UMich Reports Suggest Growing Middle/Lower Income Unrest

The preliminary University of Michigan consumer survey for June showed an unexpected deterioration in the overall sentiment index to 65.6 (72,0 expected, 69.1 prior). There were likewise unexpected falls in each of the the current conditions (62.5 vs 72.2 expected, 69.6 prior) and expectations (67.6 vs 72.0 expected, 68.8 prior) indices.

- Median inflation expectations were basically steady, at 3.3% over a 1-year horizon (3.2% expected, 3.3% prior), with 5-10 year expectations ticking up 0.1pp to 3.0% (had been expected to remain steady at 3.0%).

- We (and most observers) take the Michigan survey with a healthy dose of skepticism, particularly the preliminary reading which is subject to large revisions, but if June's figures are confirmed in the final it would make for the weakest report in a couple of years.

The pullback in the overall indices appears to be a correction in a volatile but overall slow uptrend since early 2022, so the weakness shouldn't be over-interpreted as a signal for economic activity. But many of the internal survey results portrayed a negative outlook for income, employment, and consumption, consistent with recessionary conditions:

- Consumers' assessment of their current financial situation compared with the previous year dipped to an index level of 79, joint-lowest since December 2022, vs 91 in May and March's 2+ year high of 104

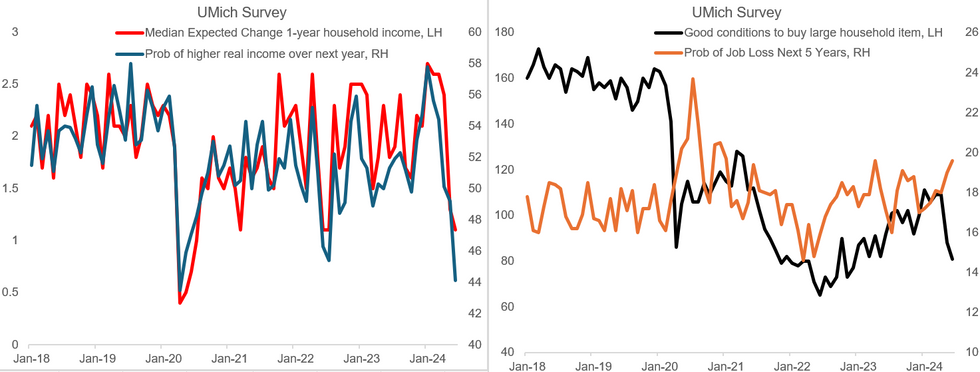

- The median expected change in household income over the coming 1-2 years dropped to 1.1%, joint-lowest since July 2020. As recently as April this was 2.4% Only 44.1% see expect higher real income over the next year, not far from the pandemic low of 43.5%.

- Job loss expectations over the next 5 years are up to 19.6%, joint-highest since January 2021.

- The "Good time to buy a major household Item" index was 81, lowest since Dec 2022.

The Michigan report acknowledges this deterioration, explaining it by a divergence across income levels.

- Higher-income consumers are not complaining as much as they have in the past about higher prices, but lower/middle-class consumers' complaints "have continued largely unabated", with middle-income consumers' views "resembl[ing] those of their lower-income counterparts, a departure from historical patterns in which their mentions are squarely in between those of higher- and lower-income consumers."

- Per UMich, overall sentiment for top one-third of income earners is up 56% since June 2022, vs 29% for the middle tercile and 11% for the bottom tercile.

Source: UMich, BBG, MNI

Source: UMich, BBG, MNI