-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessParliament Passes Budget Ahead Of PM Resignation, Snap Election

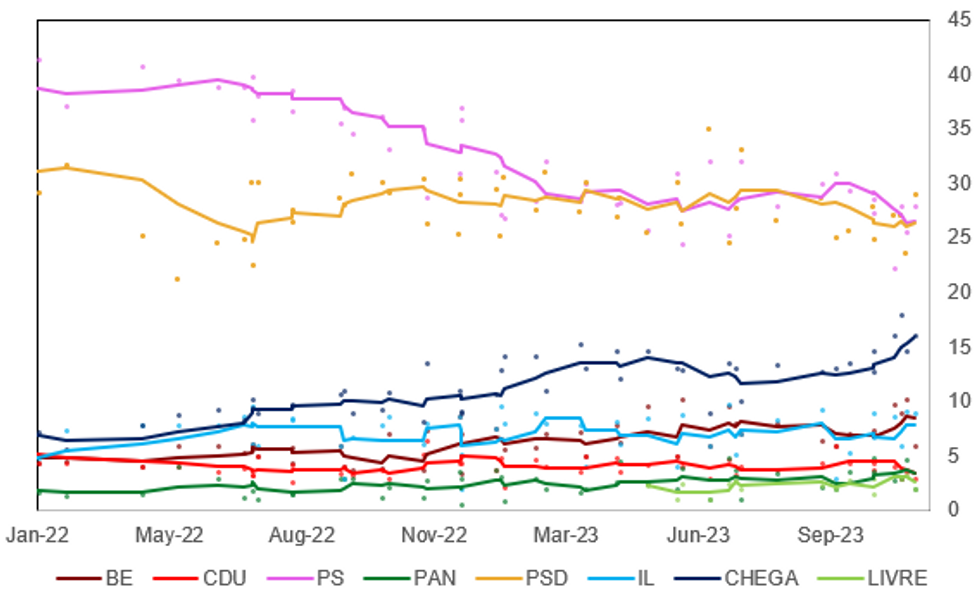

The Portuguese parliament has passed the 2024 budget, fulfilling one of its final actions before PM Antonio Costa resigns ahead of the snap election taking place 10 March 2024. The parliament had approved the budget in an initial vote in October, ahead of Costa announcing his resignation.

- Bloomberg: "The 2024 budget includes income tax cuts and targets a surplus of 0.2% of gross domestic product, smaller than the surplus projected for 2023. While the country’s economy is forecast to slow this year after bouncing back following the pandemic, the government plans to keep lowering the debt burden."

- Opinion polling in November has shown Portugal's two main parties - the centre-left Socialist Party (PS) and the centre-right Social Democratic Party (PSD) - struggling to maintain support amid broad dissatisfaction with the political establishment in the wake of the corruption scandal that claimed Costa's position.

- The right-wing nationalist CHEGA party has seen its support continue to rise, and looks on course to secure a strong third place. Should the PSD find itself short of a majority after the election, it could - despite claiming it would not work with the party - form a governing coalition. This would mark the first time the nationalist right has been included in a Portuguese gov't since the end of the Estado Novo in 1974.

Chart 1. General Election Opinion Polling, % and 5-Poll Moving Average

Source: Aximage, CESOP, Intercampus, ICS, MNI

Source: Aximage, CESOP, Intercampus, ICS, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.