June 06, 2024 14:08 GMT

RCI Banque (RENAUL Baa1/BBB-/NR): Outperformance

CONSUMER CYCLICALS

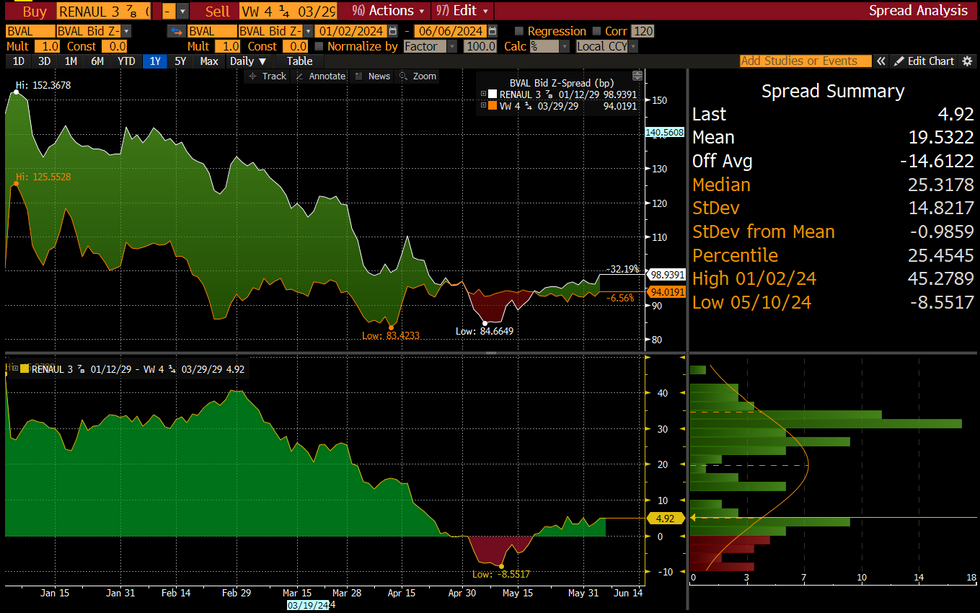

- While VW (A3/BBB+/A-) has been a strong performer YTD, RENAUL has been even firmer, with the 29s briefly inside VW Finance before correcting to +5bp currently (chart).

- RENAUL issued €1.5bn in March following €600mn in Jan, with the bulk of refinancing needs for the year seemingly done; perhaps one more benchmark to do.

- VW has issued around €11bn this year vs c.€14bn total 2024 maturities.

- Issuance sentiment above seems to have driven the move. We note that this week’s VW deals came with little to no NIC, however. RCI Banque’s outlook was affirmed at stable by Moody’s yesterday despite parent Renault SA’s recent change to positive (no direct bearing on RCI).

121 words