May 31, 2024 13:24 GMT

Nominal And Real Spending Weaker Than Expected In April With Lower Revisions

US DATA

DataEM BulletHomepagemarkets-real-timeCommoditiesEmerging Market NewsMetals bulletEnergy BulletsData BulletBulletMarketsFixed Income BulletsForeign Exchange Bullets

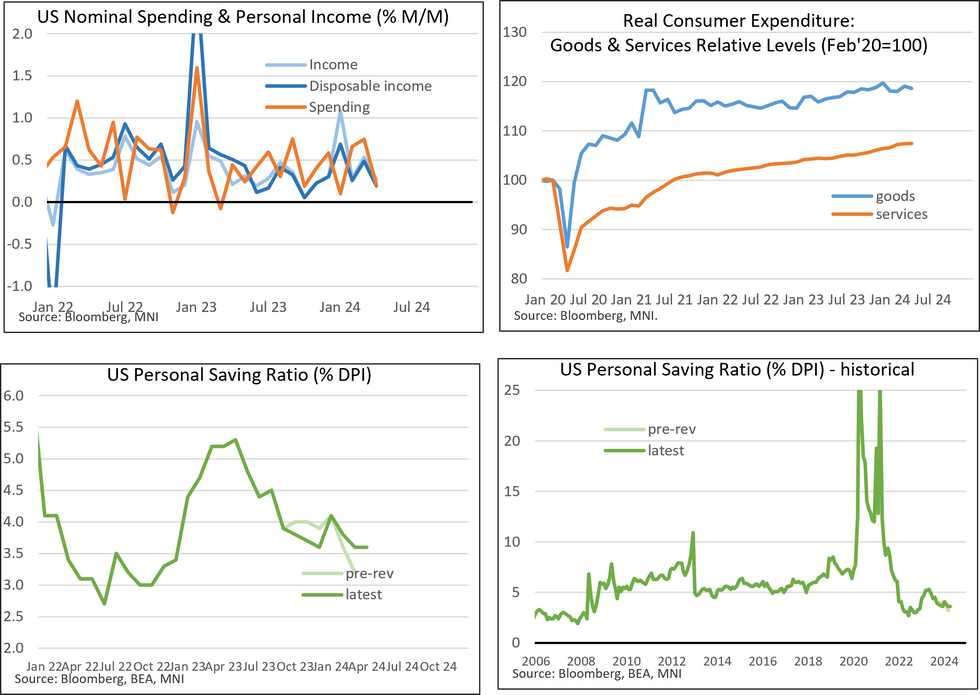

April nominal personal income growth was in line with consensus at an unrounded 0.27% M/M (vs 0.3% cons, 0.53% prior), though nominal spending was weaker than expected at 0.20% M/M (vs 0.3% cons).

- Real spending also missed, coming in at a rounded -0.1% M/M (unrounded -0.05%) vs 0.1% cons.

- Both nominal and real spending saw downward revisions in March, to 0.7% and 0.4% respectively, while personal income was unrevised.

- The softness in April’s income/spending data comes after personal consumption was below consensus at 2.0% Q/Q (vs 2.2% cons) in yesterday’s GDP 2nd estimate, after 2.5% in the advance reading.

- The annualised 3mma of real spending nonetheless rose in April, to 2.7% (vs 1.7% prior), while the annualised 3m/3m ticked up to 2.1% (vs 2.0% prior).

- The household savings ratio was steady at 3.6%, after March’s reading saw a 0.4pp upward revision from 3.2% (consistent with the downward spending revisions and unrevised income figures).

163 words