-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessReserves In The Balance As Treasury Set To Restart Bill Sales (2/2)

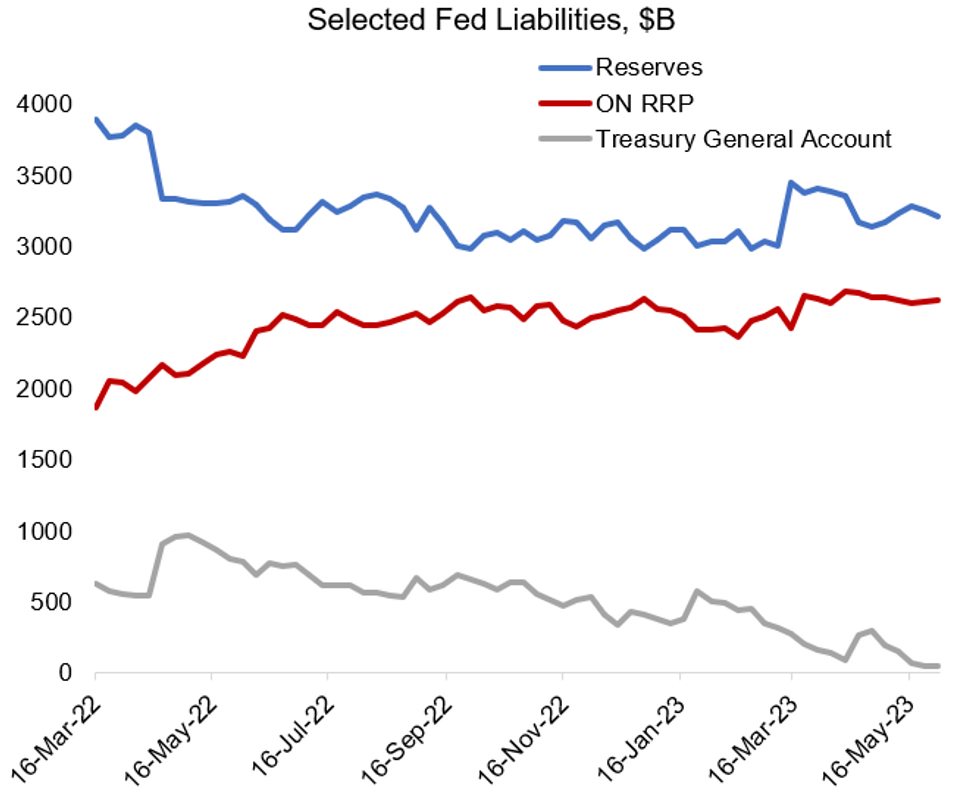

This week's agreement on suspending the Federal debt limit comes within days of the projected "x-date" and with under $50B of cash left in the Treasury's General Account (TGA) at the Fed. Attention turns to the Treasury's next move which will almost certainly include replenishing its coffers via high levels of net debt issuance.

- At the beginning of June, Treasury's refunding process assumed an end-of-September cash balance of $600B. The broad expectation is that Treasury will have to issue a net $900-1T of bills over the coming months to reach such a balance.

- As the TGA grows, usually system reserves fall, all else being equal, as private market participants buy government securities. Reserves currently stand at $3.2T. But funds parked in ON RRP, which exceed $2.6T, will play a key role as well.

- Because of the dearth of net bill issuance amid the debt limit crisis, financial institutions have ballooned the ON RRP facility. Much of the funds are expected to shift from ON RRP, which currently pays 5.05%, to bills, which pay at least 5.05% from each tenor from 45-day onward.

- Some analysts see reserve scarcity ahead, depending on whether money market funds see strong inflows, taking away from reserves, while simultaneously not participating too heavily in bill purchases. TD for instance sees $500B of RRP moving into bills, but that wouldn't be enough to prevent reserve scarcity (which they see at reserves <$2.8T). In a high reserve scenario they could see a $700B drop in RRP usage, with reserves staying at $2.9T.

- The next step is to see what Treasury announces for issuance throughout the coming month. They'd be likely to smooth issuance over the next few months so as to avoid market disruptions, but the cash-raising pace is still likely to be swift. It probably wouldn't be until well into the summer before there was any sign of reserve scarcity being a problem, but it bears watching.

Source: Fed, Treasury, MNI

Source: Fed, Treasury, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.