0076.

- The greenback continues to consolidate with the USD index broadly respecting the 108.50-1.09 range ahead of more significant employment data on Friday.

- On Thursday, Chinese Caixin Manufacturing PMI due overnight before German retail sales and Swiss inflation data. Final releases of European PMIs will also be published. In the US, jobless claims and ISM Manufacturing PMI data highlight the docket.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/09/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/09/2022 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 01/09/2022 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 01/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/09/2022 | 0630/0830 | *** |  | CH | CPI |

| 01/09/2022 | 0630/0830 | ** |  | CH | retail sales |

| 01/09/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0830/0930 |  | UK | S&P Global Manufacturing PMI (f) | |

| 01/09/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/09/2022 | 0830/0930 |  | UK | BOE Decision Makers Panel | |

| 01/09/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/09/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/09/2022 | 1230/0830 | * |  | CA | Building Permits |

| 01/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 01/09/2022 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 01/09/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/09/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/09/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 01/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/09/2022 | 1930/1530 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.