-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

UPDATE MNI ASIA OPEN: Inflation Progress, But Not Done Yet

EXECUTIVE SUMMARY

- MNI FED: Fed's Williams Sees Gradual, Bumpy Return to 2% Inflation

- MNI INTERVIEW: Strong Jobs May Fuel US Productivity-Rothstein

- MNI FED: Collins Says Less Fed Easing May Be Warranted

- MNI US DATA: Headline PPI Misses But Core Measures In Line

US

FED (MNI): Fed's Williams Sees Gradual, Bumpy Return to 2% Inflation: New York Fed President John Williams on Thursday said he expects a gradual but not always linear decline in U.S. inflation to persist despite a third month of stronger-than-expected consumer price readings.

- "I expect inflation to continue its gradual return to 2%, although there will likely be bumps along the way, as we’ve seen in some recent inflation readings," he said. "I expect overall PCE inflation to be 2.25 to 2.5% this year, before moving closer to 2% next year."

- There's been significant progress in restoring balance to the U.S. economy and bringing inflation down, but price growth remains above the central bank's target, he said.

US INTERVIEW (MNI): Strong Jobs May Fuel US Productivity-Rothstein: A persistently strong U.S. labor market might be creating a positive cycle of economic activity and experimentation that is boosting productivity, potentially allowing for stronger wage growth that doesn’t necessarily fuel inflation, former chief economist at the U.S. Department of Labor Jesse Rothstein told MNI.

- With workers in short supply, firms have to find creative ways to boost the efficiency of the existing workforce, he said.

- “My reading is that when you have full employment you get productivity gains. This been a tremendous run of full employment that we’ve seen for longer than usual - all of a sudden you need to figure out ways to get more productive,” said Rothstein, also a former senior economist at the White House Council of Economic Advisors.

FED (MNI): Collins Says Less Fed Easing May Be Warranted: interest rates may have to stay higher for longer after recent data showing strong jobs growth and higher core inflation compared to last year, Boston Fed President Susan Collins said Thursday, adding she continues to expect to lower rates some time this year.

- Resilient demand in the face of higher rates also suggest the current level of interest rates may be restraining the economy by less than expected, she said in remarks prepared for the Economic Club of New York.

- "The recent data have not materially changed my outlook, but they do highlight uncertainties related to timing, and the need for patience – recognizing that disinflation may continue to be uneven," she said. "This also implies that less easing of policy this year than previously thought may be warranted."

NEWS

FED (MNI): Williams – Tremendous Progress Toward Balance, But Not Over Yet: NY Fed’s Williams (voter) in a speech to the FHLBNY doesn't directly refer to yesterday's stronger than expected CPI release but could well be asked on it in Q&A. “All in all, there has been tremendous progress toward better balance. But this episode is not yet over, and I am still very focused on ensuring we achieve both of our goals.

FED (MNI): Barkin Repeats Smart To Take Time To See If Inflation Slows (After Strong CPI): Richmond Fed’s Barkin (’24 voter), speaking in Q&A the day after another upside surprise for CPI, says that it’s smart to take time to see if inflation slows. The headline is identical to prepared remarks he gave last week. The inflation data raises the question if we are seeing a shift.

US (MNI): Senior Democrats Urge Dems To Sign Ukraine Discharge Petition: Heather Caygle at Punchbowl News reporting that former House Speaker Nancy Pelosi (D-CA) and former House Majority Leader Steny Hoyer (D-MD) have made, "impassioned pitches" to the House Democratic Party whips, "encouraging members" to sign the national security supplemental discharge petition even if they don't support Israel funding - a major hurdle for progressive Democrats.

ECB BRIEF (MNI): Inflation To Fluctuate Near Current Levels-Lagarde: Eurozone inflation is likely to fluctuate around current levels before converging sustainably around target in 2025, ECB President Christine Lagarde said Thursday, though she noted upside risks from geopolitical uncertainty and wages growth.

ISRAEL (MNI): Netanyahu-Preparing To Respond Defensively & Offensively To Sec Threats: Wires reporting comments from Israeli PM Benjamin Netanyahu: "We are living in a period full of challenges. We are at the height of a war in Gaza which continues with determination, at the same time we continue our efforts to free our hostages, but we are also preparing to several scenarios. We have established a simple principle: whoever harms us, we will fight back.

HUNGARY (MNI): Magyar Deal w/Tisza Could See Anti-Orban Activist Enter Euro Parl't: Péter Magyar, former Fidesz party official and increasingly prominent anti-gov't activist, has announced that his 'Hungarians Rise' political movement will run under the banner of the Respect and Freedom (Tisza) Party in the upcoming European Parliament election.

CHINA-EU: (MNI) MOFCOM-EU Turbine Probe 'May Undermine Mutual Trust In Trade & Econ': Wires carrying comments from the Chinese Commerce Ministry regarding the new foreign subsidies probe by the European Commission into Chinese-made wind turbines.

SOUTH KOREA (MNI): Opposition Short Of Supermajority Only Bright Spot For Yoon & PPP: Seat totals from the 10 April legislative election show the main opposition liberal Democratic Party of Korea (DPK) and its allies have maintained their majority in the National Assembly, but even with outside support will fall short of the 200-seat 'supermajority' that would have given it sweeping powers in overriding presidential vetos and beginning impeachment proceedings.

US TSYS Treasuries See-Saw Off Lows, In-Line PPI Twist Steepens Curve

- Treasury futures are looking to finish mixed Thursday, late support following large 2Y and 5Y Block buys evaporating, though curves hold steeper (2s10s +4.736 at -38.427).

- Volatile morning as Treasury futures drew fast two-way trade after ECB steady rate announcement and largely in-line US Producer Price data brought some relief to global core FI market after Wednesday's hot CPI figure: PPI inflation misses at 0.15% M/M (0.3) in March but core measures in line.

- Initial claims were lower than expected at a seasonally adjusted 211k (cons 215k) in the week to Apr 6 after a marginally upward revised 222k (initial 221k).

- Treasuries dipped briefly after $22B 30Y auction (912810TX6) re-open tailed for the first time in 5 auctions (5.2bp tail in Nov'23): 4.671% high yield vs. 4.662% WI; 2.37x bid-to-cover vs. 2.47x in the prior month.

- Indirect take-up falls to 64.38% (lowest since Nov'23) vs. 69.29% prior; direct bidder take-up climbs to 18.28% vs. 16.77% prior; primary dealer take-up 17.34% (highest since Nov) vs. 13.93%.

- Projected rate cut pricing gained slightly vs. late Wednesday levels: May 2024 at -2.6% w/ cumulative -.6bp at 5.322%; June 2024 at -22.6bs vs. -16.2% earlier (-55.1% pre-CPI) w/ cumulative rate cut -6.3bp at 5.226%. July'24 cumulative at -14.1bp, Sep'24 cumulative -25bp.

OVERNIGHT DATA

US DATA (MNI): Headline PPI Misses But Core Measures In Line: PPI inflation misses at 0.15% M/M (0.3) in March but core measures in line.

- Ex food & energy: 0.23% (cons 0.2) after an unrevised 0.29. Net upward revision of 0.04pps.

- Ex food, energy & trade: 0.21 % (cons 0.2) after a downward revised 0.34 (initial 0.44). Net downward revision of -0.05pps.

US DATA (MNI): Conflicting Jobless Claims Data Again: Initial claims were lower than expected at a seasonally adjusted 211k (cons 215k) in the week to Apr 6 after a marginally upward revised 222k (initial 221k).

- It fully unwinds the prior week’s surprise pop higher but the four-week average is near unchanged at 214k. It has drifted from just over 200k early in the year but remains low historically (2019 av 218k).

- Continuing claims meanwhile were higher than expected at a seasonally adjusted (cons 1800k) in the week to Mar 30 after only a slightly downward revised 1789k (initial 1791k).

- It keeps to its newly found relatively flat range but is drifting towards the higher end, vs the 1829k high from mid-January.

- The sidelining in non-seasonally adjusted data at 1935k after 1938k compares a little unfavorably compared to the recent years.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 74.27 points (0.19%) at 38536.1

- S&P E-Mini Future up 42.5 points (0.82%) at 5249.75

- Nasdaq up 270.1 points (1.7%) at 16440.34

- US 10-Yr yield is up 1.9 bps at 4.562%

- US Jun 10-Yr futures are down 0.5/32 at 108-6

- EURUSD down 0.0014 (-0.13%) at 1.0729

- USDJPY up 0.03 (0.02%) at 153.19

- WTI Crude Oil (front-month) down $0.89 (-1.03%) at $85.32

- Gold is up $30.61 (1.31%) at $2364.75

- European bourses closing levels:

- EuroStoxx 50 down 34.15 points (-0.68%) at 4966.68

- FTSE 100 down 37.41 points (-0.47%) at 7923.8

- German DAX down 142.82 points (-0.79%) at 17954.48

- French CAC 40 down 21.64 points (-0.27%) at 8023.74

US TREASURY FUTURES CLOSE

- 3M10Y +3.289, -84.33 (L: -92.266 / H: -81.672)

- 2Y10Y +5.191, -37.972 (L: -45.387 / H: -36.936)

- 2Y30Y +6.398, -28.891 (L: -34.045 / H: -27.043)

- 5Y30Y +2.368, 4.079 (L: 0.727 / H: 6.103)

- Current futures levels:

- Jun 2-Yr futures up 1.5/32 at 101-18.5 (L: 101-13 / H: 101-20.125)

- Jun 5-Yr futures up 1.25/32 at 105-8.5 (L: 104-30.75 / H: 105-14.25)

- Jun 10-Yr futures down 0.5/32 at 108-6 (L: 107-27.5 / H: 108-16.5)

- Jun 30-Yr futures down 7/32 at 115-11 (L: 114-29 / H: 116-01)

- Jun Ultra futures down 11/32 at 122-9 (L: 121-20 / H: 123-03)

US 10Y FUTURE TECHS: (M4) Bearish Trend Condition

- RES 4: 111-10+ High Mar 13

- RES 3: 110-18/31+ 50-day EMA / High Mar 27 and key resistance

- RES 2: 110-06 High Apr 4

- RES 1: 109-02/26+ Low Apr 8 / High Apr 10

- PRICE: 108-05 @ 1530 ET Apr 11

- SUP 1: 108-00 Round number support

- SUP 2: 107-26+ 2.382 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 3: 107-07+ 76.4% of the Oct - Dec ‘23 bull leg (cont)

- SUP 4: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

The sharp sell-off in Treasuries Wednesday reinforces the current bearish cycle and confirms a resumption of this year’s downtrend. The contract has traded through the 109-00 handle and breached 108-25, the 2.00 projection of Dec 27 - Jan 19 - Feb 1 price swing. Sights are on the 108-00 handle next. Initial resistance has been defined at 109-26+, Wednesday’s intraday high. Key short-term resistance is at 110-06, the Apr 4 high.

SOFR FUTURES CLOSE

- Jun 24 +0.025 at 94.745

- Sep 24 +0.030 at 94.90

- Dec 24 +0.020 at 95.090

- Mar 25 +0.015 at 95.280

- Red Pack (Jun 25-Mar 26) +0.015 to +0.025

- Green Pack (Jun 26-Mar 27) steadysteady0 to +0.010

- Blue Pack (Jun 27-Mar 28) -0.01 to -0.005

- Gold Pack (Jun 28-Mar 29) -0.02 to -0.01

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00170 to 5.31895 (+0.00049/wk)

- 3M -0.00694 to 5.29892 (+0.00553/wk)

- 6M -0.01793 to 5.23137 (+0.01103/wk)

- 12M -0.02609 to 5.06156 (+0.03049/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.909T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $707B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $698B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $251B

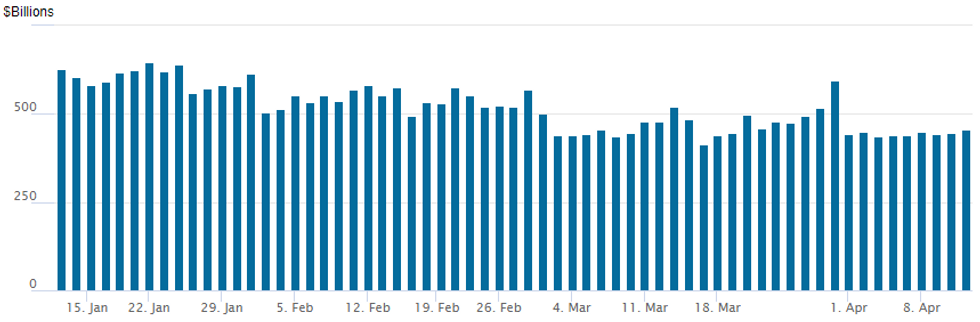

FED Reverse Repo Operation

- RRP usage climbs to $455.361B vs $445.816B on Wednesday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties at 69 vs. 67 yesterday, near April 4 2+ year low of 66.

PIPELINE: US$ Corporate Issuance Slows Ahead Next Earnings Cycle

The pace of US$ corporate bond issuance is slowing down heading into the next earnings cycle that kicks off Friday with JP Morgan, BlackRock, Wells Fargo, State Street and Citigroup reporting.

- Date $MM Issuer (Priced *, Launch #)

- 4/11 $2B #RWE Finance $1B 10Y +135, $1B 30Y +160

- 4/11 $1.5B #Jefferies 10Y +165

- 4/11 $750M #Blue Owl Finance 10Y +190

- 4/11 $Benchmark KEB Hana Bank 3Y/5Y Investor calls

- 4/11 $Benchmark Ford Otosan 5Y Investor calls

- 4/11 $Benchmark Puma Energy Investor calls

- $3B Priced Wednesday

- 4/10 $1.5B *Rentenbank 5Y SOFR+35

- 4/10 $1B *FHLB 3Y Global +7

- 4/10 $500M *Engie Chile 10Y +225a

- 4/10 $Benchmark Blue Owl Finance investor calls

EGBs-GILTS CASH CLOSE: Selloff Continues Despite ECB Cut Inclination

Gilts underperformed Bunds for a second consecutive session Thursday, with the prior session's strong US CPI data continuing to reverberate.

- The ECB meeting was more or less as expected, with the statement noting that if the inflation comes in as expected, it “would be appropriate” to ease.

- Lagarde provided few revelations in the press conference, noting that while "a few" members were already confident enough in the inflation trajectory to cut rates, a "very large majority" preferred waiting to see incoming data through the June meeting.

- Largely in-line US producer price data brought some relief to global core FI after the hot CPI figure, but the move faded.

- BoE's Greene drew a modestly hawkish reaction at the open after commenting overnight that cuts "should still be a way off".

- 2024 ECB implied cuts were pared by 2bp on the day (now around 76bp), with around 8bp less BoE easing expected (at 49bp, now just under 2 cuts for the year).

- The German curve twist steepened, with the UK short- and long-ends underperforming. Periphery EGB spreads widened.

- Friday's early calendar highlight is UK GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.4bps at 2.962%, 5-Yr is up 1.6bps at 2.477%, 10-Yr is up 2.8bps at 2.463%, and 30-Yr is up 3.1bps at 2.586%.

- UK: The 2-Yr yield is up 5.6bps at 4.403%, 5-Yr is up 5.1bps at 4.103%, 10-Yr is up 5.3bps at 4.201%, and 30-Yr is up 5.8bps at 4.678%.

- Italian BTP spread up 3.8bps at 141bps / Spanish up 1.3bps at 82.1bps

FOREX Softer US PPI Details Prompts Moderate Antipodean FX Reversal

- Softer details within today’s US PPI data means the Fed’s preferred core PCE reading will give a softer signal on inflation that Wednesday’s CPI. As such, equity markets were buoyed across Thursday, modestly weighing on the USD index and boosting the likes of AUD and NZD.

- Both AUDUSD and NZDUSD have risen just shy of half a percent, taking back a portion of the significant losses from the prior session.

- The sharp sell-off in AUDUSD Wednesday signals the end of the recent bull phase and reinstates a bearish threat. A continuation lower would signal scope for a test of support at 0.6478, the Mar 5 low. Clearance of this level would expose the bear trigger at 0.6443, the Feb 13 low.

- USDJPY rose as high as 153.32 and continues to trade above the 153.00 mark as we approach the APAC crossover. Bullish conditions were cemented Wednesday on the break of the significant 152.00 level, however, markets will remain wary of Japanese MOF strengthening their rhetoric on potentially intervening in the currency.

- EURUSD touched a near one month low at 1.0699 in the aftermath of the ECB, where the governing council left rates unchanged and pointed to a possible rate cut in June in its post-meeting statement on Thursday, while saying it would keep a data-dependent approach and not commit to a pre-determined easing path.

- UK growth data headlines the calendar on Friday, before UMich consumer sentiment and inflation expectations will be the US focus.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 12/04/2024 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/04/2024 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/04/2024 | 0600/0700 | ** |  | UK | Index of Services |

| 12/04/2024 | 0600/0700 | *** |  | UK | Index of Production |

| 12/04/2024 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/04/2024 | 0600/0800 | *** |  | DE | HICP (f) |

| 12/04/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 12/04/2024 | 0600/0700 |  | UK | BOE's Greene Panellist at Delphi Economic Forum on US vs Europe Growth | |

| 12/04/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/04/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/04/2024 | 1100/1200 |  | UK | BOE's Bernanke Review of Forecasting for Monetary Policymaking | |

| 12/04/2024 | 1100/1300 |  | EU | ECB's Elderson Speaks At Delphi Economic Forum | |

| 12/04/2024 | - | *** |  | CN | Trade |

| 12/04/2024 | 1200/0800 |  | US | San Francisco Fed's Mary Daly | |

| 12/04/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/04/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 12/04/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 12/04/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 12/04/2024 | 1700/1300 |  | US | Kansas City Fed's Jeff Schmid | |

| 12/04/2024 | 1830/1430 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/04/2024 | 1930/1530 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.