-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTimes Claims 2p NIC Cut In Budget; May Not Be Enough For Conservative Right

Steven Swinford at The Times reportingthat Chancellor of the Exchequer Jeremy Hunt is to cut National Insurance Contributions (NICs) by 2 pence in the upcoming Budget statement on 6 March. Times: "The chancellor will make national insurance the central measure in his spring budget after deciding against cutting income tax." There has been speculation over the past week that with less 'fiscal headroom' than had previously been expected, Hunt would mirror his actions in the 2023 Autumn Statement with another NIC cut.

- Times: "Cutting income tax is significantly more expensive as it benefits both workers and pensioners. A cut of two percentage points in employee national insurance costs about £10 billion a year, while a 2p cut in income tax costs £13.7 billion a year."

- Politically the move is unlikely to quell the right of the governing Conservative party, which is calling for significant personal tax cuts with the tax burden currently at its highest level since the end of WWII. Amid record-low support in the latest Ipsos poll there is the low-probability, high-impact prospect of challenge for the party leadership ahead of the next general election.

- This threat could have seen the PM move towards more populist tax cuts, but there remain concerns regarding market reaction to measures seen as fiscally imprudent, with the lasting impact from the Truss-Kwarteng mini-budget in late-2022 fresh in the memory.

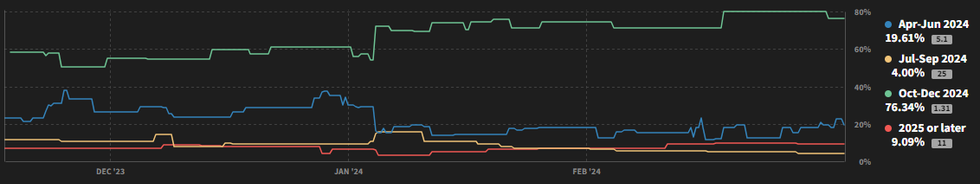

- Betting markets still see Q424 as the most likely time for an election, with a 76.3% implied probability. Given the state of polling for the party, a Jan 2025 election could prove more likely than Q224.

Source: Smarkets

Source: Smarkets

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.