-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

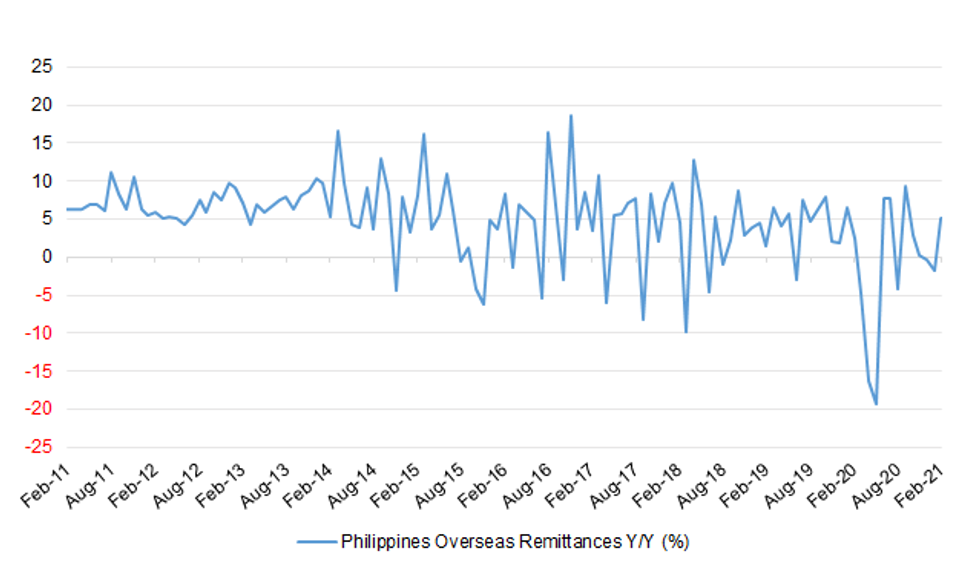

Free AccessOverseas Remittances Beat Expectations

Spot USD/PHP has recouped its opening losses, despite a beat in overseas remittances. The rate last trades at PHP48.495, little changed on the day.

- A break above the 200-DMA at PHP48.588 is needed to give bulls some fresh impetus, opening up Mar 17/Feb 23 highs of PHP48.736/48.755. Bears look for a clean breach of the 50-DMA at PHP48.443, followed by Apr 6 low of PHP48.319.

- Overseas remittances rose 5.1% Y/Y in Feb, beating BBG est. of a 2.0% increase, after a 1.7% decline recorded in Jan. Philippine workers sent $2.48bn home, boosting the YtD sum of foreign remittances to $5.08bn.

- Finance Sec Dominguez brushed away suggestions that the Philippines has become too reliant on stimulus programmes and pledged that the gov't will continue striking a balance between providing economic support and long-term debt sustainability.

- Philippine House of Reps will start debating the Bayanihan 3 law next week, which would provide another round of stimulus measures.

- Philippine vaccine tsar Galvez said that Manila will continue talks on J&J Covid-19 vaccine supply, despite the "operational pause" on using the jab. Galves also revealed that the Philippines struck a deal with Russia's Gamaleya Centre to buy 10mn of Sputnik V vaccine doses.

- OCTA Research Group estimated that the fatality rate among Covid-19 patients in the capital increased to 5.4% between Mar 28 and Apr 13.

- Several Philippine business groups joint the gov't in urging China to withdraw its vessels from a disputed reef in the South China Sea.

- BSP is expected to release March foreign reserves data by the end of this week.

Fig. 1: Philippines Overseas Remittances Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.