June 27, 2024 07:38 GMT

Rate Path Revised Lower As Three More Cuts In '24 Possible

RIKSBANK

Highlights from the policy statement:

- More dovish than previously: “If inflation prospects remain the same, the policy rate can be cut two or three times during the second half of the year.”

- “The most recent outcome for inflation excluding energy prices was somewhat higher than expected, which underlines that there can be setbacks when inflation adjusts towards the target. This emphasises the need for policy rate cuts to be made gradually”.

- “Given that inflation is fundamentally developing favourably, economic activity is assessed to be somewhat weaker, and the krona exchange rate is a little stronger, the forecast for the policy rate has been adjusted down somewhat”.

- Similar balance of risks: “There are risks linked, for instance, to inflation abroad, geopolitical unease, the krona exchange rate and the recovery in the Swedish economy”

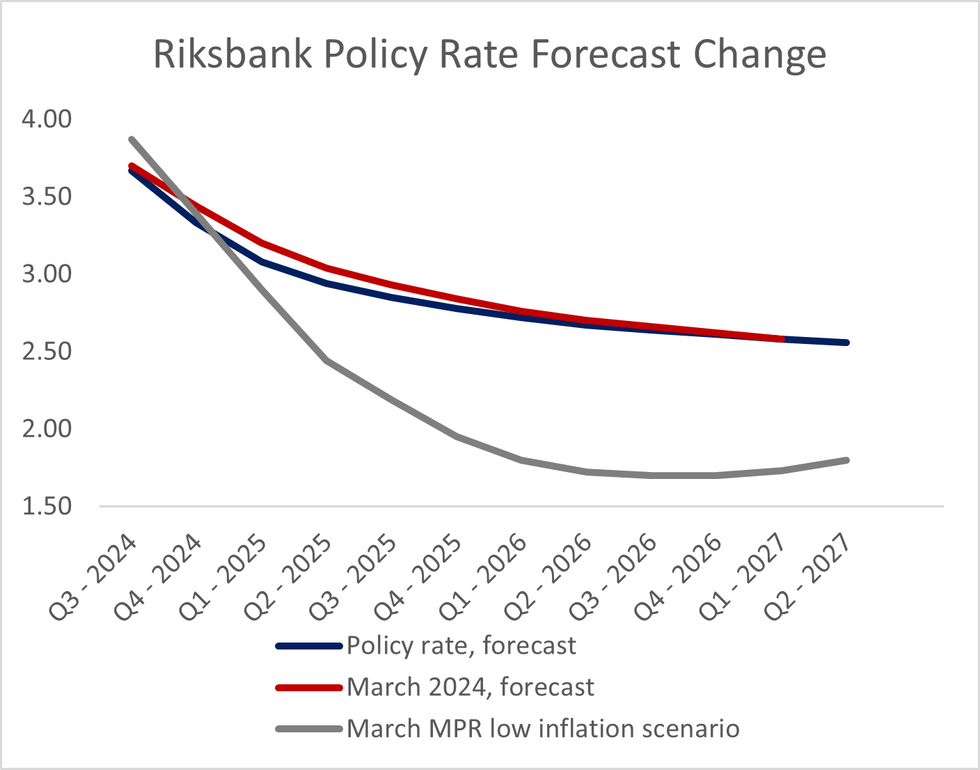

Revised Policy Path Lower In 2024 and 2025, see image:

151 words