June 27, 2024 10:47 GMT

Services Expected Prices Remain At Elevated Levels

EUROZONE DATA

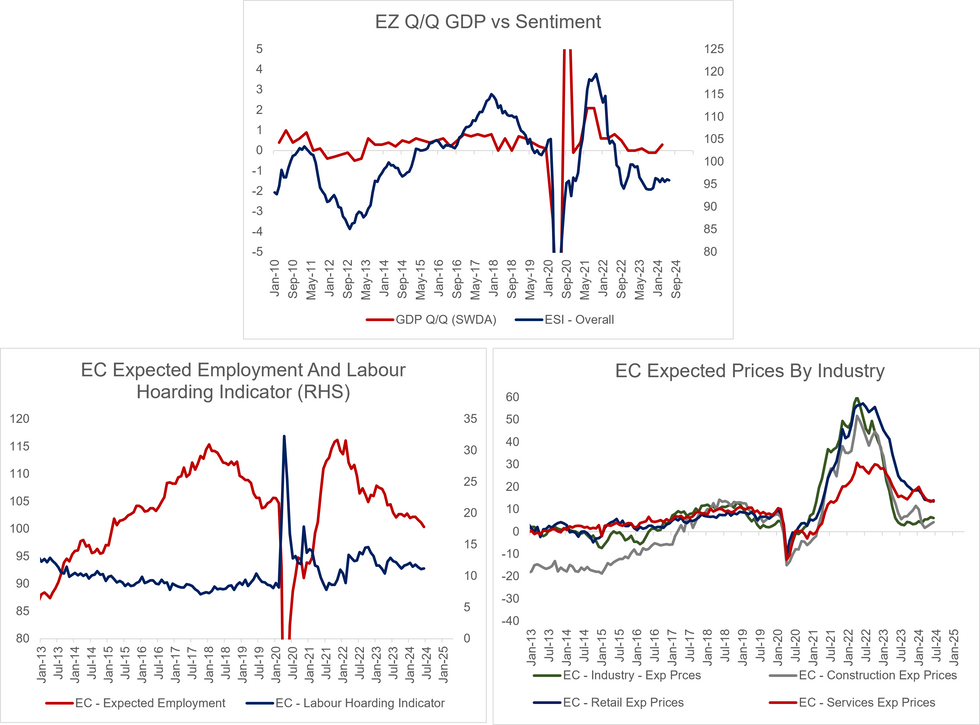

The EC’s June business and consumer survey saw overall Economic Sentiment (ESI) moderate slightly to 95.9 (vs a one tenth upwardly revised 96.1 prior and 96.1 cons). This reflected a small improvement in consumer sentiment (-14.0 vs -14.3 prior) but falls in business sentiment across industries.

- ESI, which is a reasonable forward-looking indicator for turning points in GDP growth, suggests little change from the 0.3% Q/Q registered in Q1. Bloomberg consensus for Q2 currently stands at 0.2% Q/Q.

- On the inflation front, services expected prices ticked up to 14.1 (vs 13.4 prior), reversing May’s fall. At a country level, Belgium saw a 4.1-point rise in expected prices, while Spanish and French expectations ticked higher to a lesser extent. Italian price expectations fell 1.3 points, while Germany was broadly unchanged.

- Overall, services expected prices are off cycle highs, but remain at elevated levels.

- Industry and retail expected prices fell in June, though the overall signal that core goods HICP should stall in the coming months remains intact.

- The Expected Employment metric fell slightly, while the labour hoarding indicator was broadly unchanged.

190 words