-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY To Fresh YTD Highs

EXECUTIVE SUMMARY

- MOODY’S CUTS LAST U.S AAA RATING OUTLOOK TO NEGATIVE - MNI

- JAPAN OCT CGPI RISE SLOWS TO +0.8% VS. SEPT +2.2% - MNI BRIEF

- CHINA WEIGHS ENDING FREEZE ON BOEING WITH 737 MAX DEAL IN US - BBG

- LOCAL SERVICES FUELING INFLATION - RBA’S KOHLER - MNI BRIEF

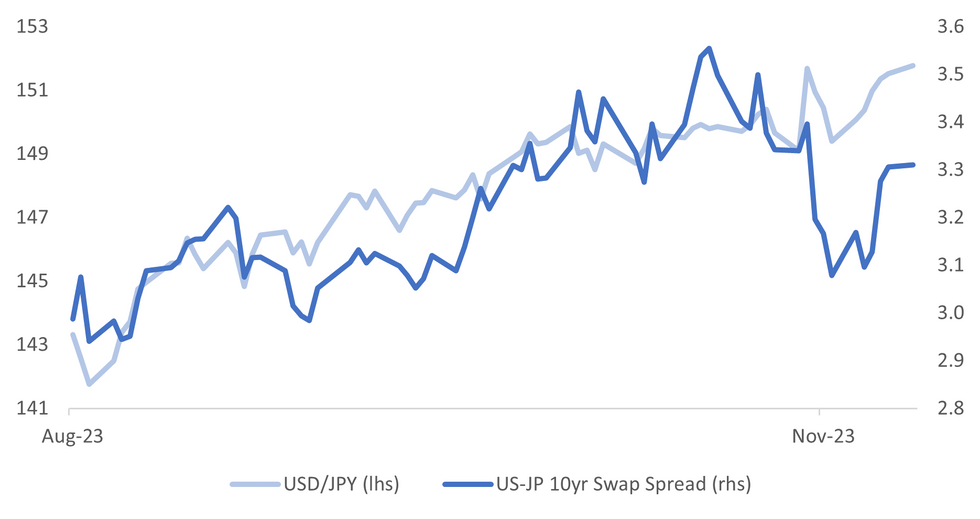

Fig. 1: USD/JPY Versus US-Japan 10yr Swap Rate Differential

Source: MNI - Market News/Bloomberg

U.K.

WAGES (RTRS): Strong pay growth in Britain's private sector will be matched in the public sector in the year ahead, according to a survey which showed no sign of an easing of inflationary heat in the jobs market.

HOUSE PRICES (BBG): Rightmove report UK November house prices -1.7% m/m, -1.3% y/y to £362,143.

EUROPE

UKRAINE (RTRS/WP): A Ukrainian military officer coordinated last year's attack on the Nord Stream natural gas pipeline, the Washington Post reported on Saturday, citing anonymous sources in Ukraine and Europe.No one has taken responsibility for the September 2022 blasts, which occurred off the Danish island of Bornholm and ruptured three out of four lines of the system that delivers Russian gas to Europe.

ECB (FT/BBG): European Central Bank President Christine Lagarde said that keeping the deposit rate at 4% should be enough to tame inflation, but officials will consider raising borrowing costs again if they need to.

POLAND (ECONOMIST): On Monday MPs will fill the 460 seats in Poland’s parliament for the first time since an election in October. There will be 117 fresh faces. But the main change is that, after eight years of rule, the Law and Justice (PiS) party no longer commands a majority in the Sejm, the more powerful lower house.

FRANCE (BBC): Far from a distant observer, one of a chorus of countries offering opinions on the Israel-Gaza war, France feels very much caught up in the conflict. It is home to Europe's largest Jewish community and has the largest Muslim population of any European country.

ITALY (BBG): A possible downgrade of Italy to junk this week would be hugely symbolic, potentially consequential — and very controversial. The unprecedented branding of a Group of Seven economy as a “substantial credit risk” could be delivered by Moody’s Investors Service, whose Baa3 rating for the country is at the lowest rung of investment grade, with a negative outlook.

U.S.

US/CHINA (RTRS): U.S. President Joe Biden wants to re-establish military-to-military ties with China, White House national security adviser Jake Sullivan said on Sunday, days before the president and the Chinese leader are set to meet.

US/CHINA (BBG): US Treasury Secretary Janet Yellen will visit China again next year at her counterpart’s invitation, as officials in the world’s two biggest economies seek to boost contact further and improve tense relations.

FISCAL (BBG): The US still faces a risk of a government shutdown at the end of this week despite a new compromise plan by Speaker Mike Johnson that leaves out hardline conservative priorities like cutting spending and curtailing migration.

FISCAL (BBG): The US fiscal position is on an “unsustainable trajectory” due to a lack of political will to resolve the crisis at a time when debt costs are soaring, former Federal Reserve Bank of New York President Bill Dudley said.

MIDEAST (RTRS): The United States carried out two air strikes in Syria against Iran and its aligned groups on Sunday, the Pentagon said, in the latest response to a series of attacks against American forces in Syria and in Iraq.

RATING (MNI): The last major ratings firm to rank U.S. government as a AAA credit cut its outlook on America's debt to negative late Friday, citing the absence of steps to reduce the government's expanding deficit.

POLITICS (BBG): South Carolina Senator Tim Scott is ending his presidential campaign, a long-shot bid to offer an alternative to Republican standard-bearer Donald Trump that drew the interest of prominent Wall Street executives.

OTHER

JAPAN (MNI BRIEF): The y/y rise in Japan's corporate goods price index slowed to 0.8% in October from September’s revised 2.2%, the 10th straight monthly deceleration, indicating that upstream prices continued to fall, Bank of Japan data showed on Monday.

AUSTRALIA (MNI BRIEF): Rapid growth of domestic market services prices will continue to fuel Australian inflation, which will fall slower than initially expected, according to Marion Kohler, assistant governor at the Reserve Bank of Australia.

CHINA

CHINA/US (BBG): Boeing Co. may finally see a sales breakthrough for its 737 Max aircraft in China when presidents Joe Biden and Xi Jinping meet this week, ending a long commercial freeze in a critical overseas market for the US planemaker.

FISCAL/DEBT (SECURITIES DAILY): Up to 26 provinces have disclosed plans to issue special refinancing bonds to swap out off-balance sheet debts, with the total volume reaching CNY1.26 trillion, according to the calculations of Securities Daily. Guizhou province temporarily ranks first with a scale of CNY144.8 billion, followed by Yunnan, Hunan, Inner Mongolia and Liaoning which have over CNY100 billion to issue each.

ECONOMY (YICAI): Economists in China remain positive on the economy, with the Yicai Chief Economist Survey reading 50.84 in November, down from 50.89 last month, as participants expect strong upcoming data and for the economy to achieve this year's GDP growth target of 5%. Economists predicted average fixed-asset investment growth of 3.14% year-to-date in October, and for retail sales to grow 6.62% y/y, up 1.12 percentage points from September.

ECONOMY (BBG): Alibaba Group Holding Ltd. and JD.com Inc. reported sales increases during China’s most important shopping festival, yet likely lagged newer entrants from social media platforms like ByteDance Ltd.’s Douyin during a muted year for consumer spending.

CHINA MARKETS

MNI: PBOC Injects Net CNY95 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY113 billion via 7-day reverse repo on Monday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY95 billion after offsetting the maturity of CNY18 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8066% at 09:49 am local time from the close of 1.8470% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Friday, compared with the close of 45 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1769 Monday vs 7.1771 Friday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1769 on Monday, compared with 7.1771 set on Friday. The fixing was estimated at 7.2891 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND OCT PSI 48.9; PRIOR 50.6

JAPAN OCT PPI M/M -0.4%; MEDIAN 0.0%; PRIOR -0.2%

JAPAN OCT PPI Y/Y 0.8%; MEDIAN 0.9%; PRIOR 2.2%

UK NOV RIGHTMOVE HOUSE PRICES M/M -1.7%; PRIOR 0.5%

UK NOV RIGHTMOVE HOUSE PRICES Y/Y -1.3%; PRIOR -0.8%

AUSTRALIA OCT CBA HOUSEHOLD SPENDING M/M -1.0%; PRIOR 0.3%

AUSTRALIA OCT CBA HOUSEHOLD SPENDING Y/Y 2.0%; PRIOR 3.6%

MARKETS

US TSYS: Narrow Ranges In Asia, CPI In View

TYZ3 deals at 107-09+, 0-04, a 0-04+ range has been observed on volume of ~77k.

- Cash tsys sit flat to 1bp cheaper across the major benchmarks, light bear steepening is apparent.

- Tsys have observed narrow ranges in Asia today, there was little follow through on moves and there was little in the way of meaningful macro news flow.

- TY briefly dealt below Friday's low however losses were pared. We sit a touch above the 20-Day EMA (107-08+). The next support level is 105-27+ low from Nov 1.

- Looking ahead, tomorrow's October CPI print is the highlight of the week's docket, headline CPI is expected to tick lower to 0.1% M/M and Core CPI is expected to hold steady at 0.3% M/M.

- There is a slew of Fed speakers scheduled this week, Gov Cook kicks off the docket this evening.

JGBS: 10yr Yield Rises Above 0.90%, But Little Follow Through

JGB futures have recovered some ground in the first part of afternoon trade, last at 144.29, -.25, Earlier we got to 144.18 before support emerged. This keeps us within ranges, with today's low coinciding with lows from last week.

- US futures have tracked a tight range, unable to break meaningfully below Friday's low (we were last 107-09 -04+.

- In the cash JGB space, we sit off session highs from a yield standpoint. The 10yr got above 0.90%, but we now sit back under 0.89%. We are still nearly 4bps higher for the session. The 20yr yield got close to 1.62%, but we are now 1.60%.

- Earlier we had weaker than expected PPI data, but the market reaction was to largely ignore the release. USD/JPY has firmed to fresh YTD highs, although the move has been a grind, rather than a dramatic spike.

- Tomorrow, the data calendar just contains Oct preliminary machine tool orders. 5yr supply will also be auctioned.

AUSSIE BONDS: Curve Flattens On Monday

ACGBs sit 4-6bps cheaper across the major benchmarks, light bear flattening is apparent.

- XM (-0.06) and YM (-0.06) are both softer however the contracts remain well within recent ranges.

- AGGBs were pressured in early dealing as local participants digested Friday's US Tsys cheapening. Aussie bonds held cheaper through the session dealing in narrow ranges for the most part.

- RBA's Kohler noted today that CPI in Australia is still too high and that the return to target is likely to be drawn out (BBG).

- CBA Household Spending fell 1.0% M/M in October, the prior read was revised lower to 0.3% M/M from 0.5%.

- RBA-dated futures remain stable, a terminal rate of 4.50% is seen in Jun 24 with ~10bps of cuts by Dec 24.

- Looking ahead, Thursday's October Labour Market Report is the highlight of the local docket. Participants have tomorrow's US CPI print firmly in view.

NZGBS: Curve Steepens On Monday

NZGBs sit 3bps richer to 5bps cheaper across the major benchmarks, the curve has twist steepened pivoting on 5s.

- A softer October PSI print, which saw the measure fall into contractionary territory, added support to the short end of the curve whilst Friday's Tsys cheapening and further pressure on the space today weighed on the long end of the curve.

- RBNZ dated OIS price a terminal rate of 5.55% in Feb 24 with ~30bps of cuts by Sep 24.

- 10 Year NZ US Swap spreads have been stable in today's dealing and we sit at +50bps.

- Looking ahead, early in tomorrow's session October Food Prices cross. There is no estimate and the prior read was -0.4% M/M.

FOREX: Fresh YTD Highs For USD/JPY

USD/JPY printed a fresh YTD high at ¥151.78, and we sit a touch off those levels at typing. Elsewhere there have been narrow ranges across G-10 FX in Asia today, with little follow through on moves thus far. Cross asset wise US Equity Futures are down, e-minis ~0.5% lower, as Friday's gains were trimmed as tomorrow's US CPI comes into view. US Tsys are pressured but only marginally so, and WTI is ~1% lower.

- USD/JPY remains technically bullish, resistance comes in at ¥151.72 Oct 31 high and bull trigger and ¥151.95 high 21 Oct 2022. Support is at ¥149.21 low from Nov 3.

- NZD/USD is a touch firmer, the pair was marginally pressured after the October PSI dipped into contractionary territory. Losses were erased and we sit a touch below the $0.59 handle. NZD/USD has observed a narrow $0.5885/0.5900 range today.

- AUD/USD is little changed, a narrow $0.6350/70 range has persisted thus far. RBA's Kohler noted that the return of CPI to target is likely to be drawn out. Technically a short term bull cycle remains in play, resistance comes in at $0.6449 and support is at $0.6330 the 76.4% retracement of the Oct 26-Nov 6 rally.

- Elsewhere in G-10 there have been little moves of note today.

- The docket is thin for the remainder of Monday's session.

EQUITIES: Most Regional Markets Down To Start The Week

Regional equity markets are mostly in the red today, despite a positive lead from US markets on Friday. Losses are modest for the most part, while there are some pockets of strength. Still, weighing has been a pull back in US equity futures, with Eminis off 0.45%, last near 4410.5. This puts the index back sub its simple 50-day MA. Nasdaq futures are slightly weaker, down 0.50%.

- There doesn't appear a fundamental driver of these moves, although proximity to Tuesday's CPI data may be a factor. US Tsys futures are also threatening to break lower.

- Hong Kong and China markets tried to push higher, but are tracking lower at the break. The HSI -0.14%, while the CSI 300 is down 0.52%. There was a blip higher in sentiment as headlines from BBG crossed that the China authorities were considered ending a sales freeze on Boeing, which would be a further sign of improved US-China ties.

- This comes ahead of this week's APEC meetings in San Francisco, with China President Xi and US President Biden to meet on Wednesday.

- The Kospi tried to go higher at the open but is now back to fat (against early gains of 1.1%). Japan indices are also close to flat.

- The Taiex is outperforming, up 0.80%, with TSMC aiding the move amid positive sales growth, while the 4% rise in the SOX in US trade on Friday has also helped.

- In SEA, most markets are down, although Indonesian stocks are modestly outperforming. Thailand stocks are down 0.70%, with sentiment likely weighed at the margin by internal disagreement over the government's digital wallet plan.

OIL: Crude Rally Short Lived, Prices Down Again Today

Oil prices have trended down through the APAC session and are almost a percent lower today after rising over 2% on Friday as demand worries drive market moves. WTI is down to $76.43/bbl, close to the intraday low of $76.41. Brent fell below $81 to $80.65, also around the low. The USD index is slightly higher.

- This week the monthly reports from OPEC (Monday) and the IEA (Tuesday) will be published and will be important for gauging the demand outlook which the market is currently focussed on. Supply trends are also important with data showing increased OPEC+ output in October. The US also looks to be increasing production.

- Goldman Sachs has cut its 2024 Brent forecast to $92 from $98 due to stronger supply, according to Bloomberg, while it expects demand to remain robust.

- Later the Fed’s Cook gives some introductory remarks. There is little on the data front with only NY Fed inflation expectations and the US monthly budget data. The ECB’s de Guindos speaks and updated European Commission forecasts are due. The focus of the week is likely to be US CPI on Tuesday, which should be important for the Fed outlook, and then there’s a swathe of China activity data on Wednesday.

GOLD: Bullion Gradually Trending Lower On Fed Nerves & War Premium Unwind

Gold prices continued their downtrend during the APAC session today as jitters re further Fed tightening grew and the situation in the Middle East looks contained to Israel/Gaza. Thus the war premium driven by flight-to-quality flows is unwinding. Bullion is down only 0.2% today after falling 1% on Friday, ahead of Tuesday’s US CPI but is down 2.5% this month. It is trading around $1936.30/oz, off the intraday low. The USD index is slightly higher and so is the 10-year yield.

- Gold is now down 3.7% from its post-Hamas attack high of $2009.41. It cleared support at $1938.10, 50-day EMA, on Friday which has opened up $1868.80, October 13 low.

- Later the Fed’s Cook gives some introductory remarks. There is little on the data front with only NY Fed inflation expectations and the US monthly budget data. The ECB’s de Guindos speaks and updated European Commission forecasts are due. The focus of the week is likely to be US CPI on Tuesday, which should be important for the Fed outlook. Gold is likely to fall if it prints higher than expected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/11/2023 | 0815/0915 |  | EU | ECB's De Guindos speech on "The Future of Banking" | |

| 13/11/2023 | 1600/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 13/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.