Feb 13, 2025 - 10:37 AM

EUROPEAN INFLATION: Nuanced Developments in German CPI in January [2/2]

EUROPEAN INFLATION

- Insurance services (part of "other goods and services", ECB president Lagarde mentioned recently that the category is under elevated scrutiny in January as annual contracts are often set at the beginning of the year) sharply decelerated, but remain elevated, at 9.9% Y/Y vs 16.6% prior, which took away 0.13pp in contribution to headline. "Social facilities" contributing 0.07pp more than before partly made up for that in the "other" category.

- The transport category (which is mixed in weighting across services/goods) stands out with a 0.21pp higher contribution to headline - out of that, 0.09pp came from "passenger and goods transportation" (thereof 0.04pp "Combined passenger transportation services", which went to 11.6% Y/Y from 3.4% in Dec; 0.02pp from rail transport, 0.03pp from international flights), and 0.11pp from fuels.

- Note that German CPI did not see a weightings update in January (as expected).

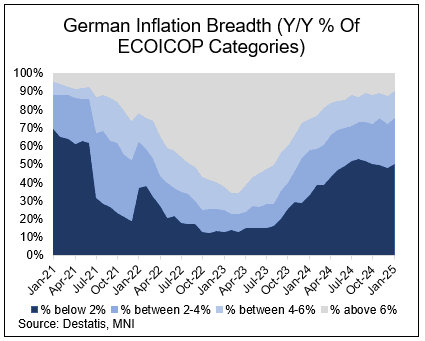

MNI’s inflation breadth tracker (see chart below) shows disinflation rebooting in the low-inflation categories in January, with the percentage of ECOICOP (European classification of individual consumption according to purpose, a standardized category split) items printing at or below 2% up to 50.7% from 48.3% in December. In the high-inflation categories, disinflation progressed also, with the percentage of categories above 6% falling to 9.3% from December's 12.2%.

203 words