-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

Persistent Core Pressures Seen Pushing ECB Rates To 4% (3/4)

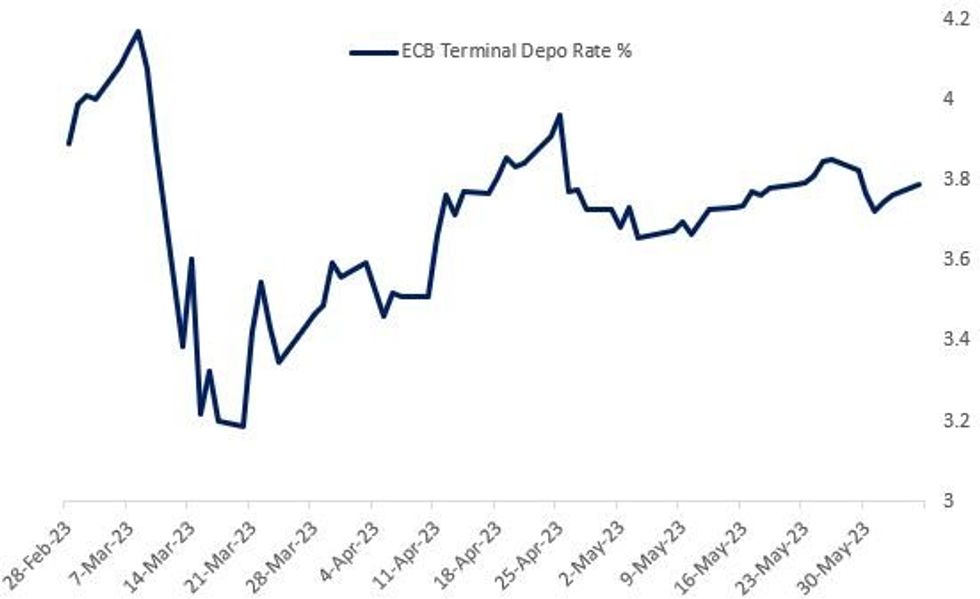

On the whole, though, most analysts looked through May's flash readings and saw little reason to expect price pressures to continue easing off. Several saw core inflation potentially picking back up over the summer, with May's one-off factors reversing, energy prices continuing to make their way through the consumer price pipeline, and wage pressures continuing to underpin services prices. That could push ECB Depo rates closer to 4% than the 3.75% currently priced.

- SocGen sees the ECB hiking to a terminal 4% rate, with underlying inflationary conditions remaining persistent. They concede that their calculation of core eurozone inflation on a seasonally adjusted basis shows easing to 0.15% M/M in May from 0.44% prior, "but that’s not the start of a weakening trend": Germany’s travel subsidies reduced core by 0.1-0.15pp, and from June onwards services inflation will reaccelerate on 1) positive base effect from 2022’s German travel pass (+0.3pp to core between June and August this year) 2) basket reweighting to increase summer travel-related items’ rates, adding 0.1pp in June and 0.35pp in July and August to core inflation, offsetting the decline in goods inflation and helping keep core around 5.5% Y/Y until August.

- With energy dragging, headline's set to move close to 2% by end-year. But overall, demand exceeds supply, with a tight labour market leading to higher wages and firms’ strong pricing power combining for record-high core inflation – seen easing only to 4% by end-2023 and averaging 3% in 2024 with upside risks depending on wage growth.

- Similarly, TD notes that when removing the German transport subsidy, services inflation was actually very strong (weighed 0.2pp on Y/Y), and the 0.3% M/M rise in core goods was the 2nd largest May increase since the 2000s - so the details "should continue to put pressure on the ECB to keep hiking beyond the June meeting". They see a 4.00% terminal rate.

- Nomura notes that while upstream price evidence suggests further falls in price momentum in coming months, "weaker upstream price momentum has been seen more in manufactured products than it has in services – that might be explained by stronger wage pressures and a shift away from spending on goods and back towards services as the euro area economy continues its recovery from the pandemic" and " even with inflation having fallen more than expected in May, we remain far away from ‘job done’" with core set to fall only to 4.5% by Dec. The ECB should hike twice more but in order to "fully address the inflation problem" cuts won't come until end-2024.

Market-Implied ECB Terminal RateSource: BBG, MNI

Market-Implied ECB Terminal RateSource: BBG, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.